Post content & earn content mining yield

placeholder

ameely

#goldhitnewhigh ROLLERCOASTER 🔥

Global markets now have one thing clear: volatility is back 🌍📈📉

🥇 Gold and $XAU 🥈 Silver are showing sharp moves $XAG — spike, pullback, then rally. This is not random; it’s a signal of macro pressure.

💣 Drivers behind the moves:

• 🌍 Geopolitical tension + global uncertainty

• 💳 Rising debt & currency pressure

• 🏦 Central banks are aggressively accumulating gold

• 📉 Rate-cut expectations are changing rapidly → algos react instantly

• 💰 Natural profit-taking after big rallies

🏭 The case for silver is different:

Industrial demand is strong and supply

Global markets now have one thing clear: volatility is back 🌍📈📉

🥇 Gold and $XAU 🥈 Silver are showing sharp moves $XAG — spike, pullback, then rally. This is not random; it’s a signal of macro pressure.

💣 Drivers behind the moves:

• 🌍 Geopolitical tension + global uncertainty

• 💳 Rising debt & currency pressure

• 🏦 Central banks are aggressively accumulating gold

• 📉 Rate-cut expectations are changing rapidly → algos react instantly

• 💰 Natural profit-taking after big rallies

🏭 The case for silver is different:

Industrial demand is strong and supply

View Original

- Reward

- 1

- Comment

- Repost

- Share

On February 3rd, according to Ember monitoring, whale Laurent Zeimes started going long a week ago at the HYPE price low of $22. As HYPE rose to $38, the current unrealized profit is $20.21 million.

Laurent Zeimes currently holds a long position of 1.478 million HYPE tokens, valued at $56.24 million, with an average entry price of $24.36.#BTC何时反弹?

View OriginalLaurent Zeimes currently holds a long position of 1.478 million HYPE tokens, valued at $56.24 million, with an average entry price of $24.36.#BTC何时反弹?

- Reward

- like

- Comment

- Repost

- Share

In this round of crash and plunge, Ethereum is quite weak and can be said to be leading the decline. Bitcoin's performance is still within reason. Currently, the market is showing a mild rebound, mainly due to the gradual digestion of panic sentiment and the influx of buying interest, but the consolidation strength is not strong.

Today, focus on the 78,000/23,000 resistance battle. Once it stabilizes below, a short-term bottom will form, and the next step will be to continue testing 80,000-81,000 and the 2,500 resistance level. $BTC

Today, focus on the 78,000/23,000 resistance battle. Once it stabilizes below, a short-term bottom will form, and the next step will be to continue testing 80,000-81,000 and the 2,500 resistance level. $BTC

BTC3,76%

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$10.44K

Create My Token

$NEAR swept liquidity at $1.136 and quickly reclaimed ground, now trading near $1.19 on the 1H chart. The bounce shows buyers defending the lower range after the flush. Immediate resistance sits at $1.22–$1.24, while $1.17–$1.18 is the key intraday support. Holding this base keeps a push toward the highs in play. Momentum is rebuilding right after the trap early signs of a reversal forming.

NEAR3,34%

- Reward

- like

- Comment

- Repost

- Share

Even though I spent a lot of my own money here, I haven't gained anything from this platform. 🤔🤔🤔

- Reward

- like

- Comment

- Repost

- Share

Who would have thought that I would update two videos at once? I never expected to do so, but here I am, sharing two new videos with everyone today. Stay tuned for more updates and thank you for your support!

View Original- Reward

- like

- Comment

- Repost

- Share

# InstitutionalHoldingsDebate

A Tale of Two Strategies: The Institutional

Divide on Bitcoin 📉📈

The current market climate has revealed a fascinating

divergence in institutional behavior regarding BTC. On one side, we see major

players continuing to accumulate, viewing volatility as a long-term buying

opportunity. On the other, recent market declines are undeniably putting

pressure on portfolios, forcing difficult conversations about risk management.

This split brings us to a critical juncture. Are these

institutions holding firm to their original long-term strategies, weathering

the storm

A Tale of Two Strategies: The Institutional

Divide on Bitcoin 📉📈

The current market climate has revealed a fascinating

divergence in institutional behavior regarding BTC. On one side, we see major

players continuing to accumulate, viewing volatility as a long-term buying

opportunity. On the other, recent market declines are undeniably putting

pressure on portfolios, forcing difficult conversations about risk management.

