AxelAdlerJr

No content yet

AxelAdlerJr

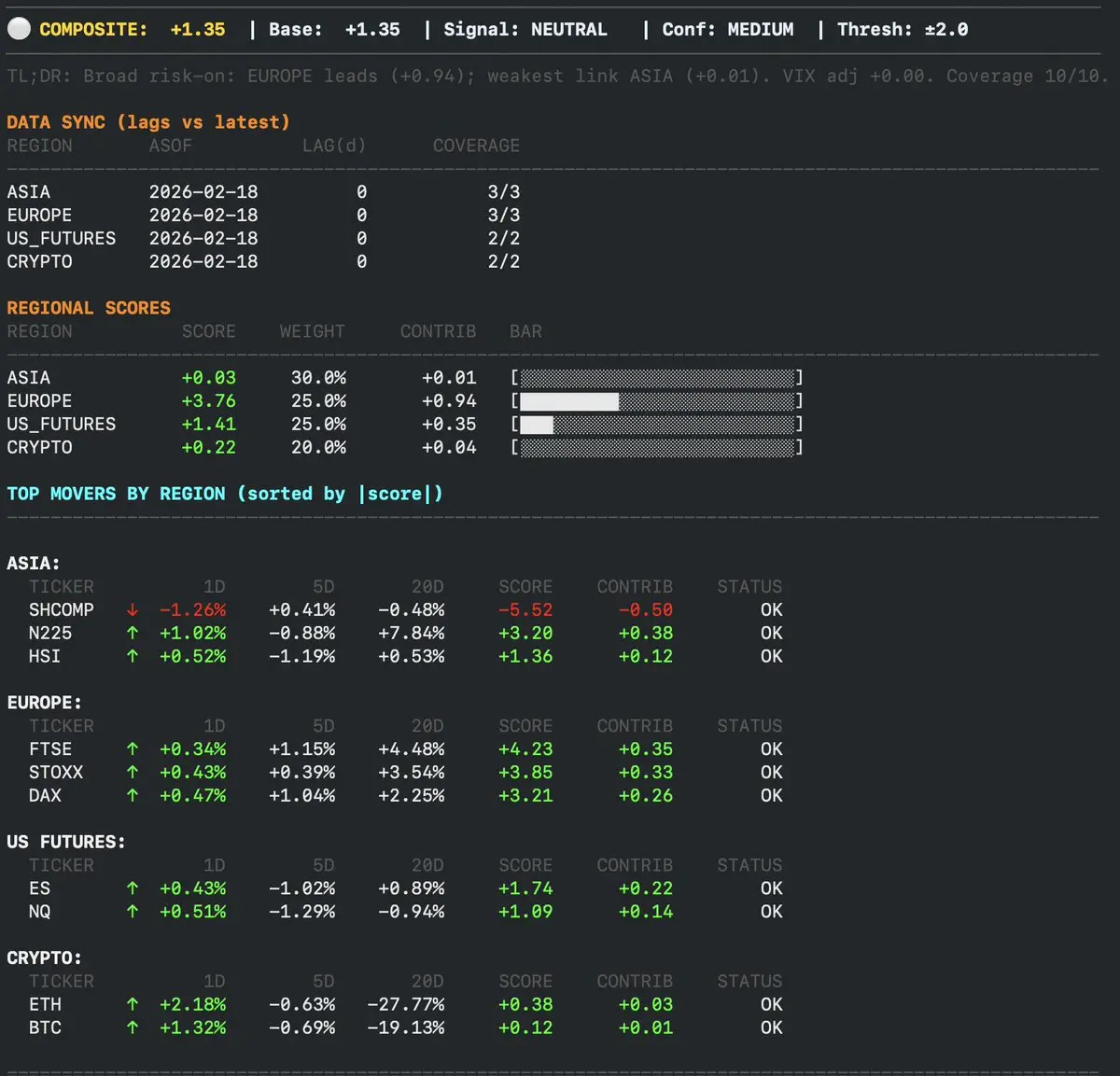

Today’s market regime may fully depend on the U.S. Supreme Court’s decision on Trump’s tariff authority under the IEEPA. Whether the justices uphold the power to impose aggressive tariffs could determine the direction of trading as early as today.

- Reward

- 1

- Comment

- Repost

- Share

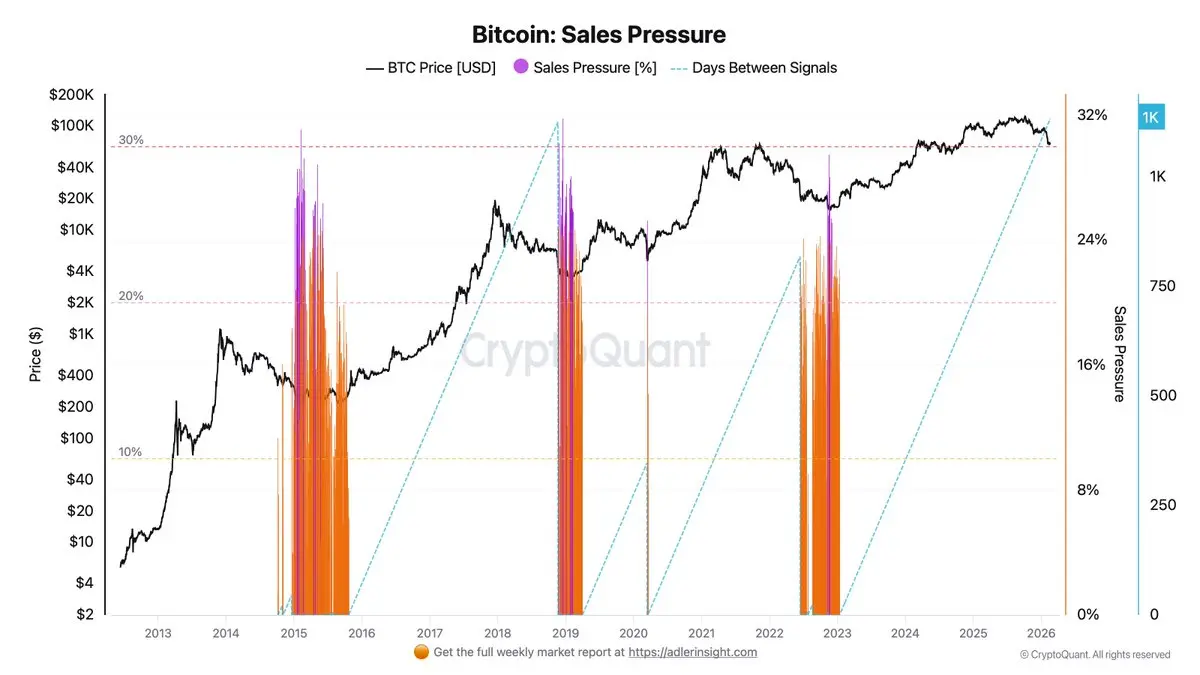

1133 days without a Sales Pressure signal. The last time the market entered this regime was in January 2023 - during the final phase of the bear cycle.

What is changing now - covered in ☕️ Adler AM #110 👇

What is changing now - covered in ☕️ Adler AM #110 👇

- Reward

- 1

- Comment

- Repost

- Share

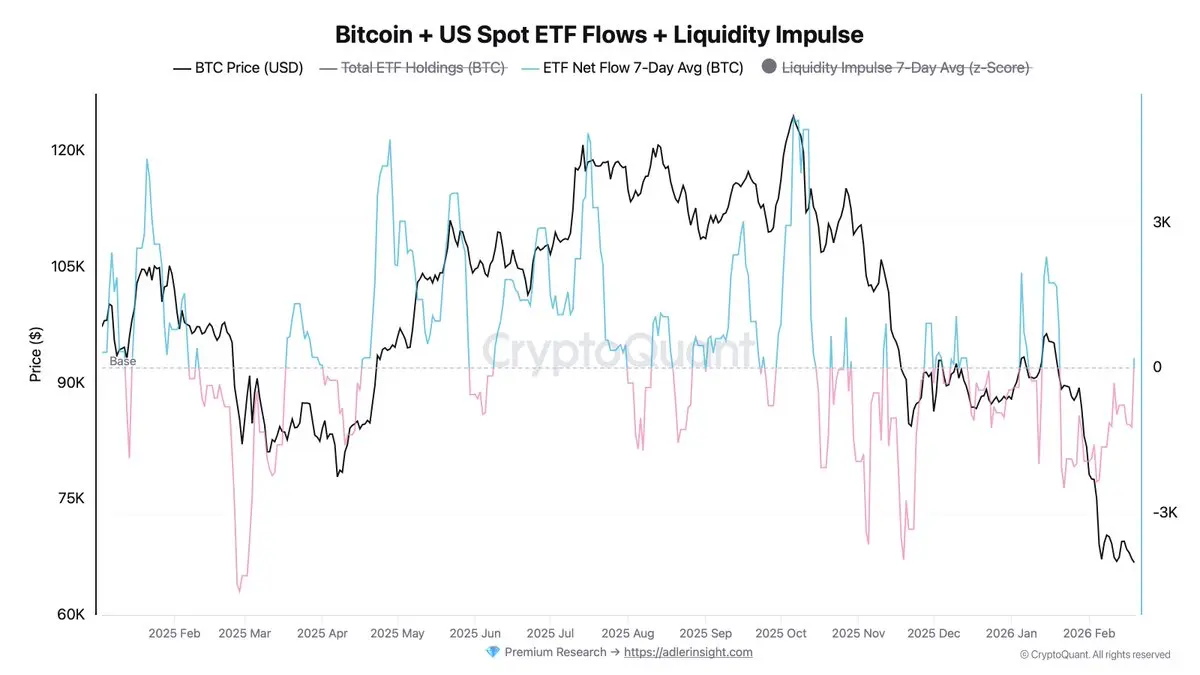

Institutions aren't buying. They're selling. −11,042 BTC left ETFs in 7 days. Exchanges are flooded with supply.

Full breakdown in ☕️ Morning Brief 109 👇

Full breakdown in ☕️ Morning Brief 109 👇

BTC1,68%

- Reward

- like

- Comment

- Repost

- Share

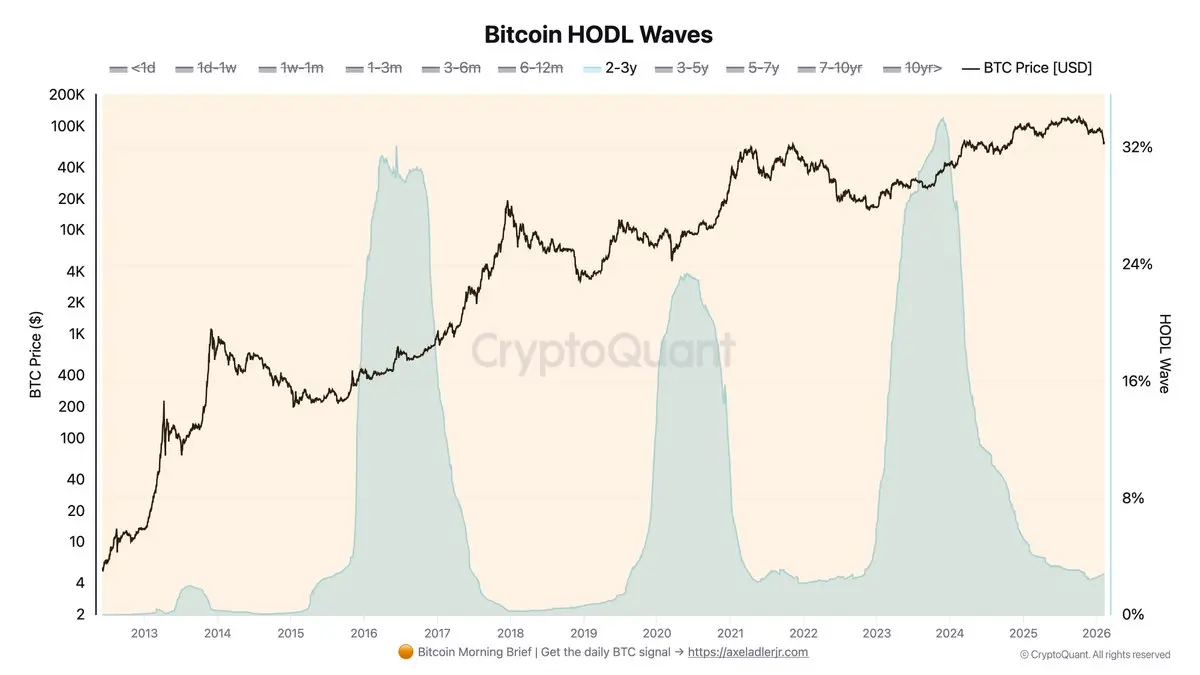

In November 2022, 78% of all Bitcoin was held by Long-Term Holders. That was the bottom.

Today that number is 49%. What does this mean for the current market?

SQL of the Week #015: HODL Waves - age structure of supply, SQL for BigQuery and interpretation of the current state.

🔗

Today that number is 49%. What does this mean for the current market?

SQL of the Week #015: HODL Waves - age structure of supply, SQL for BigQuery and interpretation of the current state.

🔗

BTC1,68%

- Reward

- like

- Comment

- Repost

- Share

The🩸bear market spares no one - I hope the guys make it through this cycle.

- Reward

- like

- Comment

- Repost

- Share

Today could be a strong green trading day if progress in the U.S.-Iran talks continues.

- Reward

- like

- Comment

- Repost

- Share

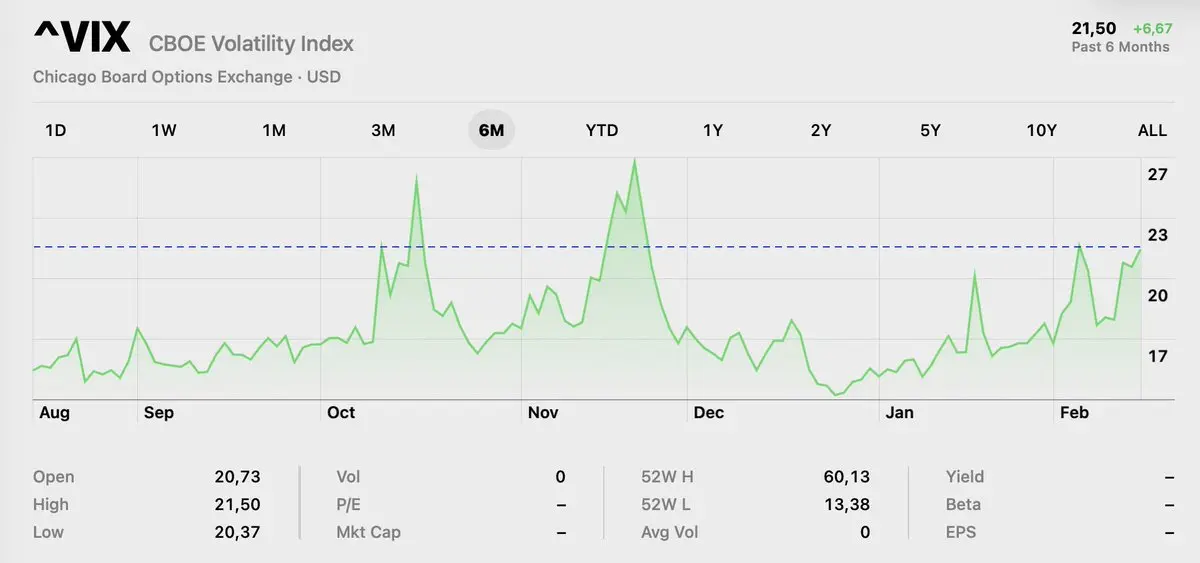

VIX and MOVE are rising. This is a toxic combination for the markets, increasing the probability of whipsaws and sharp moves.

- Reward

- like

- Comment

- Repost

- Share

STH SOPR crossed back above 1.0 for the first time in a week: short-term holders are selling at a profit again. But MVRV is still 17% below the norm - the structural overhang hasn't gone anywhere. Every bounce will be met by sellers who just want to break even.

