Gate Research: Tokenized Stocks: Battle of the Paths

Summary

- The total market capitalization of tokenized stocks has surpassed $500 million, achieving over 50× growth year-to-date; however, penetration remains extremely low at ~0.0004% of global equities and ~0.003% of the global ETF market, implying enormous headroom for future expansion.

- Core value proposition lies in five key dimensions that fundamentally reshape traditional stock trading: 7×24 uninterrupted trading, global accessibility, DeFi composability, T+0 settlement, and regulatory arbitrage.

- Solutions exhibit clear differentiation: xStocks focuses on secondary-market trading of stock tokens, Ondo emphasizes primary issuance of stock tokens, StableStock prioritizes 1:1 backing and physical-share redemption, while Robinhood centers on CFD-based exposure; the ecosystem is further complemented by multi-chain players such as Dinari and licensed issuers like Superstate.

- Growth is currently constrained by three major bottlenecks: insufficient liquidity causing excessive bid-ask spreads, misalignment between product design and actual user demand, and feature compromises made in pursuit of regulatory compliance.

- Outlook: further asset diversification (ETFs, pre-IPO shares, and perpetual contracts), regional market development alongside evolving regulation, and deeper participation by traditional financial giants and institutions.

I. Introduction

1.1 Overview of Asset Tokenization

Asset tokenization refers to the process of representing real-world assets (RWA) as on-chain tokens, leveraging blockchain’s core properties: immutability, programmable smart contracts, and distributed ledger transparency. The historical evolution of tokenization has followed a clear progression from low-risk, fixed-income assets toward high-liquidity, complex equity assets.

- The Origin

Strictly speaking, BTC and ETH represent the earliest forms of “tokenized assets,” as they tokenized computational power and decentralized consensus value. The subsequent emergence of stablecoins USDT and USDC marked a pivotal milestone, achieving on-chain representation of fiat currency value and establishing both a unit of account and a medium of exchange for all later RWA tokenization efforts.

- From Bonds to Broader RWA

Early tokenization experiments were dominated by traditional banks conducting on-chain bond issuance pilots. For instance, in 2019 Santander issued a $20 million 1-year bond directly on Ethereum, while Société Générale followed with a €100 million bond on the same network. These pilots primarily aimed to enhance transparency and settlement efficiency for bonds but did not meaningfully address secondary-market liquidity.

Parallel to these institutional trials, the 2020 DeFi Summer sparked the rise of native crypto RWA protocols. Projects such as Centrifuge, Maple, Goldfinch, and Centrifuge pioneered the tokenization of non-standardized assets—including real estate, private credit, and corporate loans—thereby providing initial validation for on-chain credit markets.

- Tokenized Treasury Bills

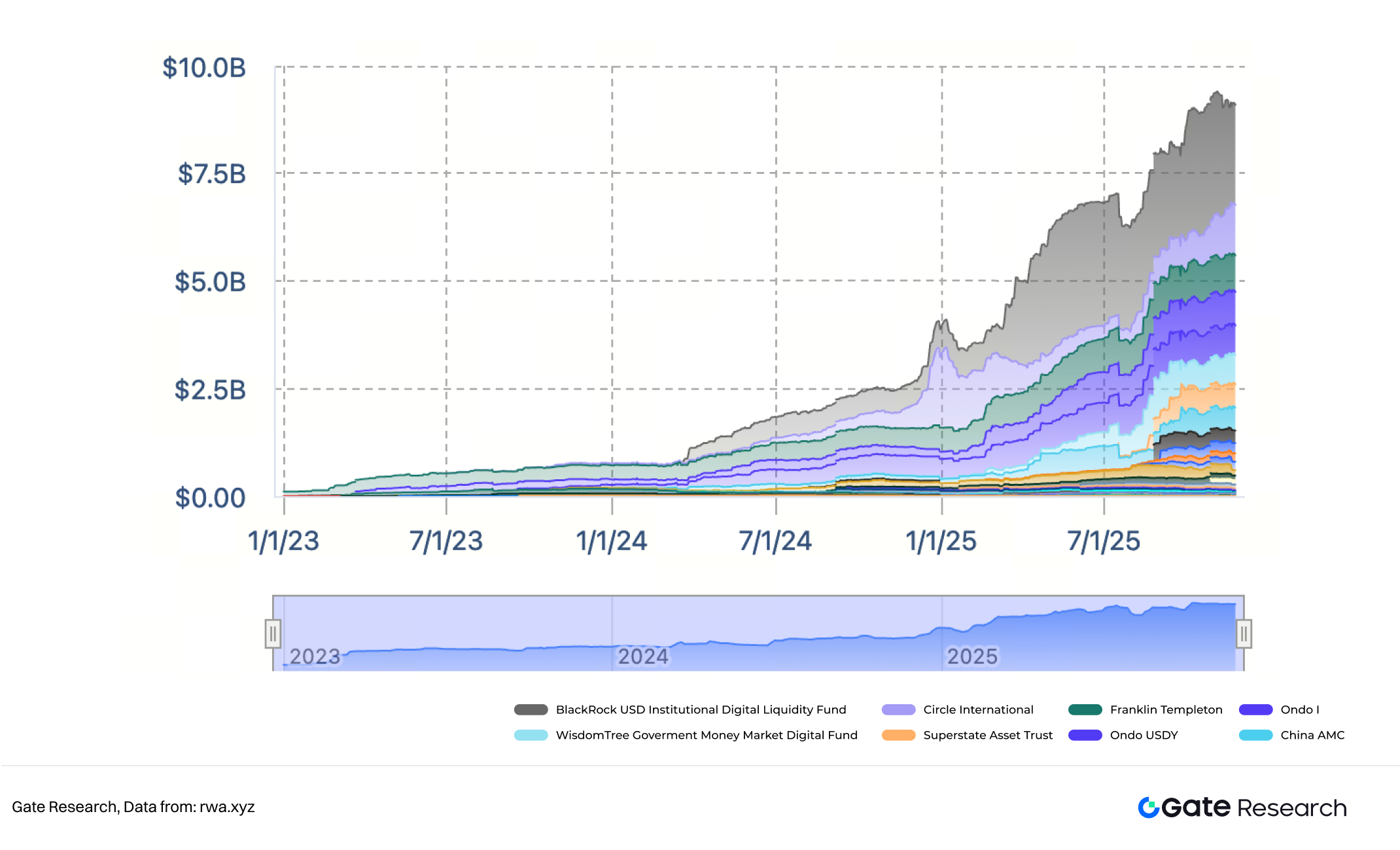

I: Scale of Tokenized Treasury Bills

Amid rising global interest rates from 2023 to 2025 and a concurrent decline in DeFi yields, tokenized U.S. Treasury bills (T-Bills) emerged as the premier on-chain safe-haven for capital. Projects such as BlackRock, Circle, Franklin Templeton, and Ondo Finance mapped short-term Treasury yields onto blockchain tokens via special purpose vehicles (SPVs) or fund structures, exemplified by BlackRock’s BUIDL and Ondo’s OUSG.

This phase was characterized by low asset risk profiles; clear regulatory compliance frameworks; dominance by established TradFi institutions and stablecoin issuers; and deep integration with DeFi primitives. On-chain capital flowed en masse toward real-world assets for the first time, propelling the total TVL of tokenized Treasuries to approach $10 billion and fostering maturation in tokenization infrastructure and trust mechanisms.

- Tokenized Stocks

Tokenized equities represent a formidable frontier in asset tokenization, owing to their multifaceted complexities beyond mere economic rights—such as dividends and price appreciation—which encompass voting rights, shareholder registration, dividend taxation, securities custody, and cross-border regulatory hurdles. Nevertheless, with the T-Bill tokenization model now battle-tested, market attention has predictably shifted toward the world’s largest and most universally recognized asset class: stocks.

