Post content & earn content mining yield

placeholder

AbcXyz

BTC, ETH experienced unusually high trading volume in the early morning, with prices fluctuating wildly in a short period. PANews February 8th reports that, according to market news, BTC and ETH experienced abnormal price movements within a few minutes starting from 00:05, with trading volume on multiple exchanges spiking dramatically. The market speculates that this may be related to abnormal transactions by some market makers.

View Original

- Reward

- like

- Comment

- Repost

- Share

【$FET Signal】No Position + Weak Consolidation Awaiting Breakout

$FET Consolidating weakly in the 0.161-0.170 range, showing disorderly oscillation after a decline on the 4H timeframe. The price center shifts downward, but buy orders are densely clustered in the 0.161-0.163 area, forming a temporary support. The key contradiction is: open interest remains stable (OI Trend: Stable) while the price declines, combined with negative funding rates (-0.0045%) and sell orders from takers (is_taker_buying: false), indicating that bears are dominant but have not triggered panic selling. It appears more

View Original$FET Consolidating weakly in the 0.161-0.170 range, showing disorderly oscillation after a decline on the 4H timeframe. The price center shifts downward, but buy orders are densely clustered in the 0.161-0.163 area, forming a temporary support. The key contradiction is: open interest remains stable (OI Trend: Stable) while the price declines, combined with negative funding rates (-0.0045%) and sell orders from takers (is_taker_buying: false), indicating that bears are dominant but have not triggered panic selling. It appears more

- Reward

- like

- Comment

- Repost

- Share

CHINA

扬我国威

Created By@BearishTradersCanSurviveFor

Listing Progress

0.00%

MC:

$0.1

Create My Token

#WhyAreGoldStocksandBTCFallingTogether? #WhyAreGoldStocksandBTCFallingTogether

The simultaneous decline of gold, gold-related stocks, and Bitcoin has captured the attention of investors across markets. At first glance, it may seem counterintuitive. Gold has traditionally been viewed as a safe haven, a hedge against inflation, and a store of value during times of market stress. Bitcoin, often referred to as digital gold, has similarly been positioned as an alternative store of value and a hedge against currency debasement. Yet in recent movements, both assets are retreating together, raising qu

The simultaneous decline of gold, gold-related stocks, and Bitcoin has captured the attention of investors across markets. At first glance, it may seem counterintuitive. Gold has traditionally been viewed as a safe haven, a hedge against inflation, and a store of value during times of market stress. Bitcoin, often referred to as digital gold, has similarly been positioned as an alternative store of value and a hedge against currency debasement. Yet in recent movements, both assets are retreating together, raising qu

BTC-1,42%

- Reward

- 1

- 1

- Repost

- Share

Yunna :

:

hold hold【$PTB Signal】Empty Position + Main Force Distribution Pattern

$PTB Forms a distribution structure at high levels after a massive surge, with price action indicating that the main force is unloading using liquidity.

🎯 Direction: Empty Position

Market Logic: A massive upper shadow (0.001897) appears on the 4H chart, accompanied by stable open interest but dominated by active sell orders (Taker Sell). This is a typical pattern of pushing up to unload. The buy/sell ratio hovers around 0.5, indicating a lack of sustained buying support. The current price oscillates in the middle of a massive can

View Original$PTB Forms a distribution structure at high levels after a massive surge, with price action indicating that the main force is unloading using liquidity.

🎯 Direction: Empty Position

Market Logic: A massive upper shadow (0.001897) appears on the 4H chart, accompanied by stable open interest but dominated by active sell orders (Taker Sell). This is a typical pattern of pushing up to unload. The buy/sell ratio hovers around 0.5, indicating a lack of sustained buying support. The current price oscillates in the middle of a massive can

- Reward

- like

- Comment

- Repost

- Share

BTC closes green and suddenly life makes sense.#Crypto #NFTs

BTC-1,42%

- Reward

- like

- Comment

- Repost

- Share

【$LA Signal】Empty position, cooling-off phase after major players distribute

$LA After experiencing a 13.5% violent rally, the price is cooling down. The 4H chart shows long upper shadows, accompanied by stable open interest and a price decline, which is a typical sign of “pumping and dumping.” Taker sell volume dominates, and the funding rate is significantly negative, indicating that the main players are distributing at high levels, and retail traders chasing the high are caught.

