2025 MLT Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: MLT's Market Position and Investment Value

Media Licensing Token (MLT) serves as the native token of the MILC platform, which revolutionizes the global media content market by bridging media professionals and viewers. Since its launch in 2021, MLT has established itself as a utility token designed to streamline media licensing processes. As of December 2025, MLT commands a market capitalization of approximately $4.59 million, with a circulating supply of around 146.4 million tokens, trading at $0.022945. This innovative asset, recognized for its "one-click licensing solution" functionality, is playing an increasingly crucial role in transforming media content distribution and monetization across the entertainment industry.

This article will comprehensively analyze MLT's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

Media Licensing Token (MLT) Market Analysis Report

I. MLT Price History Review and Current Market Status

MLT Historical Price Trajectory

Media Licensing Token (MLT) was published on May 18, 2021, at an initial price of $0.2004. The token experienced significant appreciation in its early phase, reaching its all-time high (ATH) of $0.728855 on November 30, 2021, approximately seven months after launch. This represented a substantial return for early investors.

Following the peak in late 2021, MLT has entered a prolonged downtrend. The token declined significantly through 2022-2025, reaching its all-time low (ATL) of $0.00556696 on April 9, 2025. This represents a decline of over 99% from its historical peak.

MLT Current Market Status

As of December 24, 2025, MLT is trading at $0.022945, reflecting a 24-hour decline of -4.39%. Short-term price action shows weakness across multiple timeframes:

- 1-hour change: -1.42%

- 7-day change: -13.05%

- 30-day change: -27.87%

- 1-year change: -28.1%

The 24-hour trading volume stands at $12,652.75, with a current market capitalization of approximately $3,359,181. The token's circulating supply is 146,401,460.93 MLT out of a total supply of 200,000,000 MLT, representing a circulation ratio of 73.20%.

MLT maintains a market ranking of 1,792 with a market dominance of 0.00014%. The token is currently trading between a 24-hour high of $0.036998 and a low of $0.022768. The fully diluted valuation (FDV) is $4,589,000, with the circulating market cap representing 73.2% of the FDV.

Click to view current MLT market price

MLT Market Sentiment Index

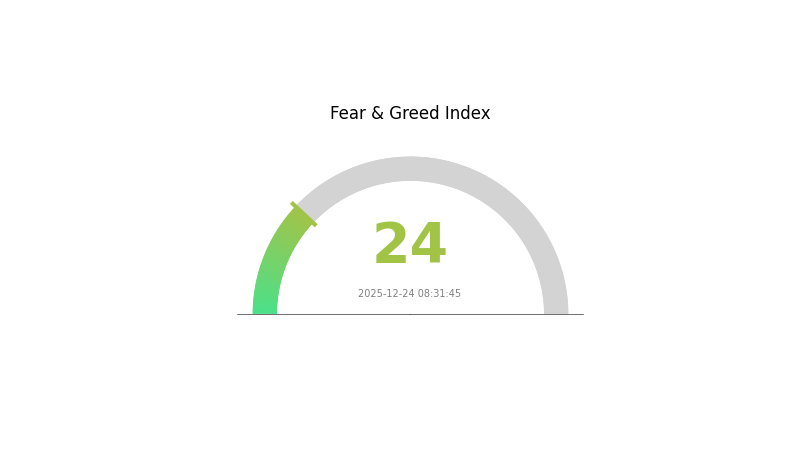

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant pessimism among investors and heightened market anxiety. During periods of extreme fear, risk-averse traders typically reduce positions, while contrarian investors may view this as a potential buying opportunity. The low reading suggests heightened volatility and uncertainty in the market. Investors should exercise caution, conduct thorough research, and consider their risk tolerance before making trading decisions. Historical data shows that extreme fear periods often precede market recoveries, but timing remains unpredictable. Monitor market developments closely on Gate.com for real-time sentiment analysis and trading opportunities.

