# MarketStructure

5.68K

Crypto_Exper

Crypto Is Not Pumping — It’s Resetting

The Quiet Phase That Decides Who Wins the Next Cycle

Most people think markets move in straight lines.

They don’t.

Markets move in phases — and the most important phase is always the one people ignore.

Right now, crypto is not in a bull market.

It is not in a bear market either.

It is in a reset phase.

And this phase decides everything.

Why This Moment Is More Important Than Any Rally

Rallies excite people.

Resets select people.

In a rally:

Everyone feels smart

Risk is ignored

Timing matters less

In a reset:

Confidence is low

Conviction is tested

Only log

The Quiet Phase That Decides Who Wins the Next Cycle

Most people think markets move in straight lines.

They don’t.

Markets move in phases — and the most important phase is always the one people ignore.

Right now, crypto is not in a bull market.

It is not in a bear market either.

It is in a reset phase.

And this phase decides everything.

Why This Moment Is More Important Than Any Rally

Rallies excite people.

Resets select people.

In a rally:

Everyone feels smart

Risk is ignored

Timing matters less

In a reset:

Confidence is low

Conviction is tested

Only log

- Reward

- 1

- Comment

- Repost

- Share

The Market Moves Before You See the News.

By the time headlines scream “Bull Run!”

The move has already started.

By the time articles say “Market Crash!”

Most of the damage is already priced in.

Crypto doesn’t react to news

It reacts to liquidity shifts and positioning.

Smart money enters quietly.

Retail enters loudly.

Smart money exits gradually.

Retail exits in panic.

The real advantage in this market isn’t access to information.

It’s understanding where capital is flowing before emotions catch up.

That means watching: • Volume expansion

• Exchange inflows/outflows

• Breakouts from long con

By the time headlines scream “Bull Run!”

The move has already started.

By the time articles say “Market Crash!”

Most of the damage is already priced in.

Crypto doesn’t react to news

It reacts to liquidity shifts and positioning.

Smart money enters quietly.

Retail enters loudly.

Smart money exits gradually.

Retail exits in panic.

The real advantage in this market isn’t access to information.

It’s understanding where capital is flowing before emotions catch up.

That means watching: • Volume expansion

• Exchange inflows/outflows

• Breakouts from long con

- Reward

- 2

- Comment

- Repost

- Share

Everyone is watching price… but the real signal right now is TIME ⏳

Let’s break it down:

$BTC

🔹 The first range of this downtrend lasted 55 days (~21%)

🔹 The current range is 22 days in (~20%) and still developingSame size. Different duration.

Why does this matter?

Price shows the level.

Time shows the battle between buyers and sellers.

A long range = strong demand absorbing supply.

A short range = sellers are in control and buyers are just liquidity.

The first structure took nearly 2 months to break → buyers were active, defending value.If this current range breaks down faster, it means:

➡

Let’s break it down:

$BTC

🔹 The first range of this downtrend lasted 55 days (~21%)

🔹 The current range is 22 days in (~20%) and still developingSame size. Different duration.

Why does this matter?

Price shows the level.

Time shows the battle between buyers and sellers.

A long range = strong demand absorbing supply.

A short range = sellers are in control and buyers are just liquidity.

The first structure took nearly 2 months to break → buyers were active, defending value.If this current range breaks down faster, it means:

➡

BTC-2,69%

- Reward

- 2

- Comment

- Repost

- Share

#CryptoSurvivalGuide

🔥 #CryptoSurvivalGuide — HOW TO STAY ALIVE IN A BLEEDING MARKET 🔥

When BTC struggles near major levels and alts keep printing lower highs, this is no longer a “make money fast” phase.

This is a capital preservation phase.

Survival first. Profits later.

🛡 1️⃣ Rule #1 — Protect Capital

In drawdown conditions:

• Reduce position size

• Avoid over-leverage

• Cut weak setups fast

• Keep majority capital in stable form

If you survive the storm, you trade the sunshine.

📊 2️⃣ Trade Structure, Not Hope

Ask yourself before every entry:

✔ Is market structure bullish or broken?

✔

🔥 #CryptoSurvivalGuide — HOW TO STAY ALIVE IN A BLEEDING MARKET 🔥

When BTC struggles near major levels and alts keep printing lower highs, this is no longer a “make money fast” phase.

This is a capital preservation phase.

Survival first. Profits later.

🛡 1️⃣ Rule #1 — Protect Capital

In drawdown conditions:

• Reduce position size

• Avoid over-leverage

• Cut weak setups fast

• Keep majority capital in stable form

If you survive the storm, you trade the sunshine.