1.2CurrentStatusoftheTokenizedStocksTrack

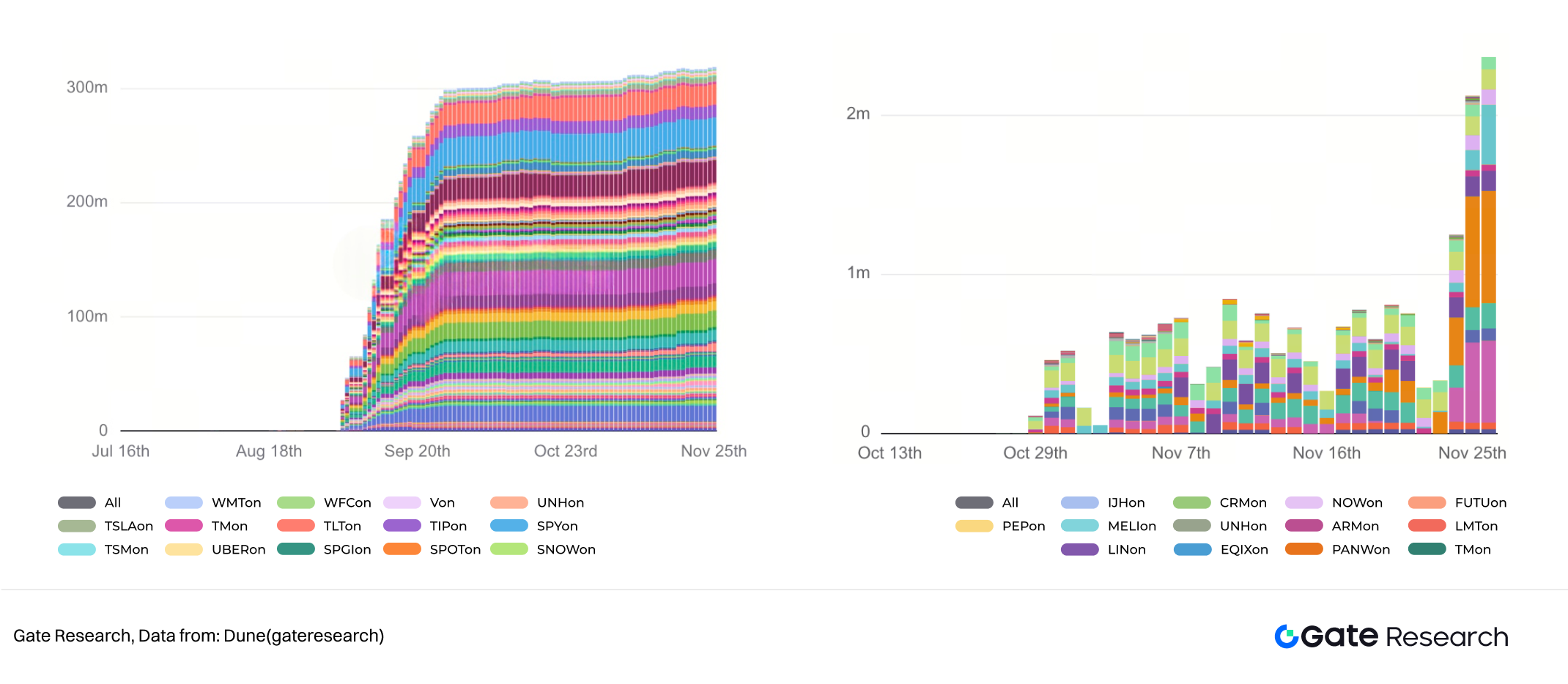

II. Tokenized Stocks Market Scale

According to data from rwa.xyz, as of November 25, 2025, the total market capitalization of tokenized stocks (including ETFs) has surpassed $500 million. Although this remains minuscule relative to traditional financial markets, its growth rate has been astonishing—with market cap surging over 50× from less than $10 million in early 2025 to several hundred million dollars, and daily transfer volumes skyrocketing from under $1 million to $40–60 million. This momentum is primarily propelled by the launches of Kraken’s xStocks (in June) and Ondo Global Markets (in September).

Public data indicates that the total market capitalization of global stock exchanges (including major venues such as the NYSE, Nasdaq, and Tokyo Stock Exchange) reached a record high of $147.6 trillion in October 2025, while the global ETF assets under management stood at $19.25 trillion during the same period. Tokenized stocks, by contrast, account for merely ~0.0004% of the global stock market and ~0.003% of the ETF market—negligible in scale. Yet this disparity also signals immense growth potential: achieving just 1% penetration could expand the tokenized stocks sector to hundreds of billions or even trillions of dollars, representing thousands-fold upside from current levels.

In summary, the tokenized stocks track has successfully achieved a breakthrough from 0 to 1 in 2025 and now stands on the cusp of explosive scaling from 1 to N.

1.3 Value Proposition of Tokenized Stocks

Tokenized stocks are far more than merely “putting equities on-chain.” They represent a fundamental reconstruction of traditional securities infrastructure, trading hours, and ownership definition. By converting the traditionally closed attributes of equities—trading time, geography, custody, settlement, and regulation—into open, programmable on-chain logic, tokenized stocks unlock unprecedented composability and global efficiency. Compared with traditional stocks, tokenized versions deliver a quantum leap across five core dimensions:

- 7×24 All-Weather Trading

Traditional equity markets are constrained by exchange hours (e.g., U.S. markets operate Monday–Friday, 09:30–16:00 EST). Tokenized stocks, running on blockchain protocols, enable true 24/7/365 trading. Investors can react instantly to breaking news outside regular hours, and as tokenized volume scales, off-hours price discovery has the potential to spill back into legacy markets and eventually serve as a new global pricing anchor.

- Global Accessibility: Breaking Geographic and Entry Barriers

Conventional securities trading relies on localized custody and brokerage systems that impose onerous account-opening and compliance requirements. Tokenized stocks, accessible via self-custodial wallets and stablecoins, eliminate national borders—any user worldwide with a wallet can gain exposure to U.S., European, or Asian equities and ETFs, dramatically lowering the threshold especially for investors in emerging and developing markets.

- DeFi Composability and Interoperability

Issued as standard tokens (typically ERC-20 or equivalent), tokenized stocks become native building blocks in DeFi. They can be directly used as collateral for lending/borrowing, incorporated into on-chain indices, or serve as underlying assets for leveraged derivatives and structured products—paving the way for an emerging “StockFi” ecosystem.

- T+0 Instant Settlement

Legacy equities settle on a T+1 basis, introducing counterparty risk and capital inefficiency. Tokenized stocks settle atomically via smart contracts in T+0—funds and assets are exchanged simultaneously, eliminating manual reconciliation and intermediary bridging.

- Regulatory Arbitrage Through Economic-Exposure Design

Most mainstream tokenized stock implementations adopt an “economic rights separation” model: the on-chain token grants only economic exposure to price movements and dividends, while legal title to the underlying shares remains with a regulated SPV or custodian (e.g., Backed Finance xStocks uses a Swiss-law SPV with bank custody, Ondo Global Markets relies on a U.S.-registered broker-dealer combined with a Liechtenstein trust, and Robinhood in the EU employs a CFD-based synthetic model). This structure sidesteps many securities-law hurdles in most jurisdictions while still delivering near-identical economic outcomes for end users.

Taken together, these five dimensions transform equities from rigid, siloed instruments into fully programmable, globally liquid, instantly settleable financial primitives—laying the foundation for the convergence of traditional capital markets and decentralized finance.

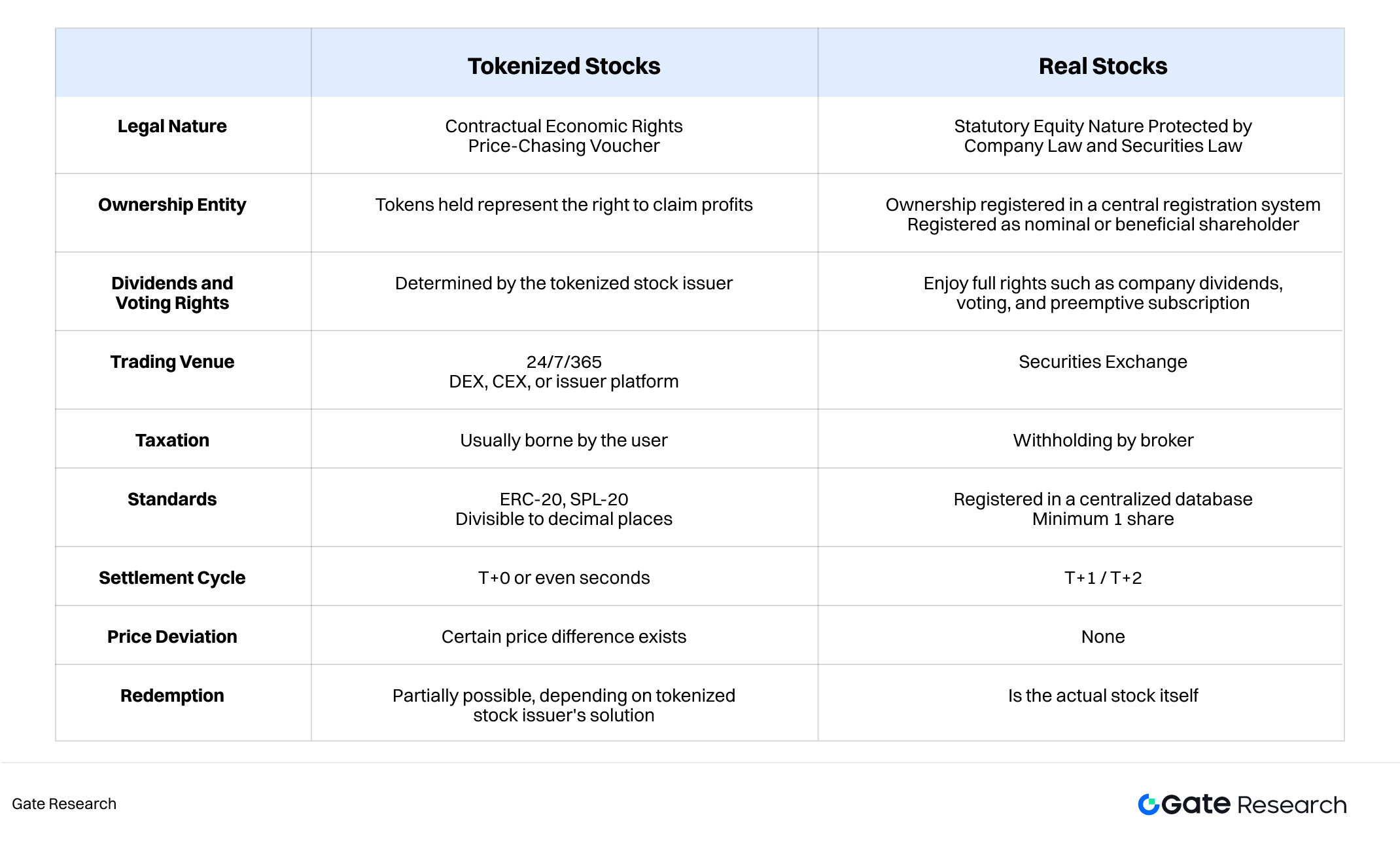

1.4 Structural Differences Between Tokenized Stocks and Real Stocks

III. Illustrated Comparison: Tokenized Stocks vs. Real Stocks

II. Overview of Mainstream Solutions

The tokenized stocks market currently features a variety of platforms that, despite sharing the common objective of bringing traditional equities on-chain and dramatically improving global accessibility, adopt markedly different technical architectures, legal frameworks, and business priorities. This has resulted in a clearly segmented and multi-track ecosystem.

Overall, four distinct models have emerged as the most representative: the liquidity- and secondary-market-focused xStocks (Kraken/Backed Finance), the primary-issuance-centric Ondo Global Markets that emphasizes compliant minting and multi-chain distribution of 1:1 backed tokens, the brokerage-style StableStock that combines on-chain trading with genuine real-share redemption capabilities, and Robinhood’s synthetic price-tracking approach built primarily around CFD mechanics and retail-friendly fiat–crypto gateways.

2.1 xStocks: Secondary-Market-Oriented

xStocks is currently the most representative secondary-market-oriented tokenized stock platform on the market. Its core goal is to replicate the price behavior of traditional stocks on the Solana blockchain through tokenization, enabling users to trade stock tokens on DEXs and select CEXs, thereby achieving cross-time-zone price discovery and on-chain exposure. xStocks adopts a two-tier market structure:

- Primary issuance market for stock tokens

Accessible only to compliant professional/institutional investors. These participants hold the underlying real stocks off-chain and are responsible for the minting and redemption of tokens, while also performing the function of anchoring the price spread. Retail investors have no direct access to the actual shares.

- Secondary trading market

Open to all users, allowing direct trading of stock tokens on DEXs or select CEXs. The token price is anchored to the real underlying stock price through arbitrage mechanisms executed by institutions that have the right to directly mint and redeem tokens.

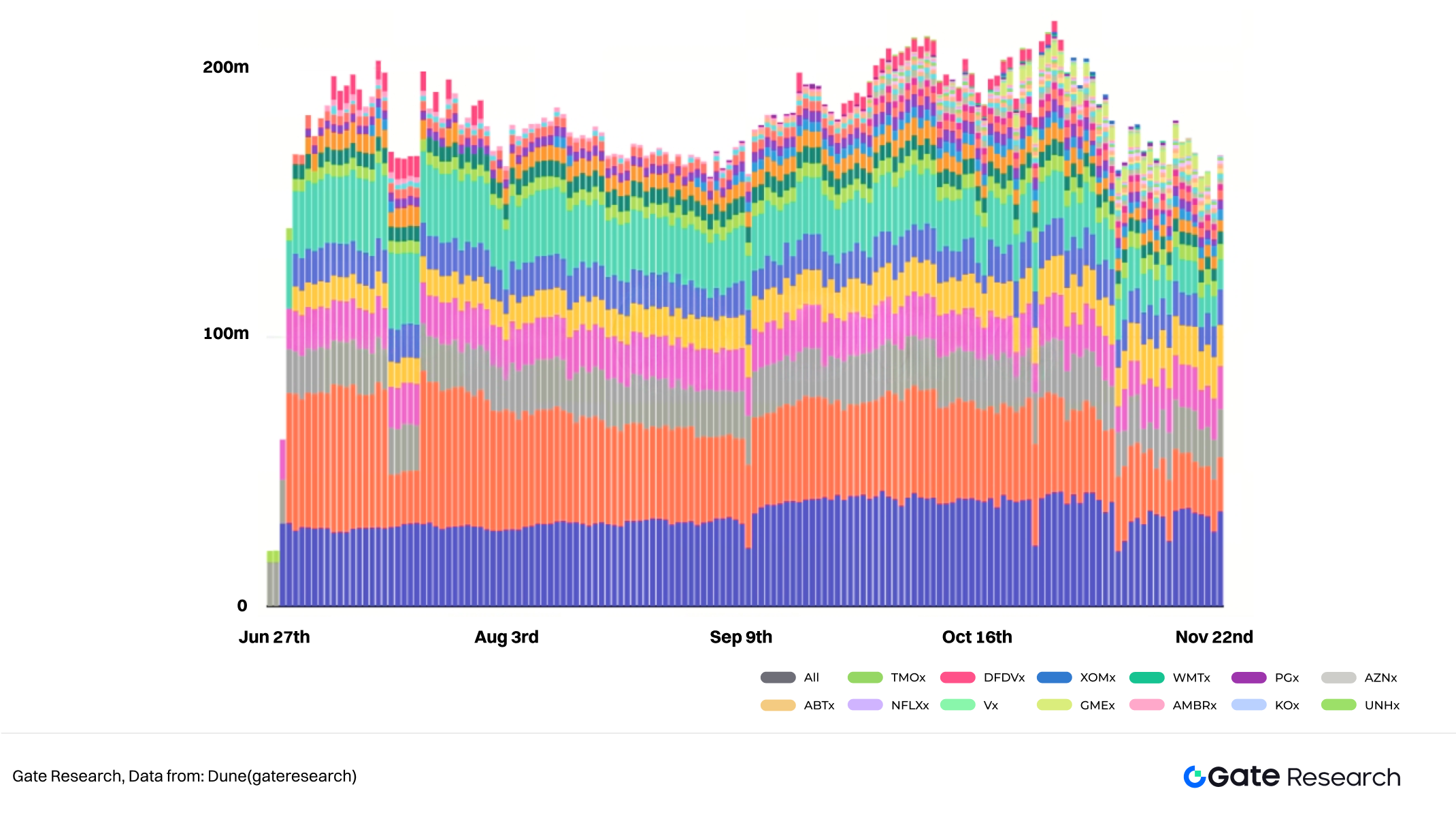

IV. xStocks On-Chain Tokenized Stock Scale

This design draws on the primary issuance + secondary circulation logic of traditional ETFs, but in an on-chain environment it faces significantly higher friction costs. The number of professional/institutional investors acting as primary issuers is very limited, and they lack sufficient incentive to issue. They have little motivation to continuously mint new token supply or provide ongoing market-making. As a result, the on-chain supply of stock tokens has largely stagnated. This creates a situation where, although retail users can trade freely, the severe shortage of available tokens for purchase leads to extremely shallow market depth and poor trading stability. Prices frequently deviate from the underlying stock in the short term — especially on large buy orders — and in extreme cases, the token price can become substantially disconnected from the real share price for extended periods. Due to insufficient liquidity and price stability, xStocks tokenized stocks are currently difficult to adopt at scale by mainstream DeFi protocols for lending, derivatives, or other use cases.

