Post content & earn content mining yield

placeholder

GateUser-f937182c

$BTC Just look at the data to see how the market is doing. Open interest and trading volume are continuously increasing. How can Bitcoin fall? Trust me, as long as everyone holds steady and doesn't sell, Bitcoin is guaranteed to take off. If no one is left, there are no supplies for large investors to buy, which makes Bitcoin scarce in the market. So the price will naturally rise. Don't pay too much attention to those fake news; just look at the actual data directly. As long as everyone doesn't sell, the big players can't sustain their capital turnover. They will automatically give up. We are

BTC-1,68%

- Reward

- like

- 1

- Repost

- Share

DragonWalkingOnSnow :

:

You keep holding on, I will go to 30,000 and wait for you 😚😚😚Market Analysis and Finding the Best Entry Point

- Reward

- like

- Comment

- Repost

- Share

🌈🌈

想要一个温暖的家

Created By@BigGuys,TakeMeBackT

Listing Progress

0.00%

MC:

$2.46K

Create My Token

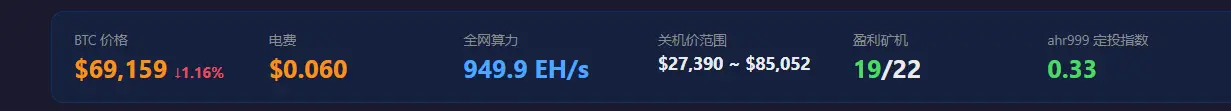

Bitcoin mining difficulty experiences the largest single adjustment since summer 2021, with the entire network's seven-day average hash rate dropping to 990.08 EH/s.

Bitcoin completed a new round of mining difficulty adjustment at block height 935424, with difficulty decreasing by 11.16% to 125.86 T, marking the largest single adjustment since summer 2021, and the tenth largest difficulty adjustment in Bitcoin history.

Currently, the network's seven-day average hash rate is 990.08 EH/s.

Data shows that over the past month, the total hash rate of the Bitcoin network has decreased by about 20%,

Bitcoin completed a new round of mining difficulty adjustment at block height 935424, with difficulty decreasing by 11.16% to 125.86 T, marking the largest single adjustment since summer 2021, and the tenth largest difficulty adjustment in Bitcoin history.

Currently, the network's seven-day average hash rate is 990.08 EH/s.

Data shows that over the past month, the total hash rate of the Bitcoin network has decreased by about 20%,

BTC-1,68%

- Reward

- like

- Comment

- Repost

- Share

#USIranNuclearTalksTurmoil

Geopolitical heat is back on full blast after the latest round of US-Iran indirect nuclear talks wrapped up in Oman on Feb 6. Both sides called it a "good start" and "very good," with another round slated early this week (likely Feb 9-10). But deep divisions persist—no major breakthroughs, just framework discussions and posturing. Here's the fully extended, point-by-point deep dive with fresh context from the Oman meetings, sticking points, and real-time market ripples:

1️⃣ Current Status of Negotiations – Fresh from Oman (Feb 6 Round)

Indirect talks mediated by Oma

Geopolitical heat is back on full blast after the latest round of US-Iran indirect nuclear talks wrapped up in Oman on Feb 6. Both sides called it a "good start" and "very good," with another round slated early this week (likely Feb 9-10). But deep divisions persist—no major breakthroughs, just framework discussions and posturing. Here's the fully extended, point-by-point deep dive with fresh context from the Oman meetings, sticking points, and real-time market ripples:

1️⃣ Current Status of Negotiations – Fresh from Oman (Feb 6 Round)

Indirect talks mediated by Oma

- Reward

- 8

- 12

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

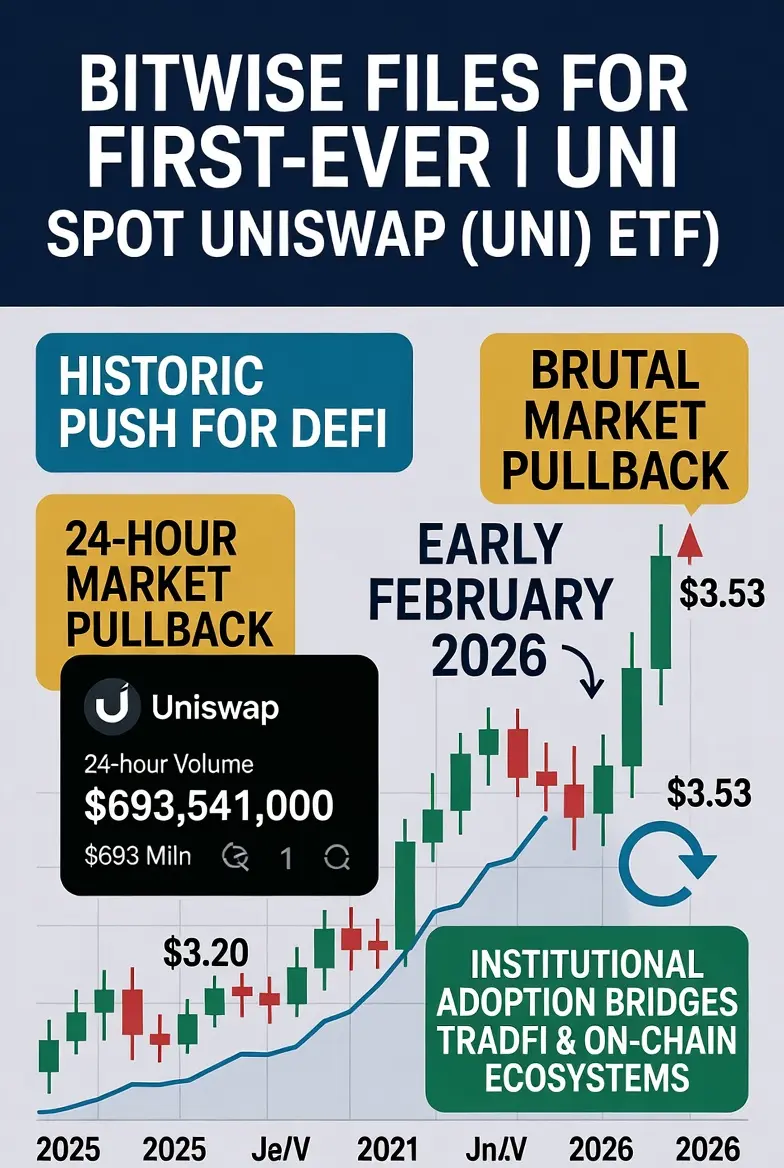

#BitwiseFilesforUNISpotETF

Bitwise Files for First-Ever Spot Uniswap (UNI) ETF: Historic DeFi Push Amid Brutal Market Pullback – Full Extended Breakdown (February 2026)

Bitwise Asset Management has dropped a major bombshell in the crypto space: On February 5, 2026, they officially filed Form S-1 with the U.S. SEC for the Bitwise Uniswap ETF, the first spot ETF dedicated to tracking the UNI token – the governance token of Uniswap, the world's leading decentralized exchange (DEX). This filing marks a groundbreaking move to bring regulated, institutional-grade exposure to a core DeFi asset, even

Bitwise Files for First-Ever Spot Uniswap (UNI) ETF: Historic DeFi Push Amid Brutal Market Pullback – Full Extended Breakdown (February 2026)

Bitwise Asset Management has dropped a major bombshell in the crypto space: On February 5, 2026, they officially filed Form S-1 with the U.S. SEC for the Bitwise Uniswap ETF, the first spot ETF dedicated to tracking the UNI token – the governance token of Uniswap, the world's leading decentralized exchange (DEX). This filing marks a groundbreaking move to bring regulated, institutional-grade exposure to a core DeFi asset, even

- Reward

- 8

- 7

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

Nothing about this was instant 🔥Consistency pays off with time 💯Still building. Still early 🧱If you’re still showing up drop a reply 👇

- Reward

- 1

- Comment

- Repost

- Share

【$IOTA Signal】No Position + Weak Consolidation Awaiting Breakout

$IOTA is showing weak consolidation on the 4H timeframe, with the price being suppressed below 0.0727. Buying pressure is insufficient to trigger a meaningful rebound.

🎯 Direction: No Position

Market Logic: Price declines while open interest remains stable, indicating no long liquidation. This suggests either main players are offloading or there is a lack of buying interest. The 4H candlestick buy/sell ratio hovers around 0.5, showing a balanced battle between bulls and bears but with a downward shift in the price center of gr

View Original$IOTA is showing weak consolidation on the 4H timeframe, with the price being suppressed below 0.0727. Buying pressure is insufficient to trigger a meaningful rebound.

🎯 Direction: No Position

Market Logic: Price declines while open interest remains stable, indicating no long liquidation. This suggests either main players are offloading or there is a lack of buying interest. The 4H candlestick buy/sell ratio hovers around 0.5, showing a balanced battle between bulls and bears but with a downward shift in the price center of gr

- Reward

- 1

- 1

- Repost

- Share

LivermoreJesse :

:

【$IOTA Signal】Short Position + Weak Consolidation Awaiting Breakout $IOTA is showing a weak consolidation on the 4H timeframe, with the price suppressed below 0.0727, and buying pressure unable to trigger an effective rebound.

🎯Direction: Short

Market Logic: Price declines accompanied by stable open interest, indicating no long liquidation, suggesting main players are offloading or lacking bullish interest. The 4H K-line buy/sell ratio hovers around 0.5, showing a balanced battle between bulls and bears but with a downward shift in the price center of gravity, slightly favoring the bears. Taker Volume indicates active selling dominance, with heavy sell walls above (0.0706-0.0707). The current structure leans toward weak oscillation within the 0.070-0.073 range, awaiting a directional move, but the probability of a downward break is increasing.