This split brings us to a critical juncture. Are these

institutions holding firm to their original long-term strategies, weathering

the storm

BTC3,76%

- Reward

- like

- Comment

- Repost

- Share

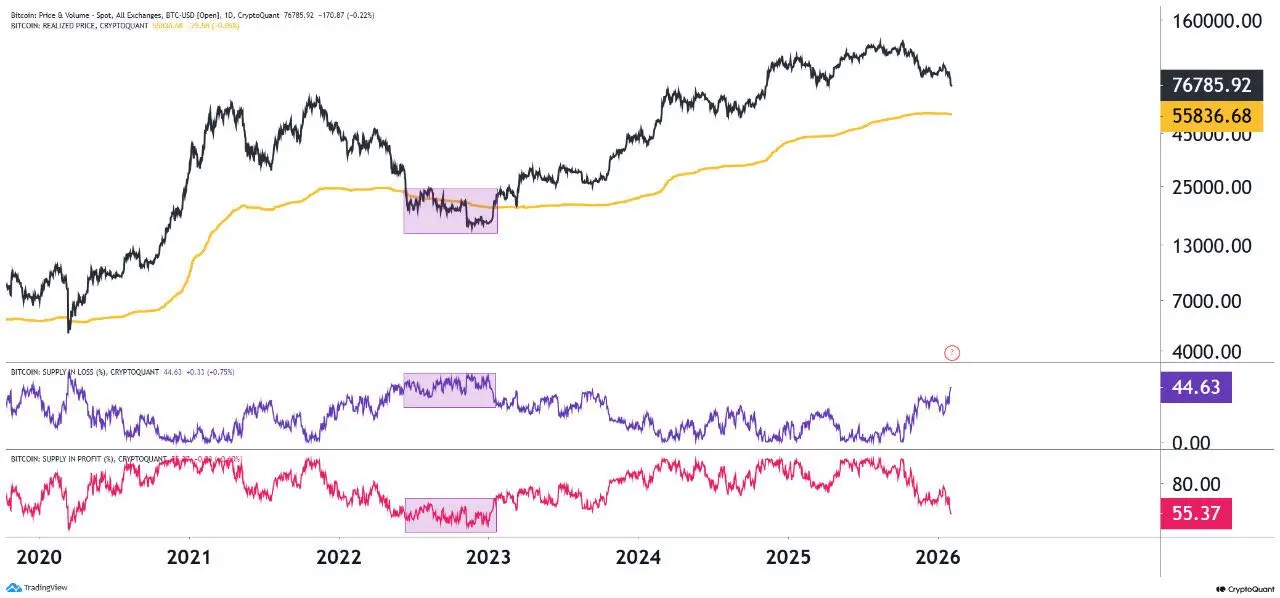

During the weekend, it was believed that if no systemic risks emerged, the downside of US stocks and cryptocurrencies should be limited. Although Asian investors panicked on Monday morning and futures declined significantly when CME opened, the market started to recover around 15:00 Beijing time when Europe’s trading session began. After the open, US stocks and $BTC$ rebounded quite well, but gold and silver still remained in a downward trend.

Looking at Bitcoin’s data, the turnover rate isn’t very high, which was expected. The current price is almost below $MSTR$’s cost basis and also below t

Looking at Bitcoin’s data, the turnover rate isn’t very high, which was expected. The current price is almost below $MSTR$’s cost basis and also below t

BTC3,76%

- Reward

- like

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

Major BTC-holding companies, including Strategy, are now showing unrealized losses due to the recent market pullback. The drop below $78K in BTC price has affected their mark-to-market positions, which impacts both balance sheets and broader market sentiment. While unrealized losses do not immediately affect cash flow or operations, they highlight the tension between long-term accumulation strategies and short-term volatility.

Companies like Strategy, MicroStrategy, and other institutional holders have accumulated large BTC positions over time, often using a d

Major BTC-holding companies, including Strategy, are now showing unrealized losses due to the recent market pullback. The drop below $78K in BTC price has affected their mark-to-market positions, which impacts both balance sheets and broader market sentiment. While unrealized losses do not immediately affect cash flow or operations, they highlight the tension between long-term accumulation strategies and short-term volatility.

