Ethereum Price Prediction Fusaka Upgrade Boosts ETH Toward 3500 Resistance

Market Overview

Ethereum has once again taken center stage in the market. With the official rollout of the Fusaka upgrade, ETH has rebounded steadily to around $3,200. After weeks of volatility and overall uncertainty across the crypto sector, this technical upgrade—coupled with heightened on-chain activity—has introduced a fresh narrative for traders.

Over the past 24 hours, ETH has gained approximately 4–5%, outperforming most major cryptocurrencies and briefly reclaiming the $3,200 psychological threshold. Market data shows trading volumes on the rise and large holders increasing their positions, though sentiment indicators remain firmly in the fear zone.

Fusaka Upgrade Impact

The Fusaka upgrade represents Ethereum’s second major network update of 2025, activated at block height 18,200,000. Its core technology, PeerDAS, enables nodes to store only portions of blob data rather than entire data packages. This innovation can theoretically boost data throughput by roughly eightfold, alleviating network congestion and allowing more Layer 2 transactions to settle on the Ethereum mainnet.

The upgrade also integrates several Ethereum Improvement Proposals (EIPs), adjusting gas limits, transaction sizes, cryptographic support, and block configurations. These changes aim to enhance network efficiency while ensuring validator requirements remain manageable.

Large Holders, ETFs, and Technical Signals

On-chain data indicates that wallets holding 1,000–10,000 ETH have been actively accumulating in the $2,700–$3,000 range. Institutional demand is rising as well: BitMine increased its treasury by over 18,000 ETH ahead of Fusaka, and US spot Ethereum ETFs have seen significant capital inflows.

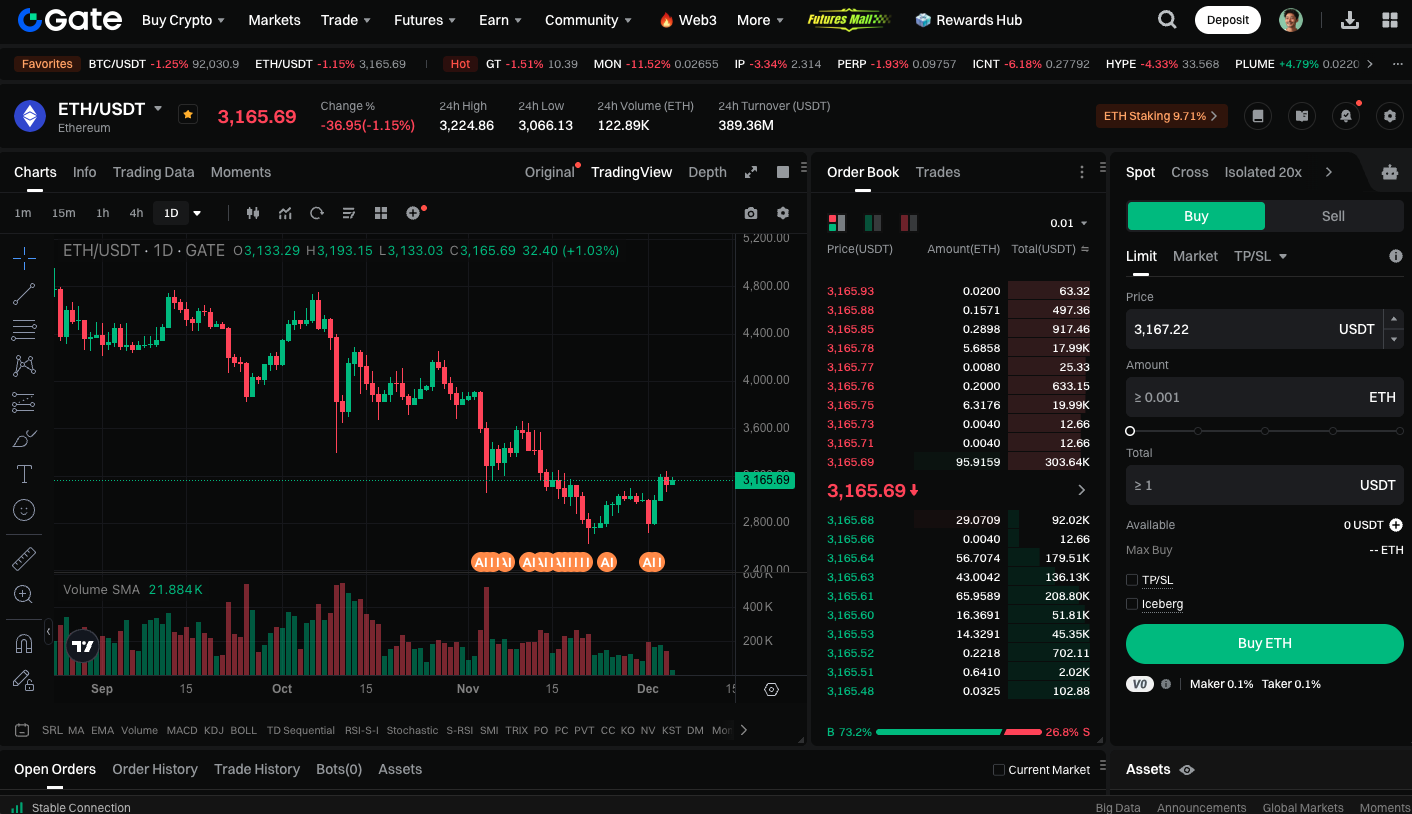

From a technical perspective, ETH is trading near $3,200, with analysts eyeing resistance at $3,300–$3,500. Short-term models suggest ETH could approach $3,500 within days. If momentum continues, the short-term upside could reach around 10%. However, broader indicators remain mixed, with the market still skewed bearish; any pullback could test support at $3,100, $3,000, or $2,850.

Begin spot trading ETH now: https://www.gate.com/trade/ETH_USDT

Summary

The Fusaka upgrade has refocused market attention on Ethereum’s fundamentals. ETH has delivered a strong short-term breakout above $3,200. If bullish momentum continues and breaks through the $3,500 resistance, the near-term target could reach $3,537. Investors should monitor support levels and institutional inflows to evaluate further upside potential.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution