# technicalanalysis

29.19K

Crypto_Exper

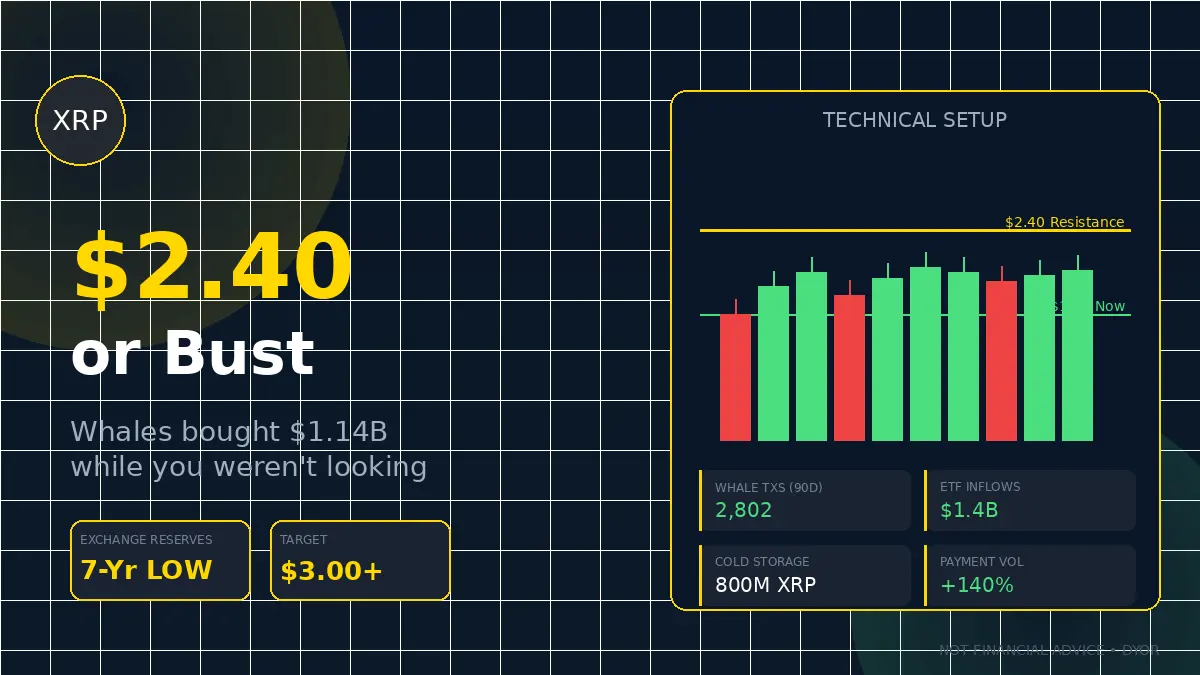

$XRP at $1.92 while whales moved $1.14B in January.

Exchange reserves just hit a 7-year low.

800M tokens disappeared into cold storage last month.

But here's the weird part...

Retail is OUT (-94% active addresses).

Institutions are IN (+140% payment volume).

Price? Still 48% below ATH and stuck at $1.92.

This is textbook re-accumulation.

The next 2 weeks decide everything:

Break above $2.40 → we're going to $3.00+

Rejection → back to $2.00, maybe $1.80

Volume at $2.50-$2.75 is ghost town thin. If we crack it, there's nothing stopping a fast move to $3.20.

My play?

DCA between $1.90-$2.10.

Exchange reserves just hit a 7-year low.

800M tokens disappeared into cold storage last month.

But here's the weird part...

Retail is OUT (-94% active addresses).

Institutions are IN (+140% payment volume).

Price? Still 48% below ATH and stuck at $1.92.

This is textbook re-accumulation.

The next 2 weeks decide everything:

Break above $2.40 → we're going to $3.00+

Rejection → back to $2.00, maybe $1.80

Volume at $2.50-$2.75 is ghost town thin. If we crack it, there's nothing stopping a fast move to $3.20.

My play?

DCA between $1.90-$2.10.