📊 2️⃣ Trade Structure, Not Hope

Ask yourself before every entry:

✔ Is market structure bullish or broken?

✔

BTC-2,69%

- Reward

- 14

- 17

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#CLARITYActAdvances y

#CLARITYActAdvances 🇺🇸📜

📅 22 Feb

The CLARITY Act is moving forward — and this is more than just another headline.

For years, crypto markets have operated in regulatory gray zones. Now, policymakers are pushing toward clearer definitions around digital assets, oversight, and market structure.

Why This Matters 👇

🔹 Clearer distinction between securities and commodities

🔹 Defined roles for regulators

🔹 Reduced uncertainty for builders and investors

🔹 Potential boost in institutional confidence

Markets don’t just move on hype — they move on certainty.

Regulatory clari

#CLARITYActAdvances 🇺🇸📜

📅 22 Feb

The CLARITY Act is moving forward — and this is more than just another headline.

For years, crypto markets have operated in regulatory gray zones. Now, policymakers are pushing toward clearer definitions around digital assets, oversight, and market structure.

Why This Matters 👇

🔹 Clearer distinction between securities and commodities

🔹 Defined roles for regulators

🔹 Reduced uncertainty for builders and investors

🔹 Potential boost in institutional confidence

Markets don’t just move on hype — they move on certainty.

Regulatory clari

- Reward

- 11

- 20

- Repost

- Share

AngelEye :

:

To The Moon 🌕View More

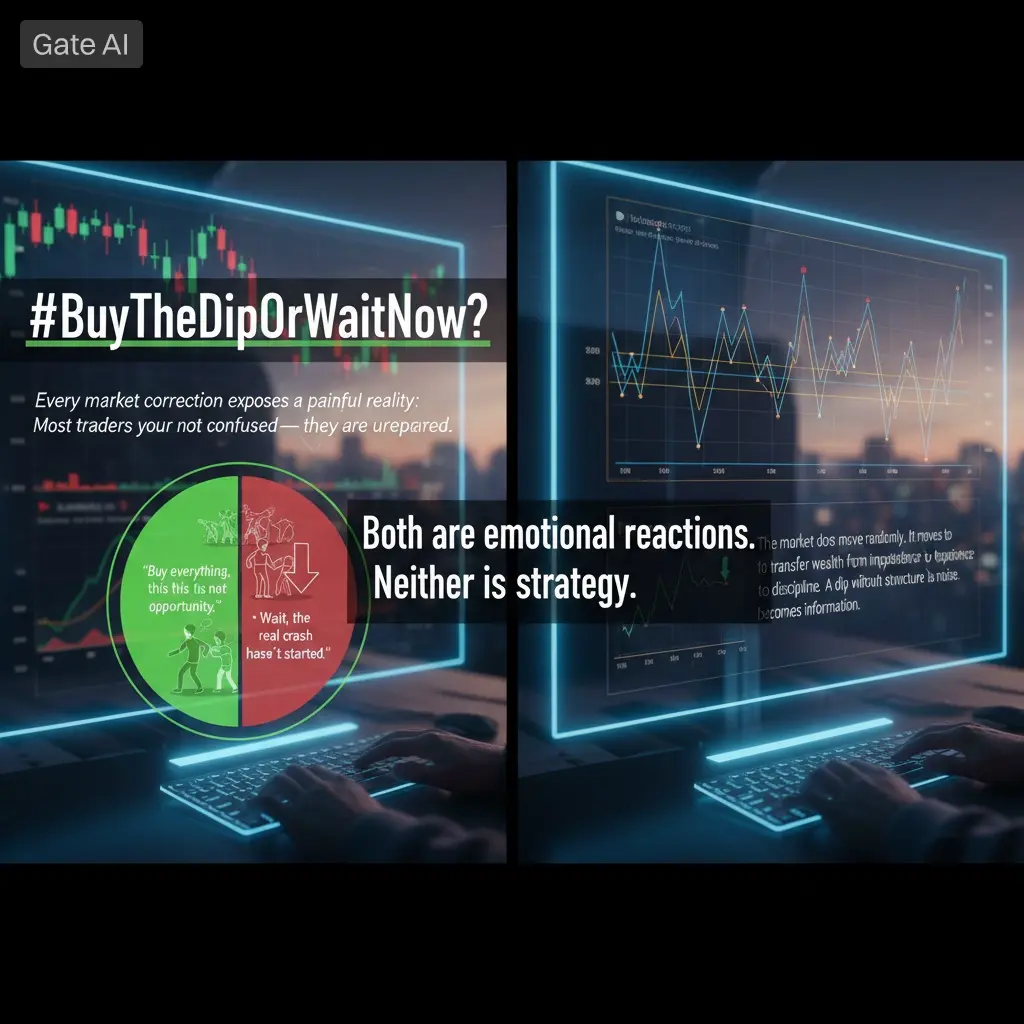

#BuyTheDipOrWaitNow? Every market correction exposes a painful reality:

Most traders are not confused — they are unprepared.