2.2 Ondo Global Markets: Primary-Issuance-Driven

Ondo Global Markets is the tokenized stock and ETF issuance platform launched by Ondo Finance on Ethereum (later expanded to BNB Chain) as an extension of its broader RWA strategy. In stark contrast to the secondary-market-driven liquidity model of xStocks, Ondo adopts a primary-issuance-driven + fully transparent custody approach. When a user purchases a stock token, this directly triggers the purchase and custody of the underlying real shares off-chain, with a corresponding mint (or burn) of the token on-chain, forming a closed-loop 1:1 asset mapping. This model directly inherits the compliance and custody expertise Ondo accumulated in the tokenized U.S. Treasury Bills (OUSG, USDY) space and replicates the same architecture for equities. Ondo Global Markets can therefore be regarded as the most complete, fully compliant, and genuinely asset-backed tokenized stock platform currently available.

The core innovation of Ondo Global Markets lies in its “buy-to-mint, sell-to-burn” direct primary issuance mechanism:

- Primary issuance: mint on buy, burn on sell

After passing KYC on the Ondo platform, compliant users and institutions can purchase stocks directly. In practice, however, only a limited number of qualified (mostly institutional) participants purchase directly through the official Ondo Global Markets interface. When a user buys with USDC, Ondo purchases the corresponding real shares in traditional markets and simultaneously mints an equal amount of stock tokens on-chain. During this process, the user’s USDC is first swapped into Ondo’s own stablecoin USDY to execute the operation. When the user sells the stock tokens, Ondo simultaneously sells the underlying shares off-chain, burns the tokens, and settles the proceeds back to USDY before swapping to USDC and returning it to the user.

As a result, the liquidity of Ondo’s tokenized stocks does not rely on crypto-native secondary markets; instead, liquidity is provided entirely by Ondo acting as the buyer/seller of last resort in traditional markets on behalf of users.

- Pricing mechanism and custody structure

Token pricing is determined by Ondo’s internal quotation engine, based on the real-time underlying stock price plus a small premium/spread that constitutes Ondo’s revenue. This quote-driven matching model is essentially identical to the creation/redemption mechanism used by brokerages for net-asset-value (NAV) subscriptions and redemptions of mutual funds/ETFs. The actual shares are held by regulated third-party custodians; Ondo itself never takes direct possession of the underlying stocks.

- Aggregator distribution and proxy buy/sell logic

Because the primary issuance model does not require U-based liquidity pools on DEXs, Ondo stock tokens can be distributed through aggregators such as CowSwap, 1inch, or third-party wallet-integrated APIs. Although Ondo Global Markets itself is a heavily KYC/AML-compliant platform, using aggregators and wallets as distribution channels allows retail users to effectively bypass KYC while still accessing Ondo’s services for stock purchases and sales. In reality, every purchase executed via an aggregator is still routed through Ondo’s backend, triggering the same proxy-buy-and-mint (or proxy-sell-and-burn) process on the primary market.

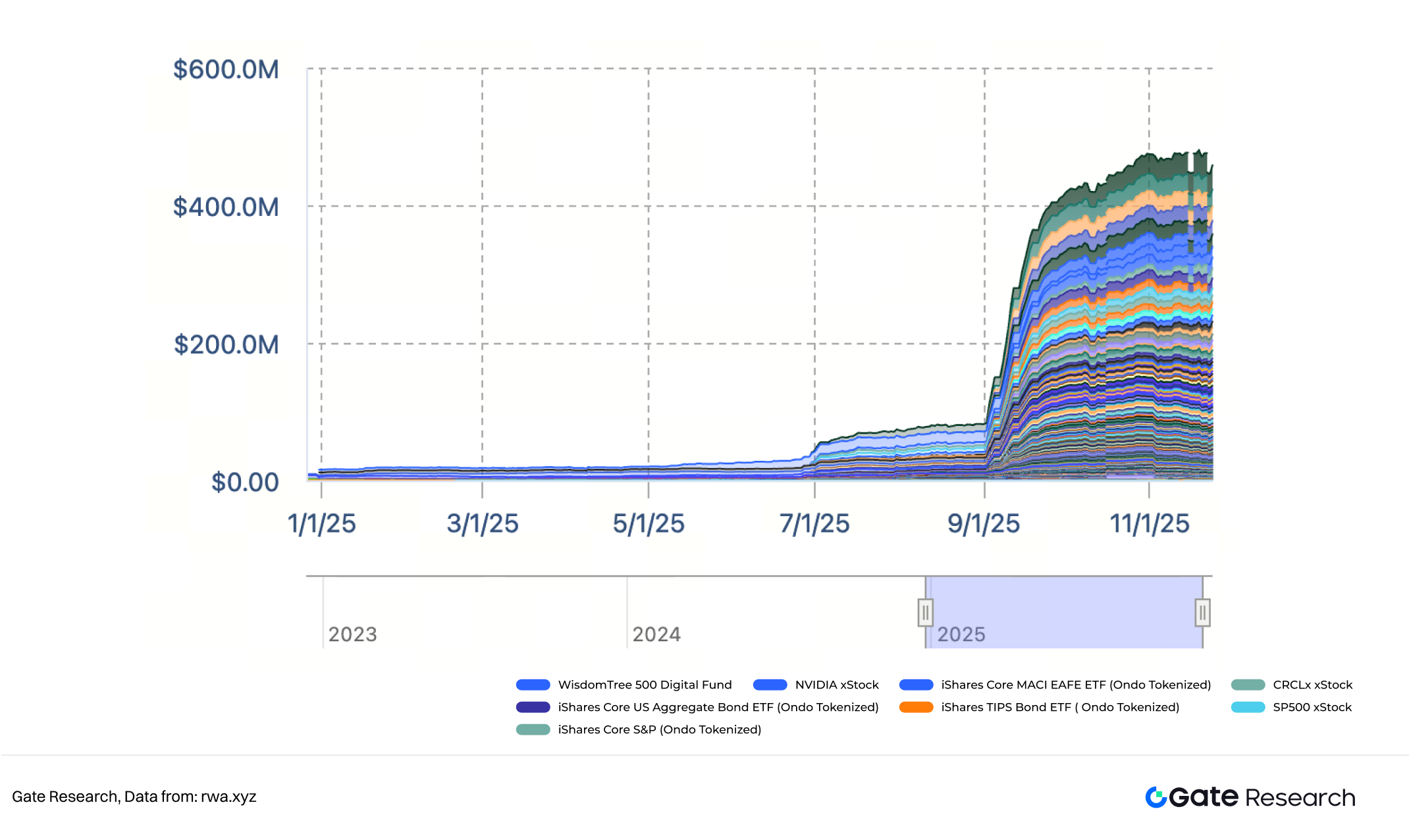

V. & VI. Ondo Global Markets Tokenized Stock On-Chain Scale on Ethereum (Left) and BNB Chain (Right)

Ondo’s tokenized stock AUM experienced a rapid surge in early to mid-September, quickly approaching and briefly surpassing that of xStocks in a matter of weeks. However, growth subsequently stalled amid broader market headwinds. Following a slowdown in expansion on the Ethereum network, Ondo extended its tokenized stock offerings to BNB Chain at the end of October. As of November 25, Ondo Global Markets’ stock token AUM stood at $320 million on Ethereum and $2.36 million on BNB Chain.

2.3 StableStock: On-Chain Broker

StableStock positions itself as a crypto-native brokerage, building a full-fledged on-chain stock trading platform on BNB Chain that bridges the gap between traditional brokerages and DeFi protocols.

- Real share custody and 1:1 mapping

When users buy stocks on StableStock using USDT, the platform, through its partnered traditional broker (HabitTrade), purchases the corresponding real shares in the underlying market. These shares are then held by regulated custodians SafeHeron and Coinbase Institutional. This custody ensures that every on-chain representation is fully backed by actual stocks. Upon purchase, users first receive a stock certificate on-chain, essentially an on-chain account-level mapping of their off-chain holdings.