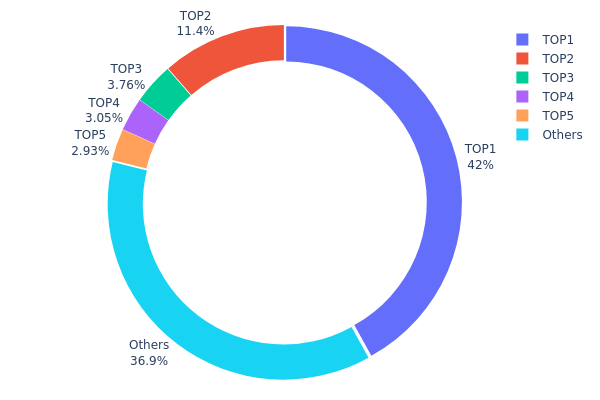

MLT Holdings Distribution

The address holdings distribution map illustrates the concentration of MLT tokens across the blockchain network by tracking the top individual addresses and their proportional stake in total circulating supply. This metric serves as a critical indicator of token concentration risk and provides insights into the decentralization structure of the asset.

MLT exhibits significant concentration characteristics in its current holdings distribution. The top holder commands 41.95% of total supply, while the combined top five addresses collectively control 63.1% of all tokens. This level of concentration indicates a moderately centralized token structure, where decision-making power and price influence are concentrated among a limited number of stakeholders. The second-largest holder maintains an 11.42% position, followed by progressively smaller holdings, suggesting a tiered distribution model. The remaining 36.9% dispersed among other addresses provides a baseline level of decentralization but remains insufficient to counterbalance the significant influence wielded by top holders.

The current distribution pattern presents notable implications for market dynamics and structural stability. Such concentrated holdings increase vulnerability to large-scale selling pressure or coordinated movements, potentially amplifying price volatility during market stress periods. The dominance of the top address warrants monitoring regarding potential supply shocks or governance influence. However, the non-trivial portion held by dispersed addresses (36.9%) provides some resilience against complete market manipulation. The distribution structure suggests a market environment where whale activity and institutional or early-stage holder positioning significantly shape price discovery mechanisms and market sentiment trajectories.

Click to view current MLT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x533e...ff9648 | 83900.68K | 41.95% |

| 2 | 0x262f...901974 | 22855.85K | 11.42% |

| 3 | 0xd507...27714a | 7520.38K | 3.76% |

| 4 | 0x9b3d...5d7ae6 | 6099.74K | 3.04% |

| 5 | 0x9642...2f5d4e | 5861.60K | 2.93% |

| - | Others | 73761.75K | 36.9% |

Core Factors Influencing MLT's Future Price

Supply Mechanism

-

Circulating Supply: MILC Platform (MLT) has a current circulating supply of 124,423,464 MLT tokens, with a total market value of د.ت8,426,407.96 TND.

-

Historical Price Performance: MLT has experienced significant price volatility over the past year. One year ago, 1 MLT was valued at د.ت0.09090 TND, representing a -25.49% change from the current price of د.ت0.06772 TND. The all-time high price reached د.ت3.15 per token, indicating substantial room for potential recovery if market conditions improve.

-

Current Market Dynamics: Over the past 7 days, MLT's exchange rate against TND declined by -10.41%. In the past 24 hours, the rate fluctuated by -3.25%, with a high of 0.09430 TND and a low of 0.06702 TND. Trading volume increased significantly by 68.75% over the past 24 hours (د.ت26,981.63 TND), up from د.ت39,248.12 in the previous trading day, suggesting growing market interest despite price pressure.

Note: The provided data primarily contains pricing and market data from a cryptocurrency exchange platform. Comprehensive information about MLT's institutional holdings, corporate adoption, government policies, technological developments, and ecosystem projects is not available in the source materials. Investors should conduct thorough due diligence and monitor official MLT project announcements for the most current information regarding project developments and market catalysts.

Three、2025-2030 MLT Price Forecast

2025 Outlook

- Conservative Forecast: $0.01813 - $0.02295

- Neutral Forecast: $0.02295

- Optimistic Forecast: $0.03143 (requires sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and gradual appreciation phase with consolidation patterns, driven by expanding adoption and protocol upgrades

- Price Range Forecast:

- 2026: $0.01903 - $0.03154

- 2027: $0.02525 - $0.03201

- 2028: $0.02117 - $0.03682

- Key Catalysts: Enhanced tokenomics implementation, ecosystem partnership announcements, integration with major platforms, and overall market cycle recovery

2029-2030 Long-term Outlook

- Base Case: $0.02700 - $0.03477 (assumes steady adoption and favorable macroeconomic conditions)

- Optimistic Scenario: $0.03376 - $0.04385 (assumes accelerated institutional adoption and breakthrough technological milestones)

- Transformative Scenario: $0.04385+ (extreme positive conditions including mainstream financial integration and significant regulatory clarity)

- 2030-12-31: MLT projected at $0.04385 (peak prediction scenario representing 49% cumulative appreciation from current baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03143 | 0.02295 | 0.01813 | 0 |

| 2026 | 0.03154 | 0.02719 | 0.01903 | 18 |

| 2027 | 0.03201 | 0.02937 | 0.02525 | 27 |

| 2028 | 0.03682 | 0.03069 | 0.02117 | 33 |

| 2029 | 0.03477 | 0.03376 | 0.027 | 47 |

| 2030 | 0.04385 | 0.03426 | 0.02227 | 49 |

Media Licensing Token (MLT) Professional Investment Report

IV. MLT Professional Investment Strategy and Risk Management

MLT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in the MILC platform's vision to revolutionize media content licensing through blockchain technology; investors seeking exposure to the convergence of media, AI, and distributed systems

- Operational Recommendations:

- Accumulate during market downturns, particularly during periods of sustained negative price action (current 1-year decline of -28.1%)

- Hold positions through market cycles, recognizing that utility-driven projects require time for ecosystem maturation and adoption

- Reinvest any staking rewards or ecosystem participation gains to compound returns over extended periods

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor key support and resistance levels: historical all-time high of $0.728855 (November 30, 2021) and recent all-time low of $0.00556696 (April 9, 2025)

- Current price at $0.022945 represents recovery from recent lows but significant depreciation from previous peaks

- Wave Operation Key Points:

- Capitalize on short-term volatility: 24-hour range shows trading between $0.022768 and $0.036998

- Execute trades during periods of elevated volume relative to the 24-hour average of $12,652.75

MLT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total cryptocurrency portfolio

- Aggressive Investors: 3-8% of total cryptocurrency portfolio

- Professional Investors: 5-15% with active rebalancing strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual position exposure to maintain portfolio stability given the token's high volatility and relatively low market liquidity

- Dollar-Cost Averaging: Deploy capital in incremental tranches over time to reduce the impact of price volatility and adverse entry points

(3) Secure Storage Solutions

- Cold Storage Approach: For long-term holdings, utilize self-custody solutions with enhanced security protocols

- Exchange Storage: Maintain only active trading amounts on Gate.com, withdrawing majority holdings to secure addresses

- Security Precautions: Implement hardware-based security measures, maintain strict key management practices, and employ multi-signature verification protocols where applicable

V. MLT Potential Risks and Challenges

MLT Market Risks

- Extreme Price Volatility: MLT exhibits substantial price swings, with 1-year decline of -28.1% and 24-hour fluctuations of -4.39%, creating significant liquidation risk for leveraged positions

- Low Liquidity and Trading Volume: Daily volume of $12,652.75 on a fully diluted valuation of $4.589 million indicates relatively thin liquidity, exposing large position sizes to significant slippage

- Holder Concentration: With only 5,074 token holders across all chains, the token exhibits potential concentration risk where large holders could influence market dynamics

MLT Regulatory Risks

- Evolving Media Content Regulations: Global variations in media licensing frameworks and content distribution regulations could impact the MILC platform's operational model in different jurisdictions

- Digital Asset Classification Uncertainty: Regulatory treatment of utility tokens in media licensing remains ambiguous in many major markets, creating potential compliance challenges

- Cross-Border Licensing Compliance: Operating across multiple countries (Germany, Switzerland, and potential expansions) requires navigation of complex, jurisdiction-specific media licensing requirements

MLT Technical Risks

- Smart Contract Vulnerabilities: While the project maintains active GitHub repositories for smart contracts, any undiscovered vulnerabilities could impact token security or platform functionality

- Blockchain Network Dependency: MLT operates on Ethereum and BSC; network congestion, fee escalation, or technical failures on these chains could disrupt token transfers and ecosystem transactions

- Platform Adoption Challenges: Realization of the MILC platform's vision depends on significant adoption by content creators, broadcasters, and investors, which remains unproven at scale

VI. Conclusions and Action Recommendations

MLT Investment Value Assessment

Media Licensing Token represents a speculative investment opportunity in the nascent intersection of blockchain technology and media licensing. The project's backing by Welt der Wunder GmbH, an established German media company with 25 years of operational history and significant audience reach, provides tangible real-world operational experience. However, the token's 68% decline from peak valuations, relatively low liquidity, and the unproven scalability of blockchain-based media licensing create substantial risk considerations. Success depends on meaningful ecosystem adoption and the ability to streamline media licensing processes sufficiently to justify blockchain implementation.

MLT Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of total crypto holdings; utilize dollar-cost averaging to build positions; prioritize education about the MILC platform's value proposition before substantial capital deployment

✅ Experienced Investors: Allocate 3-5% based on conviction in media licensing tokenization; employ technical analysis combined with fundamental ecosystem monitoring; consider partial positions established at current depressed valuations

✅ Institutional Investors: Conduct comprehensive due diligence on the MILC platform's commercialization roadmap, regulatory compliance framework, and adoption metrics; allocate 5-10% if institutional-grade custody solutions and legal clarity are established

MLT Trading Participation Methods

- Gate.com Spot Trading: Execute buy and sell orders directly through Gate.com's spot trading interface with real-time liquidity; suitable for accumulation during downtrends and position management

- Direct wallet Storage: Purchase MLT via Gate.com and transfer to self-custody Ethereum or BSC addresses for long-term holding, eliminating exchange counterparty risk

- Ecosystem Participation: Engage with the MILC platform's community forum to gain deeper understanding of project development and participate in governance discussions where applicable

Cryptocurrency investments carry substantial risk. This report does not constitute investment advice. Investors must make independent decisions based on individual risk tolerance and financial circumstances. Consult qualified financial advisors before significant capital allocation. Never invest more than you can afford to lose completely.

FAQ

What is MLT crypto?

MLT is the native cryptocurrency of the MILC Platform, designed to streamline media licensing transactions. It facilitates efficient licensing processes within the media industry ecosystem.

What is the value of MLT?

Media Licensing Token (MLT) is currently valued at BTC0.062683 with a market cap of BTC39.2750. It has a circulating supply of 150 million MLT tokens. The 24-hour trading volume is $23,457.13.

What is the price prediction for MTL?

Metal (MTL) is forecasted to reach $0.3218 by January 5, 2026, representing a -1.45% change. For longer-term predictions, MTL may reach $0.3090 by January 22, 2026, with an expected -7.47% decline throughout 2026.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Latest analysis and investment prospects for Toncoin price in June 2025

Sui Price Market Analysis and Long-term Investment Potential in 2025

Where to Find Alpha in the 2025 Crypto Spot Market

Bitcoin Cash (BCH) Price Analysis and Investment Outlook for 2025

Crypto RSI Heatmap

Ethereum Maintains 62% NFT Market Share Despite Growing Competition

CryptoQuant On-Chain Analysis Tools: Bitcoin Market Insights and Whale Tracking for Crypto Traders in 2026

Mist Browser (Ethereum DApp Browser)

Moo Deng (MOODENG) — The Viral Hippo Taking Over Crypto