UnlimitedCryptoTrading

No content yet

UnlimitedCryptoTrading

📉 PI/USDT Market Update — Simple Breakdown

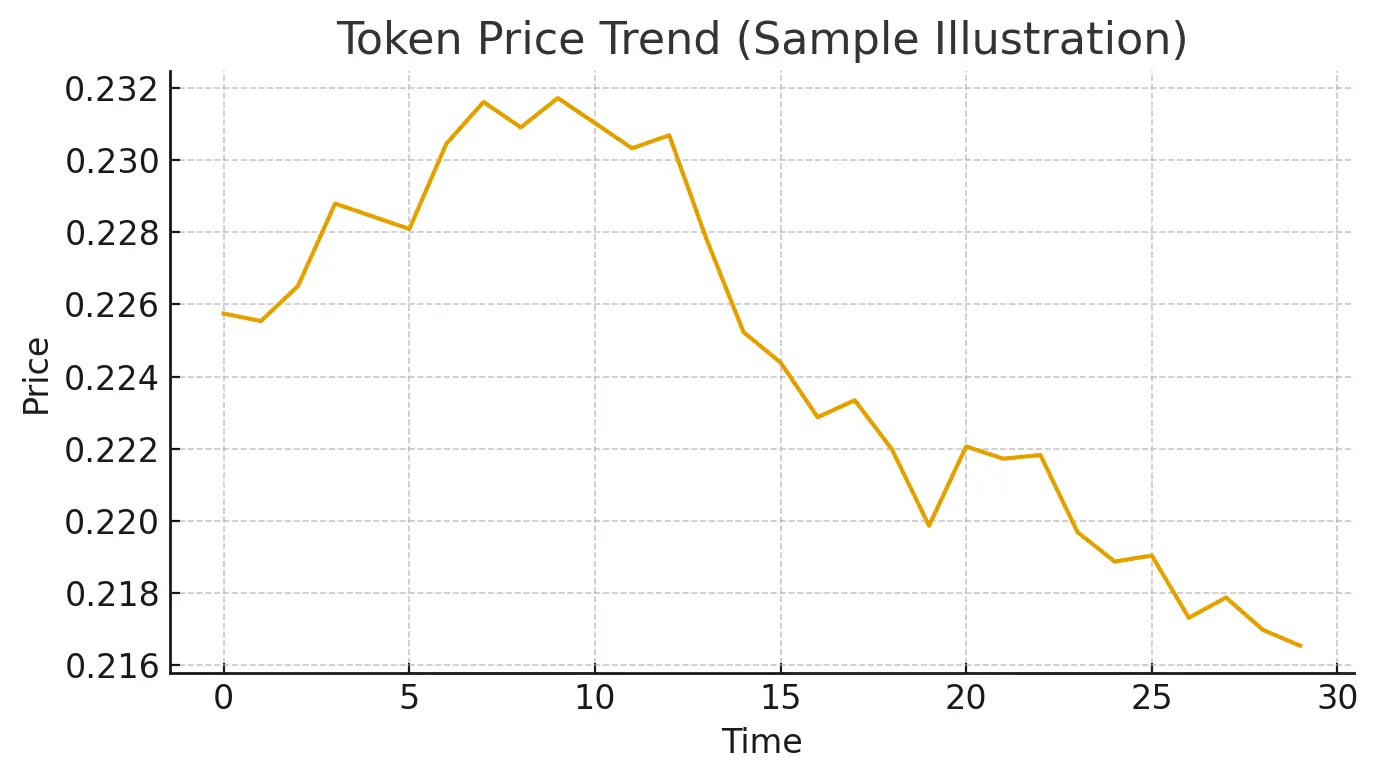

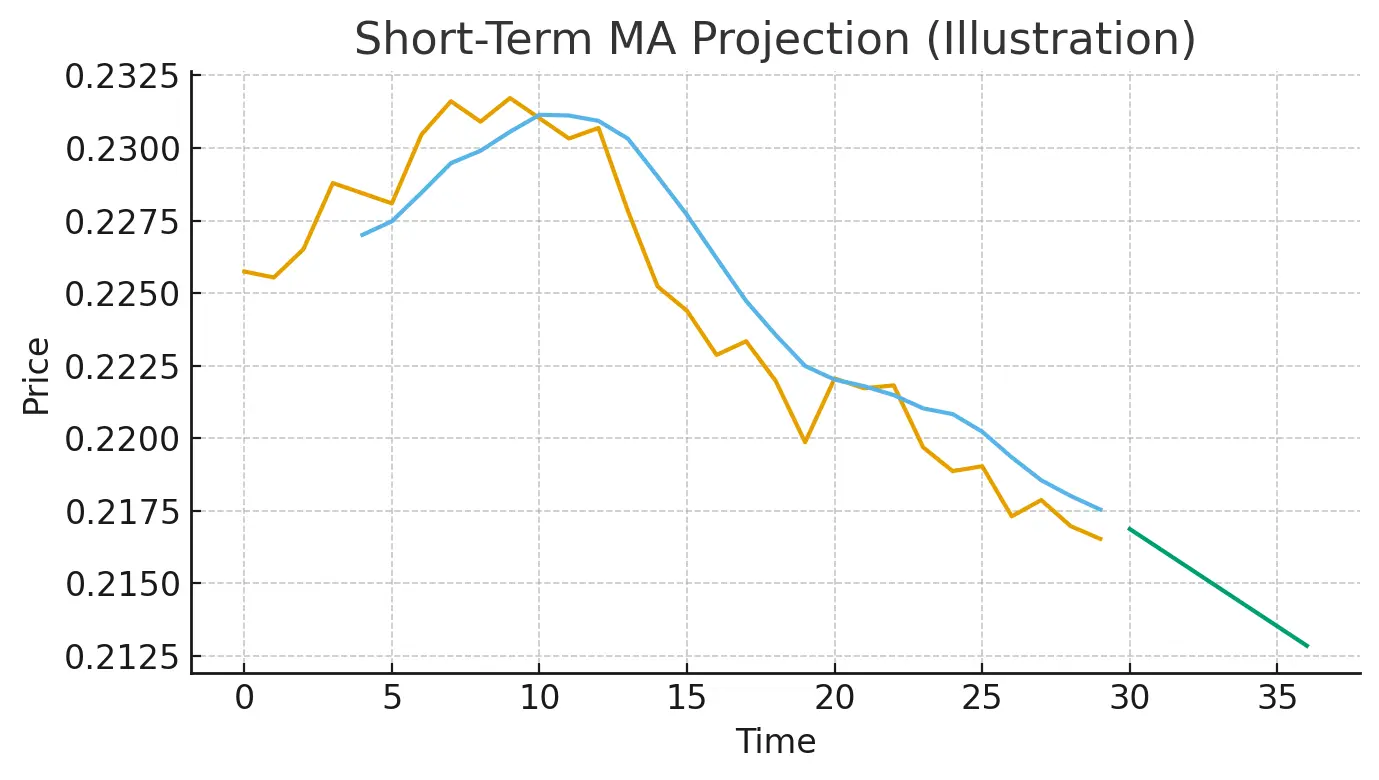

The market has been moving in a tight range, and PI is trying to hold above the 0.22 zone. Volume is steady, but momentum indicators are still mixed, which means the market hasn’t chosen a strong direction yet.

What I’m seeing now:

Price is mostly moving sideways after yesterday’s drop

RSI is sitting around the mid-40s → neither overbought nor oversold

MA lines are still close together → no strong trend yet

Small pullback pressure but buyers are defending the lower range

📌 Short-Term View

If the price can stay above 0.223, we might see another push

The market has been moving in a tight range, and PI is trying to hold above the 0.22 zone. Volume is steady, but momentum indicators are still mixed, which means the market hasn’t chosen a strong direction yet.

What I’m seeing now:

Price is mostly moving sideways after yesterday’s drop

RSI is sitting around the mid-40s → neither overbought nor oversold

MA lines are still close together → no strong trend yet

Small pullback pressure but buyers are defending the lower range

📌 Short-Term View

If the price can stay above 0.223, we might see another push

PI-0.39%

- Reward

- 1

- Comment

- Repost

- Share

PLANCK Market Update

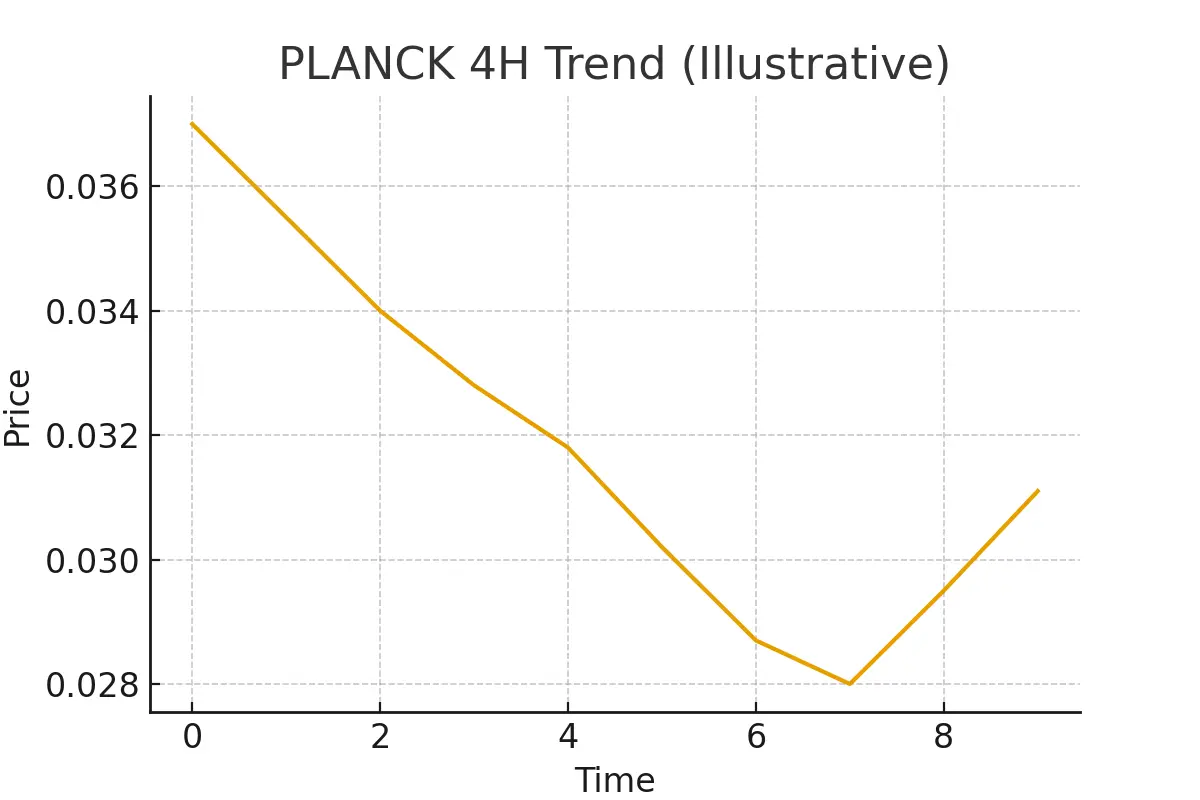

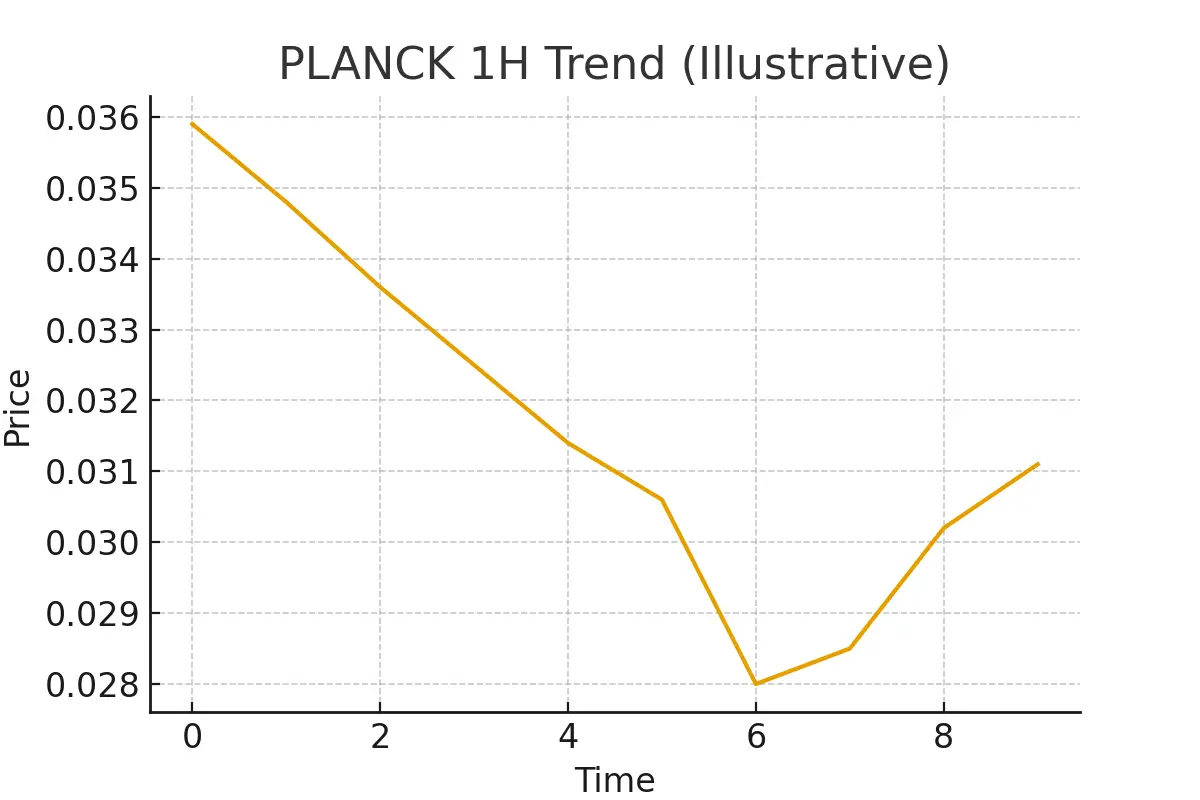

PLANCK finally showed some strength after a long drop. Buyers stepped in near the bottom, and the price moved up smoothly, breaking back above the short-term moving averages. Momentum looks better now, and indicators are showing a healthier recovery.

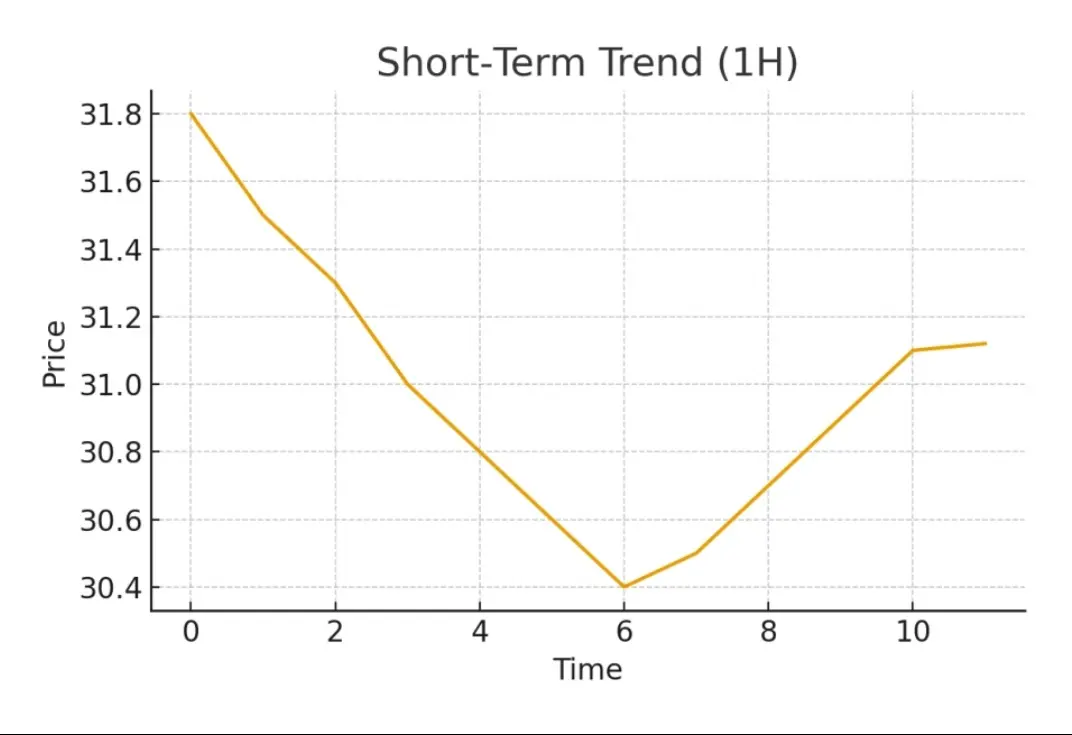

On the 1H timeframe, the trend is climbing slowly. Pullbacks are light, and buyers are still active around the support zones.

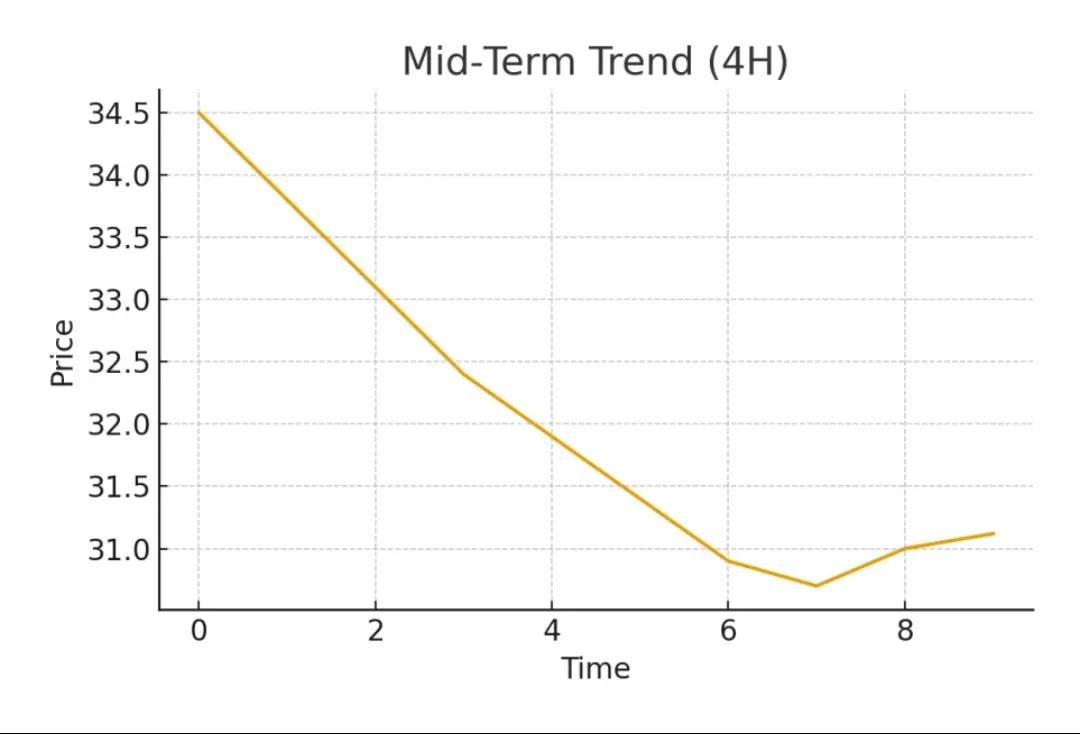

On the 4H timeframe, the bigger trend is starting to shift from a downtrend to a possible early reversal. If the price holds above the recent support, it may continue this steady climb.

Short-Term: Mild

PLANCK finally showed some strength after a long drop. Buyers stepped in near the bottom, and the price moved up smoothly, breaking back above the short-term moving averages. Momentum looks better now, and indicators are showing a healthier recovery.

On the 1H timeframe, the trend is climbing slowly. Pullbacks are light, and buyers are still active around the support zones.

On the 4H timeframe, the bigger trend is starting to shift from a downtrend to a possible early reversal. If the price holds above the recent support, it may continue this steady climb.

Short-Term: Mild

PLANCK7.46%

- Reward

- like

- Comment

- Repost

- Share

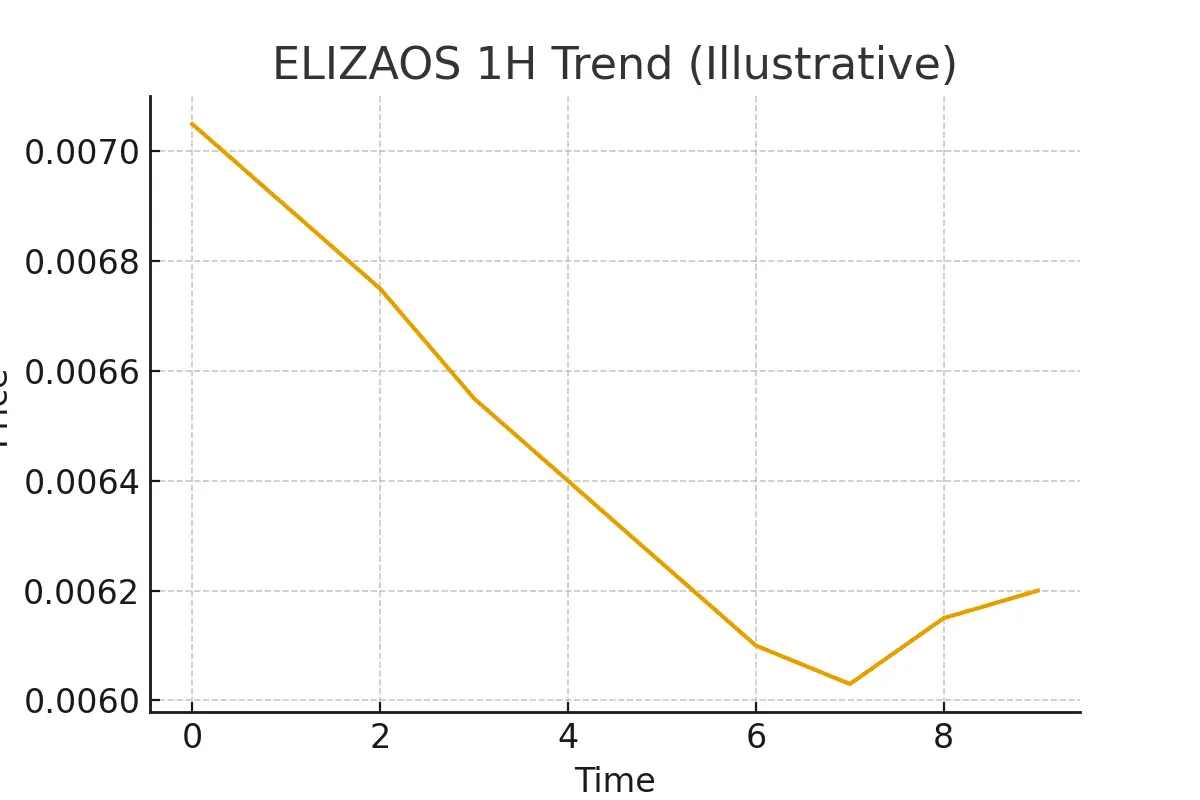

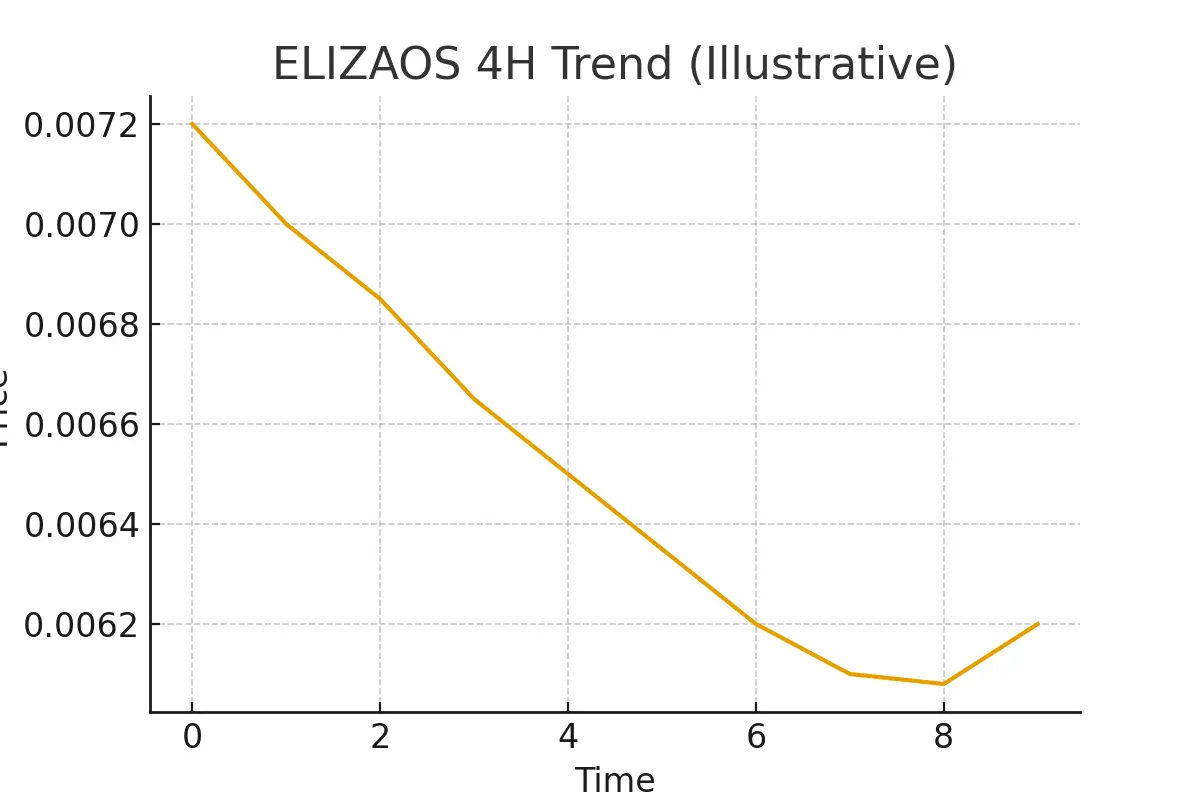

ELIZAOS Market Update

The chart has been sliding down for a while, but the last few candles show the price trying to slow down near support. Both the moving averages and indicators are still pointing to a weak trend, but the selling pressure looks lighter than before.

On the 1H view, the price is trying to hold above the recent low, showing small attempts from buyers. It’s not strong yet, but the market looks calmer than yesterday.

On the 4H view, the overall trend is still down, but the momentum is losing speed. If the support continues to hold, the market might try a small bounce. If not, it

The chart has been sliding down for a while, but the last few candles show the price trying to slow down near support. Both the moving averages and indicators are still pointing to a weak trend, but the selling pressure looks lighter than before.

On the 1H view, the price is trying to hold above the recent low, showing small attempts from buyers. It’s not strong yet, but the market looks calmer than yesterday.

On the 4H view, the overall trend is still down, but the momentum is losing speed. If the support continues to hold, the market might try a small bounce. If not, it

ELIZAOS-1.96%

- Reward

- like

- Comment

- Repost

- Share

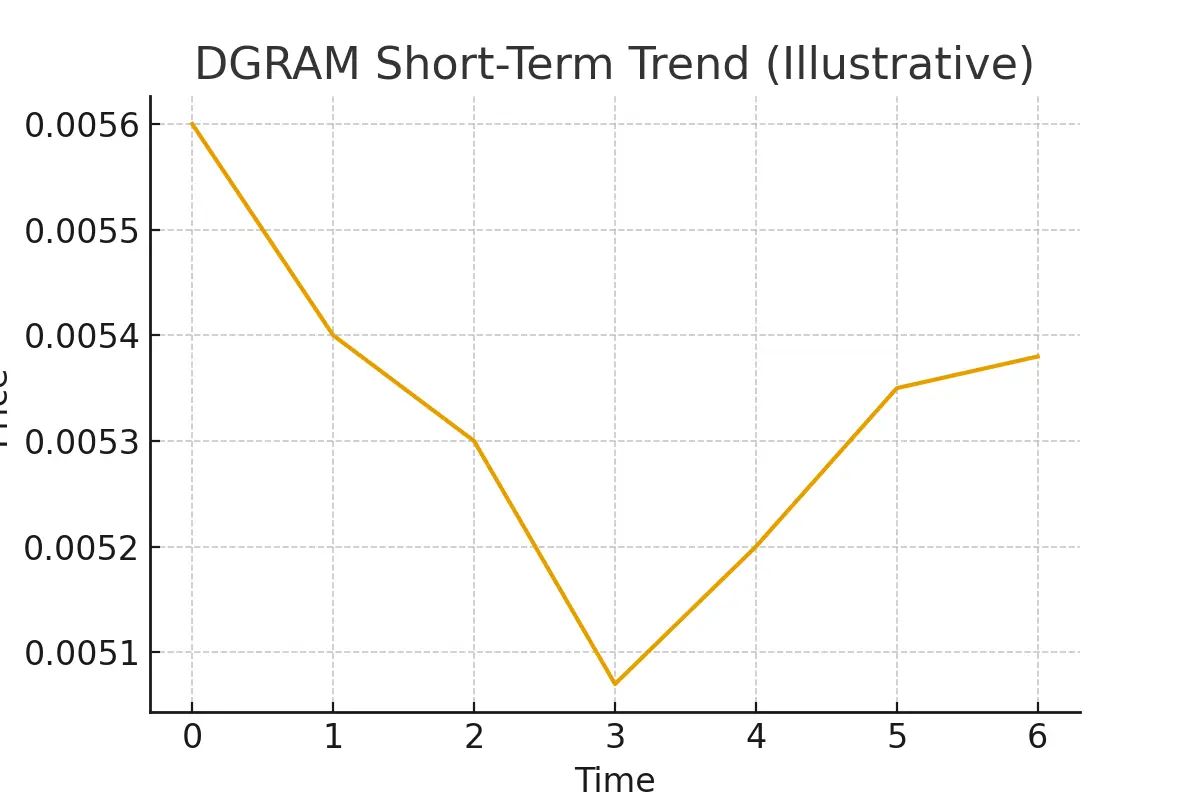

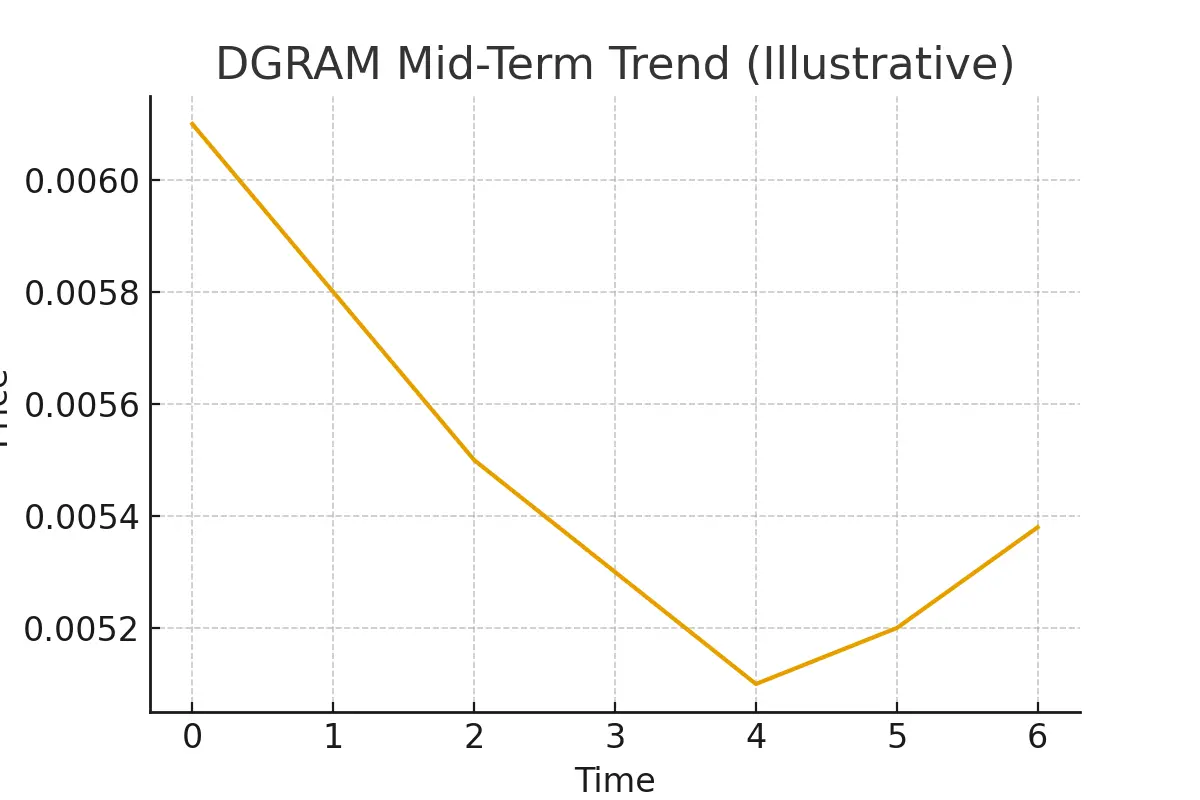

DGRAM Market Update

DGRAM is moving in a calm range after a long dip, and the chart is starting to look more stable. Buyers stepped in a few times, lifting the price from the recent bottom. The candles are now sitting close to the moving averages, which usually means the market is getting ready for a direction.

In the short-term frame, DGRAM is slowly pushing upward from its weak zone. The small bumps in price show early signs of buyers returning, though the momentum is still soft.

In the mid-term view, the downtrend has slowed down a lot. If the price continues to hold above its recent suppor

DGRAM is moving in a calm range after a long dip, and the chart is starting to look more stable. Buyers stepped in a few times, lifting the price from the recent bottom. The candles are now sitting close to the moving averages, which usually means the market is getting ready for a direction.

In the short-term frame, DGRAM is slowly pushing upward from its weak zone. The small bumps in price show early signs of buyers returning, though the momentum is still soft.

In the mid-term view, the downtrend has slowed down a lot. If the price continues to hold above its recent suppor

DGRAM2.92%

- Reward

- like

- Comment

- Repost

- Share

GAIB Market Update

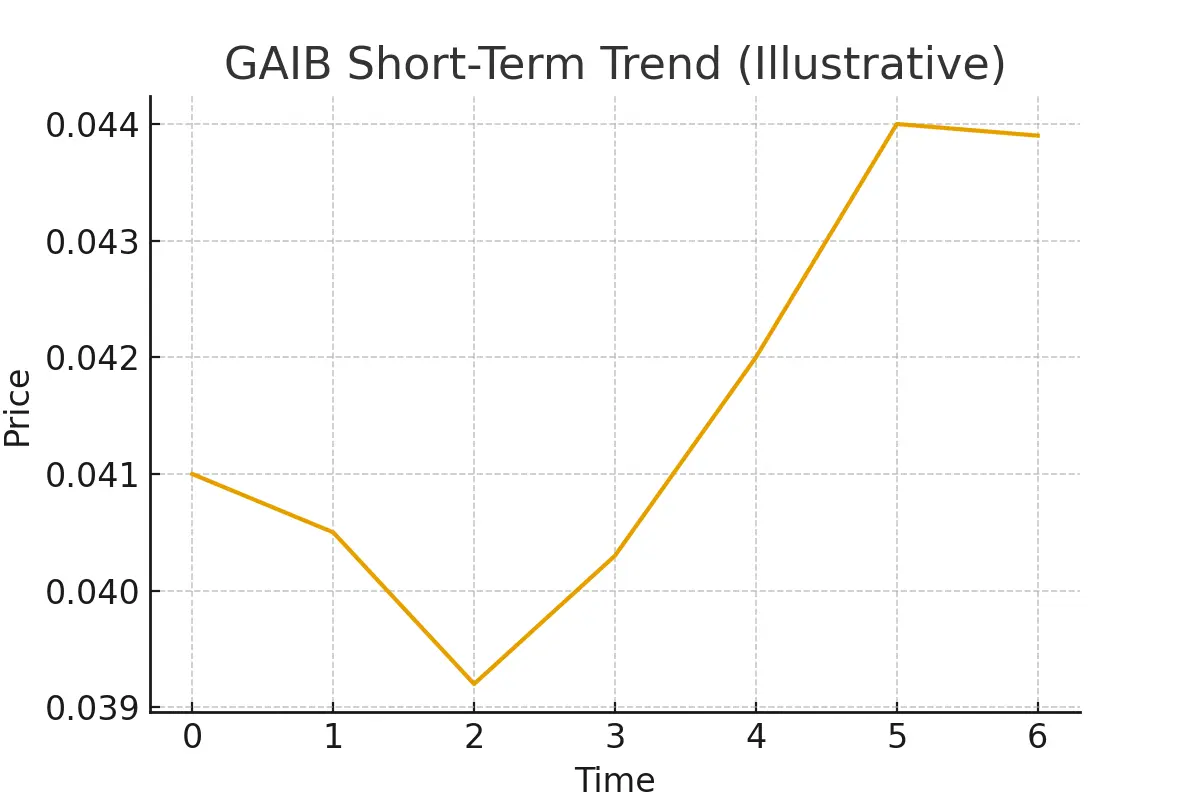

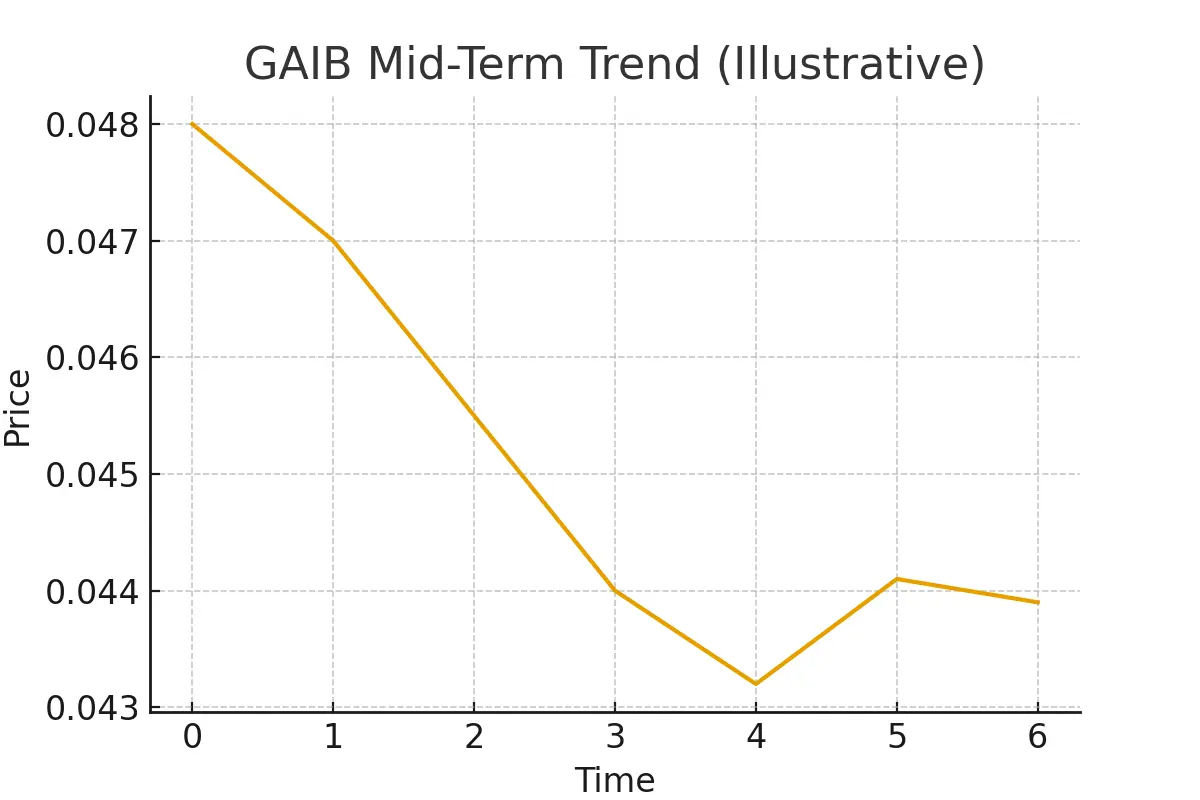

GAIB showed a clean bounce after hitting the recent low, and momentum is slowly coming back. Buyers stepped in strongly, which pushed the price up before cooling off again. Right now, the market looks like it’s trying to build a new support zone.

On the short-term view, the candles are moving tightly around the moving averages, which usually means the market is preparing for its next move. If buying pressure holds, GAIB may try to retest the recent spike zone again.

The mid-term structure looks smoother. The trend is still recovering from the dip, but the indicators are slow

GAIB showed a clean bounce after hitting the recent low, and momentum is slowly coming back. Buyers stepped in strongly, which pushed the price up before cooling off again. Right now, the market looks like it’s trying to build a new support zone.

On the short-term view, the candles are moving tightly around the moving averages, which usually means the market is preparing for its next move. If buying pressure holds, GAIB may try to retest the recent spike zone again.

The mid-term structure looks smoother. The trend is still recovering from the dip, but the indicators are slow

