Cointime

No content yet

Cointime

Japanese listed company Metaplanet announces raising $50 million to purchase Bitcoin

According to market news: Japanese Bitcoin treasury company Metaplanet announced that it has raised $50 million in funds, which are planned to be used to purchase more Bitcoin.

According to market news: Japanese Bitcoin treasury company Metaplanet announced that it has raised $50 million in funds, which are planned to be used to purchase more Bitcoin.

BTC-1.82%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

US DTCC Survey: 72% of Respondents Cite Global Demand and Regulatory Momentum as the Primary Drivers for Extended Trading Hours

According to market news, a survey by the Depository Trust & Clearing Corporation (DTCC) in the US shows that 72% of respondents cite global demand and regulatory momentum as the primary drivers for extending trading hours, while the 24/7 trading nature of the cryptocurrency market has influenced this demand.

View OriginalAccording to market news, a survey by the Depository Trust & Clearing Corporation (DTCC) in the US shows that 72% of respondents cite global demand and regulatory momentum as the primary drivers for extending trading hours, while the 24/7 trading nature of the cryptocurrency market has influenced this demand.

- Reward

- like

- Comment

- Repost

- Share

BlackRock’s Bitcoin ETF has seen five consecutive weeks of outflows, totaling over $2.7 billion

BlackRock's iShares Bitcoin Trust (IBIT) has experienced its longest single-week outflow since its launch in January 2024. In the five weeks ending November 28, investors withdrew more than $2.7 billion from the ETF.

As of Thursday, the ETF faced another $113 million in redemptions, putting it on track for a potential sixth consecutive week of net outflows.

IBIT currently has over $71 billion in assets under management. Blockchain analytics firm Glassnode noted that this trend signifies a clear reve

BlackRock's iShares Bitcoin Trust (IBIT) has experienced its longest single-week outflow since its launch in January 2024. In the five weeks ending November 28, investors withdrew more than $2.7 billion from the ETF.

As of Thursday, the ETF faced another $113 million in redemptions, putting it on track for a potential sixth consecutive week of net outflows.

IBIT currently has over $71 billion in assets under management. Blockchain analytics firm Glassnode noted that this trend signifies a clear reve

BTC-1.82%

- Reward

- like

- Comment

- Repost

- Share

U.S. Treasury yields edged lower as the market awaits PCE data

U.S. Treasury yields declined, giving back part of Thursday’s gains that were driven by better-than-expected initial jobless claims data. On Friday, the focus for U.S. economic data is the September Personal Consumption Expenditures (PCE) Price Index.

This inflation gauge, favored by the Federal Reserve, had its release delayed due to the longest government shutdown in U.S. history. According to Tradeweb data, during the Asian trading session, Treasury yields across maturities fell by 1 to 1.5 basis points, with the two-year yield

View OriginalU.S. Treasury yields declined, giving back part of Thursday’s gains that were driven by better-than-expected initial jobless claims data. On Friday, the focus for U.S. economic data is the September Personal Consumption Expenditures (PCE) Price Index.

This inflation gauge, favored by the Federal Reserve, had its release delayed due to the longest government shutdown in U.S. history. According to Tradeweb data, during the Asian trading session, Treasury yields across maturities fell by 1 to 1.5 basis points, with the two-year yield

- Reward

- like

- Comment

- Repost

- Share

Analyst: Labor Data May Mark the End of the Fed’s “Hawkish Rate Cut” Era

On December 5, Daniel Loughney, an analyst at Mediolanum International Funds, stated that, in line with market expectations, he anticipates the Federal Reserve will lower the federal funds target range by 25 basis points next week, driven by weakness in labor market statistics.

The head of fixed income and managing director said in a report: “Recent rate cuts have been viewed as ‘hawkish cuts,’ but this time, the weak labor market may prompt a more dovish response.” He noted that the key focus will be the “dot plot”—that

View OriginalOn December 5, Daniel Loughney, an analyst at Mediolanum International Funds, stated that, in line with market expectations, he anticipates the Federal Reserve will lower the federal funds target range by 25 basis points next week, driven by weakness in labor market statistics.

The head of fixed income and managing director said in a report: “Recent rate cuts have been viewed as ‘hawkish cuts,’ but this time, the weak labor market may prompt a more dovish response.” He noted that the key focus will be the “dot plot”—that

- Reward

- like

- Comment

- Repost

- Share

The Federal Reserve will release the PCE data tonight, with CPI absent as the sole inflation indicator

At 23:00 Beijing time, the Federal Reserve's preferred inflation indicator—the PCE data—will be released. Since the CPI data has been officially announced as absent, tonight's data will become the only inflation guide before the Fed's December meeting. The market will scrutinize every detail of this report, remaining alert to potential market volatility.

View OriginalAt 23:00 Beijing time, the Federal Reserve's preferred inflation indicator—the PCE data—will be released. Since the CPI data has been officially announced as absent, tonight's data will become the only inflation guide before the Fed's December meeting. The market will scrutinize every detail of this report, remaining alert to potential market volatility.

- Reward

- like

- Comment

- Repost

- Share

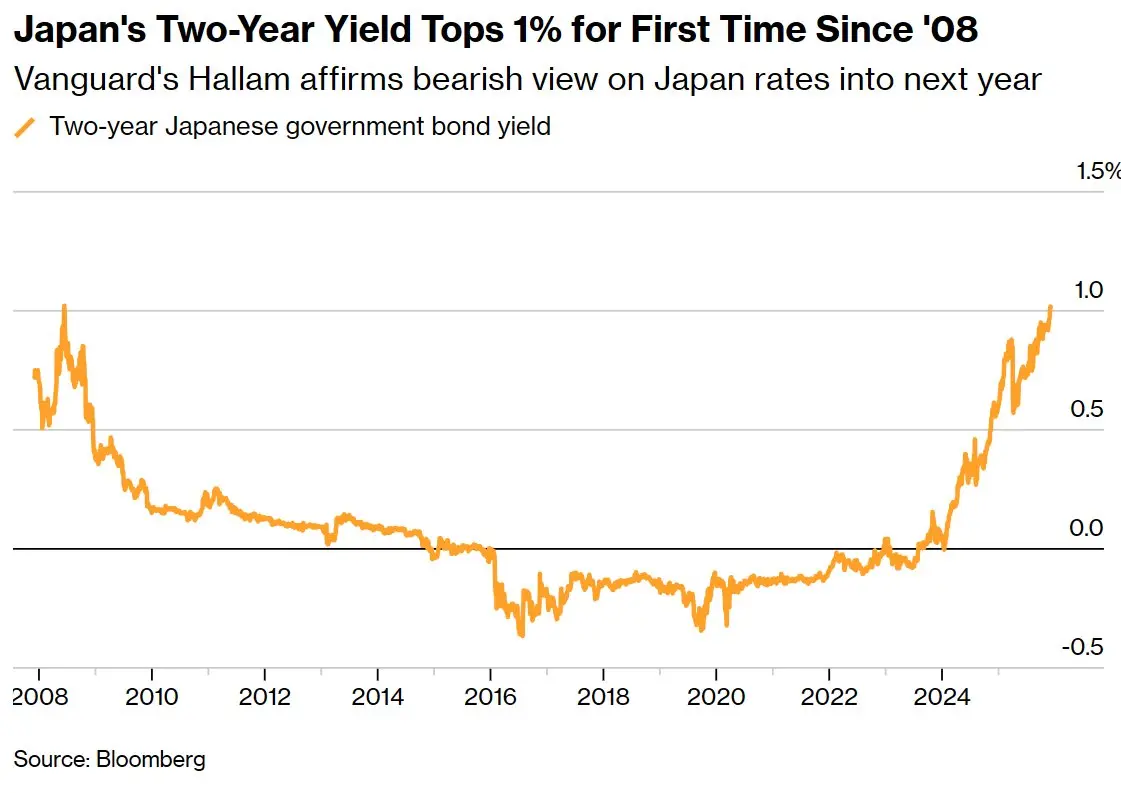

BofA: Bank of Japan to Raise Rates to 0.75% in December, Then Hike Every Six Months

BofA economist Takayasu Kudo wrote in a report that after the Bank of Japan raises its target rate from 0.5% to 0.75% at its December 18-19 meeting, it is expected to continue raising the policy rate once every six months.

He stated: "Based on recent developments in corporate earnings, wage negotiations, the depreciation of the yen in the foreign exchange market, as well as dialogues with the government, the Bank of Japan is increasingly confident that it can raise rates at the upcoming December meeting." The e

View OriginalBofA economist Takayasu Kudo wrote in a report that after the Bank of Japan raises its target rate from 0.5% to 0.75% at its December 18-19 meeting, it is expected to continue raising the policy rate once every six months.

He stated: "Based on recent developments in corporate earnings, wage negotiations, the depreciation of the yen in the foreign exchange market, as well as dialogues with the government, the Bank of Japan is increasingly confident that it can raise rates at the upcoming December meeting." The e

- Reward

- like

- Comment

- Repost

- Share

Trump to sign executive order at 3:00 p.m. local time on Friday

Market news: U.S. President Trump will sign an executive order at 3:00 p.m. local time on Friday (4:00 a.m. Beijing time the next day).

View OriginalMarket news: U.S. President Trump will sign an executive order at 3:00 p.m. local time on Friday (4:00 a.m. Beijing time the next day).

- Reward

- like

- Comment

- Repost

- Share

Preview: The US will release the September Core PCE Price Index YoY at 23:00 tonight

At 23:00 Beijing time on Friday night, the US Department of Commerce will release the US September Core PCE Price Index YoY, with an expected value of 2.9% and a previous value of 2.9%.

View OriginalAt 23:00 Beijing time on Friday night, the US Department of Commerce will release the US September Core PCE Price Index YoY, with an expected value of 2.9% and a previous value of 2.9%.

- Reward

- like

- Comment

- Repost

- Share

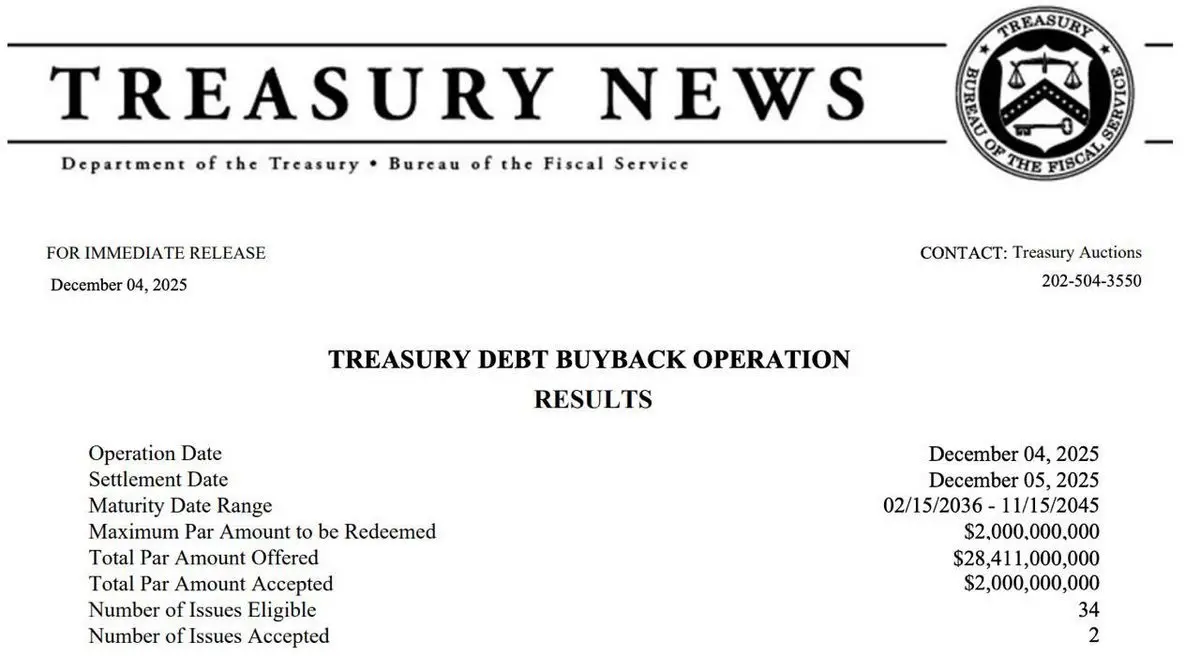

The US Treasury has added another $2 billion in debt buybacks, bringing the total buyback amount this week to $14.5 billion

According to reports, following its historic $12.5 billion debt buyback (the largest ever), the US Treasury has added an additional $2 billion in buybacks, bringing this week’s total buyback amount to $145 billion dollars.

View OriginalAccording to reports, following its historic $12.5 billion debt buyback (the largest ever), the US Treasury has added an additional $2 billion in buybacks, bringing this week’s total buyback amount to $145 billion dollars.

- Reward

- like

- Comment

- Repost

- Share

Bitwise CIO: Strategy Will Not Be Forced to Sell Bitcoin

On December 5, according to Cointelegraph, Bitwise Chief Investment Officer Matt Hougan stated that despite the drop in MStrategy (MSTR) stock price, the company will not be forced to sell its $60 billion worth of Bitcoin holdings.

Hougan pointed out that MSTR has $1.4 billion in cash reserves, does not need to repay its debt until 2027, and the current Bitcoin price is about $92,000, higher than the company’s average purchase cost of $74,000.

On December 5, according to Cointelegraph, Bitwise Chief Investment Officer Matt Hougan stated that despite the drop in MStrategy (MSTR) stock price, the company will not be forced to sell its $60 billion worth of Bitcoin holdings.