- Users control tokenization, burning, and real-share redemption

After purchasing, users can freely choose whether to tokenize their stock certificates. The platform supports 1:1 minting of fully fungible sTokens, which can be traded directly on StableStock Swap. For compliant users, StableStock also offers a real-share redemption mechanism, allowing them to apply for direct transfer of the custodied shares into their personal traditional brokerage accounts, achieving true cross-boundary asset flow from on-chain back to TradFi.

- Open ecosystem and composability

In the near future, users will be able to deposit sTokens into StableVault to convert them into yield-bearing stTokens. These stTokens will represent “activated,” income-generating stock assets that can be freely used across DeFi: Provide liquidity in DEX pools; Collateralize in lending protocols; Use in perpetuals, structured products, or yield aggregators; Serve as underlying assets for on-chain stock indices or ETF-like products

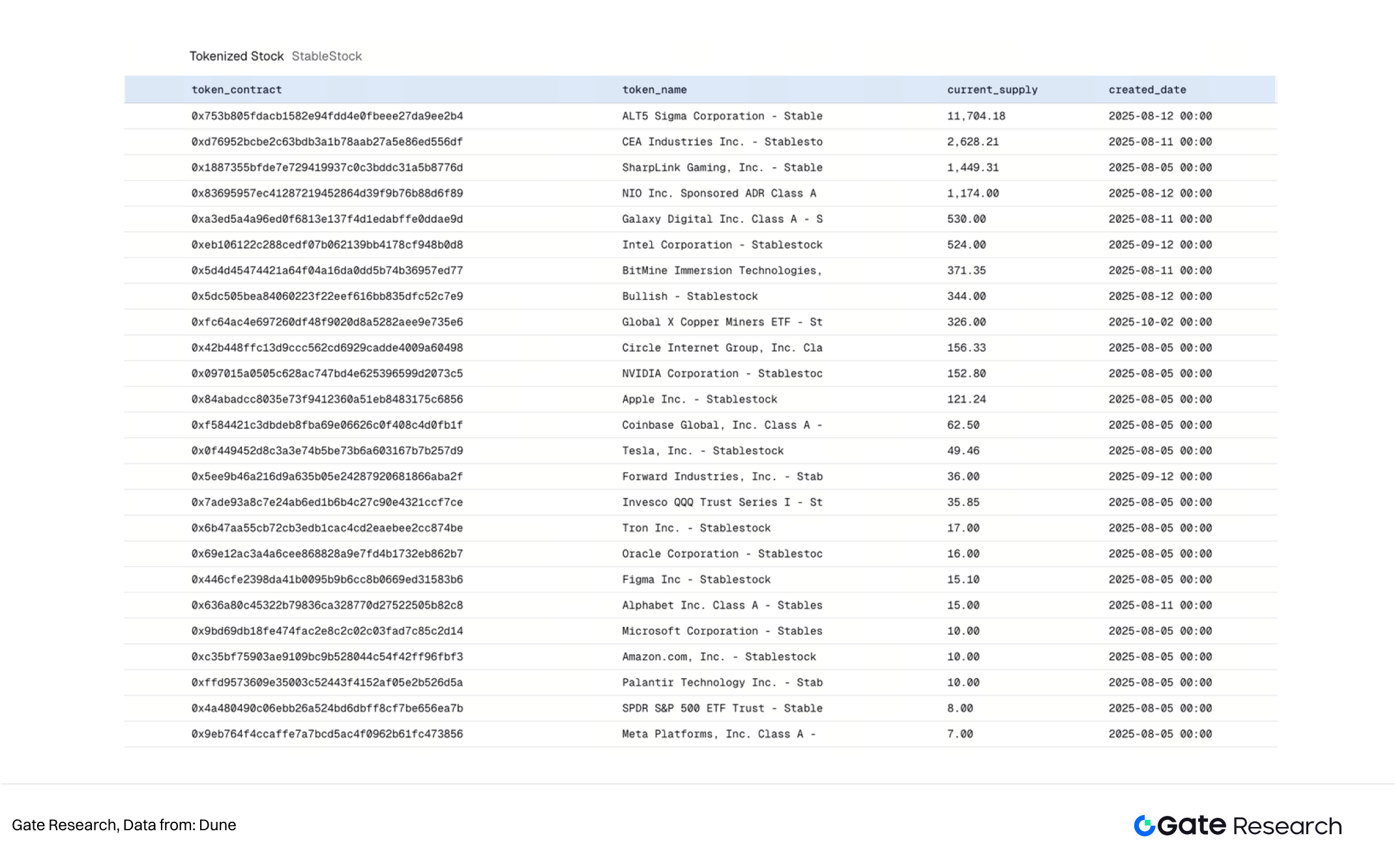

VII. StableStock Tokenized Stock Overview

This three-tier structure—from certificates → tokens → yield-bearing assets—transforms StableStock from a mere trading platform into a foundational on-chain financial layer for stock assets, converting traditional static equities into fully composable DeFi building blocks. As of November 25, 2025, StableStock has deployed 249 tokenized stock variants, meaning users can freely choose to mint or redeem any of 249 underlying stocks into real shares. This positions it as one of the most comprehensive tokenized services for real-share redemption, offering the broadest coverage in its category.

2.4 Robinhood: CFD Model

Robinhood has launched its tokenized stock products in the European market, employing a closed-loop OTC derivatives contract + on-chain ledger hybrid model. This covers U.S. stocks, ETFs, and high-profile private assets such as OpenAI and SpaceX. At its core, it functions as a one-to-one CFD (Contract for Difference) between the user and Robinhood. The tokens merely represent price exposure and simulated dividend rights under the contract, without transferring any legal ownership of the underlying stocks. As a result, in the EU, these are classified as MiFID II complex financial instruments rather than securities, successfully circumventing securities registration and cross-border ownership challenges.

- Operations and Trading

The entire trading process is completed in a closed loop within the Robinhood App: Users place orders, which are internally matched by Robinhood, with risk managed through SPVs or hedging positions. Tokens are minted/burned on Arbitrum solely to record position status, serving as a verifiable ledger without any on-chain functionality. Tokens are non-withdrawable, non-transferable, and non-circulatable externally—closing a position simply triggers destruction.

- Regulation and Compliance

Robinhood has completed its acquisition of the European crypto exchange Bitstamp (covering multi-jurisdictional licenses in the EU, UK, and U.S.), and holds relevant investment services/crypto qualifications in the EU to support its derivatives and crypto business expansion. The MiFID derivatives framework avoids the high complexity of cross-border real-share custody, enabling the product to launch first in the EU. This also explains the design boundaries of “non-transferable/non-composable externally.”

- Crypto Extension of PFOF Thinking

Robinhood’s core monetization relies on Payment for Order Flow (PFOF). By structuring stock exposure as closed-loop derivatives within the app, it seamlessly extends PFOF and related trading revenue (including hedging/market-making ecosystems) into its existing matching, hedging, and settlement infrastructure.

2.5 Other Participants

Beyond the handful of most prominent tokenized stock platforms discussed above, the market is teeming with a diverse array of service providers pursuing entirely distinct approaches—making this one of the most differentiated and innovative tracks in the broader crypto ecosystem.

- Dinari dShares: Early Multi-Chain RWA Pioneer

As one of the earliest projects venturing into stock tokenization, Dinari launched its dShares stock tokens as far back as February 2024. However, these were initially confined to its official website, tradable exclusively using its proprietary stablecoin USD+. As a result, the scale remained relatively modest. In July of this year, Dinari took a pivotal step forward by providing USD liquidity pools on Arbitrum–Uniswap for its flagship token MSTR.d (representing MicroStrategy), marking its official entry into open on-chain trading. Additionally, Dinari rolled out the Dinari Financial Network this year—an omni-chain order book built on Avalanche—to unify liquidity for tokenized stocks across multiple chains, including Arbitrum, Base, and Plume.

- Superstate: Compliance Pathway for Official Issuer-Backed Tokens

The models highlighted earlier focus on platform-led construction, without factoring in the issuer’s (i.e., the listed company’s) own volition. Superstate offers a more deeply integrated compliance pathway: enabling public companies to directly issue board-approved “official stock tokens” on-chain, with the corporate entity itself assuming full responsibility for issuance and regulatory obligations. The standout advantage of this approach is its enhanced regulatory predictability and legal clarity. Notable examples include Galaxy Digital adopting the Superstate framework to launch its official stock token GLXY, as well as SharpLink and Forward Industries issuing their stock tokens via the same model.