- Reward

- 1

- Comment

- Repost

- Share

MON Market Update

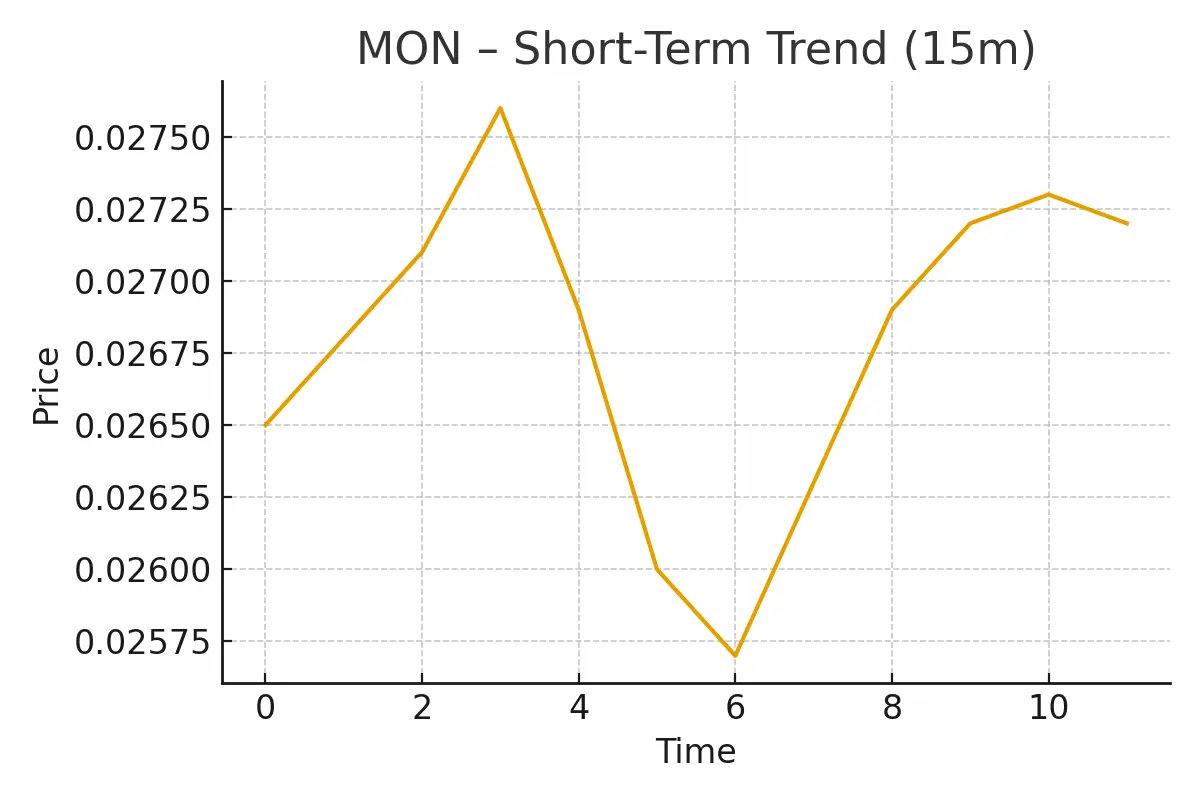

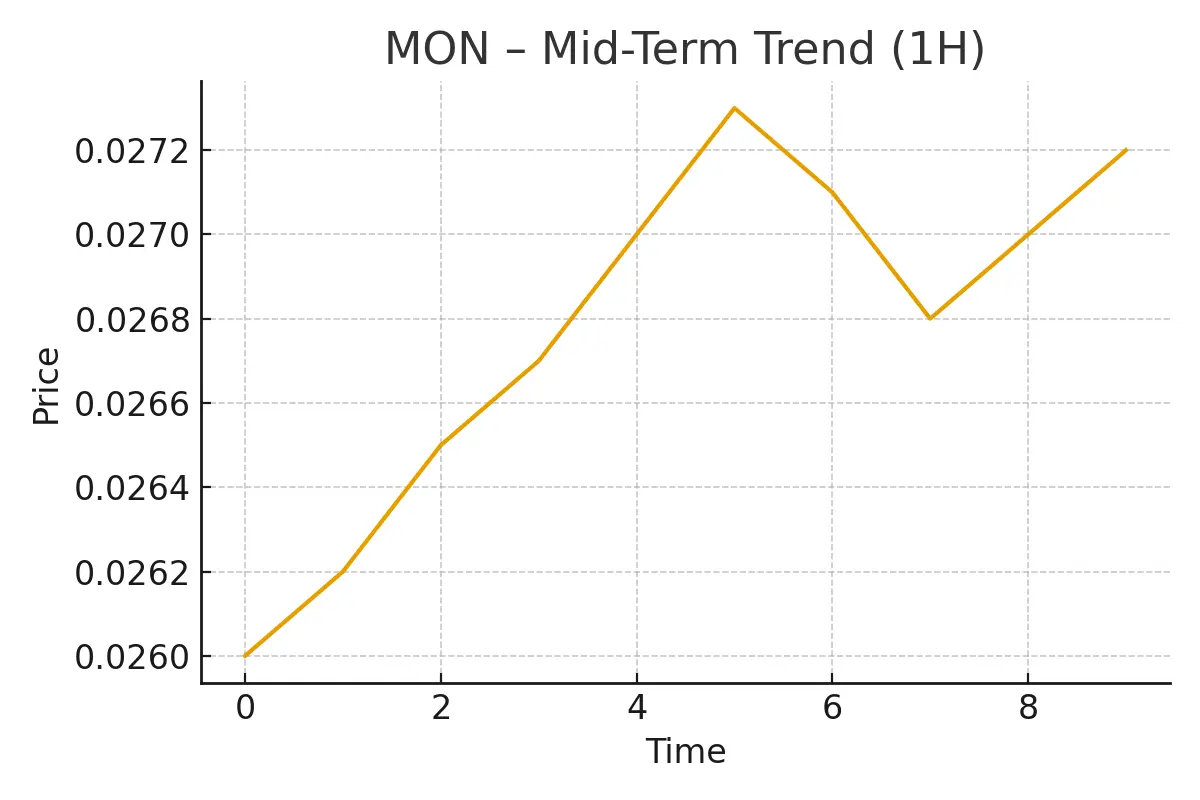

MON is slowly recovering after a heavy dip, and the price is trying to build a stable base again. The candles are staying closer to the moving averages, which usually hints that the market is calming down and preparing for the next move.

On the 15-minute chart, MON is showing short bursts of buying pressure. Each pullback is getting a little weaker, which often means buyers are trying to take control again.

On the 1-hour chart, the trend looks smoother. As long as MON holds above its recent bottom zone, it may try another gradual push upward. If momentum strengthens, we could

MON is slowly recovering after a heavy dip, and the price is trying to build a stable base again. The candles are staying closer to the moving averages, which usually hints that the market is calming down and preparing for the next move.

On the 15-minute chart, MON is showing short bursts of buying pressure. Each pullback is getting a little weaker, which often means buyers are trying to take control again.

On the 1-hour chart, the trend looks smoother. As long as MON holds above its recent bottom zone, it may try another gradual push upward. If momentum strengthens, we could

MON-0.47%

- Reward

- 1

- Comment

- Repost

- Share

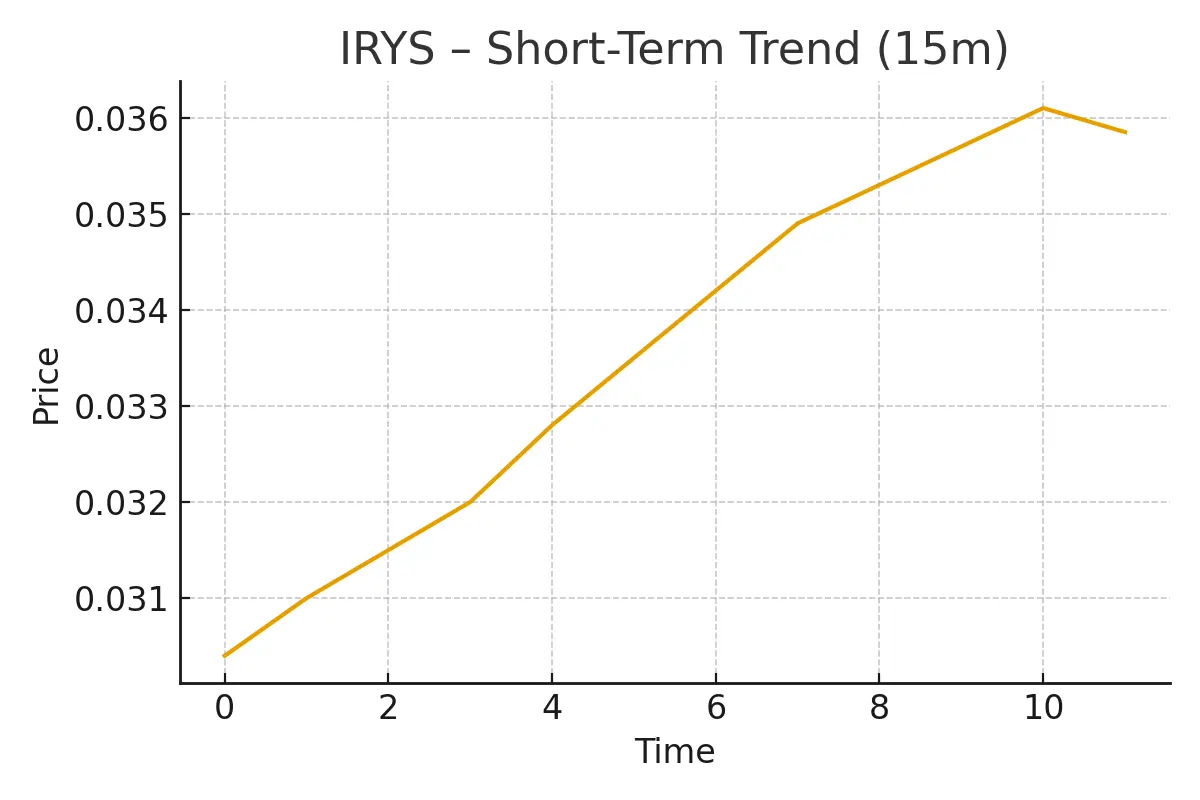

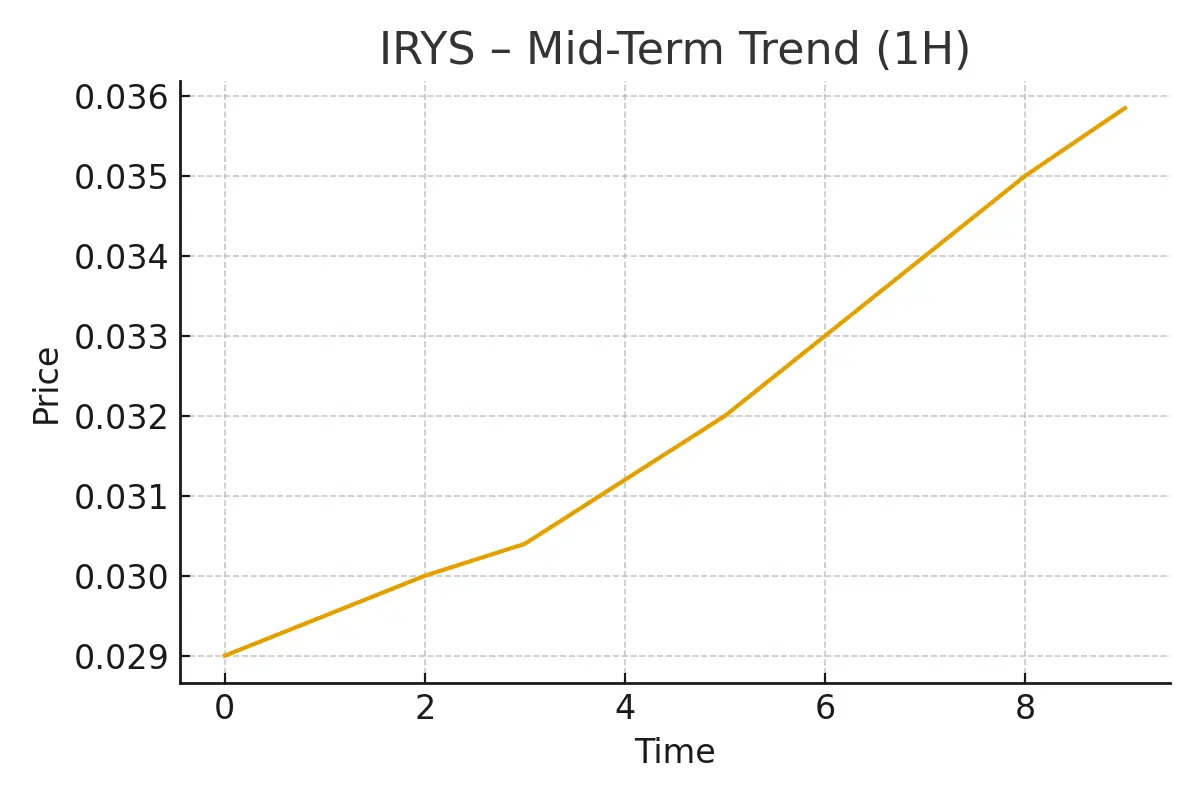

$IRYS IRYS Market Update

IRYS showed a clean breakout after holding a steady base for a while. Buyers stepped in strongly, pushing the price up with solid momentum on the short-term chart. The candles are riding above the moving averages, which usually shows strength is still active.

On the higher timeframe, IRYS is forming a smoother uptrend with gradual higher lows. As long as the market protects its recent support area, the trend can continue slowly upward. If momentum stays steady, IRYS might attempt another move toward the recent high zone.

Short-Term (15m):

Sharp push upward with quick

IRYS showed a clean breakout after holding a steady base for a while. Buyers stepped in strongly, pushing the price up with solid momentum on the short-term chart. The candles are riding above the moving averages, which usually shows strength is still active.

On the higher timeframe, IRYS is forming a smoother uptrend with gradual higher lows. As long as the market protects its recent support area, the trend can continue slowly upward. If momentum stays steady, IRYS might attempt another move toward the recent high zone.

Short-Term (15m):

Sharp push upward with quick

- Reward

- like

- Comment

- Repost

- Share

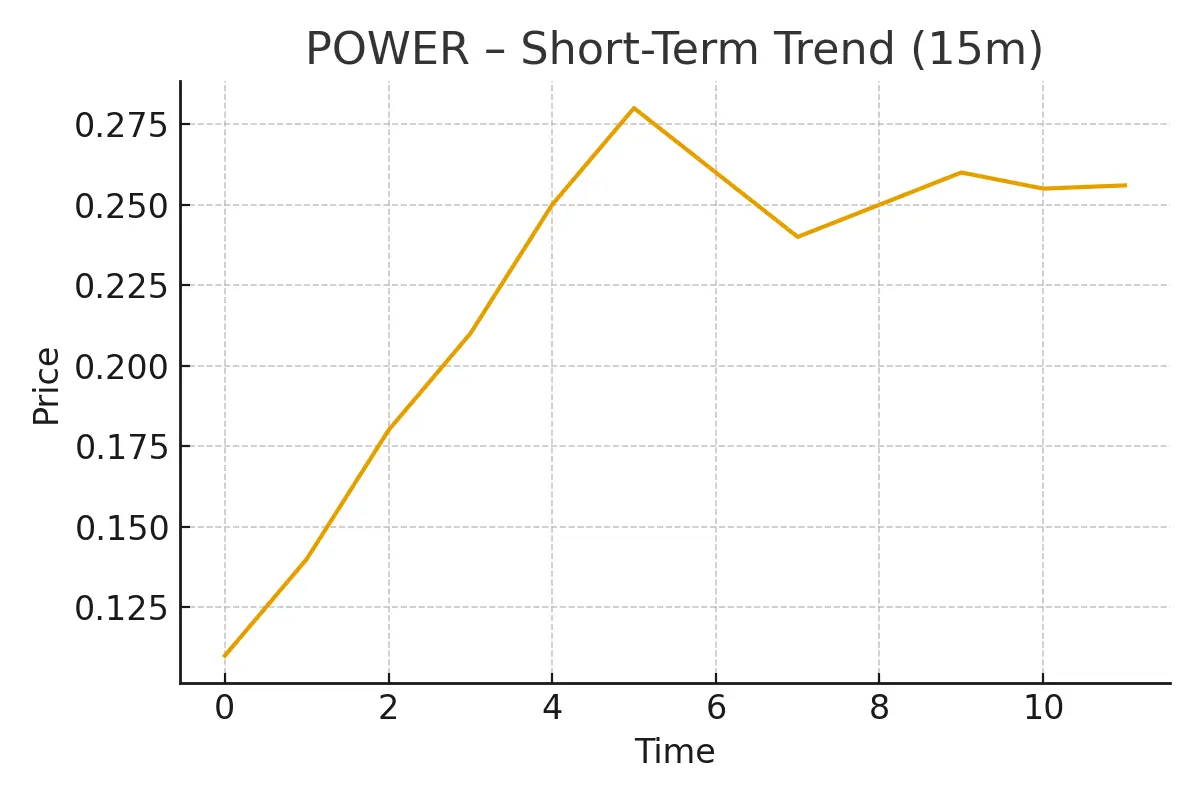

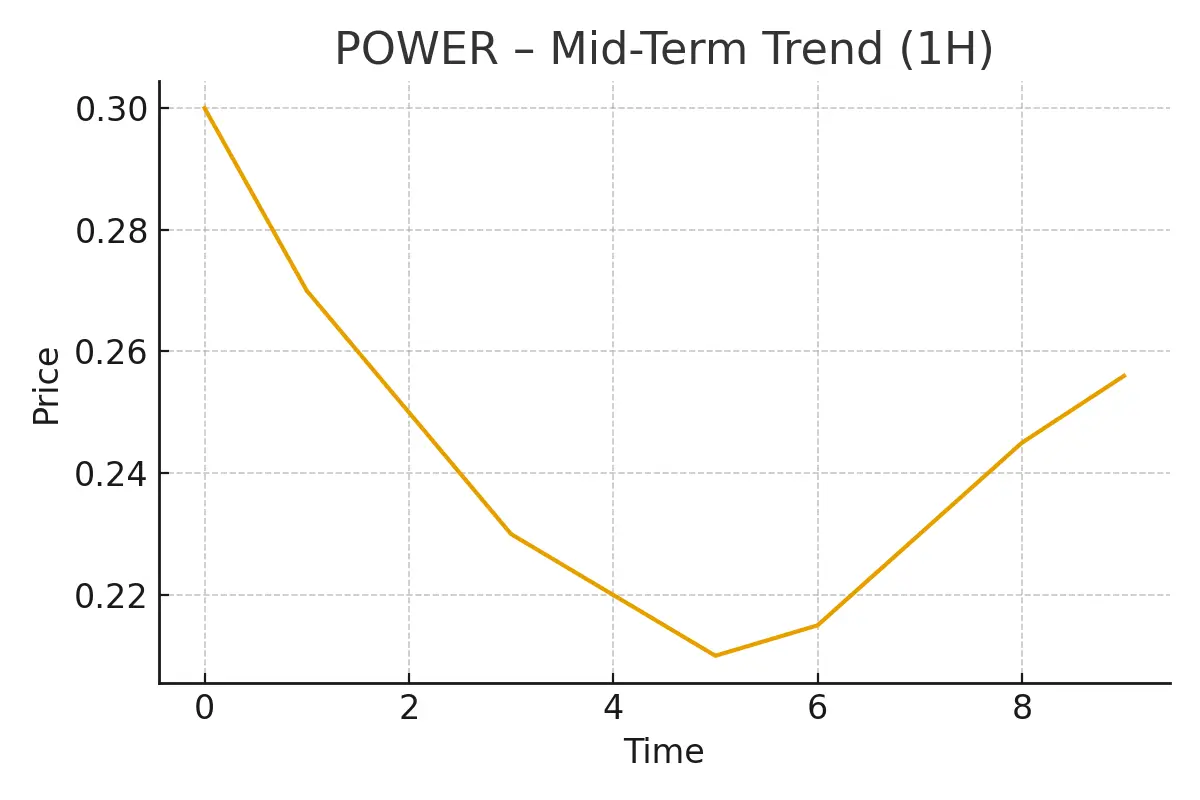

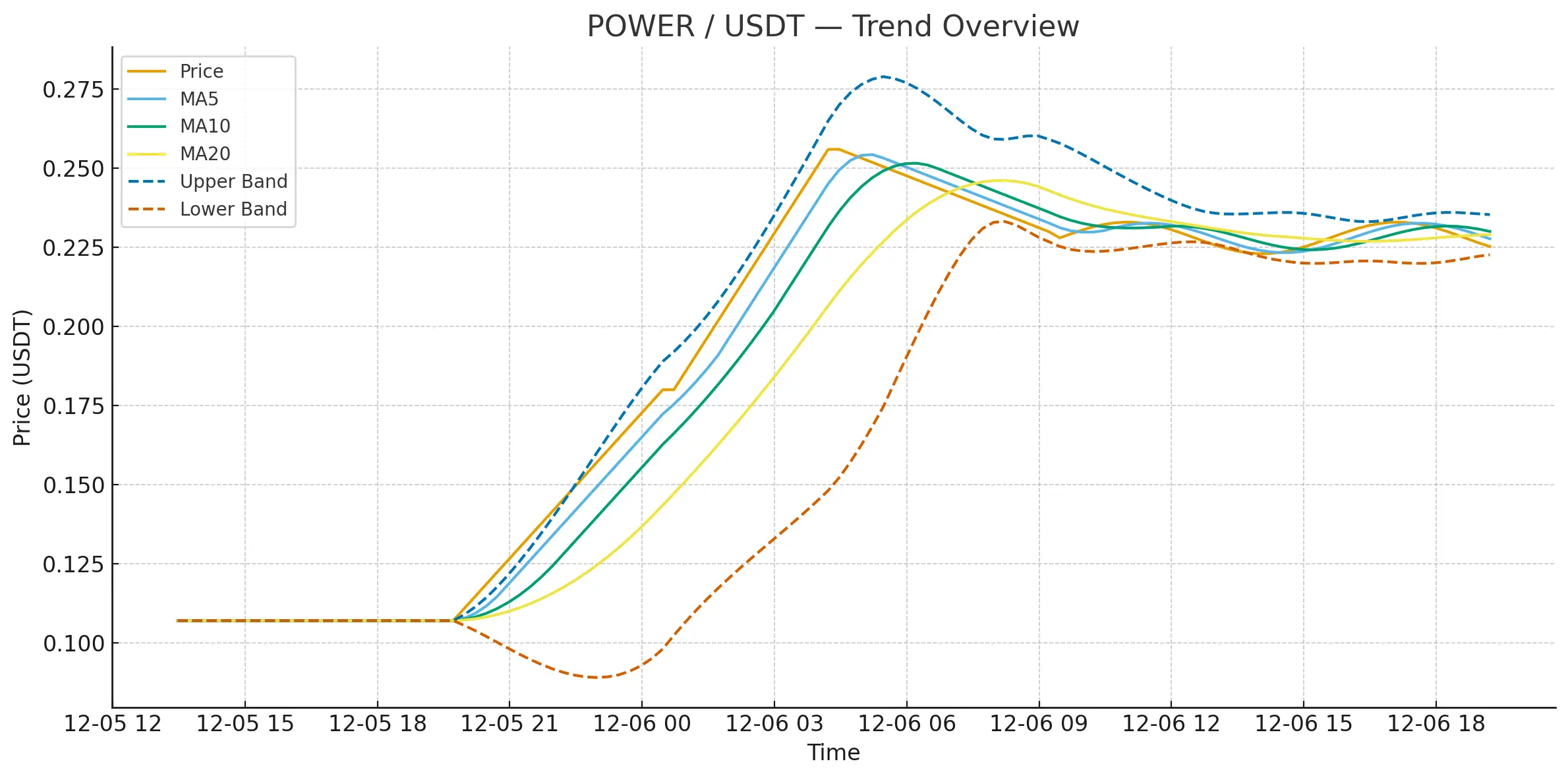

$POWER POWER Market Update

POWER just had a strong breakout and the price is trying to stabilize after a big move. On the short-term chart the momentum is still active — candles are holding above the moving averages, showing buyers are not fully letting go yet.

On the bigger timeframe, the token is cooling down but still maintaining higher lows, which usually shows the trend is not finished. If the current support holds, the market might attempt another push.

Short-Term View (15m):

Market is showing a steady climb with quick pullbacks. If the price stays above the recent support zone, a slow

POWER just had a strong breakout and the price is trying to stabilize after a big move. On the short-term chart the momentum is still active — candles are holding above the moving averages, showing buyers are not fully letting go yet.

On the bigger timeframe, the token is cooling down but still maintaining higher lows, which usually shows the trend is not finished. If the current support holds, the market might attempt another push.

Short-Term View (15m):

Market is showing a steady climb with quick pullbacks. If the price stays above the recent support zone, a slow

- Reward

- 1

- Comment

- Repost

- Share

HYPE Market Update

Price is trying to stabilize around the 31 zone after a long pullback. On the short-term chart, the token is showing small bullish attempts and the indicators are slowly turning upward. If this momentum holds, a push toward the next resistance area could happen.

Looking at a bigger timeframe, the downtrend has started to slow down. Momentum indicators are flattening out, which usually suggests the market is preparing for either a recovery bounce or a consolidation phase before choosing direction.

Short-Term Outlook (1H):

If buyers keep stepping in above the 30.8–31 support,

Price is trying to stabilize around the 31 zone after a long pullback. On the short-term chart, the token is showing small bullish attempts and the indicators are slowly turning upward. If this momentum holds, a push toward the next resistance area could happen.

Looking at a bigger timeframe, the downtrend has started to slow down. Momentum indicators are flattening out, which usually suggests the market is preparing for either a recovery bounce or a consolidation phase before choosing direction.

Short-Term Outlook (1H):

If buyers keep stepping in above the 30.8–31 support,

HYPE0.2%

- Reward

- 2

- Comment

- Repost

- Share

$RLS RLS Update:

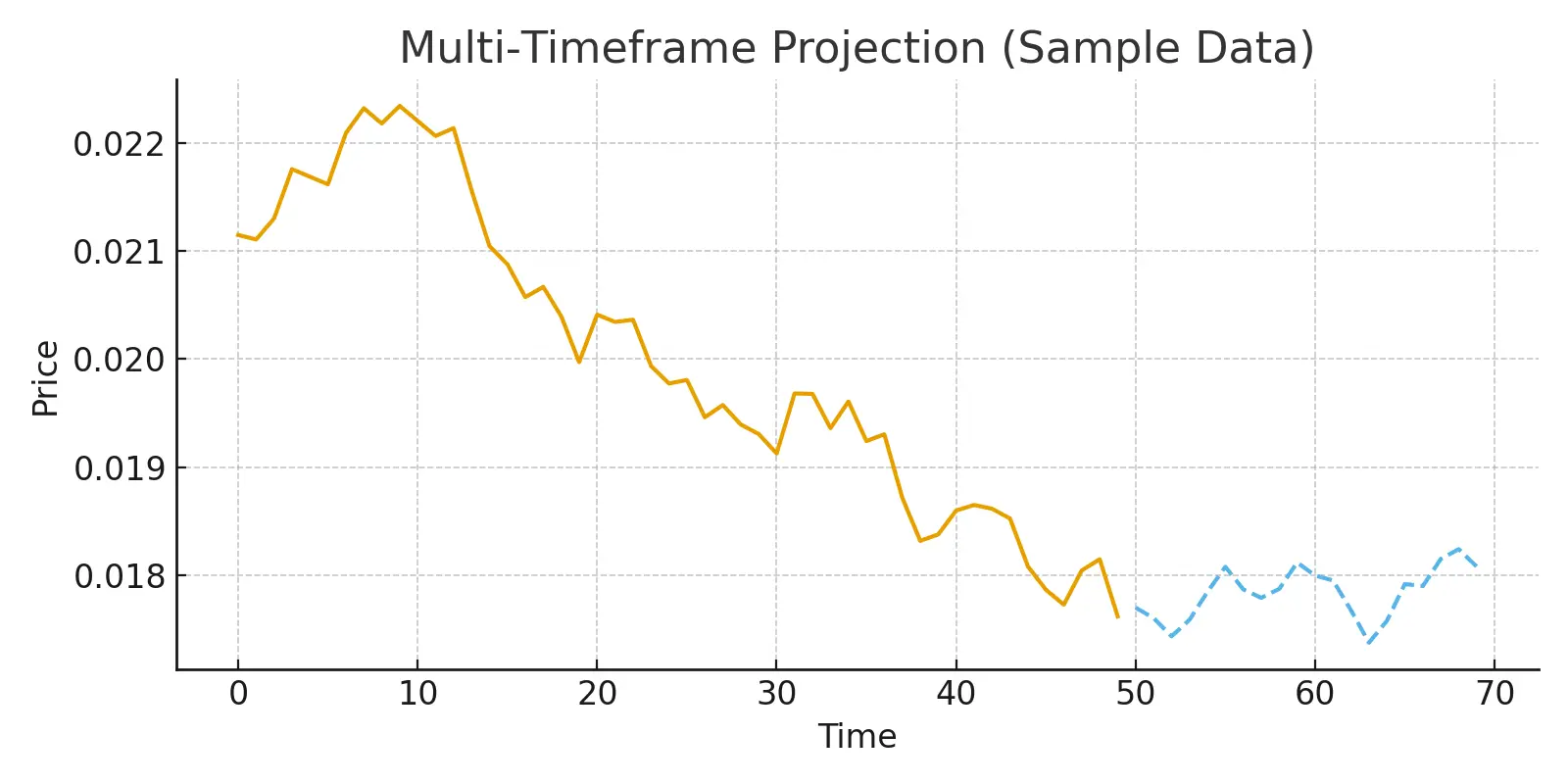

Price is showing a nice recovery after touching the 0.018 zone. Buyers stepped in strongly and pushed it back toward the 0.022 area. Short-term trend is still holding above support and indicators are showing steady momentum.

For the next move, I’m watching two things:

• Short timeframe: If it stays above its moving averages, we could see another push toward the recent high area.

• Longer timeframe: As long as the trend holds above support, the structure looks healthy for gradual upside.

This is just my personal view — not financial advice. Always DYOR.

Price is showing a nice recovery after touching the 0.018 zone. Buyers stepped in strongly and pushed it back toward the 0.022 area. Short-term trend is still holding above support and indicators are showing steady momentum.

For the next move, I’m watching two things:

• Short timeframe: If it stays above its moving averages, we could see another push toward the recent high area.

• Longer timeframe: As long as the trend holds above support, the structure looks healthy for gradual upside.

This is just my personal view — not financial advice. Always DYOR.