XRP-1,36%

- Reward

- 2

- Comment

- Repost

- Share

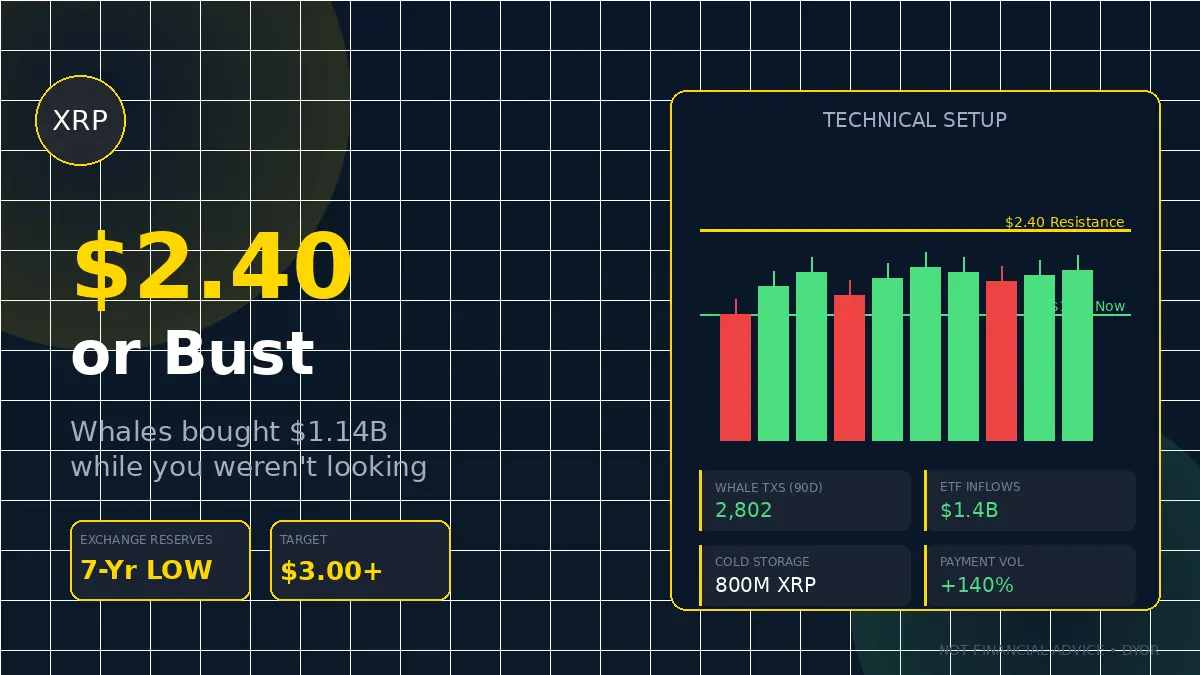

$XRP at $1.92 while whales moved $1.14B in January.

Exchange reserves just hit a 7-year low.

800M tokens disappeared into cold storage last month.

But here's the weird part...

Retail is OUT (-94% active addresses).

Institutions are IN (+140% payment volume).

Price? Still 48% below ATH and stuck at $1.92.

This is textbook re-accumulation.

The next 2 weeks decide everything:

Break above $2.40 → we're going to $3.00+

Rejection → back to $2.00, maybe $1.80

Volume at $2.50-$2.75 is ghost town thin. If we crack it, there's nothing stopping a fast move to $3.20.

My play?

DCA between $1.90-$2.10. S

Exchange reserves just hit a 7-year low.

800M tokens disappeared into cold storage last month.

But here's the weird part...

Retail is OUT (-94% active addresses).

Institutions are IN (+140% payment volume).

Price? Still 48% below ATH and stuck at $1.92.

This is textbook re-accumulation.

The next 2 weeks decide everything:

Break above $2.40 → we're going to $3.00+

Rejection → back to $2.00, maybe $1.80

Volume at $2.50-$2.75 is ghost town thin. If we crack it, there's nothing stopping a fast move to $3.20.

My play?