Trade here 👇 $IOTA

---

Follow me: Get more real-time analysis and insights on the crypto market!

#Gate广场创作者新春激励 #Is the current market a bottoming out or just watching? $BTC $ETH $SOL

【$TRADOOR Signal】Long | Healthy Pullback After Breakout

$TRADOOR After a volume breakout, the market enters a healthy pullback phase, with the price consolidating above the breakout zone and no signs of panic selling.

🎯 Direction: Long

🎯 Entry: 1.215 - 1.225

🛑 Stop Loss: 1.185 ( Rigid Stop Loss )

🚀 Target 1: 1.335

🚀 Target 2: 1.450

Hardcore Logic: The 4H chart shows volume expanding during the breakout followed by a decrease during the pullback. The buy/sell ratio remains stable above 0.5, indicating a neutral to bullish market sentiment rather than FOMO. Open interest (OI) stays stable

View Original$TRADOOR After a volume breakout, the market enters a healthy pullback phase, with the price consolidating above the breakout zone and no signs of panic selling.

🎯 Direction: Long

🎯 Entry: 1.215 - 1.225

🛑 Stop Loss: 1.185 ( Rigid Stop Loss )

🚀 Target 1: 1.335

🚀 Target 2: 1.450

Hardcore Logic: The 4H chart shows volume expanding during the breakout followed by a decrease during the pullback. The buy/sell ratio remains stable above 0.5, indicating a neutral to bullish market sentiment rather than FOMO. Open interest (OI) stays stable

- Reward

- 1

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF 🌐 Bitwise Files for Spot Uniswap ETF — Bringing DeFi Governance to Traditional Portfolios

On February 5, 2026, Bitwise Asset Management took a landmark step in regulated crypto investment products by filing with the U.S. Securities and Exchange Commission (SEC) for the Bitwise Uniswap ETF. If approved, it would become the world’s first spot exchange-traded fund tracking UNI, the governance token of Uniswap, the largest decentralized exchange (DEX) in the Ethereum ecosystem.

The filing, submitted under Form S-1, outlines a simple, regulator-friendly structure. The ET

On February 5, 2026, Bitwise Asset Management took a landmark step in regulated crypto investment products by filing with the U.S. Securities and Exchange Commission (SEC) for the Bitwise Uniswap ETF. If approved, it would become the world’s first spot exchange-traded fund tracking UNI, the governance token of Uniswap, the largest decentralized exchange (DEX) in the Ethereum ecosystem.

The filing, submitted under Form S-1, outlines a simple, regulator-friendly structure. The ET

- Reward

- 3

- 5

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

Daily dedicated time for answering private message questions: Regarding real-life choice anxiety, your current issues are: 1. Family background is average, and you have student loans. You want to join the military to alleviate financial pressure. 2. Anxiety about identity transformation, confusion about the future, and hope to make a decision you won't regret. 3. Value conflicts, the collapse of your original cognitive system, worrying that you are "selling freedom" for money. Here's my analysis: Actually, for ordinary people, the most important concern is not political issues, but whether you

View Original- Reward

- 1

- Comment

- Repost

- Share

BNB

币安币

Created By@♥BeautifulSource♥

Listing Progress

0.02%

MC:

$2.48K

Create My Token

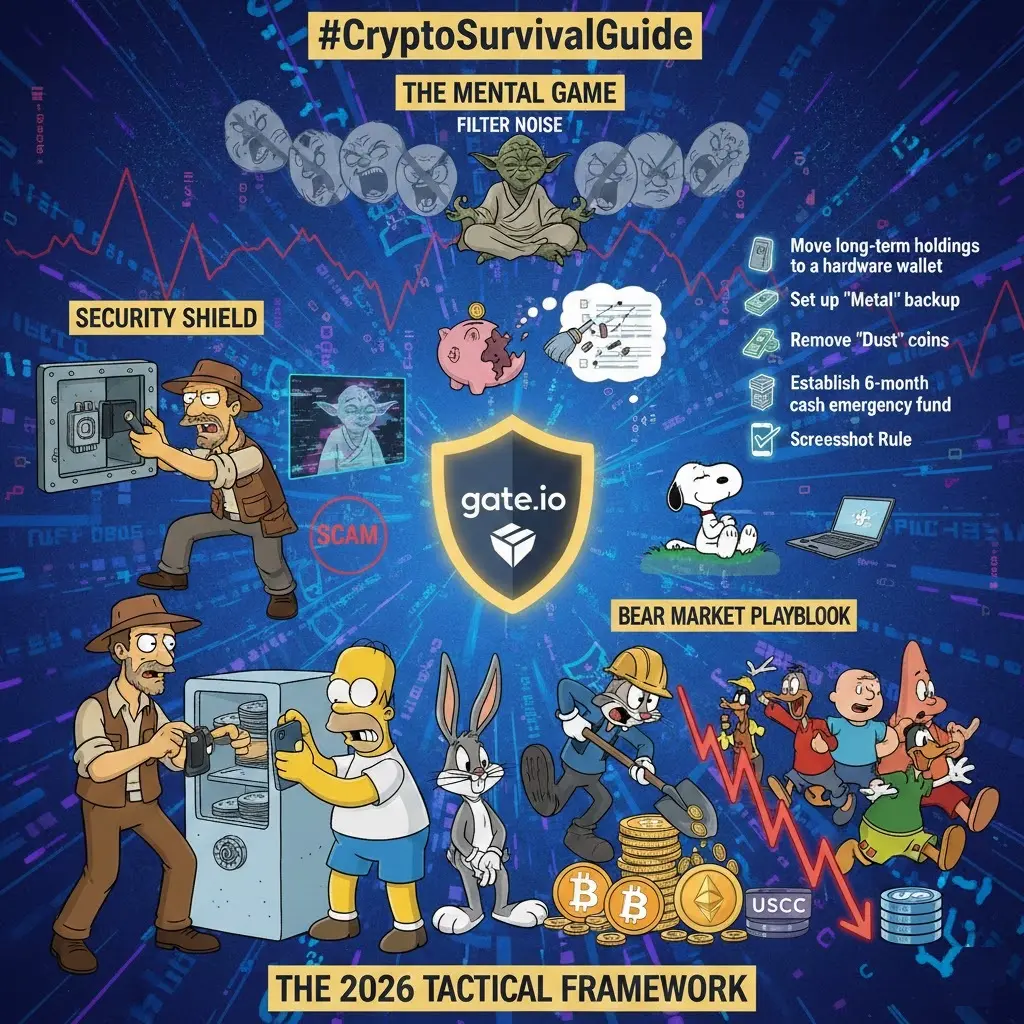

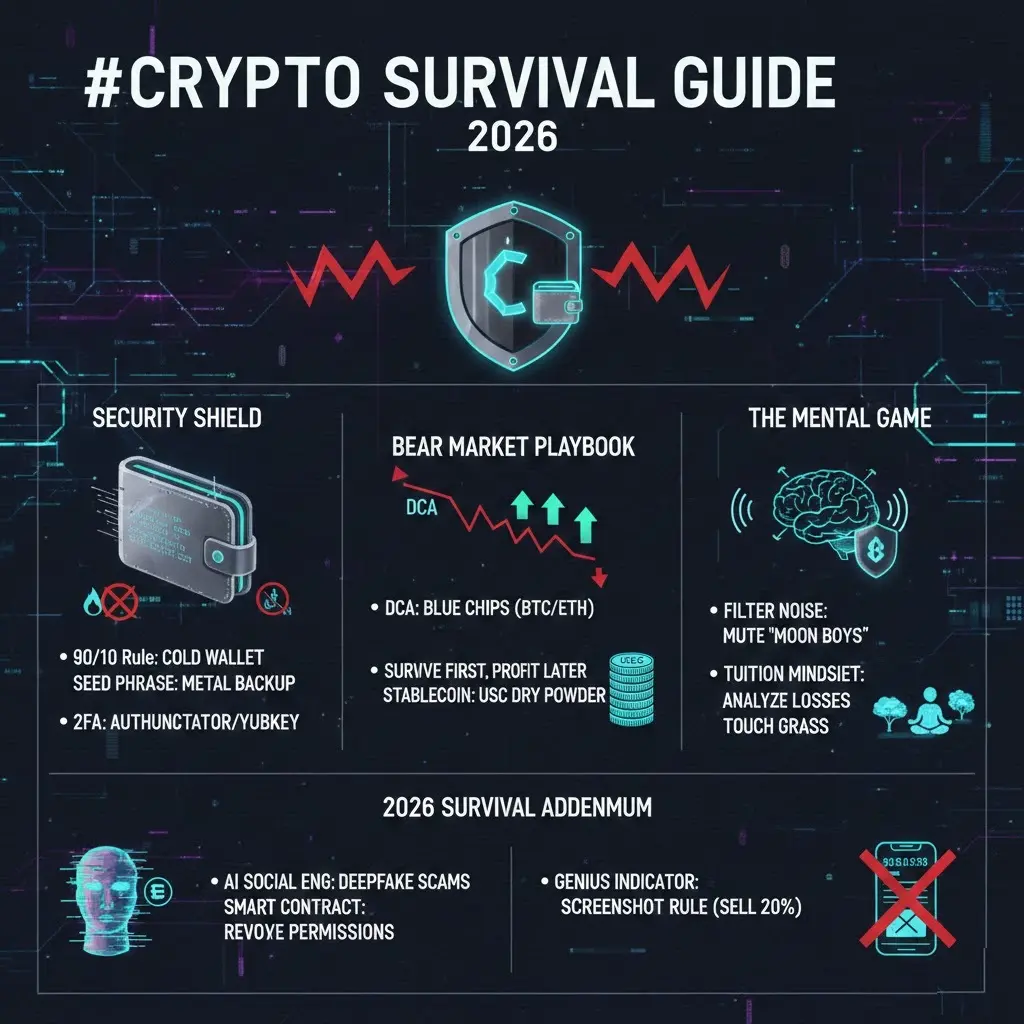

#CryptoSurvivalGuide

Welcome to the Crypto Survival Guide.

