A Clear Guide to Gate Leveraged ETFs: Mechanism, Benefits, and Key Risks

Preface

An ETF is an investment vehicle that bundles multiple assets, allowing investors to trade on exchanges as they would stocks. Unlike single-asset products, ETFs use portfolio management to spread risk and can track specific indices, commodities, or asset performance. As financial markets innovate, derivative ETFs like leveraged ETFs have gained popularity. These products multiply the price movements of underlying assets several times, allowing investors to gain leveraged exposure easily during clear short-term trends.

What Are Gate Leveraged ETF Tokens?

Gate Leveraged ETF Tokens are derivative financial instruments, similar to funds, that use allocation of contract positions to multiply the gains and losses of underlying assets. Investors can trade these tokens on the spot market to gain leveraged exposure—no need for additional margin and no risk of forced liquidation. This makes leveraged trading more straightforward and accessible.

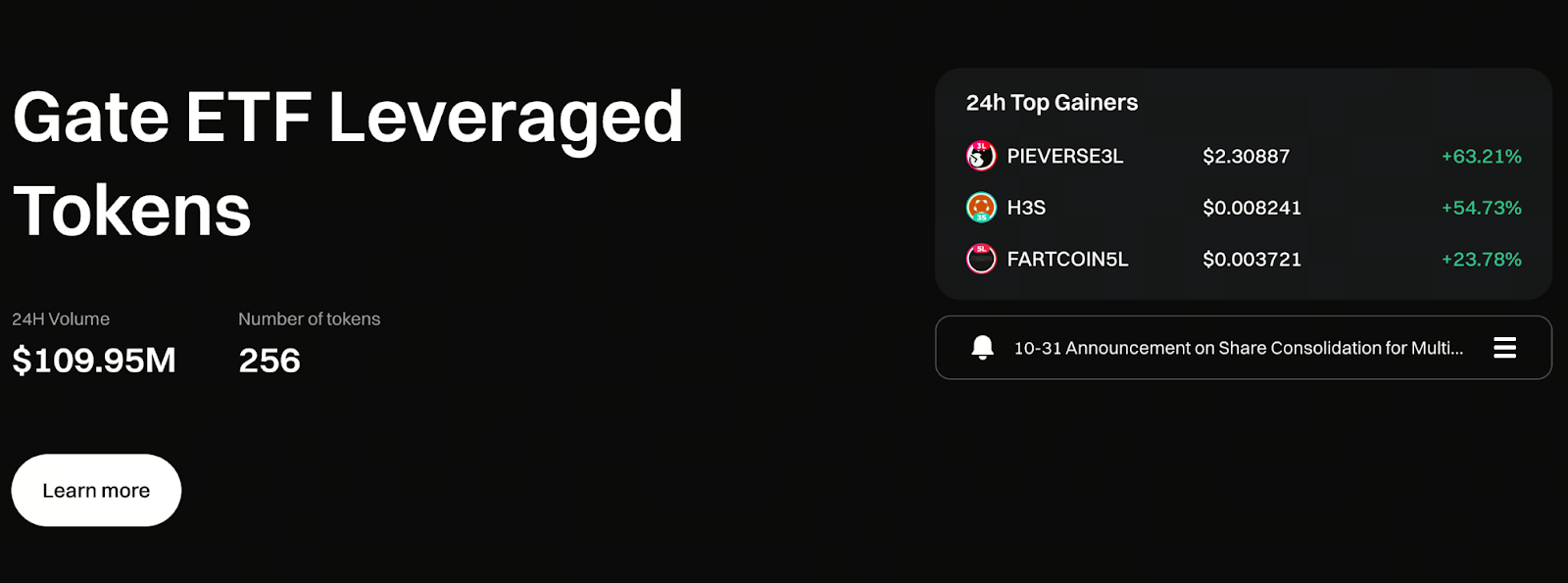

Start trading Gate Leveraged ETF Tokens now: https://www.gate.com/leveraged-etf

How Gate Leveraged ETF Tokens Work

Gate Leveraged ETF Tokens are managed by a professional team. Their core operations include:

- Futures Position Support: Each token is backed by corresponding perpetual contract positions to maintain the set leverage ratio (e.g., 3x or 5x).

- Daily Rebalancing: ETF managers adjust positions daily based on market changes to restore the target leverage ratio.

- Spot-Only Trading: Users do not need to interact with contracts directly; buying and selling ETF tokens on the spot market is enough to achieve leverage.

- Daily Management Fee: The platform charges a 0.1% management fee per day to cover hedging contract positions, transaction fees, and other related costs.

Product Features and Investment Advantages

- Built-in leverage amplifies market movements

The ETF multiplies returns by 3x or 5x, allowing investors to boost profits more efficiently during clear market trends.

- No risk of forced liquidation

The system prevents forced liquidation of losses. Because users do not interact directly with contracts, the system automatically rebalances to keep leverage within the designated range.

- Automatic compounding effect

When the market moves favorably, the system automatically increases positions, allowing profits to compound further.

- Operates just like spot trading

No borrowing or margin is needed—users simply buy and sell tokens, resulting in a low entry barrier.

Risk Warning

While leveraged ETFs are simple to use, the risks are significant:

- High leverage increases volatility: 3x or 5x leverage means both gains and losses are amplified.

- Rebalancing causes value decay: In highly volatile markets, frequent position adjustments can erode long-term returns, so long-term holding is not advised.

- Returns may not match leverage multiples: Due to the rebalancing mechanism, gains and losses over time may not be strictly proportional to the target leverage ratio.

- High holding costs: Management fees and hedging contract positions impact overall returns.

Use leveraged ETFs for short-term trading or clear market trends; avoid long-term holding.

Why Are Management Fees Charged?

The operation of leveraged ETFs requires hedging and rebalancing in the perpetual contracts market, which incurs the following costs:

- Contract trading fees

- Funding rates

- Bid-ask spread costs

Gate charges a daily management fee of 0.1%, primarily to cover these necessary expenses. This rate is among the lowest in the industry, and Gate subsidizes some of the costs.

Summary

Leveraged ETFs offer a simple and convenient way to invest with leverage. By trading tokens on the spot market, users can enjoy amplified returns without worrying about forced liquidation. However, these products are highly volatile and incur rebalancing costs, which can impact long-term performance. As such, leveraged ETFs are more suitable for short-term trading or trending markets. Investors seeking higher returns should evaluate the risks carefully and develop suitable holding strategies.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution