LululuLala

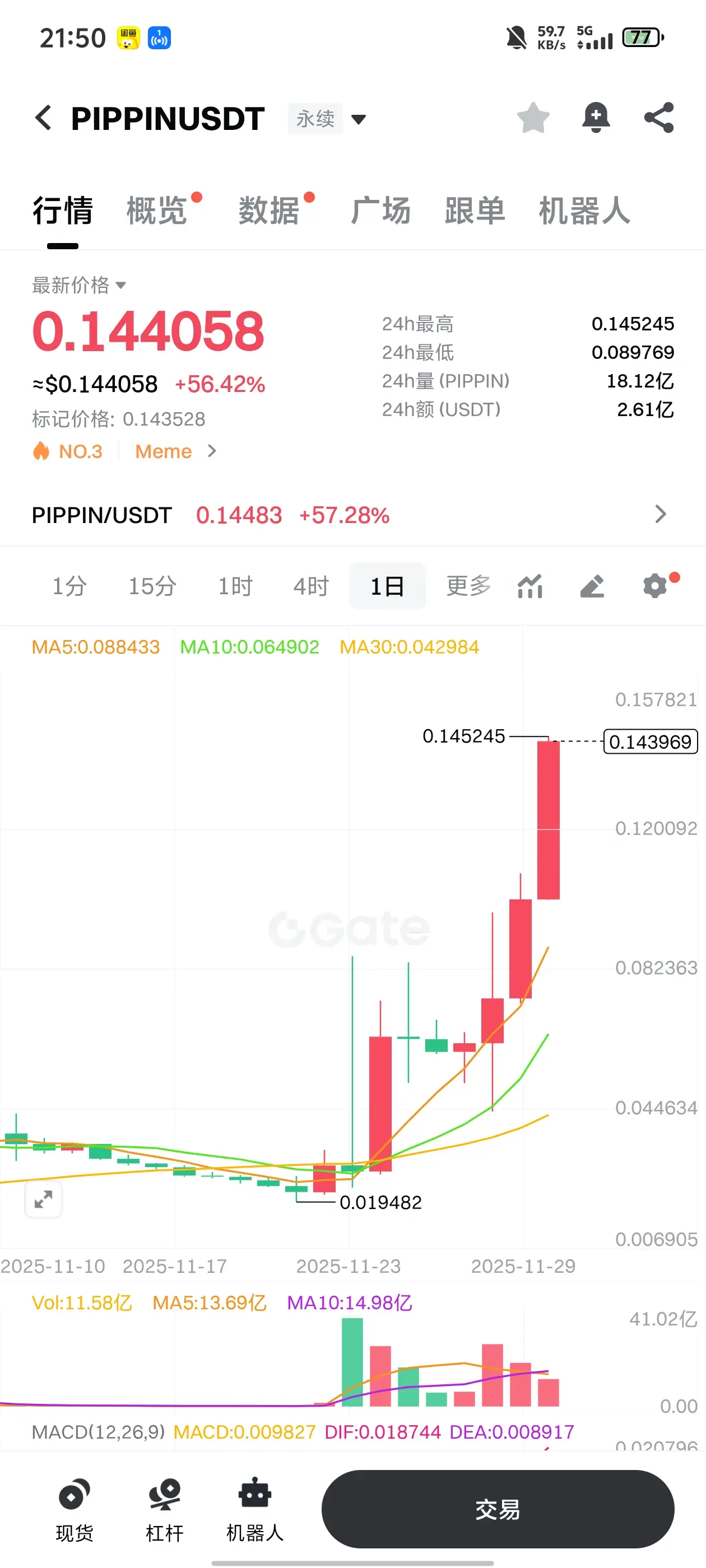

Based on current market information, here are the trading strategy references for Bitcoin (BTC) on December 7:

I. Long-term Strategy

If the price is above 97762.89 USDT after 8:00 today, consider buying in, as a long-term uptrend may follow.

II. Short-term Strategy

1. Long Opportunity:

- Entry point: 88000 USDT, defense at 87000 USDT (stop loss of 500 points), target 91000 USDT.

- Basis: 2-hour candlestick chart shows consecutive bullish candles, MACD indicates strong short-term rebound momentum, short-term support is effective.

2. Short Opportunity:

- Entry point: 91000 USDT, defense at 92000

I. Long-term Strategy

If the price is above 97762.89 USDT after 8:00 today, consider buying in, as a long-term uptrend may follow.

II. Short-term Strategy

1. Long Opportunity:

- Entry point: 88000 USDT, defense at 87000 USDT (stop loss of 500 points), target 91000 USDT.

- Basis: 2-hour candlestick chart shows consecutive bullish candles, MACD indicates strong short-term rebound momentum, short-term support is effective.

2. Short Opportunity:

- Entry point: 91000 USDT, defense at 92000

BTC-0.63%