🎯 Direction: Empty position

Market logic is clear: the price is pushed up but open interest has not increased,

View Original$LA After experiencing a 13.5% violent rally, the price is cooling down. The 4H chart shows long upper shadows, accompanied by stable open interest and a price decline, which is a typical sign of “pumping and dumping.” Taker sell volume dominates, and the funding rate is significantly negative, indicating that the main players are distributing at high levels, and retail traders chasing the high are caught.

🎯 Direction: Empty position

Market logic is clear: the price is pushed up but open interest has not increased,

- Reward

- like

- Comment

- Repost

- Share

Give me some USDT PLEASE Please Please 🥺

https://www.gate.com/referral/registry?ref=VQNFXAXBUQ&ref_type=103&page=superRebate

#BuyTheDipOrWaitNow? #CryptoMarketPullback #GateJanTransparencyReport

https://www.gate.com/referral/registry?ref=VQNFXAXBUQ&ref_type=103&page=superRebate

#BuyTheDipOrWaitNow? #CryptoMarketPullback #GateJanTransparencyReport

- Reward

- like

- Comment

- Repost

- Share

$BTC Explosion is imminent. Has the sell-off ended?

Entry: 70000🟩

Target 1: 84700 🎯

Target 2: 85300 🎯

Target 3: 85600 🎯

Stop Loss: 65000🛑

Bitcoin is making a comeback. A tactical rebound is underway. Buyers are entering the market. This is not a drill. The 85k zone in the middle will be the next battleground. Sellers will face significant resistance. Protect your capital. Move your stop loss to break even at the first target. No stop loss, no trade. Act now.

Disclaimer: This is not financial advice.

$BTC

Entry: 70000🟩

Target 1: 84700 🎯

Target 2: 85300 🎯

Target 3: 85600 🎯

Stop Loss: 65000🛑

Bitcoin is making a comeback. A tactical rebound is underway. Buyers are entering the market. This is not a drill. The 85k zone in the middle will be the next battleground. Sellers will face significant resistance. Protect your capital. Move your stop loss to break even at the first target. No stop loss, no trade. Act now.

Disclaimer: This is not financial advice.

$BTC

BTC-1,42%

- Reward

- like

- Comment

- Repost

- Share

February 8 Bitcoin Market | Large-Scale Structure and Trading Awareness

From the perspective of large-scale structure, Bitcoin short positions have not yet completed, currently only missing the **final decline—completion of the third wave**.

In terms of time cycles, multiple major bearish cycles are simultaneously entering correction phases. Do not be fooled by short-term rebounds and blindly go long at low prices.

The winter of Bitcoin has arrived, and it will enter a long-term oscillation and correction cycle. This prolonged consolidation may seem frustrating, but it is actually laying

From the perspective of large-scale structure, Bitcoin short positions have not yet completed, currently only missing the **final decline—completion of the third wave**.

In terms of time cycles, multiple major bearish cycles are simultaneously entering correction phases. Do not be fooled by short-term rebounds and blindly go long at low prices.

The winter of Bitcoin has arrived, and it will enter a long-term oscillation and correction cycle. This prolonged consolidation may seem frustrating, but it is actually laying

BTC-1,42%

- Reward

- like

- Comment

- Repost

- Share

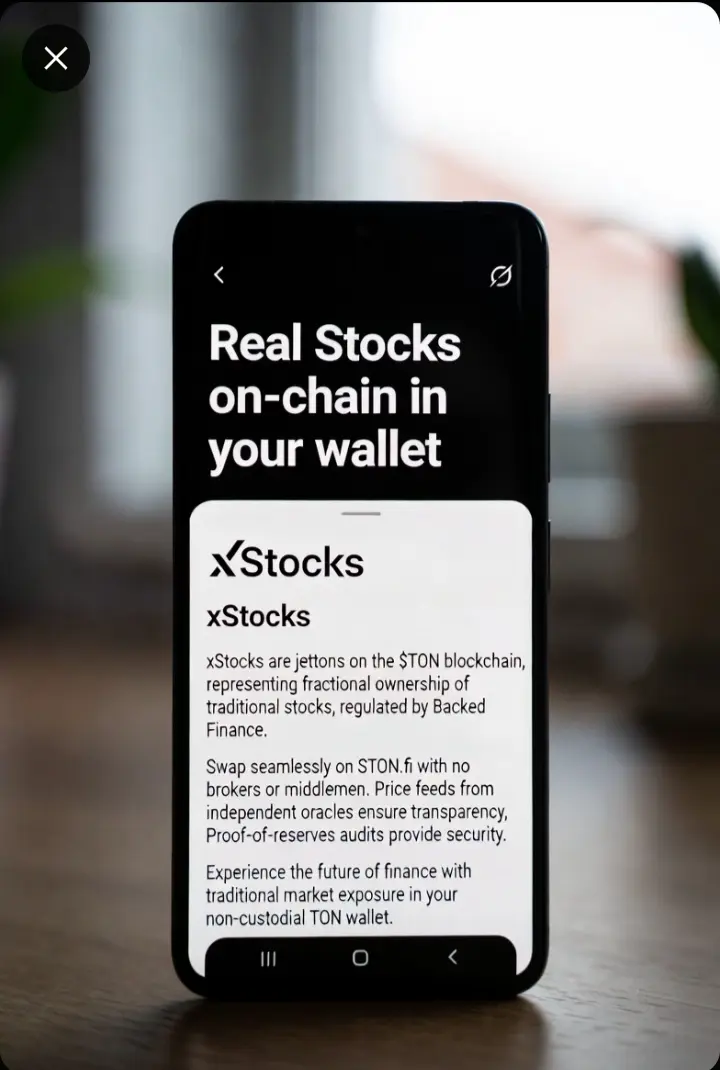

Real Stocks → On‑Chain in Your Wallet: How xStocks Actually Work 💥

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

TON0,64%

- Reward

- 1

- Comment

- Repost

- Share

【$COLLECT Signal】Short | Distribution Pattern After Volume Surge and Stagnation

After experiencing a 22.8% violent rally, a volume surge and clear Taker selling pressure appeared on the 4H timeframe. The last 4H candlestick closed below the previous low, indicating exhausted buying and accumulated sell orders.

🎯 Direction: Short

🎯 Entry: 0.0555 - 0.0560

🛑 Stop Loss: 0.0581 $COLLECT Rigid stop loss, invalidated if it breaks above the previous high (

🚀 Target 1: 0.0510

🚀 Target 2: 0.0470

Hardcore logic: After a continuous rally, open interest remains stable but Taker Volume turns to net s

View OriginalAfter experiencing a 22.8% violent rally, a volume surge and clear Taker selling pressure appeared on the 4H timeframe. The last 4H candlestick closed below the previous low, indicating exhausted buying and accumulated sell orders.

🎯 Direction: Short

🎯 Entry: 0.0555 - 0.0560

🛑 Stop Loss: 0.0581 $COLLECT Rigid stop loss, invalidated if it breaks above the previous high (

🚀 Target 1: 0.0510

🚀 Target 2: 0.0470

Hardcore logic: After a continuous rally, open interest remains stable but Taker Volume turns to net s

- Reward

- like

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.76K

Create My Token

On February 8th, Bitcoin market analysis from a higher timeframe perspective. The Bitcoin short positions are not yet complete; the final decline, which is the third wave, is still pending. From a time cycle perspective, multiple higher-level timeframes indicate that the bearish trend needs adjustment, so do not be fooled by a temporary rebound. Blindly buying low is not advisable. The winter of Bitcoin has arrived, and the oscillation cycle will require several years of adjustment. However, this kind of adjustment also sets the stage for future major market movements. So, you must understand

BTC-1,42%

- Reward

- like

- Comment

- Repost

- Share

【$BANANAS31 Signal】Short position + Main force distribution pattern

$BANANAS31 After a volume surge and rally on the 4H timeframe, the price stalls around 0.0040, showing a clear distribution structure.

🎯 Direction: Short position

Market logic: 4H candlestick chart indicates that the last bullish candle was accompanied by a massive volume (3.8B) and a buy/sell ratio of 0.53. However, the following two candles show a sharp decrease in volume and the price fails to make new highs, which is a typical "buying exhaustion" signal. Open interest remains stable while the price stagnates, combined w

View Original$BANANAS31 After a volume surge and rally on the 4H timeframe, the price stalls around 0.0040, showing a clear distribution structure.