VIII. GLXY Tokenized Stock Current Status

However, the self-issuance pathway faces equally stark real-world challenges. Listed company management teams may lack familiarity with crypto-native mechanics, and they similarly have little incentive to drive ongoing issuance or market-making. Take GLXY as an example: The number of GLXY stock tokens minted on Solana represents less than 0.02% of Galaxy Digital’s total Class A common shares outstanding. Beyond the launch day, the scale has shown virtually no growth, with on-chain holders numbering fewer than 100 individuals.

III. Mainstream Solution Differentiation and Growth Bottlenecks

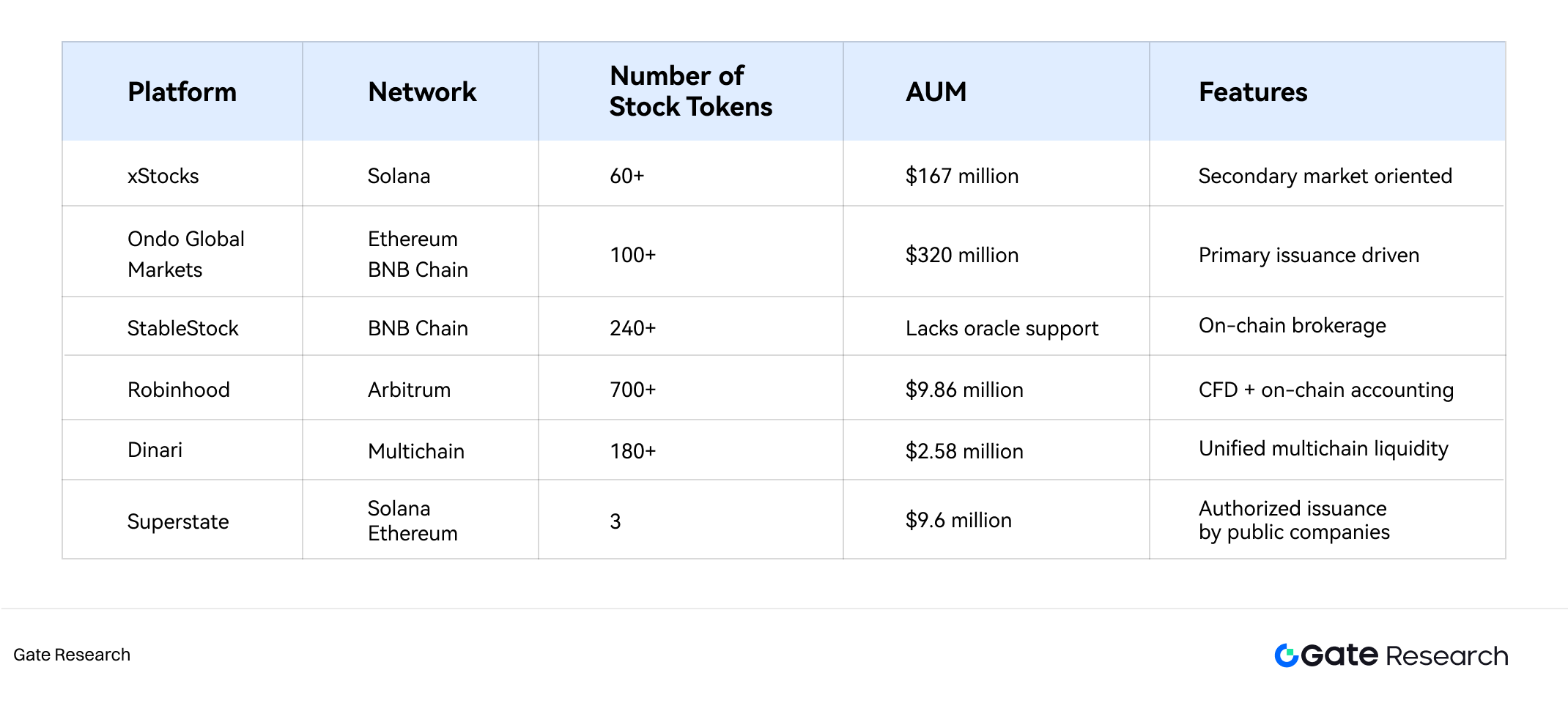

3.1Scale

IX. Major Tokenized Stock Platforms AUM Comparison

From a scale perspective:

- xStocks and Ondo form the first tier, collectively accounting for over 90% of the total market AUM.

- Robinhood’s CFD model delivers impressive trading volume, but since its on-chain component serves merely as a ledger record, it may not fully reflect the true scale.

- On-chain deployment strategy has emerged as a critical factor influencing scale. Low fees and high throughput on Solana and Arbitrum attract tokenized solutions as preferred initial deployment networks, while BNB Chain’s vast user base positions it as the go-to for emerging tokenized projects seeking overtaking opportunities and multi-chain expansions.

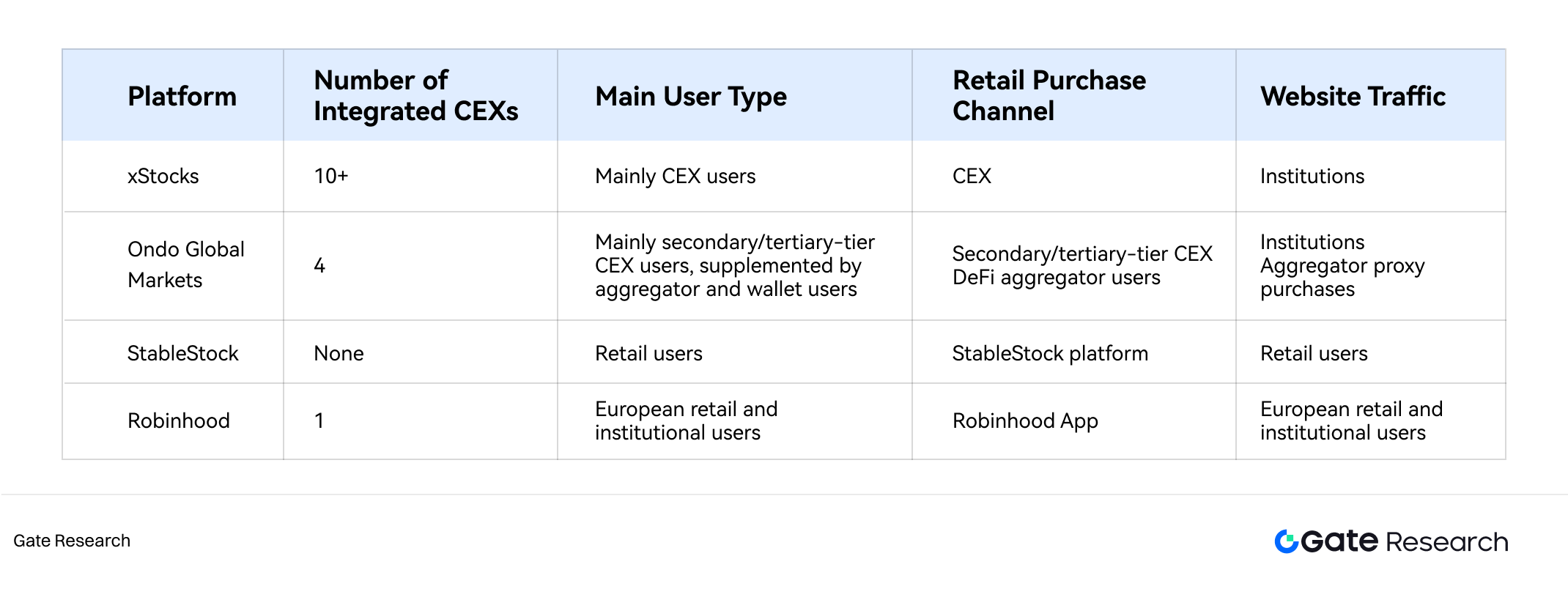

3.2 User Structure

X. Major Tokenized Stock Platforms User Structure Comparison

xStocks has integrated with more than 10 major CEXs, building the industry’s most extensive distribution network. This dominance stems directly from its first-mover advantage and secondary-market-oriented design. Its core user base consists of CEX-native traders who are accustomed to trading tokenized stocks in familiar centralized exchange environments, primarily seeking convenient U.S. equity exposure and cross-time-zone 24/7 trading opportunities.