RLS4.61%

- Reward

- 2

- Comment

- Repost

- Share

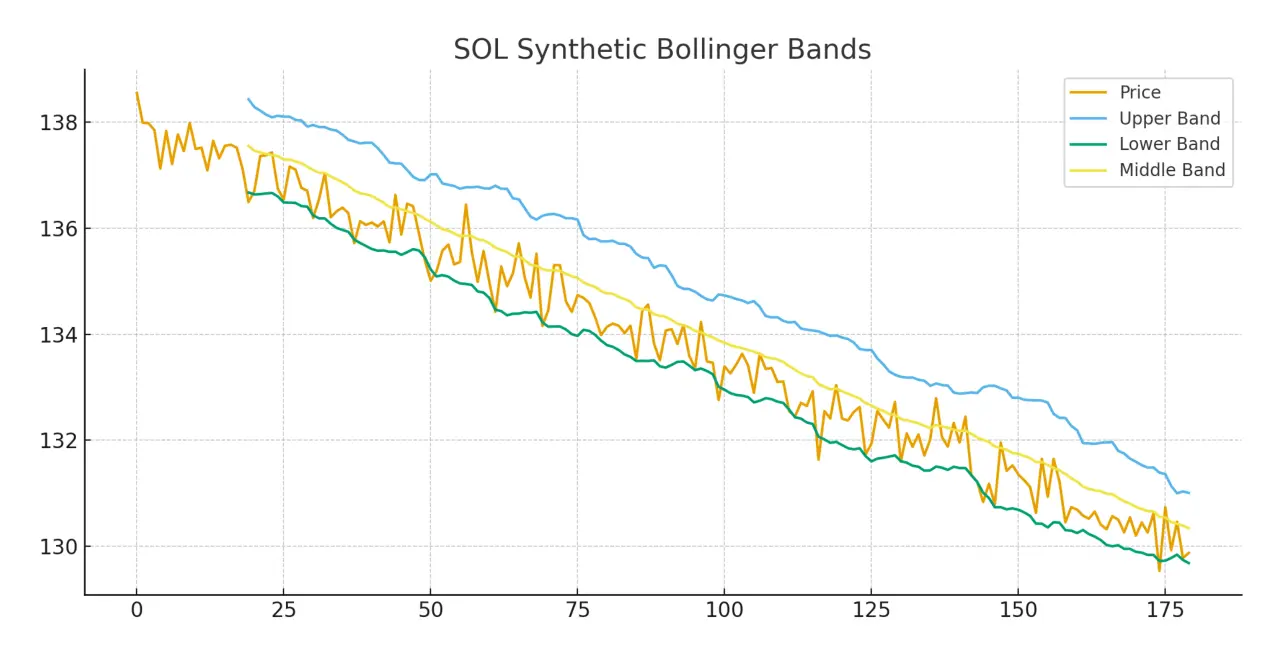

$SOL SOL 1H Quick Market Look

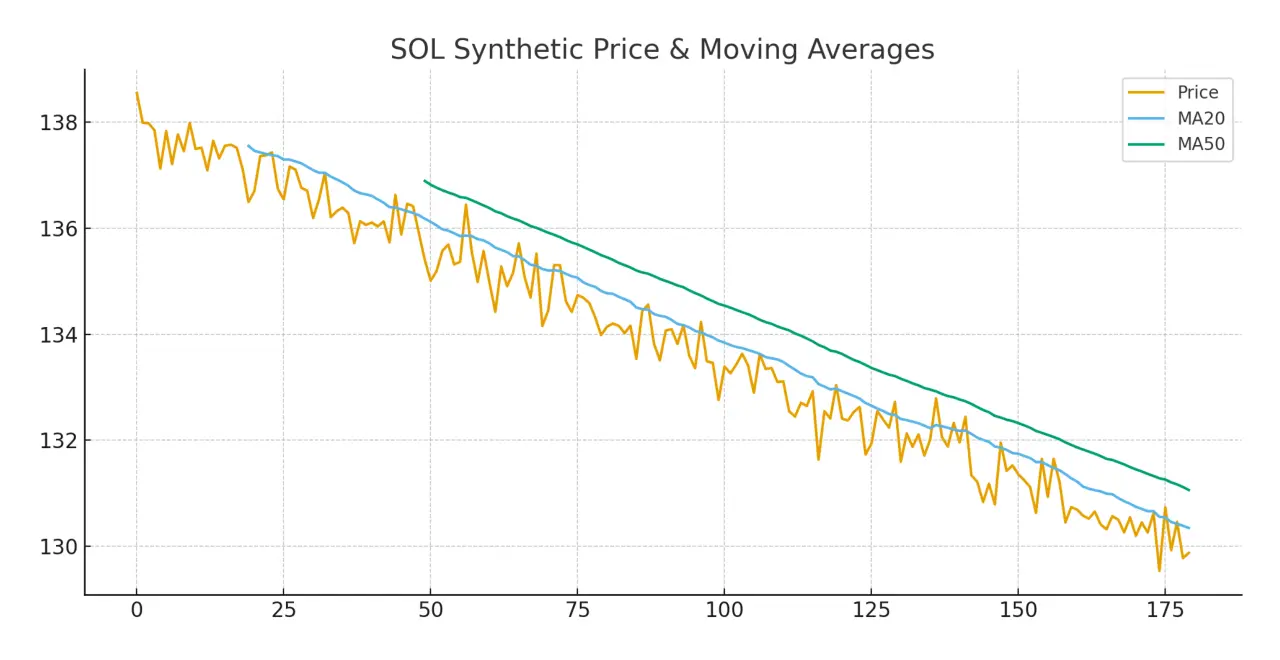

SOL has been moving in a steady downtrend, but the pace of the drop is slowing. Price is sitting near the lower band, showing the market is cooling down after the last move. The MA lines are still pointing slightly downward, meaning the trend hasn’t fully shifted yet — but momentum is flattening out.

Short-Term View (1H)

• Price is holding a tight range after the dip.

• A break above the short MAs could give a small bounce.

• If it slips under the recent support zone, sellers may push again.

Mid-Term View (4H)

Using MA + Bollinger formats, SOL still looks correc

SOL has been moving in a steady downtrend, but the pace of the drop is slowing. Price is sitting near the lower band, showing the market is cooling down after the last move. The MA lines are still pointing slightly downward, meaning the trend hasn’t fully shifted yet — but momentum is flattening out.

Short-Term View (1H)

• Price is holding a tight range after the dip.

• A break above the short MAs could give a small bounce.

• If it slips under the recent support zone, sellers may push again.

Mid-Term View (4H)

Using MA + Bollinger formats, SOL still looks correc

SOL-0.71%

- Reward

- like

- Comment

- Repost

- Share

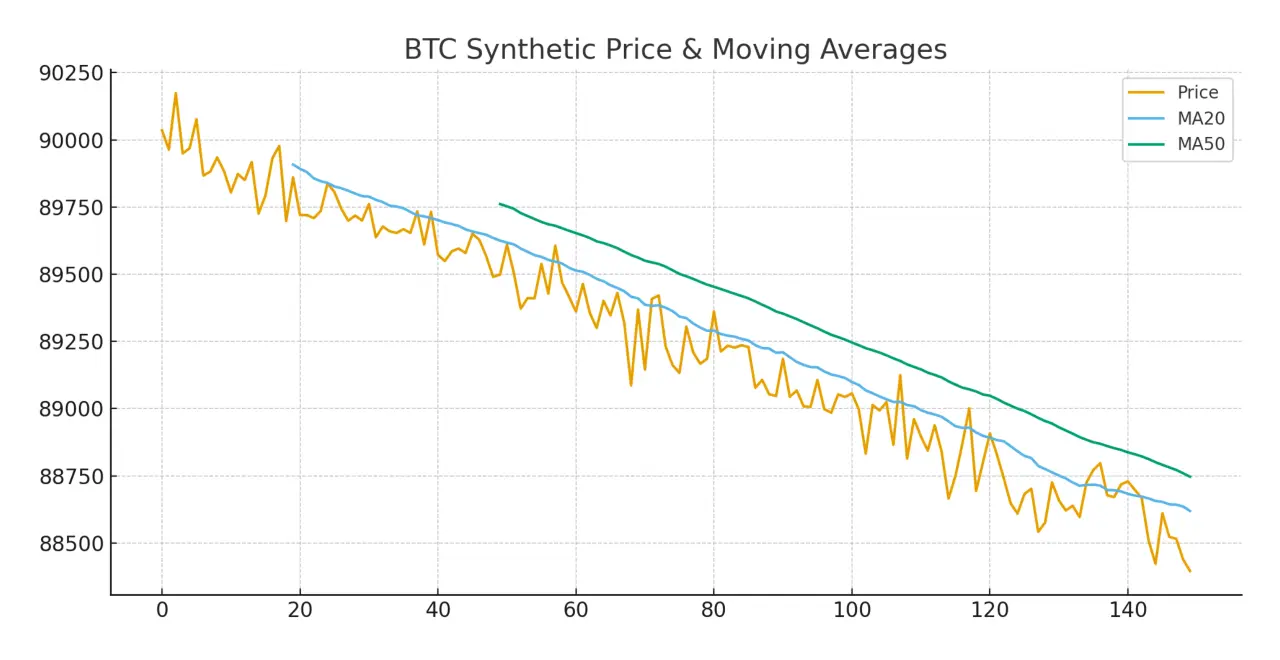

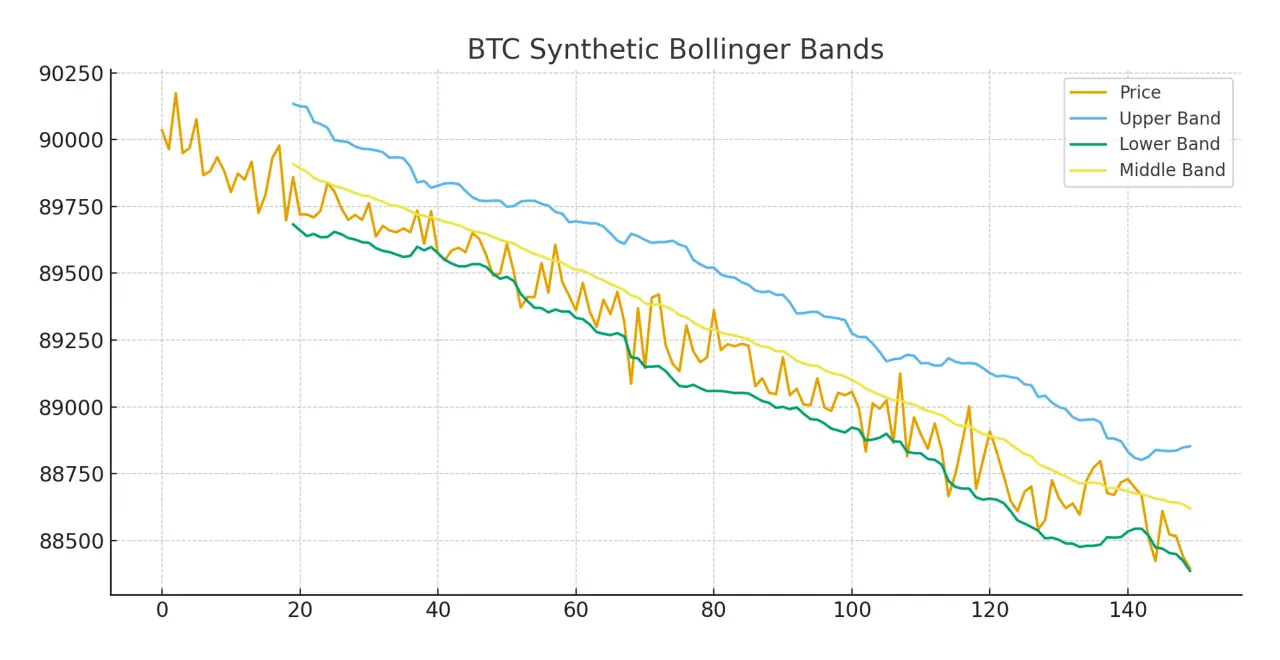

$BTC BTC 1H Market Update

BTC is still moving inside a slow-down phase after yesterday’s drop. Price is trading close to the support area, and the candles are hugging the lower bands, showing reduced volatility. MA lines are tight, which usually signals a potential shift soon.

Short-Term View (1H)

• Market is in a correction mood, but holding steady above short support.

• If price climbs back above MA20, momentum can slowly pick up again.

• Losing the current support may invite more downside pressure.

Mid-Term View (4H)

Using MA and Bollinger methods, the chart still shows a controlled pullb

BTC is still moving inside a slow-down phase after yesterday’s drop. Price is trading close to the support area, and the candles are hugging the lower bands, showing reduced volatility. MA lines are tight, which usually signals a potential shift soon.

Short-Term View (1H)

• Market is in a correction mood, but holding steady above short support.

• If price climbs back above MA20, momentum can slowly pick up again.

• Losing the current support may invite more downside pressure.

Mid-Term View (4H)

Using MA and Bollinger methods, the chart still shows a controlled pullb

BTC0.13%

- Reward

- like

- Comment

- Repost

- Share

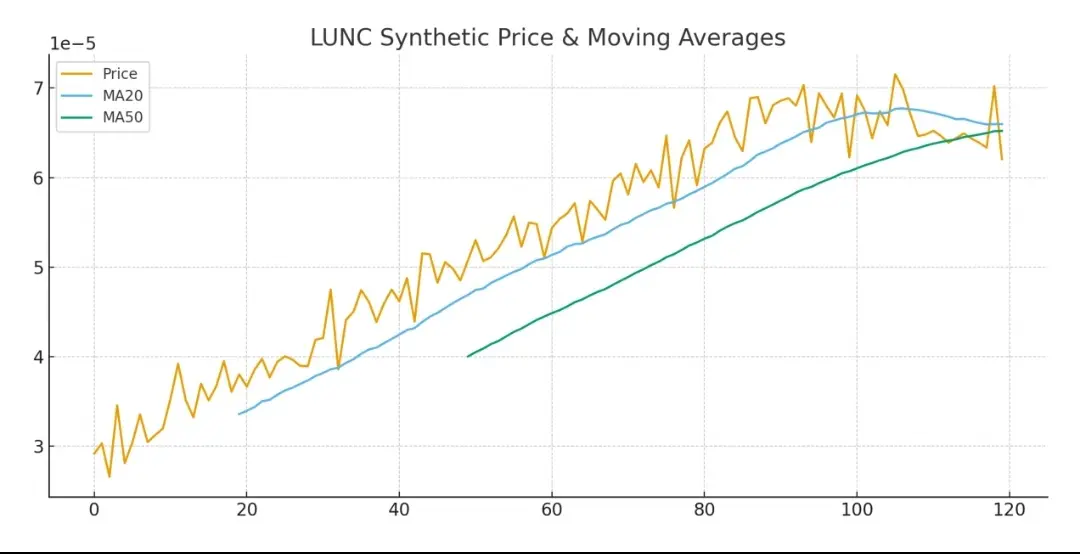

$LUNC LUNC Market Update (1H Overview)

LUNC has been showing strong momentum with a solid climb, followed by a healthy pullback. Price is still moving above key MA zones, showing buyers are active even after the dip. As long as LUNC holds above its recent support levels, the uptrend structure stays intact.