🎯 Direction: Short position

Market logic: 4H candlestick chart indicates that the last bullish candle was accompanied by a massive volume (3.8B) and a buy/sell ratio of 0.53. However, the following two candles show a sharp decrease in volume and the price fails to make new highs, which is a typical "buying exhaustion" signal. Open interest remains stable while the price stagnates, combined w

- Reward

- like

- Comment

- Repost

- Share

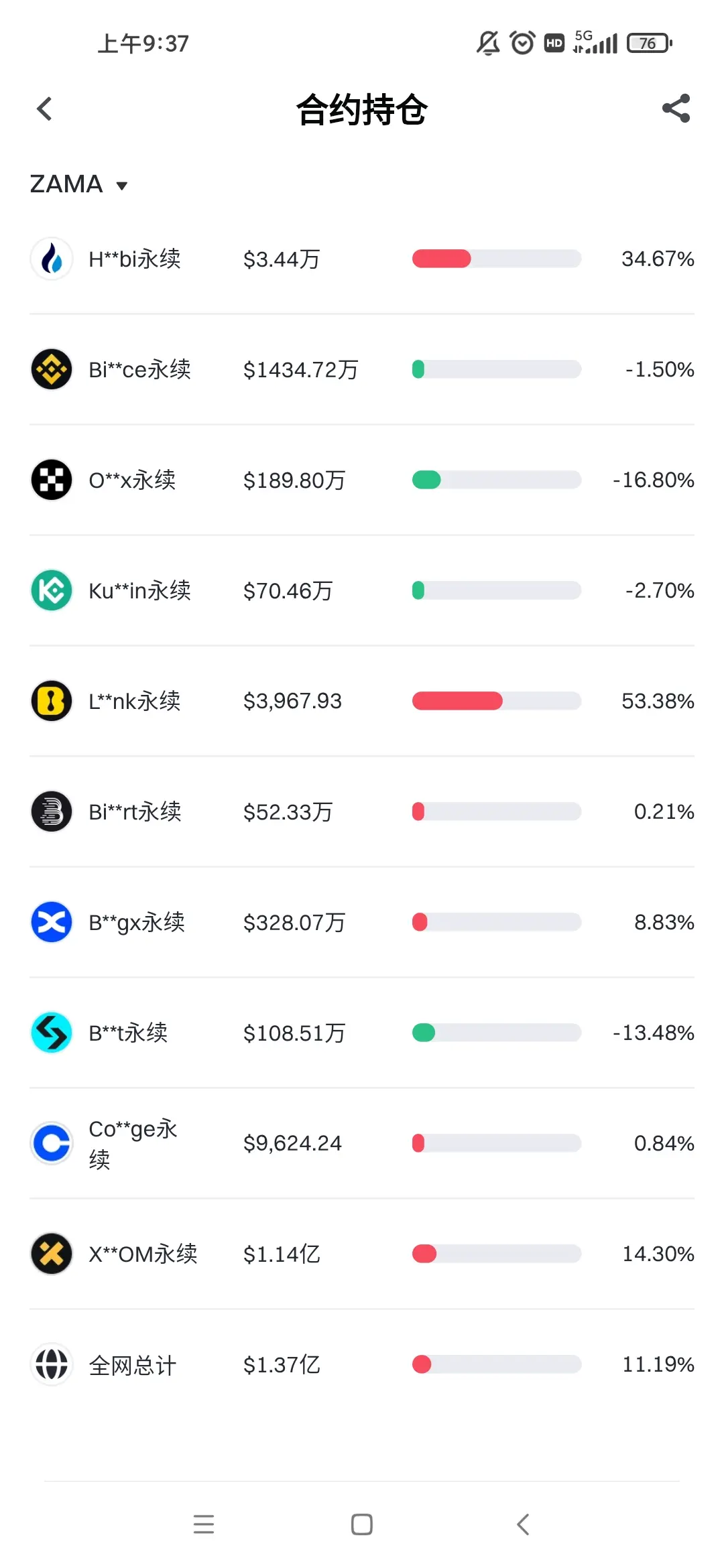