In contrast, Ondo Global Markets’ core innovation lies in its unique distribution path built around DeFi aggregators (CowSwap, 1inch, etc.) and third-party wallets. When users buy a stock token through an aggregator interface, the transaction is silently routed to Ondo’s backend, triggering the actual purchase of the underlying real shares and minting the token (and vice-versa on sell). This architecture creates an elegant regulatory separation: the aggregator frontend handles traffic aggregation and provides a KYC-free user experience, while Ondo’s backend retains full compliance responsibility for KYC, custody, and execution. The result is a “light-touch reach, heavy-compliance core” model that effectively sidesteps the regulatory complexity of directly facing retail users.

It is worth noting that certain integrated CEXs have chosen to directly list Ondo’s stock tokens for secondary trading instead of integrating the native “buy-to-mint / sell-to-burn” primary mechanism.

XI. StableStock Platform User Asset Situation

StableStock operates as a pure on-chain brokerage that serves users exclusively through its own platform. This model results in an exceptionally clean user structure—almost entirely direct retail. The entire user journey—from fiat/stablecoin onboarding, trading, token minting, to real-share redemption—takes place within a single, closed ecosystem. While this grants StableStock full ownership of user relationships and complete data control, it also means growth is entirely dependent on its own customer acquisition and conversion capabilities, unable to leverage the massive traffic dividends of external CEXs. To break this growth ceiling, StableStock is aggressively developing StableVault, aiming to transform yield-bearing stTokens into fully composable building blocks that can flow freely into the broader DeFi ecosystem across lending protocols, DEXs, perpetuals, and structured products.

Due to strict regulatory requirements, Robinhood restricts its tokenized stock offering exclusively within its own app. The entire user base is drawn from Robinhood’s and its acquired European crypto exchange Bitstamp’s existing pool of tens of millions of users, predominantly European retail investors with a smaller institutional segment. The overwhelming brand power and seamless, unified experience constitute its core competitive moat—users never need to leave the familiar Robinhood interface or learn new workflows. This enables extremely efficient internal traffic funneling and deep user penetration, but the price is a complete “walled garden” strategy that deliberately sacrifices any on-chain composability and external liquidity of the assets.

3.3 Liquidity

Liquidity is the lifeblood of tokenized stocks as tradable assets and, at the same time, the core bottleneck currently restricting the sector’s development. Different platforms, due to their fundamentally different model choices, exhibit enormous variance in liquidity sources, depth, stability, and sustainability. (Note: Robinhood’s CFD model internalizes liquidity completely and isolates it from public markets, so it is not discussed here.)

xStocks was originally designed to rely on professional investors arbitraging between the primary and secondary markets to keep token prices anchored to the underlying shares. These professional investors primarily refer to CEX market-makers for xStocks tokens and other authorized institutional participants. In an ideal scenario, whenever the trading price deviates from the underlying stock price, institutions with minting and redemption rights would step in and arbitrage the price back to fair value.

In reality, however, professional investors lack sustained incentives to keep arbitraging or minting new supply. This has caused token supply growth to stagnate and coin-margined market depth to remain extremely shallow. From another perspective, minting additional stock tokens also requires seeding corresponding U-based (USDT/USDC) liquidity pools to generate meaningful trading fees, but with only moderate market enthusiasm, the incentive to mint becomes even weaker.

At present, xStocks liquidity displays highly concentrated and fragile characteristics: liquidity is overwhelmingly concentrated in just a handful of tokens such as xTSLA and xCRCL, while the vast majority of long-tail assets suffer from almost non-existent depth; furthermore, liquidity provision depends on only a few market-makers, and as both the number of listed exchanges and overall on-chain token count continue to explode, tokenized stocks have fallen sharply in the capital-allocation priority list of these market-makers. This has created a vicious cycle in which, due to insufficient depth, even buy or sell orders of a few tens of thousands of dollars can cause the price to deviate dramatically from the underlying stock price in an instant, producing on-chain depegs from the actual U.S. share price and further dampening trading interest.

By comparison, models like Ondo Global Markets and StableStock that do not rely on secondary-market arbitrage find it much easier to maintain price stability, because their liquidity fundamentally originates from the traditional stock market itself, although the two still differ in actual execution.

Ondo operates a quote-driven model in which the price is determined by Ondo itself based on the real-time underlying stock price plus a certain premium/spread. As long as Ondo retains the ability to execute in traditional markets, users can always complete transactions at predictable prices. However, under this model Ondo effectively acts as the counterparty to every user trade; when aggregate user trading volume far exceeds the platform’s immediate execution capacity, Ondo can widen the quoted spread to throttle inflows, thereby creating an invisible liquidity ceiling. Moreover, some CEXs that integrate Ondo tokens do not adopt the native “buy-to-mint / sell-to-burn” and quote-driven mechanism, but instead simply list already-minted Ondo stock tokens for secondary trading within the exchange. In such cases, Ondo tokens on those CEXs become merely another version of xStocks and face the same liquidity predicament.

StableStock, through its partnered traditional broker, purchases real shares in the underlying market the moment a user buys with stablecoins, giving it by far the most solid price anchoring among all platforms. Nevertheless, the minting of StableStock stock tokens still depends entirely on user initiative, so the overall tokenized scale remains modest, and trading is still predominantly confined within the platform’s own StableStock Swap module, temporarily lacking mature external oracle support and deep liquidity on mainstream DEXs.

3.4 Real-Share Redemption Channel

The fundamental question facing tokenized stocks is whether they ultimately function as derivatives that merely track stock prices or as genuine tokenized vehicles representing legal ownership of the underlying equity. The availability of real-share redemption is the decisive criterion that separates the two. Robinhood’s tokenized stocks are purely CFD-based and carry no redemption concept whatsoever; from a regulatory perspective, they are unambiguously classified as financial derivatives.

xStocks, Ondo Global Markets, and StableStock all technically possess redemption functionality, yet they differ sharply in who actually enjoys redemption rights.

For xStocks, only compliant professional institutions are granted the authority to mint tokens against real shares and redeem tokens back into real shares, as they simultaneously shoulder the responsibility of primary issuance and price-spread arbitrage. Retail users have zero direct access to the underlying shares—they can only trade the stock tokens previously minted by these institutions. Consequently, the range of stocks available to retail traders is entirely dictated by the preferences and incentives of those professional issuers.

Ondo Global Markets, in theory, permits any KYC-compliant user to redeem tokens for real shares on its platform. In practice, however, the compliance review process is so stringent that ordinary users rarely qualify for direct redemption. Most retail participants continue to rely on aggregators and third-party wallets to proxy-purchase and mint tokens, without ever obtaining true redemption rights.

StableStock stands alone as the only tokenized stock platform that genuinely allows retail users to apply for delivery of actual underlying shares. Through its partnered traditional broker HabitTrade, redeemed shares are transferred directly from NASDAQ/NYSE custody into the user’s personal brokerage account.

3.5 On-Chain Composability

In theory, as long as the contract does not contain hard-coded restrictions, all ERC-20 or SPL-20 stock tokens, including those issued by Robinhood on Arbitrum, can be used in the DeFi ecosystem. However, tokenized stocks are still in their very early stage, and actual DeFi composability is extremely limited.

As of now, xStocks stock tokens exhibit the highest degree of composability. The six major tokenized assets TSLAx, NVDAx, SPYx, QQQx, GOOGLx and MSTRx have been supported by Kamino, Solana’s largest lending protocol, with deposits reaching $3.5 million, but the deposit APY is close to 0%, and these deposits are likely driven mainly by market-maker addresses. Also noteworthy is StableStock’s upcoming StableVault, which aims to create yield-bearing stock token assets, though it remains unclear where the yield will actually come from.

3.6 Summary of Growth and Scale Bottlenecks

- Liquidity Bottleneck and Fragmentation

Liquidity is the most central problem, and the price slippage that users feel most acutely stems directly from insufficient liquidity. Tokenized stocks have fallen into a negative feedback loop: “insufficient liquidity → poor user experience and reluctance of institutions to participate → even weaker liquidity.” xStocks relies on professional investors to arbitrage and maintain price anchoring, but the incentive model has largely failed due to inadequate motivation on their part. At the same time, there is still no sufficiently attractive reward mechanism to draw broad LPs into providing liquidity for long-tail assets. Ondo Global Markets’ model has not been correctly understood by most CEXs with large user bases; instead of integrating the buy-to-mint/sell-to-burn engine, they have simply listed the tokens for secondary trading in a crude manner, so the trading experience for CEX users has not meaningfully improved.

Furthermore, even though they represent the same underlying stock, liquidity remains fragmented across multiple platforms and multiple chains because of different solutions and different providers.

- Demand Mismatch

A practical challenge facing tokenized stocks is the significant mismatch between their value proposition and real market demand.

Solutions that focus on the “token” aspect have so far failed to create compelling new use cases that do not exist in traditional finance and that can only be realized by holding assets on-chain—such as highly efficient on-chain compounding strategies or innovative collateralized derivatives. As a result, tokenization itself risks becoming little more than a technological gimmick rather than a functional necessity.

Solutions that ultimately focus on the “stock” aspect ought to target users and conduct primary marketing in developing and third-world countries and regions, because for populations in developed markets, buying U.S. equities in the real world presents no material barrier. In other words, the stronger the preference for stablecoins in a given region, the greater the genuine demand to use those stablecoins to purchase U.S. stock exposure.

- Compliance Factors

Every existing tokenized stock solution exhibits certain awkward compromises, largely concessions made to regulators in order to navigate regulatory uncertainty. Because of compliance requirements, tokenized versions may lose key shareholder rights such as dividends, voting rights, or even the ability to redeem the underlying real shares.

IV. Market Trends and Outlook

The on-chain migration of global assets is an irreversible trend. As of November 25, 2025, the total TVL across the entire RWA sector has exceeded $35 billion, with tokenized stocks (including ETFs) accounting for less than 2%. On-chain tokenization of private credit and Treasuries has gradually matured, with tools becoming increasingly sophisticated. As the world’s largest and most liquid asset class, stocks are naturally the ultimate target for on-chain adoption.

4.1 Diversification of Assets and Use Cases

The scope of tokenized stock assets is rapidly expanding beyond traditional blue-chip equities into a much richer asset categories:

- ETFs and Index Products: Among the 13 tokenized stock assets that currently exceed $10 million in individual scale, more than half—seven—are tokenized ETFs or index products.

- Private Equity and Pre-IPO Assets: Robinhood already offers tokenized exposure to private companies such as OpenAI and SpaceX. This opens the door for ordinary investors to gain access to high-growth assets at earlier stages that were previously reserved almost exclusively for venture capital and accredited investors.

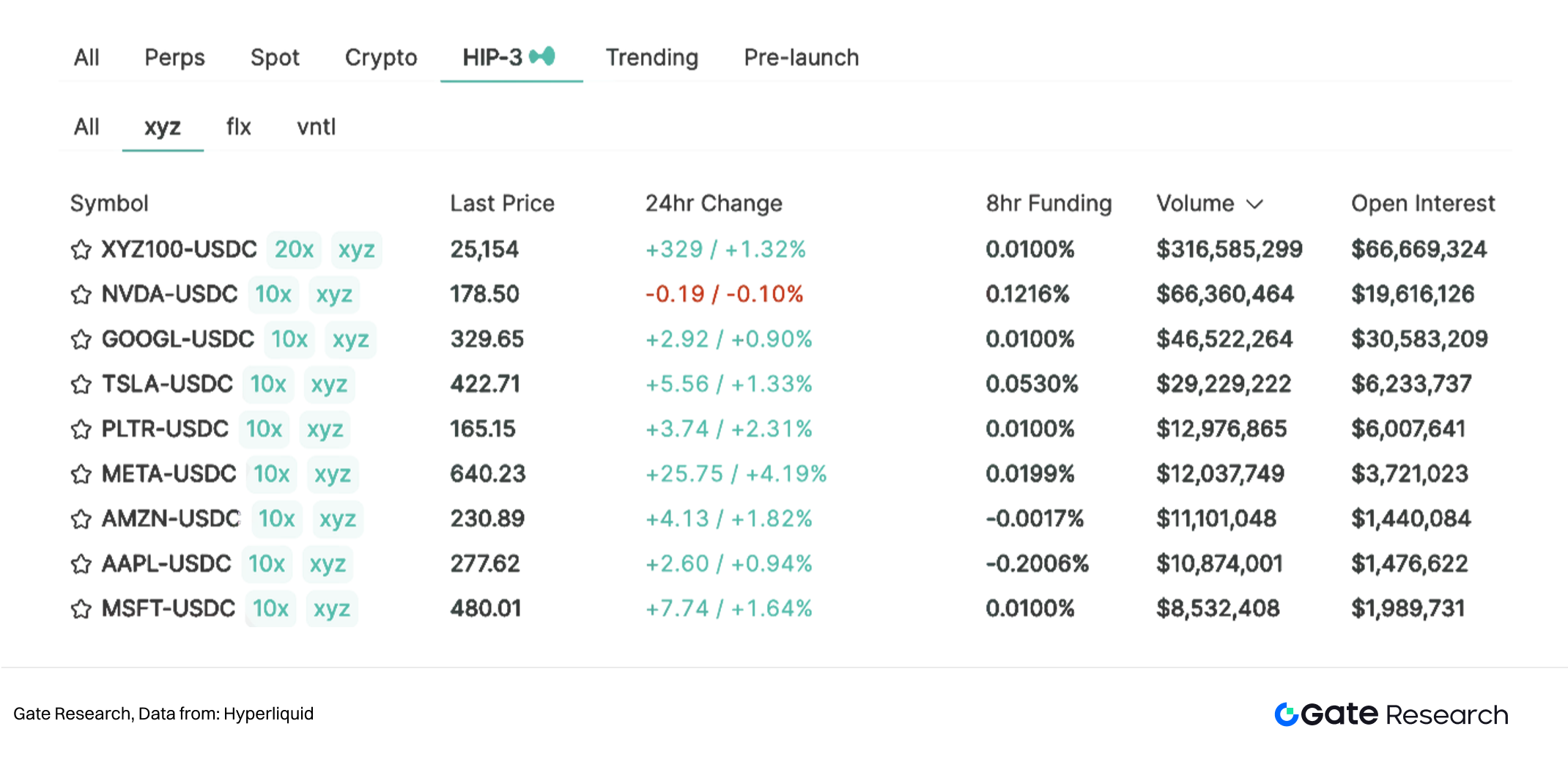

XII. Hyperliquid HIP-3 Market Overview

- Perpetual Contracts: Following Hyperliquid’s major HIP-3 upgrade, developers are now able to deploy custom perpetual contract markets, with on-chain perpetual stock markets emerging as the most important branch.

4.2 Regionalized Stock Tokenization

Regulatory exploration is gradually forming a multi-polar landscape across the EU, Middle East, and Asia (particularly Singapore and Hong Kong). For investors in developed countries or regions, who generally possess a global asset-allocation perspective, merely holding local or U.S. equities is clearly falls short of their needs. As more jurisdictions open compliant pathways for asset tokenization, not only will investors from emerging markets in Southeast Asia, Latin America, and elsewhere gain access to mainstream markets through tokenized assets, but conversely, the tokenization of local stocks in these emerging countries will also become a major opportunity for global investors seeking diversified portfolio exposure.

4.3 On-Chain ETFs Issued by Major Real-World Compliant Issuers

The next explosive growth point in the tokenized stock sector lies in deep participation by traditional financial giants such as BlackRock and Fidelity—mirroring the transformative impact they had when they spearheaded the BTC ETF and ETH ETF waves, bringing dramatic improvements to the entire industry in terms of asset credibility, regulatory communication, and viable business models.

With the entry of behemoths like BlackRock, leading native tokenized players and pioneers such as Ondo and Dinari are likely to shift their strategic focus away from direct asset issuance and toward evolving into “infrastructure” providers that serve the broader industry.

Reference

- Santander, https://www.santander.com/en/press-room/press-releases/santander-launches-the-first-end-to-end-blockchain-bond

- FORGE, https://www.sgforge.com/product/bonds/

- Voronoi, https://www.voronoiapp.com/markets/-Global-Stock-Exchange-Market-Capitalization-Reaches-Record-148-Trillion-in-October-2025-5178

- ETFGI, https://etfgi.com/research

- rwa.xyz, https://app.rwa.xyz/stocks

- AiCoin, https://www.aicoin.com/zh-Hans/article/477136

- Dune, https://dune.com/gateresearch/stocks

- Dune, https://dune.com/glxyresearch_team/glxy-class-a-common-stock-token

- Hyperliquid, https://app.hyperliquid.xyz/trade/xyz:XYZ100

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review