Companies like Strategy, MicroStrategy, and other institutional holders have accumulated large BTC positions over time, often using a d

BTC3,76%

- Reward

- 4

- 5

- Repost

- Share

repanzal :

:

Ape In 🚀View More

BTC Panic Zone Negative Funding & ETF Cost Basis Bottom or More Pain

- Reward

- 1

- Comment

- Repost

- Share

Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref=VLBNVAHDVQ&ref_type=132

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎This male-to-female cross-dressing blogger, upon seeing this, had only one thought: Xi'an can't have multiple gays, Xi'an can't have multiple gays; but on the other hand, it's just the fox's tail showing first, it's not that I can't accept it...

View Original

- Reward

- like

- Comment

- Repost

- Share

🌶️

卫龙辣条

Created By@IOnlyWant5%

Subscription Progress

0.00%

MC:

$0

Create My Token

https://gate.com/live/video?stream_id=49626f2df9eb46449d3b9ece0aec2482&session_id=49626f2df9eb46449d3b9ece0aec2482-1770096674&ref=VGQRAVLDVQ&ref_type=104

Hurry up join live stream friends 🤝 💯 🔥 ♥️

Hurry up join live stream friends 🤝 💯 🔥 ♥️

- Reward

- 1

- Comment

- Repost

- Share

White House Crypto Summit — Regulatory Clarity Could Shift Market Dynamics

The White House Crypto Summit recently addressed U.S. regulatory fragmentation in the trillion-dollar crypto ecosystem. The goal: clarify asset classifications, standardize compliance, and strike a balance between innovation and consumer protection.

Dragon Fly Official sees this as a potential catalyst for institutional adoption. Clearer regulations can reduce uncertainty, encourage large-scale investment, and help mature the market. However, overregulation could stifle growth or create temporary sell-offs.

Key analytic

The White House Crypto Summit recently addressed U.S. regulatory fragmentation in the trillion-dollar crypto ecosystem. The goal: clarify asset classifications, standardize compliance, and strike a balance between innovation and consumer protection.

Dragon Fly Official sees this as a potential catalyst for institutional adoption. Clearer regulations can reduce uncertainty, encourage large-scale investment, and help mature the market. However, overregulation could stifle growth or create temporary sell-offs.

Key analytic

- Reward

- like

- Comment

- Repost

- Share

【$NOT Signal】Long | Volume and Price Rise Together Breakout Pattern

$NOT Price and open interest are rising simultaneously, showing a healthy breakout pattern driven by institutional entry, rather than a bearish trap.

🎯 Direction: Long

🎯 Entry: 0.000445 - 0.000455

🛑 Stop Loss: 0.000425 ( Rigid Stop Loss )

🚀 Target 1: 0.000500

🚀 Target 2: 0.000530

$NOT Breaking through recent highs with volume and price coordination confirms genuine inflow of bullish funds. The market shows active buying absorption, with limited pullback, indicating a bullish market sentiment. Price is consolidating abo

View Original$NOT Price and open interest are rising simultaneously, showing a healthy breakout pattern driven by institutional entry, rather than a bearish trap.

🎯 Direction: Long

🎯 Entry: 0.000445 - 0.000455

🛑 Stop Loss: 0.000425 ( Rigid Stop Loss )

🚀 Target 1: 0.000500

🚀 Target 2: 0.000530

$NOT Breaking through recent highs with volume and price coordination confirms genuine inflow of bullish funds. The market shows active buying absorption, with limited pullback, indicating a bullish market sentiment. Price is consolidating abo

- Reward

- like

- Comment

- Repost

- Share

Bitcoin slips below $80,000 again. Where does market confidence go from here?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

GateUser-9dc9a2d2 :

:

Happy New Year! 🤑Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More5.59K Popularity

4.51K Popularity

5.93K Popularity

187 Popularity

1.03K Popularity

Hot Gate Fun

View More- MC:$2.84KHolders:10.00%

- MC:$2.83KHolders:10.00%

- MC:$2.87KHolders:20.00%

- MC:$0.1Holders:10.00%

- MC:$2.86KHolders:10.00%

News

View MoreAsia-Pacific stock markets closed significantly higher, with South Korea's KOSPI index rising 6.84% to a new high

2 m

ASTER (Aster) 24-hour increase of 10.14%

16 m

Aster launches "Hot Picks of the Week" metal trading event, with a prize pool of up to $1,000,000

19 m

Will Bitcoin retest $56,000? Galaxy warns: Key support levels are under pressure, market bottom is approaching

19 m

JPMorgan Still Bullish on Gold, Raises 2026 Year-End Target Price to $6,300

22 m

Pin