# GameFiSeesaStrongRebound

10.24K

GameFi is bouncing sharply, with AXS up nearly 37% in 24 hours and clearly outperforming the broader market. Is this a true reversal for the sector, or just a short-term rotation? Which GameFi tokens are worth watching?

MingDragonX

#GameFiSeesaStrongRebound GameFi’s renewed strength suggests the sector is entering a phase where growth is driven by execution rather than excitement, with infrastructure, user experience, and economic balance taking priority over aggressive monetization. As more games deliver console-level performance with blockchain operating quietly in the background, player onboarding is likely to accelerate organically, drawing in audiences that were previously indifferent or resistant to crypto-native mechanics. This shift positions GameFi as an extension of the global gaming industry rather than a para

GAFI2,62%

- Reward

- 4

- 15

- Repost

- Share

Yunna :

:

happy new yearView More

#GameFiSeesaStrongRebound

GameFi’s Second Act: Why Seesa’s Rebound Signals a Sector-Wide Shift

After a prolonged period of stagnation, the GameFi sector is showing signs of renewed life — and this time, the momentum feels fundamentally different. Price movement alone does not explain what is happening beneath the surface. The current rebound, led by projects like Seesa, reflects a broader recalibration of how GameFi is built, funded, and used.

Rather than a short-lived speculative surge, this recovery appears rooted in structural change.

From Hype Cycles to Functional Ecosystems

GameFi’s earl

GameFi’s Second Act: Why Seesa’s Rebound Signals a Sector-Wide Shift

After a prolonged period of stagnation, the GameFi sector is showing signs of renewed life — and this time, the momentum feels fundamentally different. Price movement alone does not explain what is happening beneath the surface. The current rebound, led by projects like Seesa, reflects a broader recalibration of how GameFi is built, funded, and used.

Rather than a short-lived speculative surge, this recovery appears rooted in structural change.

From Hype Cycles to Functional Ecosystems

GameFi’s earl

- Reward

- 4

- 15

- Repost

- Share

GateUser-7b74e9d2 :

:

Monitoring 🔍 closelyView More

#GameFiSeesaStrongRebound #GameFiSeesAStrongRebound

The recent rebound across GameFi is real — but if you think this is a simple “altseason effect,” you’re already misunderstanding what’s happening.

GameFi did not recover because sentiment improved.

It recovered because excess was purged.

The 2021–2022 GameFi boom collapsed under its own weight. Token emissions replaced gameplay, incentives replaced retention, and speculation replaced sustainability. When liquidity dried up, the illusion disappeared. Prices collapsed by 80–95%, user activity vanished, and most projects quietly stopped building

The recent rebound across GameFi is real — but if you think this is a simple “altseason effect,” you’re already misunderstanding what’s happening.

GameFi did not recover because sentiment improved.

It recovered because excess was purged.

The 2021–2022 GameFi boom collapsed under its own weight. Token emissions replaced gameplay, incentives replaced retention, and speculation replaced sustainability. When liquidity dried up, the illusion disappeared. Prices collapsed by 80–95%, user activity vanished, and most projects quietly stopped building

- Reward

- 4

- 2

- Repost

- Share

LittleQueen :

:

Buy To Earn 💎View More

#GameFiSeesaStrongRebound

The GameFi world is buzzing right now, and is leading the conversation today! After weeks of sideways price action, renewed investor confidence, and fresh ecosystem developments, GameFi markets are showing serious signs of growth and the rebound isn’t just a blip, it’s gaining momentum. What we’re seeing right now feels different: there’s strategic capital flowing in again, user activity is rising, and more builders are launching projects with real utility and play-to-earn mechanics that actually work. In 2026, the narrative around GameFi is shifting from “speculati

The GameFi world is buzzing right now, and is leading the conversation today! After weeks of sideways price action, renewed investor confidence, and fresh ecosystem developments, GameFi markets are showing serious signs of growth and the rebound isn’t just a blip, it’s gaining momentum. What we’re seeing right now feels different: there’s strategic capital flowing in again, user activity is rising, and more builders are launching projects with real utility and play-to-earn mechanics that actually work. In 2026, the narrative around GameFi is shifting from “speculati

GAFI2,62%

- Reward

- 2

- 3

- Repost

- Share

Falcon_Official :

:

DYOR 🤓View More

#GameFiSeesaStrongRebound

🎮 GameFi Back in Play as AXS Surges 37% — Structural Comeback or Short-Term Rotation?

GameFi has suddenly re-entered the spotlight. AXS exploded nearly 37% in 24 hours, massively outperforming the broader crypto market and forcing traders to reassess a sector many had already written off.

But the real question remains: Is this the beginning of a sustainable GameFi reversal — or just fast capital rotation chasing momentum?

🔍 What’s Fueling the Sudden Surge?

This rally isn’t random. Several forces are aligning:

Capital rotation from large caps into high-beta narrativ

🎮 GameFi Back in Play as AXS Surges 37% — Structural Comeback or Short-Term Rotation?

GameFi has suddenly re-entered the spotlight. AXS exploded nearly 37% in 24 hours, massively outperforming the broader crypto market and forcing traders to reassess a sector many had already written off.