When price drops, social feeds split into two camps: • “Buy everything, this is the opportunity.”

• “Wait, the real crash hasn’t started.”

Both are emotional reactions.

Neither is a strategy.

The market does not move randomly.

It moves to transfer wealth from impatience to discipline.

A dip without context is noise.

A dip with structure becomes information.

Before entering any position, experienced traders evaluate the market from the top down:

1️⃣ Market Structure Comes

Most traders are not confused — they are unprepared.

When price drops, social feeds split into two camps: • “Buy everything, this is the opportunity.”

• “Wait, the real crash hasn’t started.”

Both are emotional reactions.

Neither is a strategy.

The market does not move randomly.

It moves to transfer wealth from impatience to discipline.

A dip without context is noise.

A dip with structure becomes information.

Before entering any position, experienced traders evaluate the market from the top down:

1️⃣ Market Structure Comes

- Reward

- 12

- 11

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#BuyTheDipOrWaitNow?

📉⚡ #BuyTheDipOrWaitNow

The market pulled back.

Now comes the real test — discipline.

Every dip feels like opportunity.

But not every dip is support.

🔎 The Real Question Isn’t “Buy or Wait?”

It’s:

• Is structure still intact?

• Are buyers stepping in with volume?

• Is risk clearly defined?

• Or are you reacting to fear?

🧠 Smart Approach

🟢 Buy the dip when price holds strong demand zones and risk is small.

🟡 Wait when price is mid-range, unclear, or momentum is weak.

Sometimes patience makes more money than action.

🎯 Remember:

Capital preservation > catching bottoms.

📉⚡ #BuyTheDipOrWaitNow

The market pulled back.

Now comes the real test — discipline.

Every dip feels like opportunity.

But not every dip is support.

🔎 The Real Question Isn’t “Buy or Wait?”

It’s:

• Is structure still intact?

• Are buyers stepping in with volume?

• Is risk clearly defined?

• Or are you reacting to fear?

🧠 Smart Approach

🟢 Buy the dip when price holds strong demand zones and risk is small.

🟡 Wait when price is mid-range, unclear, or momentum is weak.

Sometimes patience makes more money than action.

🎯 Remember:

Capital preservation > catching bottoms.

- Reward

- 3

- 2

- Repost

- Share

AYATTAC :

:

To The Moon 🌕View More

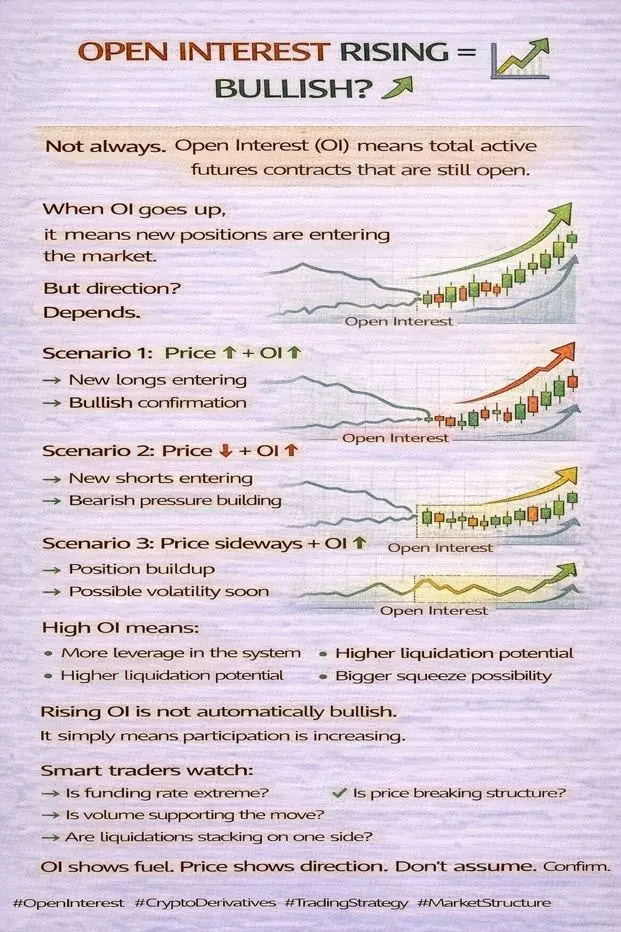

OPEN INTEREST RISING = BULLISH? 📈

Not always.