Whether you're navigating a "crypto winter" or just trying to keep your digital head above water in a volatile 2026 market, the goal is simple: Stay in the game. In crypto, survival is the prerequisite for success. Here is your tactical framework for protecting your capital and your sanity.

The Security Shield (Don't Get Rekt)

Security isn't a one-time setup; it’s a lifestyle. If you lose your keys, the "moon" doesn't matter.

The 90/10 Rule: Keep 90% of your assets in a Cold Wallet and only 10% on exchanges for active trading.

Seed

Welcome to the Crypto Survival Guide.

Whether you're navigating a "crypto winter" or just trying to keep your digital head above water in a volatile 2026 market, the goal is simple: Stay in the game. In crypto, survival is the prerequisite for success. Here is your tactical framework for protecting your capital and your sanity.

The Security Shield (Don't Get Rekt)

Security isn't a one-time setup; it’s a lifestyle. If you lose your keys, the "moon" doesn't matter.

The 90/10 Rule: Keep 90% of your assets in a Cold Wallet and only 10% on exchanges for active trading.

Seed

- Reward

- 5

- 6

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

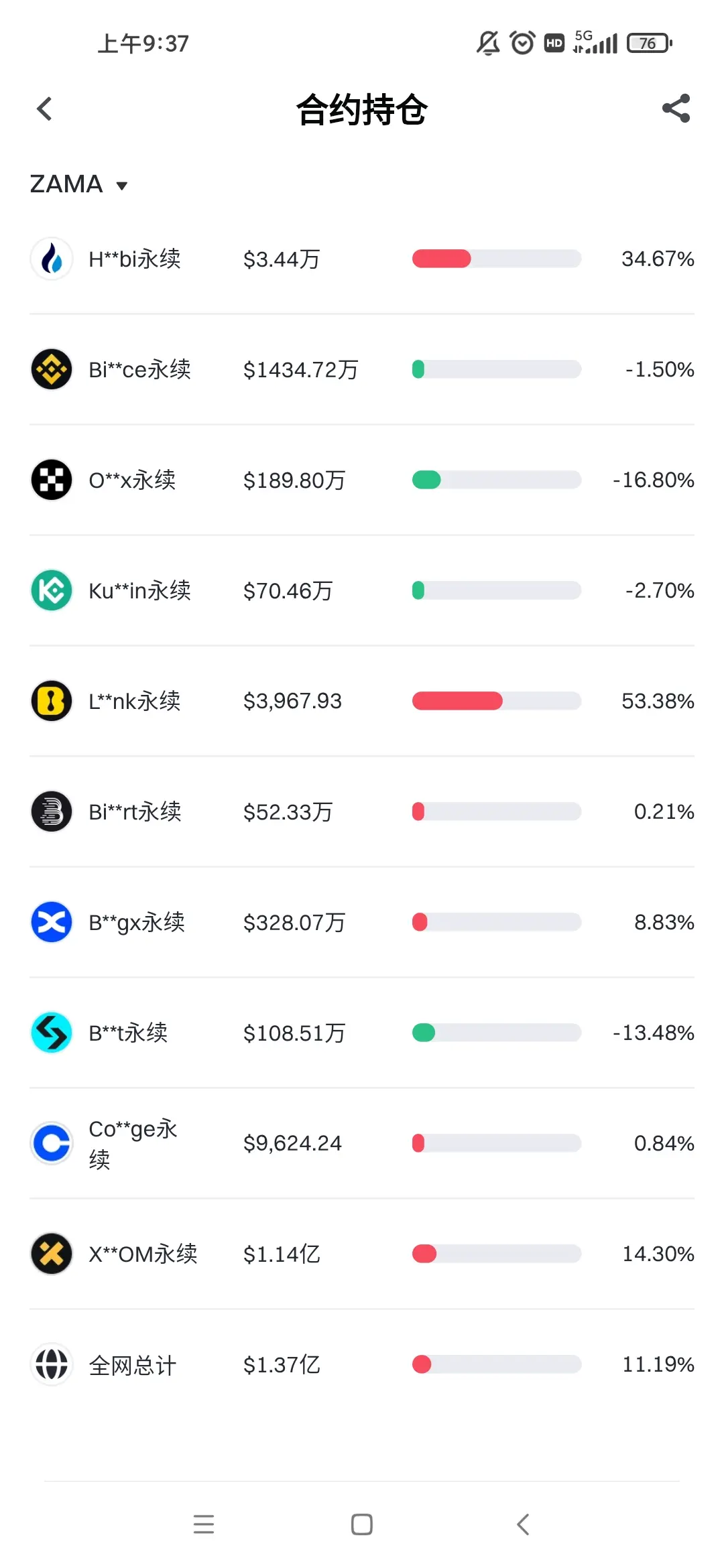

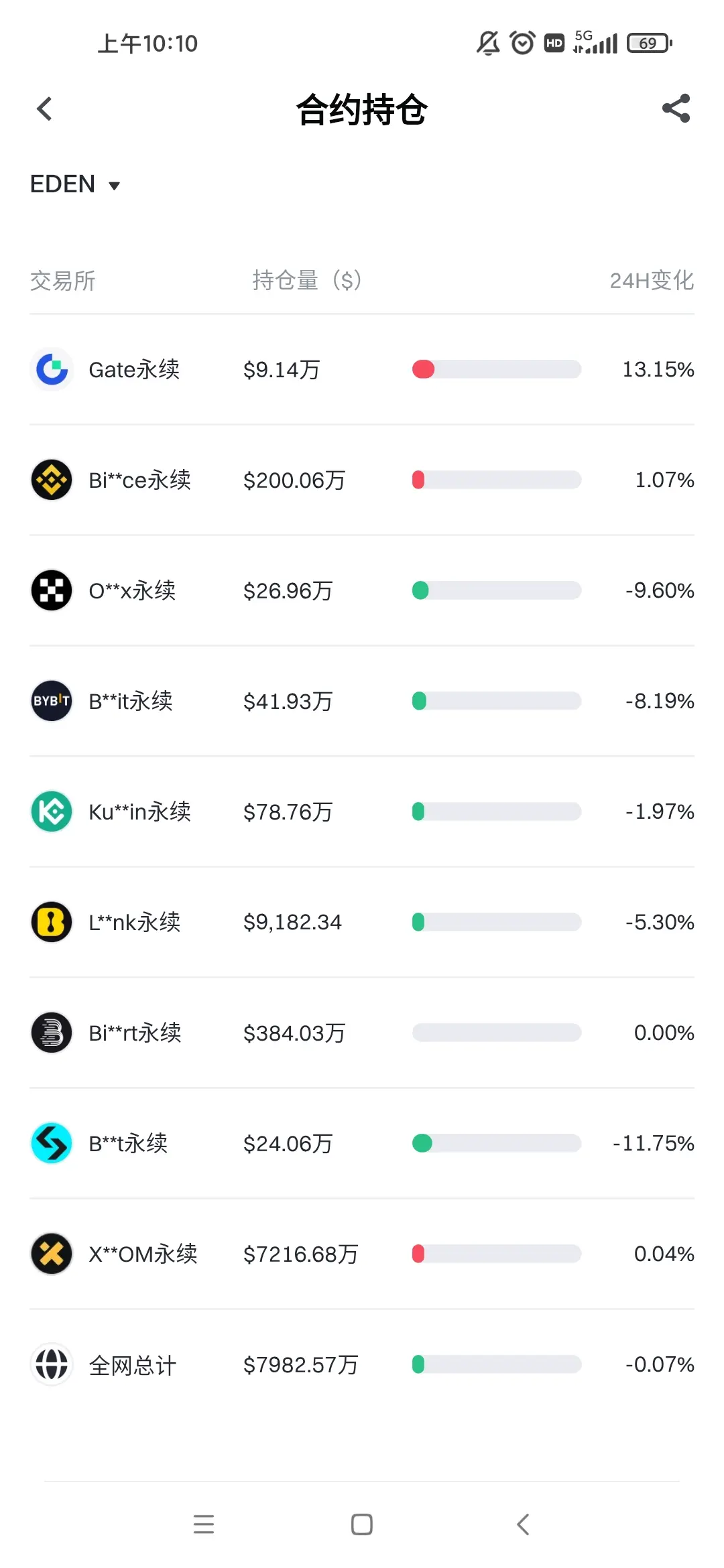

Anyone who has a large position on this X.OM has been constantly dumping, and it has never gone up. For example, EDEN, ZAMA, SENT, and so on. The positions on this exchange are used by the main players to dump, with the position size continuously increasing and no liquidation data. Such large positions, in a small exchange with no depth, no liquidity, and even very low spot trading volume, how could the contract positions be so large?