Short-Term View (1H):

• Price is cooling down after a sharp rise, forming a natural correction.

• Holding above MA20 keeps the momentum alive.

• A push back above the recent swing high could open room for another breakout.

Mid-Term View (4H):

Using wider tools like MA and Bollinger Bands,

LUNC has been showing strong momentum with a solid climb, followed by a healthy pullback. Price is still moving above key MA zones, showing buyers are active even after the dip. As long as LUNC holds above its recent support levels, the uptrend structure stays intact.

Short-Term View (1H):

• Price is cooling down after a sharp rise, forming a natural correction.

• Holding above MA20 keeps the momentum alive.

• A push back above the recent swing high could open room for another breakout.

Mid-Term View (4H):

Using wider tools like MA and Bollinger Bands,

LUNC12.26%

- Reward

- like

- Comment

- Repost

- Share

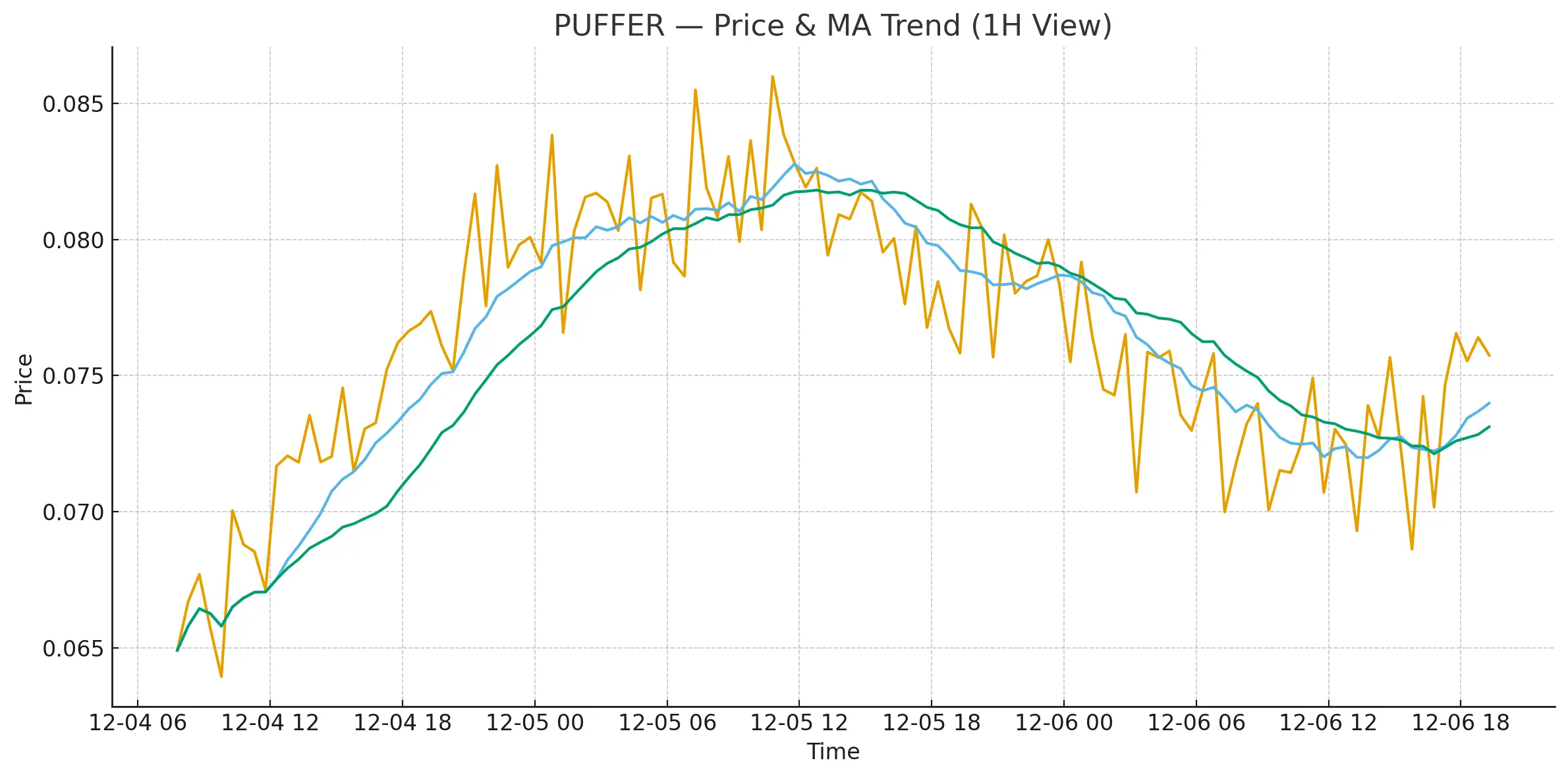

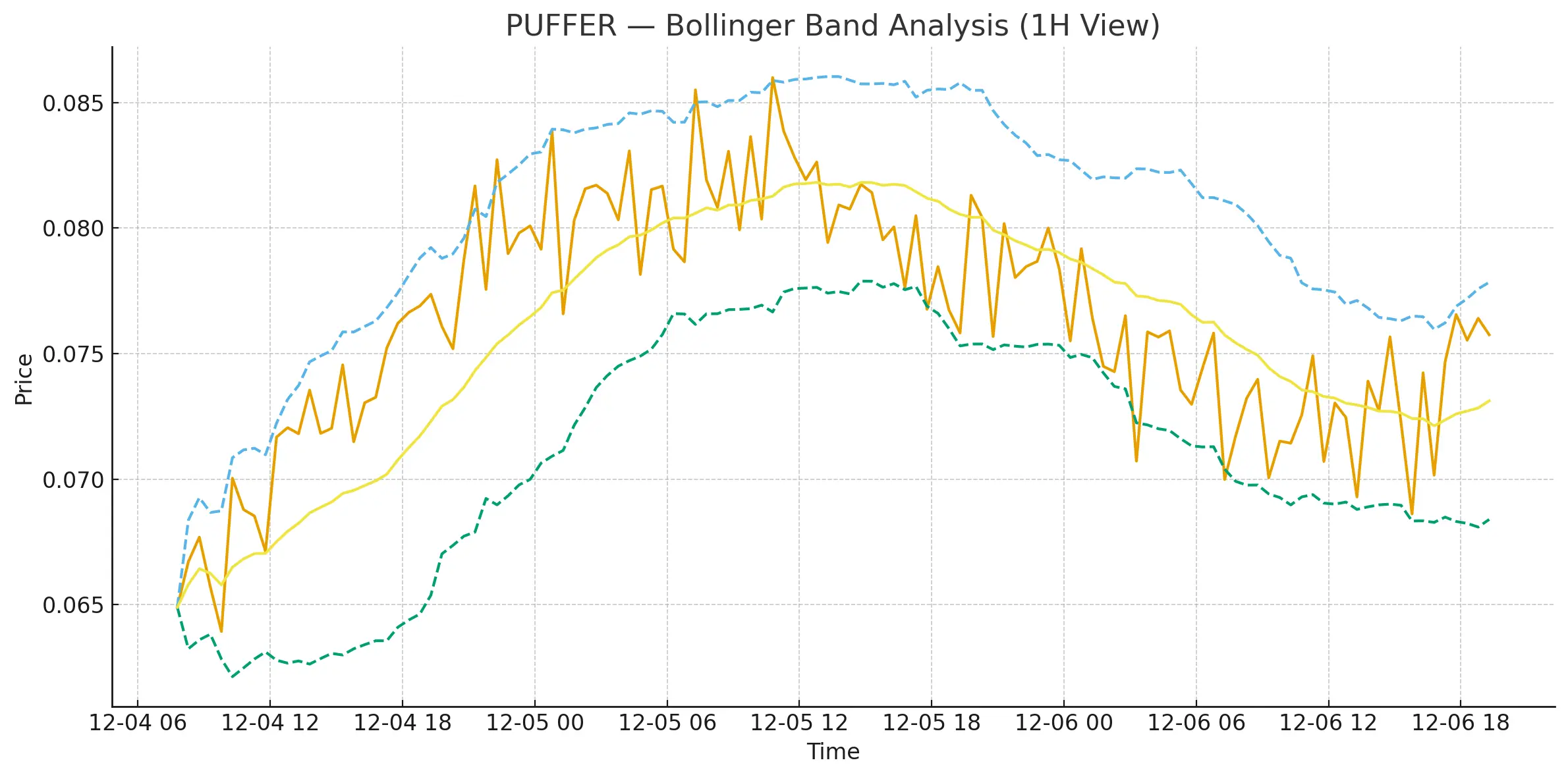

PUFFER 1H Market Update

PUFFER made a strong push earlier, tapping the 0.094 zone before cooling down. Right now the price is holding around 0.080, moving closely with the MA lines. Momentum slowed down, but the trend still looks alive as long as it holds above the local support area.

Short-Term View (1H):

• Price is stabilizing after a sharp move.

• If candles stay above the MA20 zone, a new bounce may form.

• A drop under the recent support could pull the chart into a deeper correction.

Mid-Term View (4H):

Using wider indicators like MA and Bollinger Bands, the market still shows strength. I

PUFFER made a strong push earlier, tapping the 0.094 zone before cooling down. Right now the price is holding around 0.080, moving closely with the MA lines. Momentum slowed down, but the trend still looks alive as long as it holds above the local support area.

Short-Term View (1H):

• Price is stabilizing after a sharp move.

• If candles stay above the MA20 zone, a new bounce may form.

• A drop under the recent support could pull the chart into a deeper correction.

Mid-Term View (4H):

Using wider indicators like MA and Bollinger Bands, the market still shows strength. I

PUFFER-6.42%

- Reward

- like

- Comment

- Repost

- Share

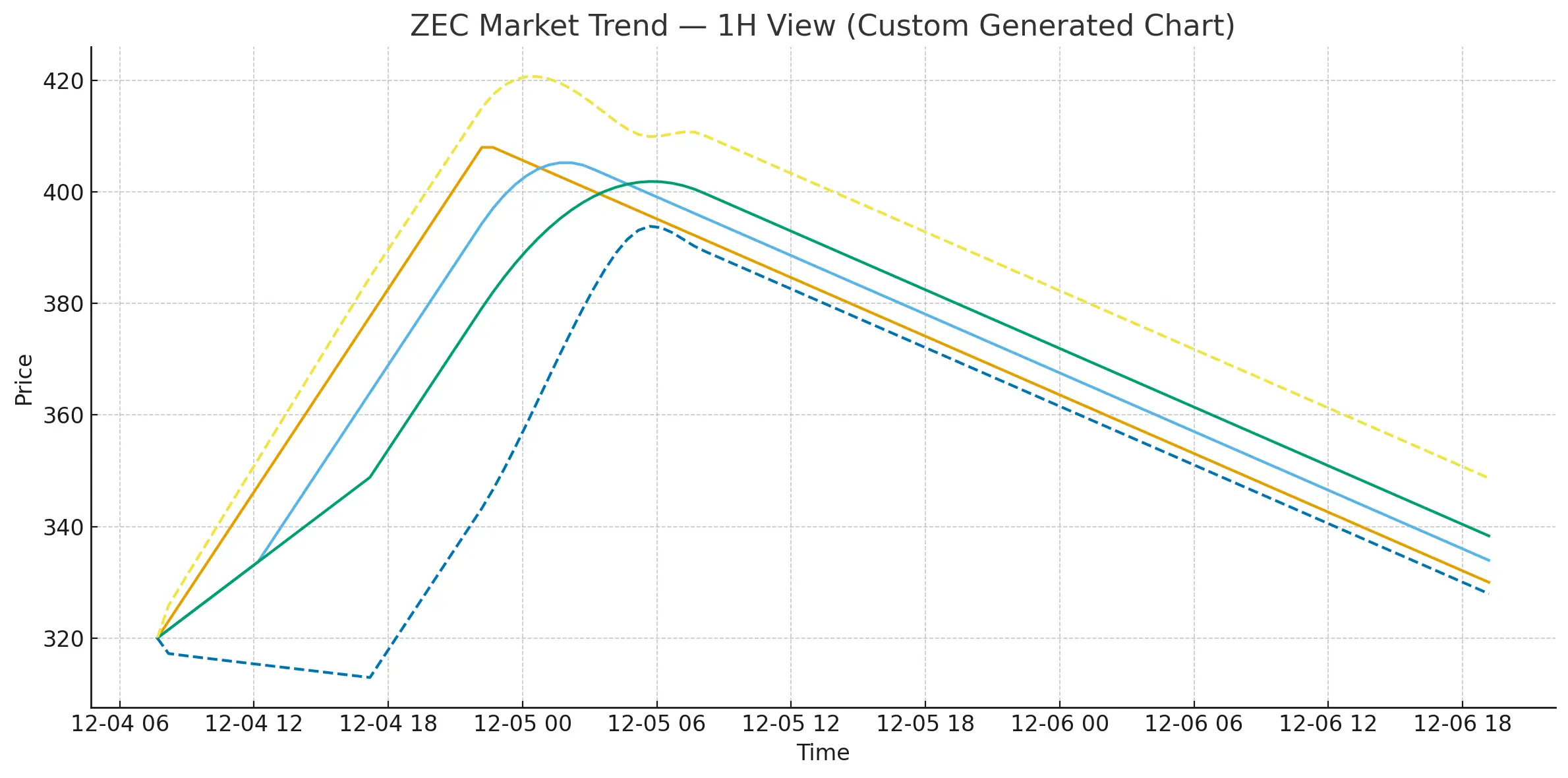

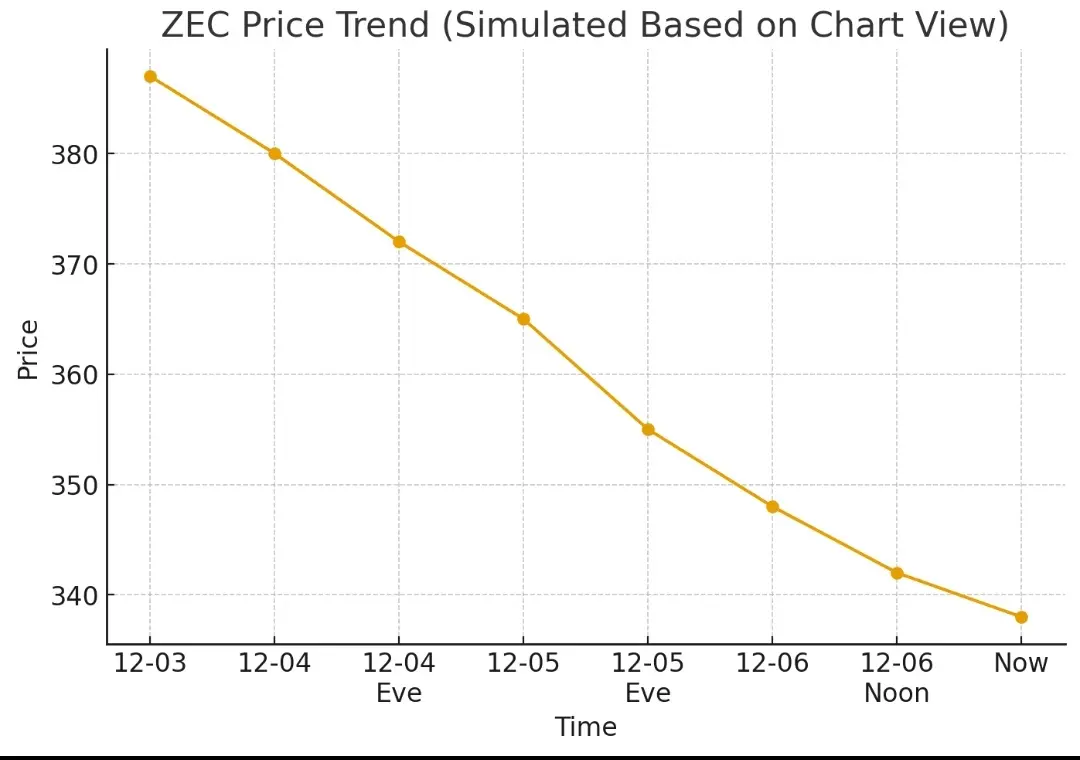

ZEC Market Update (1H Overview)

ZEC has been pulling back after that sharp run toward the 408 zone. Price is sliding along the MA lines, showing clear short-term weakness. Volume is cooling and the candles are staying close to the lower Bollinger band, which usually signals market exhaustion.