But the real question remains: Is this the beginning of a sustainable GameFi reversal — or just fast capital rotation chasing momentum?

🔍 What’s Fueling the Sudden Surge?

This rally isn’t random. Several forces are aligning:

Capital rotation from large caps into high-beta narrativ

- Reward

- 6

- 5

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

#GameFiSeesaStrongRebound 🚀

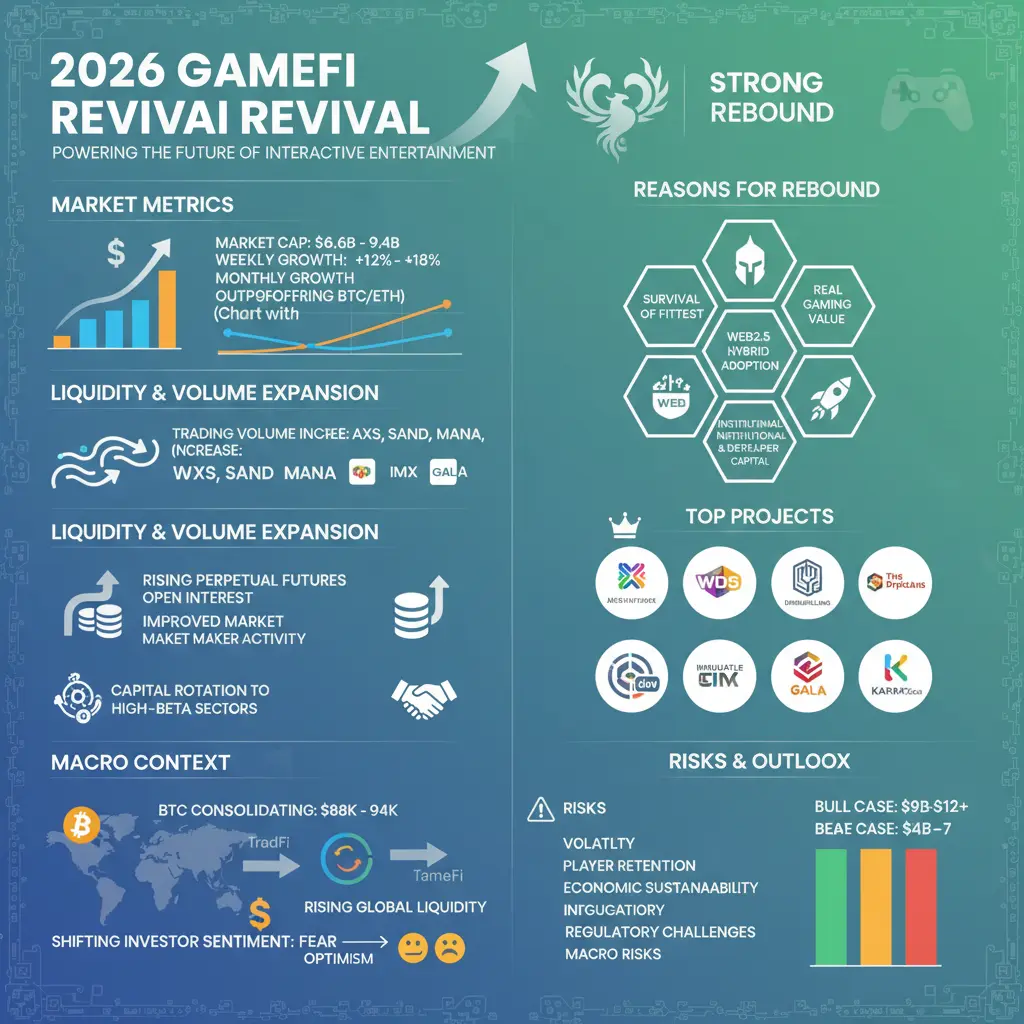

GameFi’s 2026 Revival: From 2025 Collapse to a Sustainable Renaissance

After a brutal downturn in 2025, where over 90% of GameFi projects stalled or collapsed, the sector is staging one of its strongest comebacks in early 2026. This rebound isn’t hype—it’s a structural reset: smarter tokenomics, improved gameplay, institutional capital, regulatory clarity, and a focus on real players.

Key Highlights of the 2026 GameFi Revival:

🎮 Market Metrics

Market Cap: $6.6B–$9.4B

Weekly Growth: +12%–18%

Monthly Growth: +25%–40%

Outperforming BTC/ETH in multiple sessions

💧 Liq

GameFi’s 2026 Revival: From 2025 Collapse to a Sustainable Renaissance

After a brutal downturn in 2025, where over 90% of GameFi projects stalled or collapsed, the sector is staging one of its strongest comebacks in early 2026. This rebound isn’t hype—it’s a structural reset: smarter tokenomics, improved gameplay, institutional capital, regulatory clarity, and a focus on real players.

