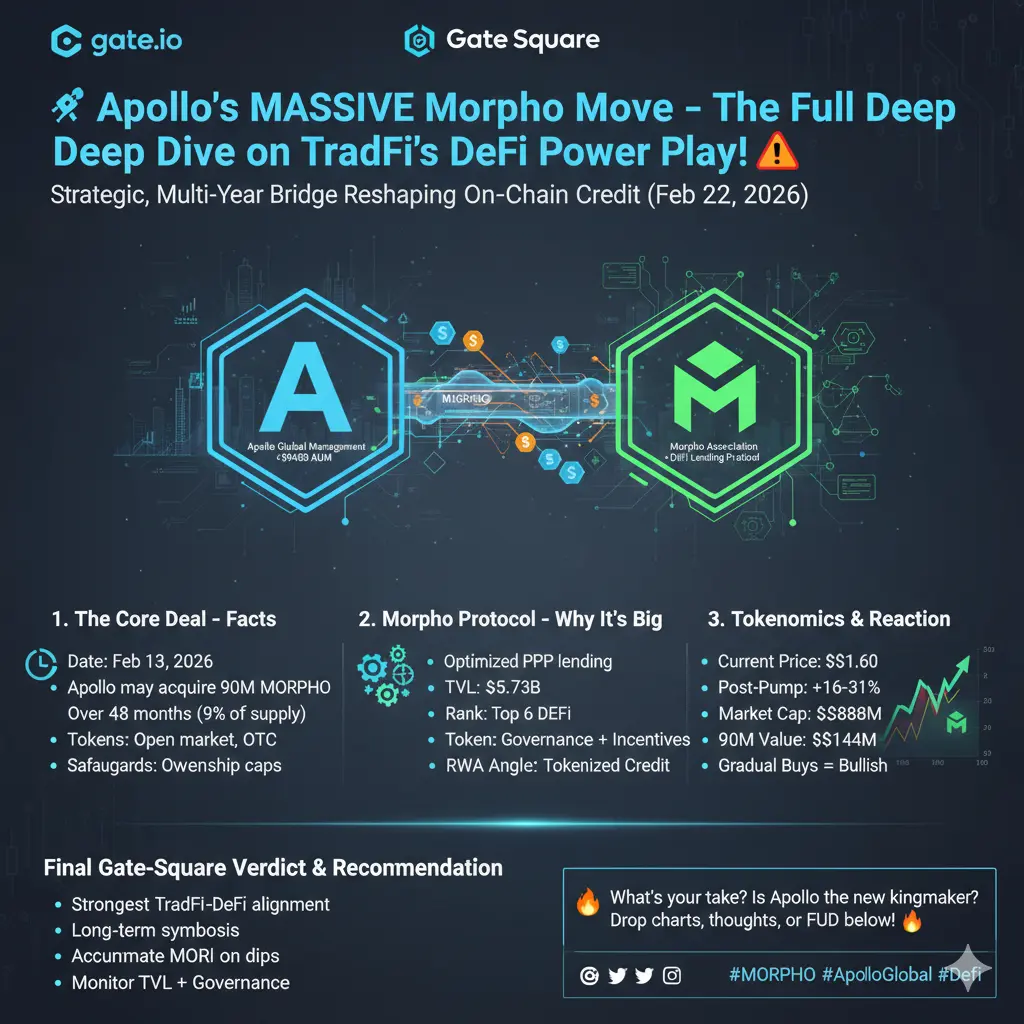

#ApollotoBuy90MMORPHOin4Years The unfolding partnership between Apollo Global Management and the decentralized lending ecosystem around Morpho Protocol is becoming one of the most closely watched institutional moves in the 2026 digital-asset landscape. The planned acquisition of 90 million MORPHO tokens over four years reflects a new style of long-horizon capital deployment where traditional asset managers are gradually embedding themselves inside blockchain financial infrastructure rather than simply holding crypto assets as speculative positions. This structured accumulation strategy is expected to function as a stability mechanism for both price discovery and protocol governance participation.

Industry analysts believe the advisory coordination involving Galaxy Digital signals deeper professionalization of institutional crypto entry. Instead of isolated purchases, the model appears to combine treasury planning, risk modeling, and compliance-ready exposure. The approach mirrors sovereign wealth style investing, where capital influence is built slowly but strategically over multi-year cycles, allowing DeFi protocols to adapt their liquidity architecture without shock absorption pressure.

The technical appeal of Morpho lies in its next-generation credit optimization model. The protocol is designed to improve capital efficiency by dynamically matching lenders and borrowers while minimizing idle liquidity. In 2026, institutional participants are focusing less on token speculation and more on programmable credit rails that can support real-world asset financing, structured lending, and automated collateral management across global markets.

Another emerging trend is the potential convergence of DeFi governance with traditional regulatory compliance standards. Large-scale token holders such as Apollo may eventually participate in shaping risk thresholds, oracle security models, and treasury sustainability policies inside the protocol ecosystem. This could lead to hybrid governance frameworks where institutional investors help stabilize volatility while maintaining decentralized operational principles.

Market observers also predict that this acquisition model could become a blueprint for future institutional entries into blockchain finance. Instead of one-time capital injections, large asset managers may adopt “time-weighted protocol integration,” spreading purchases across years to reduce market distortion and build community acceptance. Such methods could transform token ownership from a trading asset into a strategic infrastructure stake similar to ownership in payment networks or clearing systems.

Looking ahead toward the late 2020s, digital credit platforms are expected to play a major role in tokenized global finance. Blockchain-based lending systems may integrate with traditional banking liquidity pools, enabling near-instant cross-border settlement and automated interest distribution. The boundary between off-chain capital markets and on-chain financial logic is likely to continue fading as institutional players seek operational efficiency, transparency, and algorithmic risk control.

The broader significance of this development is that decentralized finance is transitioning from a niche innovation sector into foundational financial architecture. If the multi-year acquisition strategy succeeds, institutional-protocol partnerships could redefine capital formation, turning blockchain lending networks into core components of global monetary and credit systems by 2030 and beyond. 🚀

Industry analysts believe the advisory coordination involving Galaxy Digital signals deeper professionalization of institutional crypto entry. Instead of isolated purchases, the model appears to combine treasury planning, risk modeling, and compliance-ready exposure. The approach mirrors sovereign wealth style investing, where capital influence is built slowly but strategically over multi-year cycles, allowing DeFi protocols to adapt their liquidity architecture without shock absorption pressure.

The technical appeal of Morpho lies in its next-generation credit optimization model. The protocol is designed to improve capital efficiency by dynamically matching lenders and borrowers while minimizing idle liquidity. In 2026, institutional participants are focusing less on token speculation and more on programmable credit rails that can support real-world asset financing, structured lending, and automated collateral management across global markets.

Another emerging trend is the potential convergence of DeFi governance with traditional regulatory compliance standards. Large-scale token holders such as Apollo may eventually participate in shaping risk thresholds, oracle security models, and treasury sustainability policies inside the protocol ecosystem. This could lead to hybrid governance frameworks where institutional investors help stabilize volatility while maintaining decentralized operational principles.

Market observers also predict that this acquisition model could become a blueprint for future institutional entries into blockchain finance. Instead of one-time capital injections, large asset managers may adopt “time-weighted protocol integration,” spreading purchases across years to reduce market distortion and build community acceptance. Such methods could transform token ownership from a trading asset into a strategic infrastructure stake similar to ownership in payment networks or clearing systems.

Looking ahead toward the late 2020s, digital credit platforms are expected to play a major role in tokenized global finance. Blockchain-based lending systems may integrate with traditional banking liquidity pools, enabling near-instant cross-border settlement and automated interest distribution. The boundary between off-chain capital markets and on-chain financial logic is likely to continue fading as institutional players seek operational efficiency, transparency, and algorithmic risk control.

The broader significance of this development is that decentralized finance is transitioning from a niche innovation sector into foundational financial architecture. If the multi-year acquisition strategy succeeds, institutional-protocol partnerships could redefine capital formation, turning blockchain lending networks into core components of global monetary and credit systems by 2030 and beyond. 🚀