DCA between $1.90-$2.10. S

XRP-1,36%

- Reward

- 1

- Comment

- Repost

- Share

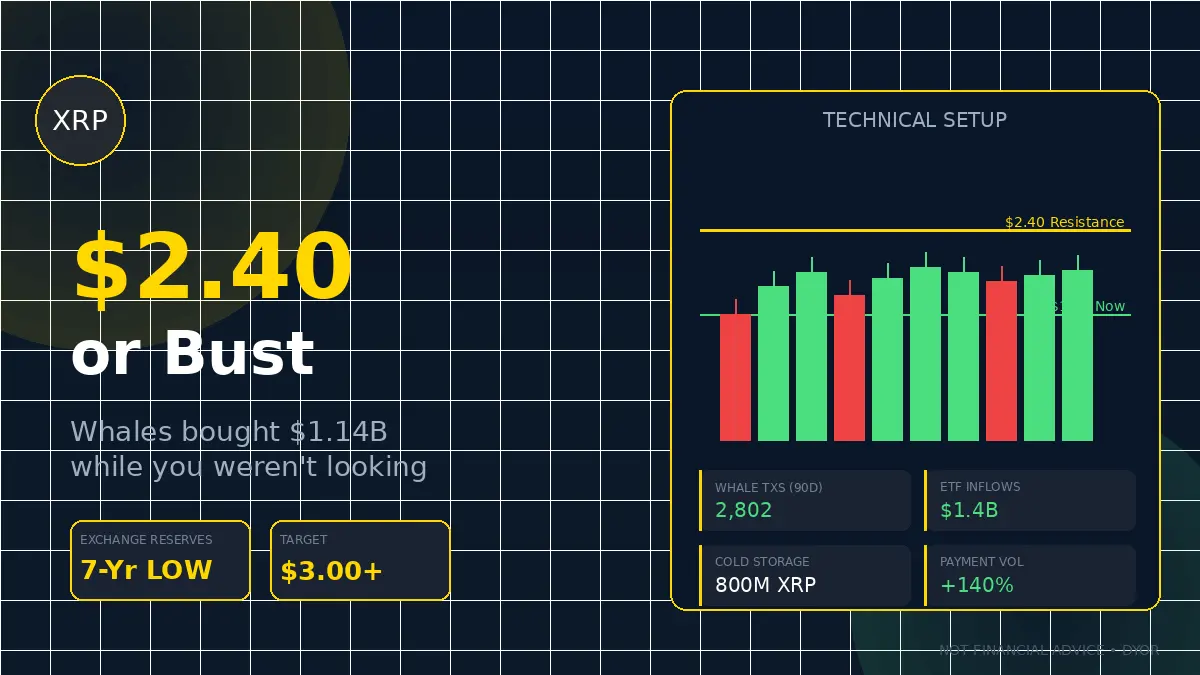

🚨 $XRP Update – Re-Accumulation in Progress 🚨

$XRP: $1.92 💎

Whales moved $1.14B in January 🐋

Exchange reserves hit 7-year low 📉

800M tokens moved to cold storage ❄️

📊 The Strange Part:

Retail: OUT (-94% active addresses) 👀

Institutions: IN (+140% payment volume) 🏦

Price: Still 48% below ATH, stuck at $1.92

📈 Next 2 Weeks Decide Everything:

Break $2.40 → $3.00+ 🚀

Rejection → $2.00, maybe $1.80 ⚠️

Volume $2.50-$2.75 = ghost town 👻

Crack it → fast move to $3.20

🎯 My Play:

DCA between $1.90–$2.10 💰

Scale if we confirm above $2.50 ⚡

Risk management below $1.80 🛡️

Conviction: 7/10 bull

$XRP: $1.92 💎

Whales moved $1.14B in January 🐋

Exchange reserves hit 7-year low 📉

800M tokens moved to cold storage ❄️

📊 The Strange Part:

Retail: OUT (-94% active addresses) 👀

Institutions: IN (+140% payment volume) 🏦

Price: Still 48% below ATH, stuck at $1.92

📈 Next 2 Weeks Decide Everything:

Break $2.40 → $3.00+ 🚀

Rejection → $2.00, maybe $1.80 ⚠️

Volume $2.50-$2.75 = ghost town 👻

Crack it → fast move to $3.20

🎯 My Play:

DCA between $1.90–$2.10 💰

Scale if we confirm above $2.50 ⚡

Risk management below $1.80 🛡️

Conviction: 7/10 bull

XRP-1,36%

- Reward

- 2

- Comment

- Repost

- Share

🌐 $AUCTION Analysis: Strategic Positioning for the Next Macro Reversal

Market Status:

As of January 25, 2026, Bounce Finance ($AUCTION) is trading at $5.03, currently sitting within a high-conviction "Strategic Accumulation Zone"۔ After a prolonged period of bearish pressure, the asset is showing signs of technical exhaustion, suggesting that a significant trend reversal is nearing۔

The Technical Insight:

• Oversold Conditions: On the daily charts, $AUCTION is exhibiting deep oversold signals. The 7-day RSI has plummeted to 23.81, a level that has historically served as a precursor to majo

Market Status:

As of January 25, 2026, Bounce Finance ($AUCTION) is trading at $5.03, currently sitting within a high-conviction "Strategic Accumulation Zone"۔ After a prolonged period of bearish pressure, the asset is showing signs of technical exhaustion, suggesting that a significant trend reversal is nearing۔

The Technical Insight:

• Oversold Conditions: On the daily charts, $AUCTION is exhibiting deep oversold signals. The 7-day RSI has plummeted to 23.81, a level that has historically served as a precursor to majo

AUCTION-8,74%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH-1,58%

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

PEPE price is moving in a clear downtrend channel.

Recent resistance rejection confirms seller strength.

After breaking key support, continuation to downside is expected.

Bias: Bearish

Timeframe: Next 24 hours

#CryptoMarket #PEPEUSDT #TechnicalAnalysis #ShortTrade #BearishTrend

Recent resistance rejection confirms seller strength.

After breaking key support, continuation to downside is expected.

Bias: Bearish

Timeframe: Next 24 hours

#CryptoMarket #PEPEUSDT #TechnicalAnalysis #ShortTrade #BearishTrend

PEPE-3,77%

- Reward

- like

- Comment

- Repost

- Share

📊 SMA & EMA Indicators — How Smart Traders Use Them

Most traders use moving averages…

Few actually use them correctly.

Let’s fix that 👇

🔹 What is SMA (Simple Moving Average)?

SMA shows the average price over a fixed period.

Why traders use SMA:

Smooth & reliable

Filters market noise

Perfect for trend direction

📌 Common SMA levels:

SMA 50 → Mid-term trend

SMA 100 / 200 → Long-term market bias

👉 Price above SMA 200 = Bullish

👉 Price below SMA 200 = Bearish

⚡ What is EMA (Exponential Moving Average)?

EMA gives more weight to recent prices, so it reacts faster.

Why traders love EMA:

Faster s

Most traders use moving averages…

Few actually use them correctly.

Let’s fix that 👇

🔹 What is SMA (Simple Moving Average)?

SMA shows the average price over a fixed period.

Why traders use SMA:

Smooth & reliable

Filters market noise

Perfect for trend direction

📌 Common SMA levels:

SMA 50 → Mid-term trend

SMA 100 / 200 → Long-term market bias

👉 Price above SMA 200 = Bullish

👉 Price below SMA 200 = Bearish

⚡ What is EMA (Exponential Moving Average)?

EMA gives more weight to recent prices, so it reacts faster.

Why traders love EMA:

Faster s

- Reward

- 1

- 1

- Repost

- Share

BlockchainDisaster :

:

use indicators is so important ‼️$BIO /USDT: Is a Turnaround Taking Shape?

Hey there! Let's dive into what's happening with BIO/USDT right now—because the 12-hour chart is showing some patterns worth paying attention to.

After reaching 0.05626, $BIO cooled off and pulled back (completely normal—early buyers often take profits along the way). But here's the interesting part: the price has found support around 0.04015 and is now testing the 0.04695 level.