View Original

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/id/campaigns/3959?ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

Why can I understand transgender people and homosexuals? Civil liberties and freedom are macro values, and the core is that I have crossed my own perceptions several times. I hadn't completed secondary development before puberty, so I was quite handsome. Who knew I would quickly grow into a standard woman later on. Handsomeness was very brief. My initial ideal was to be a 1.8-meter-tall transgender person, but I didn't grow to 1.8 meters. I felt that without being 1.8 meters tall as a man, I was also unqualified, so I gave up and decided to honestly be a beautiful woman.

View Original

- Reward

- like

- Comment

- Repost

- Share

The prototype of the Bitcoin channel has been established, spanning from 60,000 to 71,600.

BTC-1,68%

- Reward

- like

- Comment

- Repost

- Share

$BTC

"What Caused the Great Bitcoin Crash? Evidence Points to Hedge Fund Collapse in Hong Kong"

By: Jeff Roberts, Fortune Magazine

February 6, 2026 Translated with some adaptation

Summary:

- Main causes of the crash:

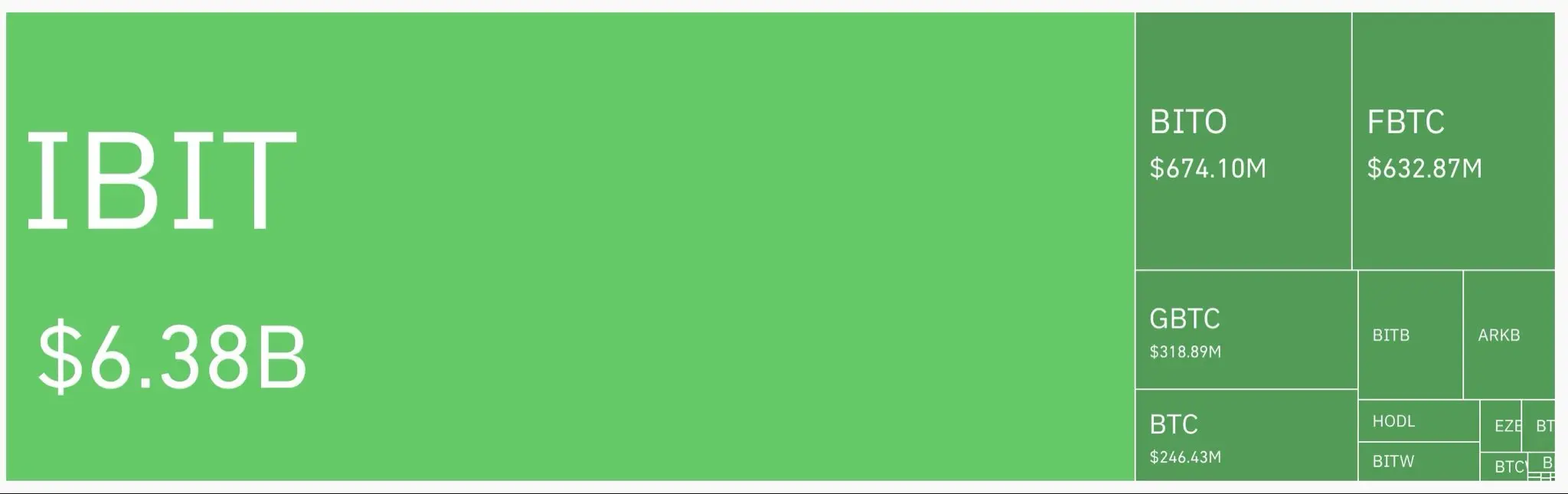

- Hong Kong Hedge Fund Theory: Collapse of hedge funds that used "Yen Carry Trade" (Yen Carry Trade) to finance highly leveraged positions in Bitcoin options for a BlackRock ETF trading Bitcoin spot $ibit (the largest Bitcoin ETF), with additional losses from the silver market.

- Liquidation of positions: The value of positions declined as the market fell, leading to forced sales

View Original"What Caused the Great Bitcoin Crash? Evidence Points to Hedge Fund Collapse in Hong Kong"

By: Jeff Roberts, Fortune Magazine

February 6, 2026 Translated with some adaptation

Summary:

- Main causes of the crash:

- Hong Kong Hedge Fund Theory: Collapse of hedge funds that used "Yen Carry Trade" (Yen Carry Trade) to finance highly leveraged positions in Bitcoin options for a BlackRock ETF trading Bitcoin spot $ibit (the largest Bitcoin ETF), with additional losses from the silver market.