Short-Term View:

If the chart holds above the 325–330 support area, we might see a small bounce.

If this support breaks, price could drift toward the lower range before building momentum.

Mid-Term View:

Indicators like MACD and RSI are showing a slowdown, not a crash. The market looks like it's resetting

ZEC has been pulling back after that sharp run toward the 408 zone. Price is sliding along the MA lines, showing clear short-term weakness. Volume is cooling and the candles are staying close to the lower Bollinger band, which usually signals market exhaustion.

Short-Term View:

If the chart holds above the 325–330 support area, we might see a small bounce.

If this support breaks, price could drift toward the lower range before building momentum.

Mid-Term View:

Indicators like MACD and RSI are showing a slowdown, not a crash. The market looks like it's resetting

ZEC-5.15%

- Reward

- 1

- Comment

- Repost

- Share

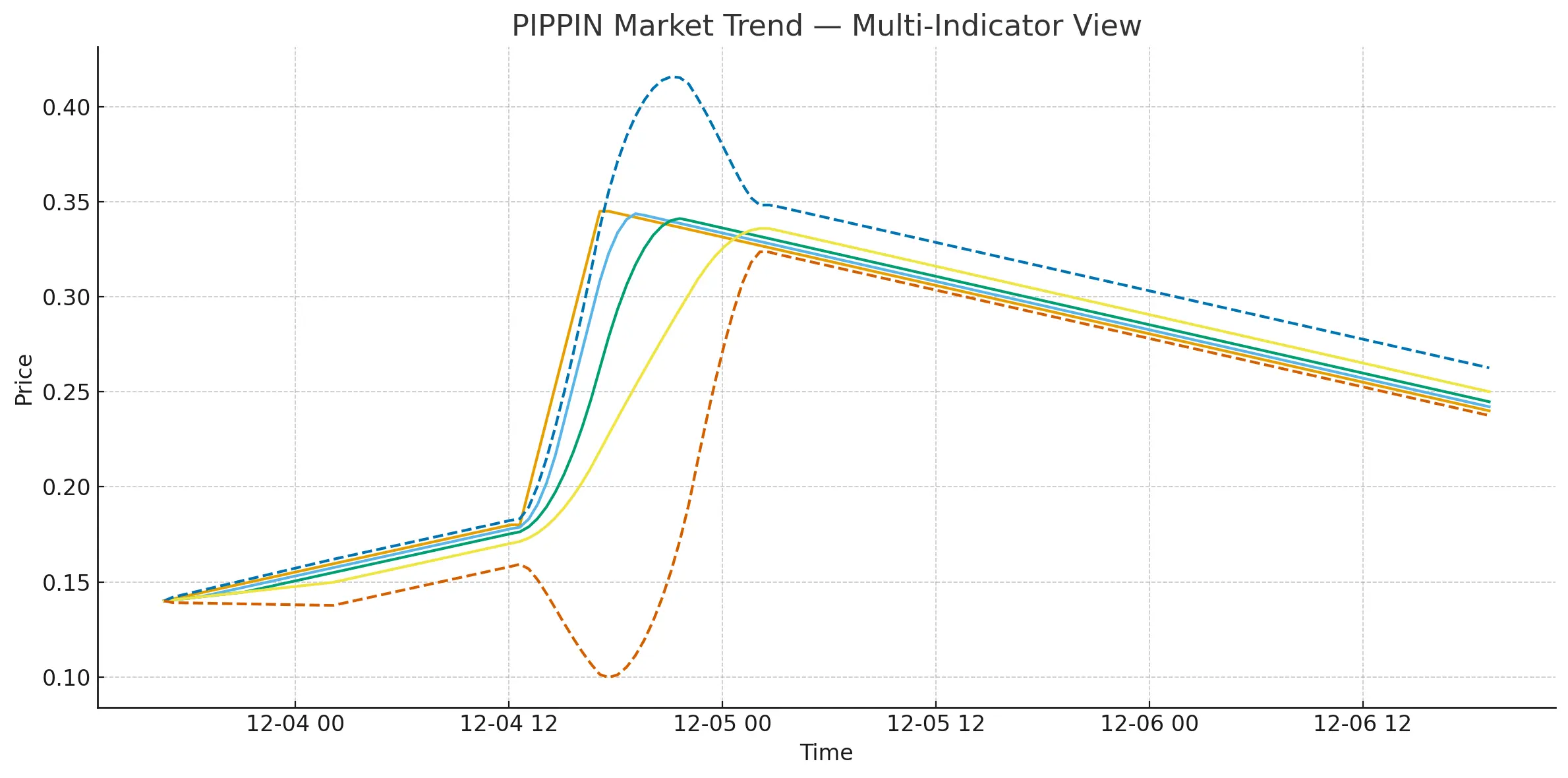

PIPPIN Market Update (1H Overview)

PIPPIN just had a massive push earlier, hitting that strong spike before cooling down into the 0.24 area. Price is now moving around the MA lines, showing the market is taking a breather after the big run.

Short-Term View:

If candles stay above the MA20 and the mid-band area, the market can try another small push.

If it dips under the short-term support, it may retest the lower range before forming the next move.

Mid-Term View:

Trend is still positive overall. Momentum indicators are easing but not bearish. Market looks like it’s resetting after the breakout.

PIPPIN just had a massive push earlier, hitting that strong spike before cooling down into the 0.24 area. Price is now moving around the MA lines, showing the market is taking a breather after the big run.

Short-Term View:

If candles stay above the MA20 and the mid-band area, the market can try another small push.

If it dips under the short-term support, it may retest the lower range before forming the next move.

Mid-Term View:

Trend is still positive overall. Momentum indicators are easing but not bearish. Market looks like it’s resetting after the breakout.

PIPPIN25.96%

- Reward

- 1

- Comment

- Repost

- Share

$AIA AIA Market Update (1H Overview)

AIA has been moving in a slow and steady range after that sharp spike earlier. Price is holding around the 0.32 zone, staying close to the MA lines. Bollinger Bands are tightening, which usually hints at an upcoming move.

Short-Term View:

If the price keeps holding above the lower band and MA20, we may see a small push toward the mid-range again.

If it drops under the recent support, the market could retest the lower zone before finding strength.

Mid-Term View:

Momentum indicators look calm. Market is cooling off but stable. Watching the 0.315–0.325 zone

AIA has been moving in a slow and steady range after that sharp spike earlier. Price is holding around the 0.32 zone, staying close to the MA lines. Bollinger Bands are tightening, which usually hints at an upcoming move.

Short-Term View:

If the price keeps holding above the lower band and MA20, we may see a small push toward the mid-range again.

If it drops under the recent support, the market could retest the lower zone before finding strength.

Mid-Term View:

Momentum indicators look calm. Market is cooling off but stable. Watching the 0.315–0.325 zone

AIA-2.97%

- Reward

- like

- Comment

- Repost

- Share

$POWER POWER Market Update (15m–4h View)

POWER pulled a strong move earlier, touching around 0.256 before cooling off. Right now it’s sitting in a clean consolidation zone near 0.228. The price is riding close to MA5/MA10, and MA20 is acting as the main support on the short timeframe.

Short-term view:

Market looks steady. If the price holds above the mid-band and volume steps back in, another push toward the recent high is possible.

If candles slip below the MA20 area, we may see a retest toward the lower range.

Mid-term view:

Trend is still positive overall. Consolidation after a breakout u

POWER pulled a strong move earlier, touching around 0.256 before cooling off. Right now it’s sitting in a clean consolidation zone near 0.228. The price is riding close to MA5/MA10, and MA20 is acting as the main support on the short timeframe.

Short-term view:

Market looks steady. If the price holds above the mid-band and volume steps back in, another push toward the recent high is possible.

If candles slip below the MA20 area, we may see a retest toward the lower range.

Mid-term view:

Trend is still positive overall. Consolidation after a breakout u

- Reward

- 1

- Comment

- Repost

- Share

$ZEC 📉 ZEC Market Update (1H View)

ZEC has been sliding down steadily, moving from the mid-380 zone to around the 330s. Buyers are still quiet and indicators show a clear cooldown phase.

What the chart suggests:

MACD → still negative, momentum weak

RSI → sitting low, showing selling pressure but also potential for a bounce

Bollinger Bands → price hugging the lower band, meaning the market is oversold

Short-term (1H) → downtrend

Mid-term (4H) → weakening momentum

Long-term (1D) → still in correction mode

My personal view:

If ZEC can hold near the current support zone, it may try a small reco

ZEC has been sliding down steadily, moving from the mid-380 zone to around the 330s. Buyers are still quiet and indicators show a clear cooldown phase.

What the chart suggests:

MACD → still negative, momentum weak

RSI → sitting low, showing selling pressure but also potential for a bounce

Bollinger Bands → price hugging the lower band, meaning the market is oversold

Short-term (1H) → downtrend

Mid-term (4H) → weakening momentum

Long-term (1D) → still in correction mode

My personal view:

If ZEC can hold near the current support zone, it may try a small reco

ZEC-5.15%

- Reward

- like

- Comment

- Repost

- Share

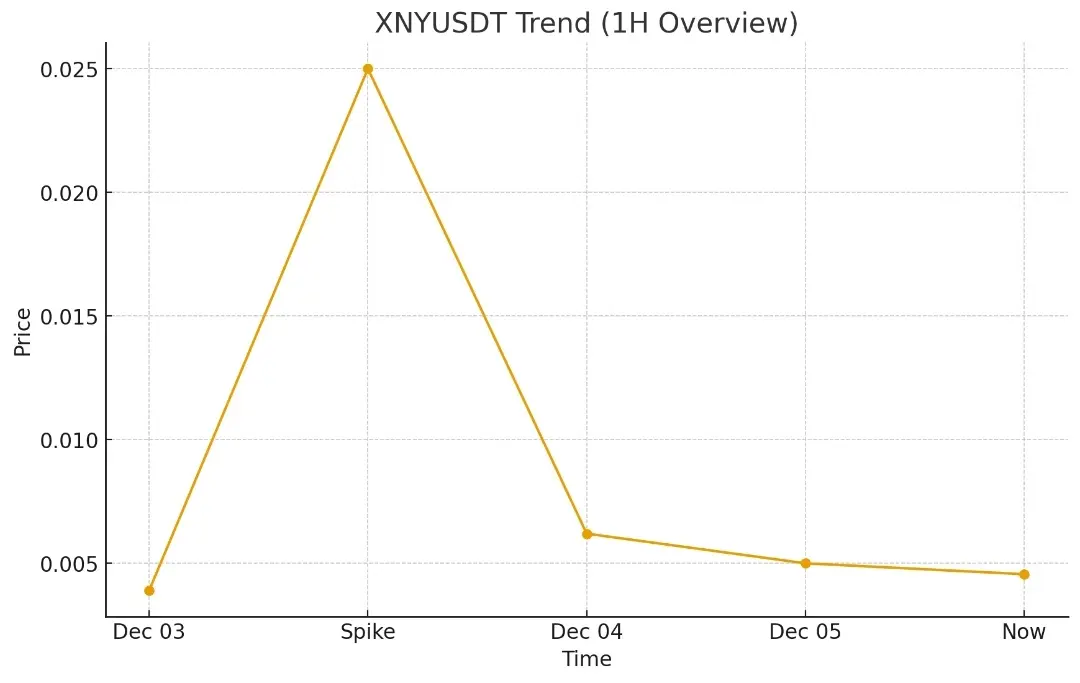

$XNY 📊 XNY Market Update (1H View)

XNY showed a huge spike earlier, but after that the price kept cooling down and is now moving in a tight range around 0.0045. Volume is lower and indicators are showing consolidation.

What I’m seeing:

MACD → still below the signal, momentum weak

RSI → sitting low, meaning sellers are slowing down

Bollinger Bands → price squeezing, breakout chance rising

Short-term (1H) → sideways

Mid-term (4H) → slowly stabilizing

Long-term (1D) → possible recovery if volume returns

My personal outlook:

If XNY holds above the support area and volume picks up, we may see a

XNY showed a huge spike earlier, but after that the price kept cooling down and is now moving in a tight range around 0.0045. Volume is lower and indicators are showing consolidation.

What I’m seeing:

MACD → still below the signal, momentum weak

RSI → sitting low, meaning sellers are slowing down

Bollinger Bands → price squeezing, breakout chance rising

Short-term (1H) → sideways

Mid-term (4H) → slowly stabilizing

Long-term (1D) → possible recovery if volume returns

My personal outlook:

If XNY holds above the support area and volume picks up, we may see a

XNY-7.68%

- Reward

- 1

- 1

- Repost

- Share

BEYBUY1 :

:

ORION