Key Highlights of the 2026 GameFi Revival:

🎮 Market Metrics

Market Cap: $6.6B–$9.4B

Weekly Growth: +12%–18%

Monthly Growth: +25%–40%

Outperforming BTC/ETH in multiple sessions

💧 Liq

- Reward

- 6

- 11

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GameFiSeesaStrongRebound GameFi has re-entered the market conversation with renewed force, proving that early obituaries were premature. The sector’s recent surge reflects not speculation, but structural recovery. What is unfolding in early 2026 is not a revival of outdated play-to-earn mechanics, but the emergence of a redesigned digital gaming economy built on scalability, realism, and sustainable incentives.

The latest market movement signals a clear shift in investor perception. Capital is no longer chasing experimental concepts; instead, it is returning to ecosystems with proven resilien

The latest market movement signals a clear shift in investor perception. Capital is no longer chasing experimental concepts; instead, it is returning to ecosystems with proven resilien

- Reward

- 14

- 15

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#GameFiSeesaStrongRebound

The GameFi sector is showing clear signs of a strong rebound, attracting renewed interest from traders, investors, and developers. After a prolonged consolidation phase, rising activity, improving fundamentals, and renewed risk appetite are driving momentum back into blockchain-based gaming projects.

Below is a detailed, step-by-step breakdown of what’s fueling this recovery and what it means for the broader crypto market.

1️⃣ Capital Flow Returns to High-Beta Sectors

As market sentiment improves, capital naturally rotates toward high-beta sectors like GameFi. Invest

The GameFi sector is showing clear signs of a strong rebound, attracting renewed interest from traders, investors, and developers. After a prolonged consolidation phase, rising activity, improving fundamentals, and renewed risk appetite are driving momentum back into blockchain-based gaming projects.

Below is a detailed, step-by-step breakdown of what’s fueling this recovery and what it means for the broader crypto market.

1️⃣ Capital Flow Returns to High-Beta Sectors

As market sentiment improves, capital naturally rotates toward high-beta sectors like GameFi. Invest

- Reward

- 2

- 2

- Repost

- Share

EagleEye :

:

thanks for sharing thisn informationView More

#GameFiSeesAStrongRebound 🚀

GameFi is making waves again! Axie Infinity (AXS) surged 37% in 24 hours, outpacing the broader crypto market. But is this a true sector revival or just a short-term speculative rotation?

Why the surge?

🎯 Speculative rotation: Investors chasing undervalued tokens

📈 Technical triggers: Oversold conditions & key support levels

🕹 Platform updates: New NFTs, tournaments & brand partnerships

Tokens to watch:

AXS: Leading the rebound; $10–$12 key resistance

SAND: Benefiting from metaverse adoption & partnerships

MANA, GALA, ILV: High-risk, high-reward; sentiment-drive

GameFi is making waves again! Axie Infinity (AXS) surged 37% in 24 hours, outpacing the broader crypto market. But is this a true sector revival or just a short-term speculative rotation?

Why the surge?

🎯 Speculative rotation: Investors chasing undervalued tokens

📈 Technical triggers: Oversold conditions & key support levels

🕹 Platform updates: New NFTs, tournaments & brand partnerships

Tokens to watch:

AXS: Leading the rebound; $10–$12 key resistance

SAND: Benefiting from metaverse adoption & partnerships

MANA, GALA, ILV: High-risk, high-reward; sentiment-drive

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

🎮 GameFi Explodes as AXS Jumps 37% — Real Sector Reversal or Just a Fast Rotation?

GameFi is suddenly back in the spotlight. AXS surged nearly 37% in 24 hours, massively outperforming the broader crypto market and pulling attention back to a sector many had written off.

But the key question is simple:

Is this the start of a true GameFi comeback — or just a short-term capital rotation?

🔍 What’s Driving the Sudden Move?

This rally isn’t happening in isolation.

Key factors behind the spike:

Capital rotating from large caps into high-beta narrative sectors

Deeply oversold GameFi valuations attra

GameFi is suddenly back in the spotlight. AXS surged nearly 37% in 24 hours, massively outperforming the broader crypto market and pulling attention back to a sector many had written off.

But the key question is simple:

Is this the start of a true GameFi comeback — or just a short-term capital rotation?

🔍 What’s Driving the Sudden Move?

This rally isn’t happening in isolation.

Key factors behind the spike:

Capital rotating from large caps into high-beta narrative sectors

Deeply oversold GameFi valuations attra

- Reward

- 14

- 9

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

11.6K Popularity

73.92K Popularity

29.4K Popularity

10.24K Popularity

10.35K Popularity

9.42K Popularity

8.33K Popularity

8.11K Popularity

74.31K Popularity

21.44K Popularity

82.44K Popularity

23.36K Popularity

50.12K Popularity

43.92K Popularity

179.19K Popularity

News

View MoreU.S. stocks open higher, Dow Jones up 0.13%, Nasdaq up 0.6%

1 m

Strive: Currently holds 13,131.82 Bitcoins, making it the tenth-largest Bitcoin holder globally.

3 m

Barclays: Euro becomes the main "anti-dollar" trading target, as the dollar approaches a four-year low

18 m

USDC Treasury在以太坊销毁9515万枚USDC

23 m

Data: 151.58 BTC transferred out from multiple anonymous addresses, worth approximately $13.67 million

39 m

Pin