Is Bitcoin Now Officially in a Bear Market? What Historical Data Says

Multiple analysts believe the ongoing Bitcoin downtrend merely represents a bull market correction, but what does market data say?

Bitcoin has now fallen for five straight months and trades 46% below its all-time high of $126,000. However, despite this downtrend, analysts still refuse to call it a full bear market. They believe Bitcoin is simply going through a correction within a larger bull cycle, not entering another crypto winter.

Nonetheless, XWIN Research, a Japanese research firm, disagrees. The firm argues that Bitcoin has already entered the early stage of a bear market. According to XWIN, many investors fail to see it because today’s price levels remain higher than what they saw in previous bear markets.

Key Points

- Bitcoin has fallen 46% from its $126,000 peak and now trades around $67,900 after five straight months of decline.

- XWIN Research says Bitcoin has entered an early winter phase, with the Fear & Greed Index at 14 and structural selling pressure visible in capital flow data.

- In 2024, $10 billion in inflows expanded the market cap, but in 2025, over $300 billion in inflows coincided with a market cap decline.

- Net realized losses recently hit $13.6 billion, matching extremes seen during the 2022 bear market, though past bottoms formed about five months after peak losses.

- Bitcoin has declined 41% over four consecutive losing months, a pattern last seen in 2018, with a similar drawdown previously recorded during the 2022 bear market.

Investors Fail to Recognize the Bear Market

The firm presented reasons why many participants resist this idea. First, investors still remember the pain of 2022, and they do not want to relive it. In addition, Bitcoin trades at much higher nominal prices than it did during the last winter, which makes the situation feel different

Further, the launch of spot ETFs, stronger institutional adoption, and improved infrastructure also give many people confidence that history will not repeat itself. For instance, industry leaders like Strategy’s Michael Saylor had suggested that the bull market would extend to this year.

Why Bitcoin May Have Already Entered a Bear Market

Still, XWIN Research stressed that price alone does not define winter. Notably, supply and demand changes, capital flows, and sentiment provide the real data. Right now, the Fear & Greed Index stands at 14, a level classified as Extreme Fear. The firm noted that similar sentiment drops appeared in past cycles before prices adjusted downward.

Capital flow data also points to winter conditions. In 2024, $10 billion in inflows helped expand Bitcoin’s market cap. However, in 2025, more than $300 billion flowed into the market, but the market cap declined

XWIN Research sees this as a sign of ongoing selling pressure. On-chain profit data also shows falling realized gains despite high price levels, which indicates weakening internal strength.

Based on this data, XWIN Research believes Bitcoin may already be entering winter, even if higher prices and stronger infrastructure delay broader recognition. The firm said it would reconsider this view if ETF inflows stabilize and if on-chain distribution slows clearly.

How History Defines Bitcoin Winter

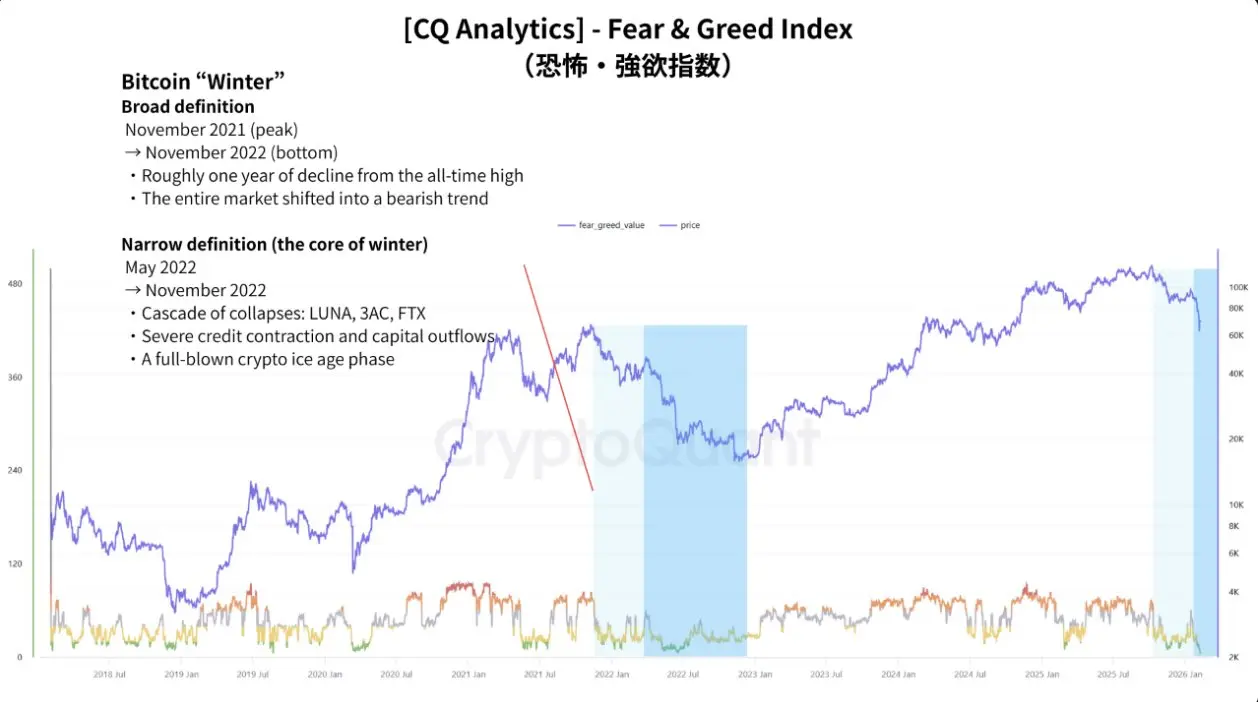

Meanwhile, the chart that accompanied XWIN’s report presented two definitions of Bitcoin winter. Under a broad definition, winter stretched from the November 2021 peak to the November 2022 bottom. During that one-year period, Bitcoin declined from its all-time high and dragged the entire crypto market into a bearish trend.

Bitcoin Bear Market Ideas | XWIN ResearchHowever, under a narrower definition, the core winter phase ran from May 2022 to November 2022. This period included the collapse of LUNA, the failure of Three Arrows Capital (3AC), and the bankruptcy of FTX

Bitcoin Bear Market Ideas | XWIN ResearchHowever, under a narrower definition, the core winter phase ran from May 2022 to November 2022. This period included the collapse of LUNA, the failure of Three Arrows Capital (3AC), and the bankruptcy of FTX

Analysts Split on What Comes Next

However, not everyone agrees that a bear market has already begun. Investor and commentator Mr. Crypto Whale shared what he calls his 2026 Bull Run Roadmap

Notably, he believes the current downtrend this month is a bear trap and will lead to a Bitcoin breakout in March. He predicts an altcoin season in April and a new all-time high around $215,000 in May. After that, he sees a bull trap in June, a liquidation cascade in July, and the official start of a bear market in August.

Meanwhile, Bitcoinsensus reported that Bitcoin’s net realized losses have reached levels similar to the worst moments of the 2022 bear market. Just three days ago, realized losses hit $13.6 billion

However, Bitcoinsensus reminded investors that in 2022, realized losses peaked about five months before the actual market bottom formed, which shows that bottoms take time to develop.

CryptoQuant author Woo Minkyu also warned three months ago that Bitcoin had already entered a bear market, citing the Bitcoin Cycle Momentum Indicator (BCMI), while it still traded above $86,000. Today, Bitcoin trades at $67,900

A Downtrend That Mirrors Past Bear Markets

Also, Bitcoin’s recent performance looks increasingly similar to past bear markets. The asset has recorded four consecutive months of losses and remains on track to log a fifth. Over this period, Bitcoin has dropped 41%.

The last time Bitcoin posted four straight months of declines was during the 2018 bear market, not even during 2022. The last time it suffered a 41% drawdown occurred during the 2022 bear market.

Related Articles

Morgan Stanley Picks 2 Bitcoin Miners to Double: 158% Upside on AI Pivot

Cardano’s Privacy Blockchain Midnight Lands Google, Telegram in March — Silbert: 5-10% of Bitcoin to Privacy

$2.52 billion BTC and $390 million ETH options set to expire and settle tomorrow

Cosmos Health purchases $500,000 worth of BTC, bringing the total digital asset investment to $2.5 million

Ripple's CTO Emeritus Calls Bitcoin 'Technological Dead End' - U.Today