What the Chart Is Telling Us:

Price Bands: The Bollinger Bands (those curved lines on the chart) show us the typical trading range. BIO is currently hovering near the middle b

Hey there! Let's dive into what's happening with BIO/USDT right now—because the 12-hour chart is showing some patterns worth paying attention to.

After reaching 0.05626, $BIO cooled off and pulled back (completely normal—early buyers often take profits along the way). But here's the interesting part: the price has found support around 0.04015 and is now testing the 0.04695 level.

What the Chart Is Telling Us:

Price Bands: The Bollinger Bands (those curved lines on the chart) show us the typical trading range. BIO is currently hovering near the middle b

BIO-5,51%

- Reward

- 2

- Comment

- Repost

- Share

🏛️ Tactical Intel: The $3,180 Ceiling and the Institutional Floor

What is understood does not have to be explained. Success in 2026 is built on reading the tape, not the hype. As of January 10, the "Market Architect" strategy remains focused on the structural battle between 3,000 and 3,180.

📉 The Volume Alert

My monitoring of the order book shows a significant thickening of the sell walls at the 3,180 level. We have over four hundred million dollars in passive sell orders currently suppressing any "False Breakouts."

The Judgment: As predicted, rebound volume is insufficient to punch thr

What is understood does not have to be explained. Success in 2026 is built on reading the tape, not the hype. As of January 10, the "Market Architect" strategy remains focused on the structural battle between 3,000 and 3,180.

📉 The Volume Alert

My monitoring of the order book shows a significant thickening of the sell walls at the 3,180 level. We have over four hundred million dollars in passive sell orders currently suppressing any "False Breakouts."

The Judgment: As predicted, rebound volume is insufficient to punch thr

- Reward

- like

- 1

- Repost

- Share

Nac54134 :

:

Just go for it!🚀 BTC $93K BREAKOUT? January 5 Market Alpha 📊

Bitcoin is starting the first full week of 2026 with a BANG. We just touched a multi-week high of $93,323! 📈 The bulls are clearly in control, but are we ready for $100K or a local top?

Here is the breakdown for the Gate.io Fam:

1️⃣ The Technical Setup (1H Chart)

• Resistance: $93,500. This is the big one. Flip this, and we enter the "FOMO Zone" toward $96K-$100K.

• Support: $91,500 is our immediate floor. If we lose it, look for a "Buy the Dip" opportunity at $88,200 (Major Whale Liquidity).

• RSI: Sitting at 64—strong momentum but not yet over

Bitcoin is starting the first full week of 2026 with a BANG. We just touched a multi-week high of $93,323! 📈 The bulls are clearly in control, but are we ready for $100K or a local top?

Here is the breakdown for the Gate.io Fam:

1️⃣ The Technical Setup (1H Chart)

• Resistance: $93,500. This is the big one. Flip this, and we enter the "FOMO Zone" toward $96K-$100K.

• Support: $91,500 is our immediate floor. If we lose it, look for a "Buy the Dip" opportunity at $88,200 (Major Whale Liquidity).

• RSI: Sitting at 64—strong momentum but not yet over

- Reward

- 9

- 8

- Repost

- Share

GorgeousQueen :

:

DYOR 🤓View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

25.71K Popularity

90.04K Popularity

38.57K Popularity

13.59K Popularity

14.69K Popularity

12.34K Popularity

11.88K Popularity

11.55K Popularity

77.22K Popularity

24.68K Popularity

84.41K Popularity

22.58K Popularity

53.05K Popularity

46.9K Popularity

199.85K Popularity

News

View MoreThe European Central Bank will accept assets based on distributed ledger technology as eligible collateral for the euro system

4 m

Data: 300.9 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

5 m

US Treasury Secretary Yellen reiterates strong dollar policy, market worries about currency depreciation

9 m

Bitcoin price news: Gold continues to soar, diverting attention; BTC may face downward pressure

24 m

0G partners with American Fortress to launch AI-native private compliant trading infrastructure

28 m

Pin