Post content & earn content mining yield

placeholder

GateUser-c97e6feb

#GateWeb3UpgradestoGateDEX

Web3 is built on ownership, transparency, and freedom—and Gate is stepping into the future with its upgrade to Gate DEX.

This upgrade empowers users to:

✅ Trade directly from their own wallets

🔐 Maintain full control of their assets

⚙️ Enjoy smoother, faster on-chain transactions

🌉 Connect seamlessly across a multi-chain DeFi ecosystem

Gate DEX isn’t just an upgrade—it’s a commitment to decentralization, where users truly come first.

Step into the next chapter of Web3 trading with confidence.

#GateWeb3UpgradestoGateDEX #Gate #GateDEX #Web3Future #Decentralization

Web3 is built on ownership, transparency, and freedom—and Gate is stepping into the future with its upgrade to Gate DEX.

This upgrade empowers users to:

✅ Trade directly from their own wallets

🔐 Maintain full control of their assets

⚙️ Enjoy smoother, faster on-chain transactions

🌉 Connect seamlessly across a multi-chain DeFi ecosystem

Gate DEX isn’t just an upgrade—it’s a commitment to decentralization, where users truly come first.

Step into the next chapter of Web3 trading with confidence.

#GateWeb3UpgradestoGateDEX #Gate #GateDEX #Web3Future #Decentralization

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

Hey @grok , what will be the end score of this game?

- Reward

- like

- Comment

- Repost

- Share

Are you smarter than whales in this world?

You just need to be patient and hold until your financial freedom exceeds your goals.

View OriginalYou just need to be patient and hold until your financial freedom exceeds your goals.

- Reward

- like

- Comment

- Repost

- Share

trump

Russia on top

Created By@jassi188

Listing Progress

0.00%

MC:

$3.4K

Create My Token

As of today (January 25, 2026), Ethereum (ETH) has once again faced resistance at the key psychological level of $3,000, currently trading within the main range of approximately $2,930 - $2,950. The market's short-term direction remains unclear, with bulls and bears in a tug-of-war.

Below are the core market insights, key price levels, and strategic references for today.

📊 Today's Key Market Points

· Current Price: $2,930 - $2,950 range.

· Key Resistance: $3,000 (psychological level and recent high); $3,050 - $3,080 (stronger technical resistance).

· Key Support: $2,880 - $2,920 (recent suppo

View OriginalBelow are the core market insights, key price levels, and strategic references for today.

📊 Today's Key Market Points

· Current Price: $2,930 - $2,950 range.

· Key Resistance: $3,000 (psychological level and recent high); $3,050 - $3,080 (stronger technical resistance).

· Key Support: $2,880 - $2,920 (recent suppo

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Subscribe to the live broadcast around 10 PM this Sunday. We will give away five free five-month subscriptions and five free quarterly subscriptions.

During next Sunday's live broadcast, we will give away three annual subscriptions and five free five-month subscriptions again.

Annual fan appreciation event. Ongoing. Next month, we will draw a large number of peripheral gifts for everyone!

View OriginalDuring next Sunday's live broadcast, we will give away three annual subscriptions and five free five-month subscriptions again.

Annual fan appreciation event. Ongoing. Next month, we will draw a large number of peripheral gifts for everyone!

- Reward

- 1

- 3

- Repost

- Share

Caijie6786 :

:

New Year Wealth Explosion 🤑View More

The core to guaranteed success in contract trading: it's not about catching more waves, but about holding onto what you have

In the contract market, the secret to long-term profit has never been about catching as many market swings as possible, but about holding onto your profits and controlling acceptable losses.

I've seen too many people who, despite making money in the market, end up losing everything due to greed-driven reckless operations, giving back all their gains in vain.

My ability to steadily profit amid the big fluctuations in the crypto world relies on three rigid but highly

View OriginalIn the contract market, the secret to long-term profit has never been about catching as many market swings as possible, but about holding onto your profits and controlling acceptable losses.

I've seen too many people who, despite making money in the market, end up losing everything due to greed-driven reckless operations, giving back all their gains in vain.

My ability to steadily profit amid the big fluctuations in the crypto world relies on three rigid but highly

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketWatch: Navigating the Evolving Crypto Landscape

The cryptocurrency market has always been a dynamic and rapidly changing environment. From the early days of Bitcoin’s inception to the rise of altcoins, DeFi, and NFTs, investors and enthusiasts have witnessed unprecedented growth, volatility, and innovation. Staying updated with market trends is no longer optional; it has become essential for anyone looking to participate meaningfully in the crypto ecosystem. #CryptoMarketWatch provides a comprehensive lens into these developments, offering insights that help traders, investors, an

The cryptocurrency market has always been a dynamic and rapidly changing environment. From the early days of Bitcoin’s inception to the rise of altcoins, DeFi, and NFTs, investors and enthusiasts have witnessed unprecedented growth, volatility, and innovation. Staying updated with market trends is no longer optional; it has become essential for anyone looking to participate meaningfully in the crypto ecosystem. #CryptoMarketWatch provides a comprehensive lens into these developments, offering insights that help traders, investors, an

- Reward

- 3

- 3

- Repost

- Share

CryptoRock :

:

DYOR 🤓View More

- Reward

- like

- Comment

- Repost

- Share

#JapanBondMarketSell-Off #JapanBondMarketSell-Off: What’s Happening and Why It Matters to Global Markets

Japan’s bond market is experiencing one of its most significant sell-offs in years, sending shockwaves through global financial markets and raising serious concerns among investors.

The #JapanBondMarketSell-Off is not just a local issue—it reflects deeper structural changes in monetary policy, inflation dynamics, and global capital flows that could reshape financial markets worldwide.

For decades, Japan’s economy was defined by ultra-low interest rates, deflationary pressure, and aggressiv

Japan’s bond market is experiencing one of its most significant sell-offs in years, sending shockwaves through global financial markets and raising serious concerns among investors.

The #JapanBondMarketSell-Off is not just a local issue—it reflects deeper structural changes in monetary policy, inflation dynamics, and global capital flows that could reshape financial markets worldwide.

For decades, Japan’s economy was defined by ultra-low interest rates, deflationary pressure, and aggressiv

- Reward

- 1

- 1

- Repost

- Share

unfriend :

:

HODL Tight 💪Chat wtf is this?

- Reward

- like

- Comment

- Repost

- Share

Gold has risen, and I regret not buying gold$btc Gold has risen, and I regret not buying Bitcoin. Houses have gone up, and I regret not buying a house. The stock market has risen, and I regret not buying stocks. Such examples are countless, so what is the use of hindsight regret? When gold surged some time ago, I started to regret not buying gold. Can we blame gold for rising? Just work honestly and earn the money you deserve. Don’t only look at the rise; consider the fall as well. When the market drops and you lose everything, what will be your feeling?

BTC-1,12%

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@FireFireFire2026

Listing Progress

100.00%

MC:

$185.38K

Create My Token

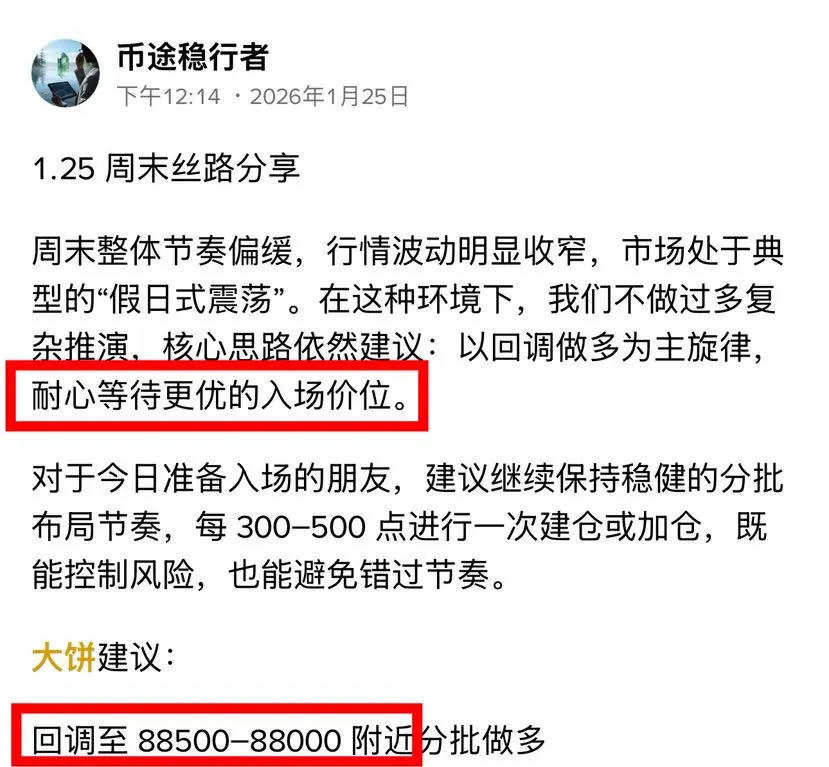

Silk Road has begun to realize the expected outcomes.

Previously, a key retracement zone was clearly identified—88,500 to 88,000, considered an important support level.

From the actual market data, the price dipped as low as 88,084, almost precisely touching the lower boundary of the suggested range, perfectly aligning with our forecast.

This round of correction not only validated the previous analysis but also provided an ideal entry window for funds that had been prepared in advance.

Even during the correction, as long as the rhythm is well managed, there are still operational entry opportun

View OriginalPreviously, a key retracement zone was clearly identified—88,500 to 88,000, considered an important support level.

From the actual market data, the price dipped as low as 88,084, almost precisely touching the lower boundary of the suggested range, perfectly aligning with our forecast.

This round of correction not only validated the previous analysis but also provided an ideal entry window for funds that had been prepared in advance.

Even during the correction, as long as the rhythm is well managed, there are still operational entry opportun

- Reward

- like

- Comment

- Repost

- Share

$PI When the heavens are about to teach me a lesson, the intensity is just right—too much might kill me, too little might prevent me from growing. It's like a whip dipped in iodine, striking and disinfecting at the same time. I really don't know what kind of virtue I have to be so favored by the heavens. On the left, hardships; on the right, dangers—such high regard for me. I'm not in the Journey to the West pilgrimage team; I haven't missed a single one of the 81 difficulties!

PI-1,27%

- Reward

- 10

- 5

- Repost

- Share

windx :

:

Watching Closely 🔍️View More

- Reward

- like

- Comment

- Repost

- Share

🌐 Global #CryptoMarketWatch: Navigating the January 2026 Supercycle

Market Sentiment: Strategic Caution ⚠️

The global crypto market is currently witnessing a fascinating tug-of-war between institutional accumulation and retail profit-taking۔ As we analyze the data for late January, several key narratives are emerging that every trader on Gate.io must watch۔

1. Bitcoin ($BTC) Dominance & Stability:

$BTC continues to act as the market’s anchor, consolidating firmly above the $88,500 support level۔ While the "Bears" are attempting to push it down, the consistent ETF inflows are providing a solid

Market Sentiment: Strategic Caution ⚠️

The global crypto market is currently witnessing a fascinating tug-of-war between institutional accumulation and retail profit-taking۔ As we analyze the data for late January, several key narratives are emerging that every trader on Gate.io must watch۔

1. Bitcoin ($BTC) Dominance & Stability:

$BTC continues to act as the market’s anchor, consolidating firmly above the $88,500 support level۔ While the "Bears" are attempting to push it down, the consistent ETF inflows are providing a solid

BTC-1,12%

- Reward

- like

- Comment

- Repost

- Share

Daily Crypto Check | BTC & ETH

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More66.68K Popularity

40.7K Popularity

34.01K Popularity

13.3K Popularity

28.16K Popularity

Hot Gate Fun

View More- MC:$3.58KHolders:21.03%

- MC:$0.1Holders:10.00%

- MC:$3.43KHolders:20.00%

- MC:$3.39KHolders:10.00%

- MC:$3.39KHolders:10.00%

News

View MoreBloomberg Analyst: Silver ETF Returns Are "Exaggerated" but Limited Capital Inflows, IBIT Wind Resistance Attracts Funds, Sending Long-term Bullish Signals for BTC

11 m

Data: If BTC breaks through $92,927, the total liquidation strength of short positions on mainstream CEXs will reach $905 million.

59 m

Data: If ETH breaks through $3,088, the total liquidation strength of long positions on mainstream CEXs will reach $637 million.

1 h

Data: 1,799,900 PENDLE transferred from an anonymous address, worth approximately $3,582,000

1 h

Blockchain ASIC chip development company AGM Group to raise $25 million through rights issue

1 h

Pin