Hougan pointed out that MSTR has $1.4 billion in cash reserves, does not need to repay its debt until 2027, and the current Bitcoin price is about $92,000, higher than the company’s average purchase cost of $74,000.

BTC-1.82%

- Reward

- like

- Comment

- Repost

- Share

Bitwise CIO: Strategy Will Not Be Forced to Sell Bitcoin

On December 5, according to Cointelegraph, Bitwise Chief Investment Officer Matt Hougan stated that despite the decline in MStrategy (MSTR) stock price, the company will not be forced to sell its $60 billion worth of Bitcoin holdings. Hougan pointed out that MSTR has $1.4 billion in cash reserves, no debt repayment required before 2027, and the current Bitcoin price is around $92,000, higher than the company’s average purchase cost of $74,000.

On December 5, according to Cointelegraph, Bitwise Chief Investment Officer Matt Hougan stated that despite the decline in MStrategy (MSTR) stock price, the company will not be forced to sell its $60 billion worth of Bitcoin holdings. Hougan pointed out that MSTR has $1.4 billion in cash reserves, no debt repayment required before 2027, and the current Bitcoin price is around $92,000, higher than the company’s average purchase cost of $74,000.

BTC-1.82%

- Reward

- like

- Comment

- Repost

- Share

Polymarket User Suspected of Insider Trading, Mysterious Account Profits $1 Million

According to Decrypt, Polymarket yesterday announced the 2025 Google search trends results, with little-known singer d4vd unexpectedly winning. A user with the code 0xafEe accurately bet on all major candidates and profited $1.15 million, sparking suspicions of insider trading. This user not only correctly predicted d4vd's victory—who had only a 0.2% chance at the time—but also accurately judged the defeat of popular candidates such as Pope Leo XIV and Trump.

Afterwards, the user immediately changed their nickn

View OriginalAccording to Decrypt, Polymarket yesterday announced the 2025 Google search trends results, with little-known singer d4vd unexpectedly winning. A user with the code 0xafEe accurately bet on all major candidates and profited $1.15 million, sparking suspicions of insider trading. This user not only correctly predicted d4vd's victory—who had only a 0.2% chance at the time—but also accurately judged the defeat of popular candidates such as Pope Leo XIV and Trump.

Afterwards, the user immediately changed their nickn

- Reward

- like

- Comment

- Repost

- Share

Pepe official website suffered a malicious attack

On December 5, the Pepe official website was hit by a front-end attack. Cybersecurity company Blockaid discovered that the site had been injected with Inferno Drainer malicious toolkit code. This toolkit is specifically used for phishing and wallet asset theft, which may result in users’ wallet credentials being stolen, unauthorized transactions, and asset losses.

On December 5, the Pepe official website was hit by a front-end attack. Cybersecurity company Blockaid discovered that the site had been injected with Inferno Drainer malicious toolkit code. This toolkit is specifically used for phishing and wallet asset theft, which may result in users’ wallet credentials being stolen, unauthorized transactions, and asset losses.

PEPE-3.39%

- Reward

- like

- Comment

- Repost

- Share

Vanguard Group warns Japan’s neutral interest rate is underestimated, recommends underweighting Japanese bonds

On December 5, trillion-dollar asset management giant Vanguard Group issued a warning that the market is severely underestimating Japan’s neutral interest rate level. The group’s global head of rates, Harlem, stated that the Bank of Japan needs a higher rate than the market expects to effectively curb inflation, and anticipates the central bank will continue to raise rates at its December 19 meeting.

Currently, Japan’s policy rate is 0.5%, while the neutral rate is estimated to be bet

View OriginalOn December 5, trillion-dollar asset management giant Vanguard Group issued a warning that the market is severely underestimating Japan’s neutral interest rate level. The group’s global head of rates, Harlem, stated that the Bank of Japan needs a higher rate than the market expects to effectively curb inflation, and anticipates the central bank will continue to raise rates at its December 19 meeting.

Currently, Japan’s policy rate is 0.5%, while the neutral rate is estimated to be bet

- Reward

- like

- Comment

- Repost

- Share

Hassett: The Fed may cut rates at the next meeting, expected by about 25 basis points

Kevin Hassett, Director of the U.S. White House National Economic Council, stated that the Federal Reserve may cut rates at its next meeting, with an expected cut of about 25 basis points. Regarding the next Fed chair candidate, he said the Fed chair needs to be someone who responds to data.

View OriginalKevin Hassett, Director of the U.S. White House National Economic Council, stated that the Federal Reserve may cut rates at its next meeting, with an expected cut of about 25 basis points. Regarding the next Fed chair candidate, he said the Fed chair needs to be someone who responds to data.

- Reward

- like

- Comment

- Repost

- Share