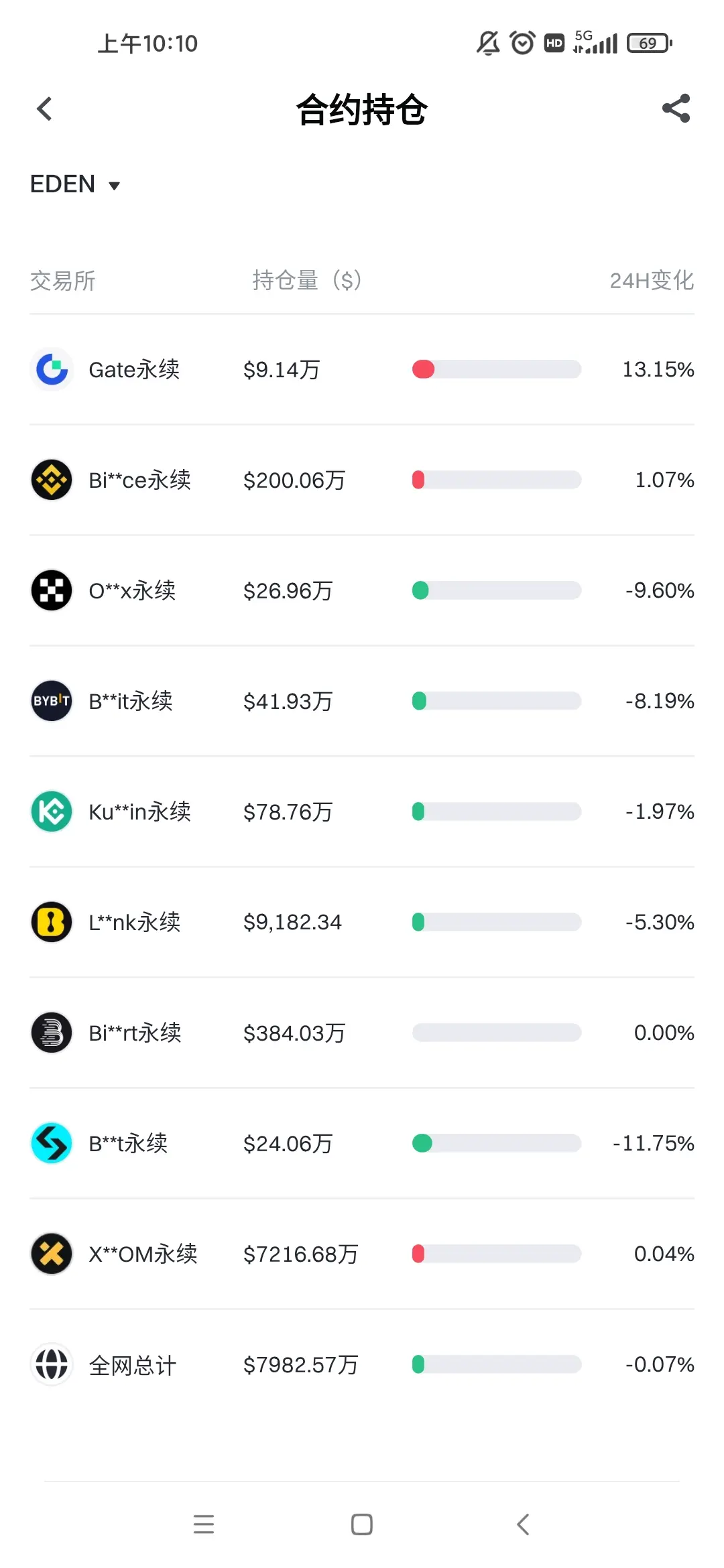

Anyone who has a large position on this X.OM has been constantly dumping, and it has never gone up. For example, EDEN, ZAMA, SENT, and so on. The positions on this exchange are used by the main players to dump, with the position size continuously increasing and no liquidation data. Such large positions, in a small exchange with no depth, no liquidity, and even very low spot trading volume, how could the contract positions be so large?