Open Interest (OI)

means total active futures contracts

that are still open.

When OI goes up,

it means new positions are entering the market.

But direction?

Depends.

Scenario 1:

Price ↑ + OI ↑

→ New longs entering

→ Bullish confirmation

Scenario 2:

Price ↓ + OI ↑

→ New shorts entering

→ Bearish pressure building

Scenario 3:

Price sideways + OI ↑

→ Position buildup

→ Possible volatility soon

High OI means:

• More leverage in the system

• Higher liquidation potential

• Bigger squeeze possibility

Rising OI is not automatically bullish.

It simply mean

Not always.

Open Interest (OI)

means total active futures contracts

that are still open.

When OI goes up,

it means new positions are entering the market.

But direction?

Depends.

Scenario 1:

Price ↑ + OI ↑

→ New longs entering

→ Bullish confirmation

Scenario 2:

Price ↓ + OI ↑

→ New shorts entering

→ Bearish pressure building

Scenario 3:

Price sideways + OI ↑

→ Position buildup

→ Possible volatility soon

High OI means:

• More leverage in the system

• Higher liquidation potential

• Bigger squeeze possibility

Rising OI is not automatically bullish.

It simply mean

- Reward

- 6

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow? 📊

₿ Decision Zone for Bitcoin: $69K–$70K

Mid-February 2026 finds BTC hovering near the $70,000 mark after a sharp rebound from the $65K sell-off. That move lower was not gentle — leverage got wiped, sentiment collapsed, ETFs saw pressure, and macro uncertainty spiked.

Yet the recovery tells us something important: buyers didn’t disappear.

Still, context matters. Price remains well below the late-2025 peak near $126K. This is best viewed as a post-bull-cycle correction, not a fresh breakout into new highs.

🧩 What Caused the Drop?

• Profit-taking after

₿ Decision Zone for Bitcoin: $69K–$70K

Mid-February 2026 finds BTC hovering near the $70,000 mark after a sharp rebound from the $65K sell-off. That move lower was not gentle — leverage got wiped, sentiment collapsed, ETFs saw pressure, and macro uncertainty spiked.

Yet the recovery tells us something important: buyers didn’t disappear.

Still, context matters. Price remains well below the late-2025 peak near $126K. This is best viewed as a post-bull-cycle correction, not a fresh breakout into new highs.

🧩 What Caused the Drop?

• Profit-taking after

BTC-2,69%

- Reward

- 7

- 13

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

📊 OM/USDT – Momentum Breakout & Technical Outlook (4H)

Current Price: ~$0.0581

24H Change: +24%

Context: Strong volatility expansion after prolonged consolidation

🔍 Market Structure

OM spent a significant period in range-bound accumulation, followed by a high-momentum breakout.

Price has now expanded well above EMA(7), EMA(25), and EMA(99), confirming a trend shift to bullish on the 4H timeframe.

The impulsive candle suggests aggressive participation, often seen at the start of a new directional move.

📈 Momentum & Indicators

Williams %R (~ −44):

Momentum is neutral-to-strong, not yet overbo

Current Price: ~$0.0581

24H Change: +24%

Context: Strong volatility expansion after prolonged consolidation

🔍 Market Structure

OM spent a significant period in range-bound accumulation, followed by a high-momentum breakout.

Price has now expanded well above EMA(7), EMA(25), and EMA(99), confirming a trend shift to bullish on the 4H timeframe.

The impulsive candle suggests aggressive participation, often seen at the start of a new directional move.

📈 Momentum & Indicators

Williams %R (~ −44):

Momentum is neutral-to-strong, not yet overbo

OM-1,03%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

362.78K Popularity

25.13K Popularity

68.86K Popularity

16.76K Popularity

469.36K Popularity

4.63K Popularity

4K Popularity

2.92K Popularity

1.46K Popularity

80.6K Popularity

42.5K Popularity

97.96K Popularity

14.93K Popularity

67.47K Popularity

3.37K Popularity

News

View MoreCryptocurrency investment firm Paradigm plans to raise $1.5 billion for a new fund

21 m

Lobster surged by 1297.84% after launching Alpha, current price is 0.0027123 USDT

59 m

The Dow Jones Industrial Average closed down 521.28 points, and both the S&P 500 and Nasdaq declined.

1 h

CRTR increased by 1019.09% after launching Alpha, current price is 0.04504 USDT

1 h

Traditional Finance Alert: NFLX Increased by Over 14%

1 h

Pin