- Liquidation of positions: The value of positions declined as the market fell, leading to forced sales

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback

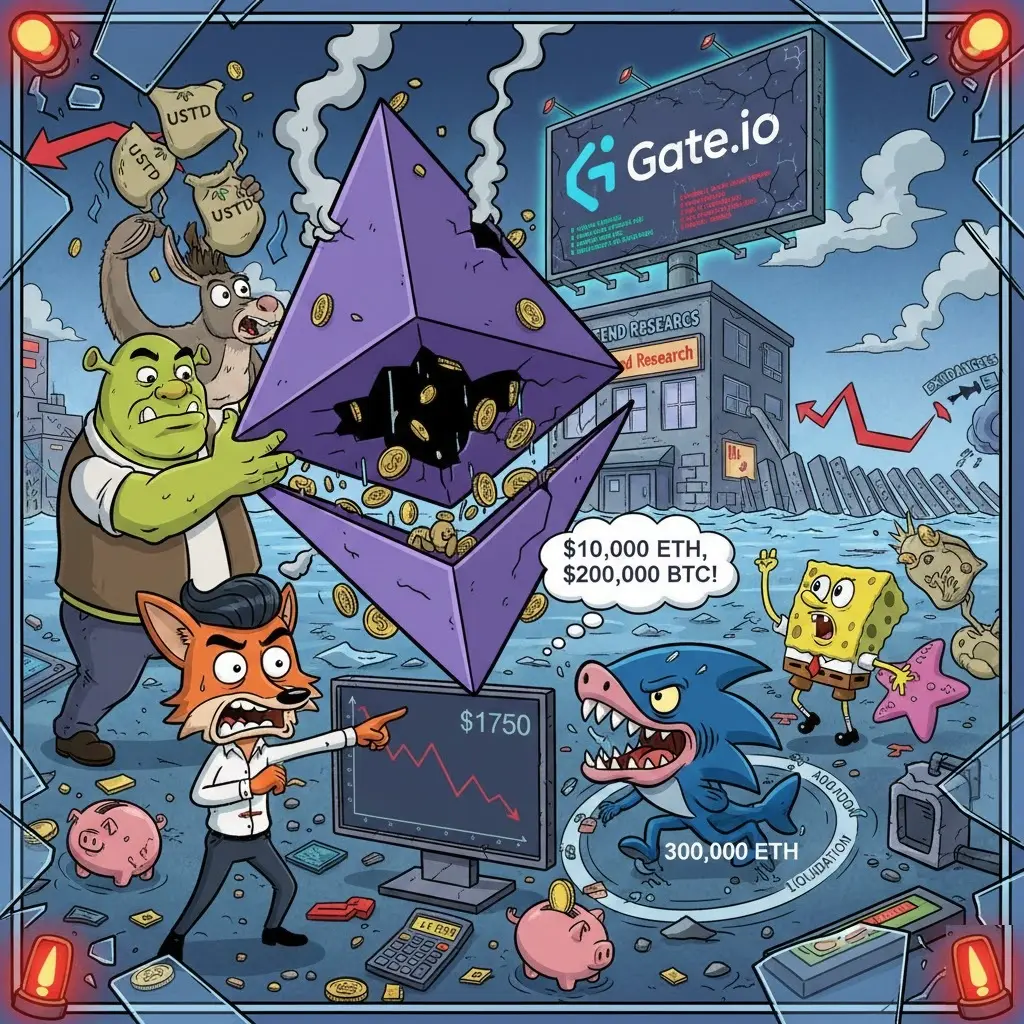

Ethereum's Weekly Catastrophic Scenario: Big Bet Backfires!

The sharp drop in Ethereum's price led to the unwinding of a large-scale leveraged position, creating a gap of hundreds of millions of dollars on a trading firm's balance sheet.

As cryptocurrency markets entered February with high volatility, the pullback in Ethereum (ETH) brought with it a remarkable balance sheet crisis. According to market sources, the trading firm Trend Research was forced to close a large position as the Ethereum price fell below $2,000.

The firm had been pursuing an aggressive long strateg

Ethereum's Weekly Catastrophic Scenario: Big Bet Backfires!

The sharp drop in Ethereum's price led to the unwinding of a large-scale leveraged position, creating a gap of hundreds of millions of dollars on a trading firm's balance sheet.

As cryptocurrency markets entered February with high volatility, the pullback in Ethereum (ETH) brought with it a remarkable balance sheet crisis. According to market sources, the trading firm Trend Research was forced to close a large position as the Ethereum price fell below $2,000.

The firm had been pursuing an aggressive long strateg

ETH1,45%

- Reward

- 5

- 4

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More142.06K Popularity

34.42K Popularity

393.16K Popularity

14.62K Popularity

13.54K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreArthur Hayes: There is no secret conspiracy behind the crypto market crash. The collapse was driven by a combination of factors including regulatory crackdowns, market overleveraging, and macroeconomic pressures. Many believe that the downturn was a natural correction after a period of excessive speculation, rather than the result of any hidden plot. Investors should remain cautious and focus on fundamentals rather than conspiracy theories.

1 m

Arthur Hayes: There is no secret conspiracy causing crashes in the cryptocurrency market

7 m

Trend Research Sells Additional 20,770 ETH Worth $43.57M, Retains Only 10,303 ETH

24 m

Market Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

1 h

Browser cache issues cause abnormal display of Arweave network block data.

1 h

Pin