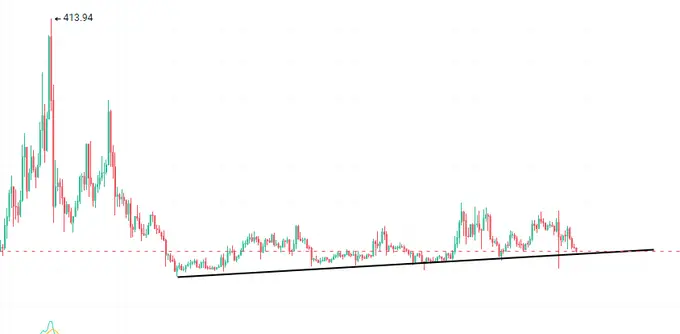

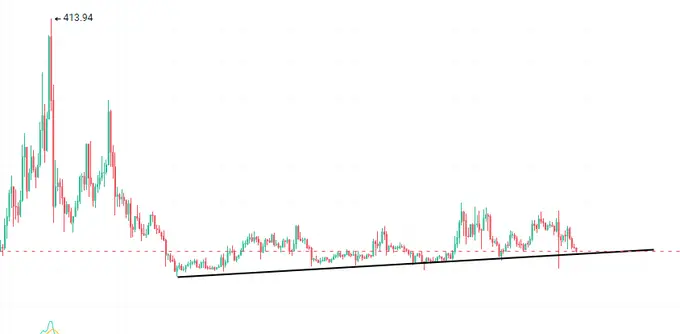

LTC has fallen near the trend line for many years. From a trading perspective, the risk-reward ratio at this position couldn't be better. However, the BTC trend is questionable. It may be prudent to take a cautious approach and observe the rebound strength here before proceeding.

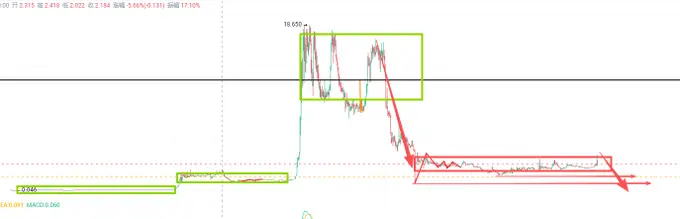

The trend shows a potential hidden divergence on the 4-hour chart, but the internal buying points are not obvious. From a higher level moving average perspective, it still takes time to rise even if it goes up in the short term; there needs to be a long-term consolidation process. Therefore, there are still many opportunities to enter, so I won't participate in the left side.

This structure (Figure 3) cannot be overlooked. First, break through 87.8, then oscillate around the 30-minute center, and then move away to form a 3-buy acceleration. This is a healthy rebound upward. If it does not break through 87.8, it will still be a falling process.

If there are a lot of free positions, it's no problem to buy some LTC spot here.

Comparing ADA, Dogecoin, and other mainstream cryptocurrencies, although LTC does not have an independent market trend, its decline has indeed been the smallest, making it the most resilient to falls.

The trend shows a potential hidden divergence on the 4-hour chart, but the internal buying points are not obvious. From a higher level moving average perspective, it still takes time to rise even if it goes up in the short term; there needs to be a long-term consolidation process. Therefore, there are still many opportunities to enter, so I won't participate in the left side.

This structure (Figure 3) cannot be overlooked. First, break through 87.8, then oscillate around the 30-minute center, and then move away to form a 3-buy acceleration. This is a healthy rebound upward. If it does not break through 87.8, it will still be a falling process.

If there are a lot of free positions, it's no problem to buy some LTC spot here.

Comparing ADA, Dogecoin, and other mainstream cryptocurrencies, although LTC does not have an independent market trend, its decline has indeed been the smallest, making it the most resilient to falls.