View Original

- Reward

- like

- Comment

- Repost

- Share

#交易机器人 I am using the BTCUSDT contract grid bot on Gate, with a total return of +157.74% since creation.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

$USD1 $USDG

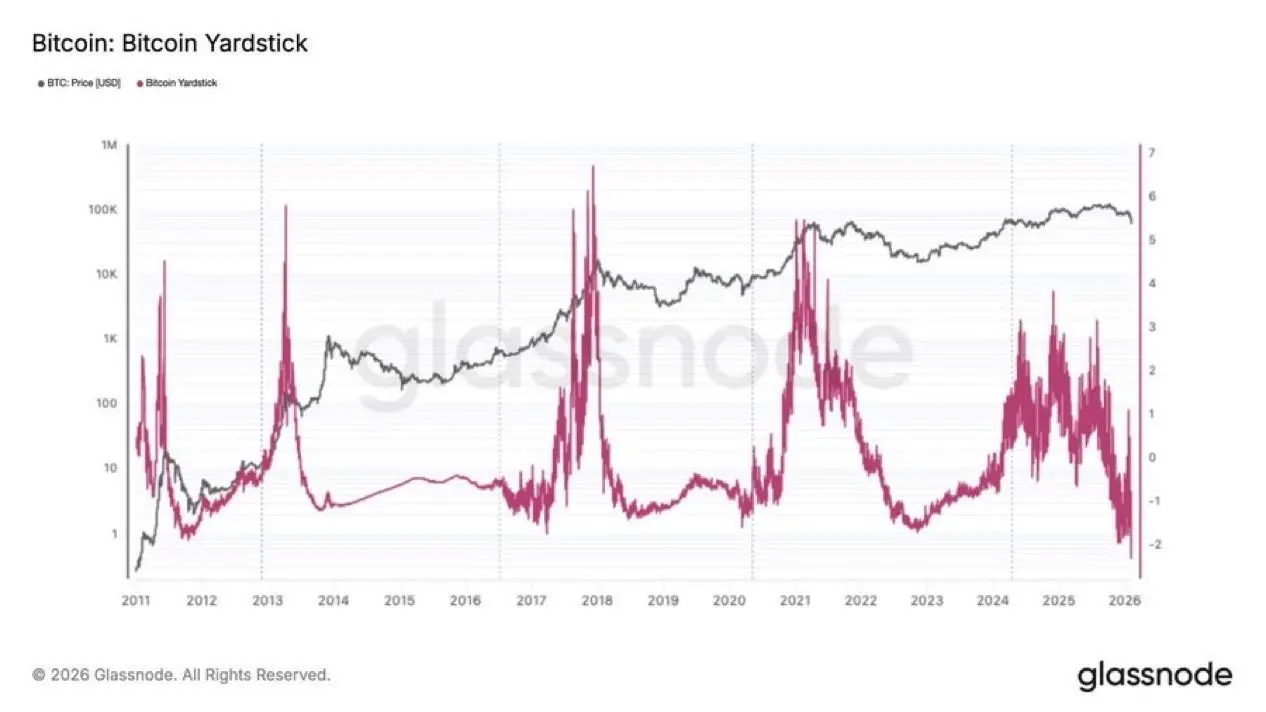

Yardstick Metric for $BTC registers its lowest level ever

According to Glassnode data, the Yardstick metric for Bitcoin has reached its all-time low,

a region that rarely lasted long during previous cycles, and often preceded strong market movements

#CMEGroupPlansCMEToken #GlobalTechSell-OffHitsRiskAssets #CryptoMarketPullback #BuyTheDipOrWaitNow?

View OriginalYardstick Metric for $BTC registers its lowest level ever

According to Glassnode data, the Yardstick metric for Bitcoin has reached its all-time low,

a region that rarely lasted long during previous cycles, and often preceded strong market movements

#CMEGroupPlansCMEToken #GlobalTechSell-OffHitsRiskAssets #CryptoMarketPullback #BuyTheDipOrWaitNow?

- Reward

- like

- Comment

- Repost

- Share

Market Analysis and Finding the Best Entry Point

- Reward

- like

- Comment

- Repost

- Share

Did everyone eat meat last night without ETH?

ETH1,88%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

ShortSellingInTheAir :

:

It's better not to eat this meat; it's a matter of risking one's life. One misstep and it's like chopping wood for a thousand days and burning it in a single day.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More145.88K Popularity

34.26K Popularity

393.06K Popularity

14.78K Popularity

13.79K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreMarket Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

36 m

Browser cache issues cause abnormal display of Arweave network block data.

42 m

Illinois proposes bill to establish state-level Bitcoin reserve

1 h

Multiple traditional financial assets experience price fluctuations, with gold, silver, and crude oil strengthening.

1 h

South African Reserve Bank Governor warns that the growth in stablecoin usage could impact monetary unity

1 h

Pin