new ☕️ Adler AM👇

new ☕️ Adler AM👇

- Reward

- like

- Comment

- Repost

- Share

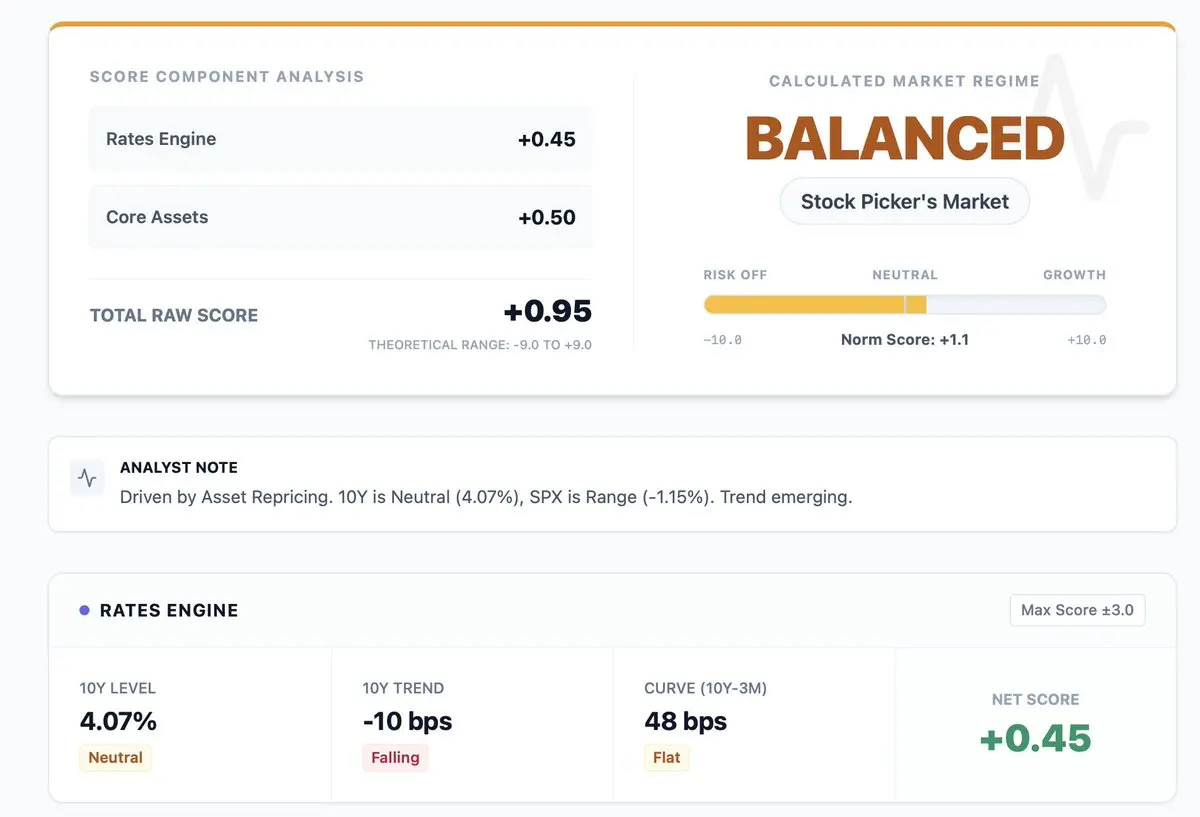

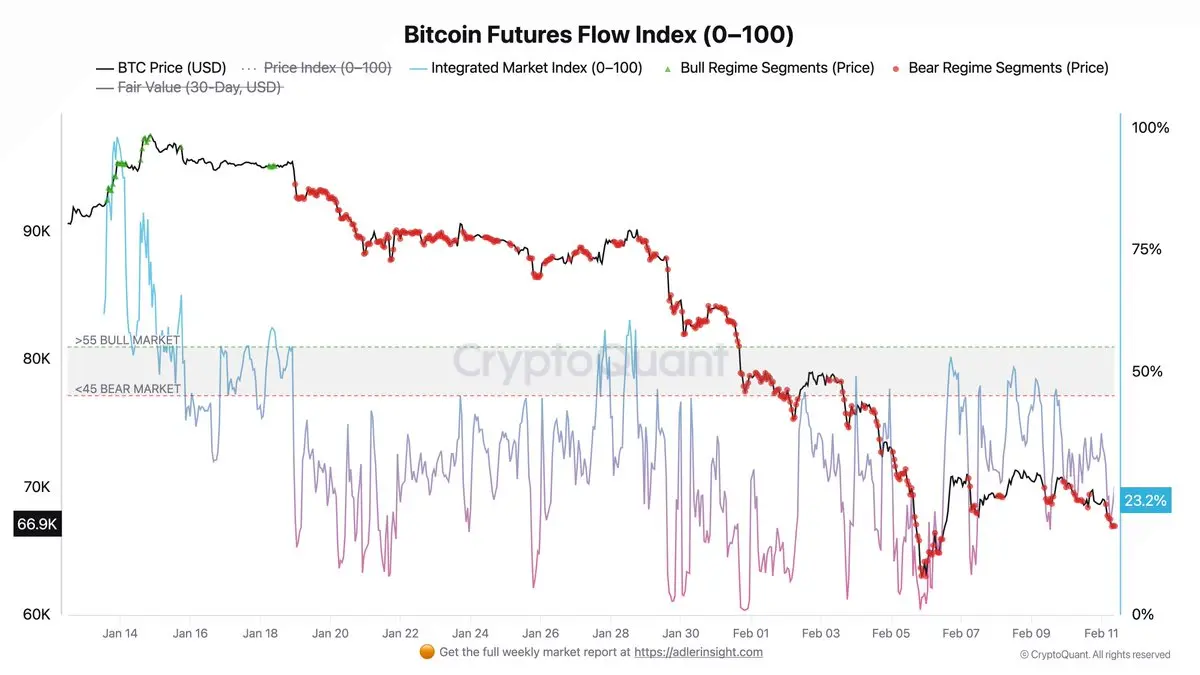

New Weekly Engine update + Trader’s Evidence is out.

Deleveraging is over - or just a pause before the next wave?

Full report below👇

Deleveraging is over - or just a pause before the next wave?

Full report below👇

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin Basis (%) - 7D SMA has returned to the neutral zone as the spot-futures premium collapsed. This indicates that demand for long exposure via derivatives has weakened, and the market is no longer pricing in an aggressive risk-on scenario. Typically, this signals a decrease in risk appetite, deleveraging, and a shift into wait-and-see mode.

Bulls need more spot demand, as derivatives are currently not pushing the market higher.

Bulls need more spot demand, as derivatives are currently not pushing the market higher.

BTC1,68%

- Reward

- like

- Comment

- Repost

- Share

Satoshi Nakamoto is a single individual, not a group.

At the time of Bitcoin's creation, he was likely in his 30s or older. His references to Hashcash, b-money, and DigiCash were not random citations, they represented his actual working context. He possessed deep expertise in applied cryptography and financial systems.

He was a person for whom solving the problem was more important than owning the solution. It is highly probable that he still holds the keys, which makes him a potential target for criminal activity.

The world does not need to know his identity, as a Patoshi coin dump could tri

At the time of Bitcoin's creation, he was likely in his 30s or older. His references to Hashcash, b-money, and DigiCash were not random citations, they represented his actual working context. He possessed deep expertise in applied cryptography and financial systems.

He was a person for whom solving the problem was more important than owning the solution. It is highly probable that he still holds the keys, which makes him a potential target for criminal activity.

The world does not need to know his identity, as a Patoshi coin dump could tri

BTC1,68%

- Reward

- like

- Comment

- Repost

- Share

Realized Price Under Threat: Market Approaching Critical Support Zone

The market is falling, but long-term support remains intact: LTH Cost Basis is rising (~$38.2K), Realized Price is declining (~$55.0K), and at current rates they will form a critical corridor of $43K-$51K within a quarter.

☕️ Adler AM 👇

The market is falling, but long-term support remains intact: LTH Cost Basis is rising (~$38.2K), Realized Price is declining (~$55.0K), and at current rates they will form a critical corridor of $43K-$51K within a quarter.

☕️ Adler AM 👇

- Reward

- like

- Comment

- 1

- Share

Market Back to Risk-Off: Stablecoins Confirm BTC Weakness

new ☕️Adler AM 👇

new ☕️Adler AM 👇

BTC1,68%

- Reward

- like

- Comment

- Repost

- Share

I’m checking the LTF futures charts every other day, hoping for some signs of improvement, but I don't see any yet.

- Reward

- like

- Comment

- Repost

- Share

Who actually holds the supply? This lesson shows how STH/LTH Supply and HODL Waves reveal whether a rally has strong support - or is just weak hands chasing price.

- Reward

- like

- Comment

- Repost

- Share

True Diamond Hands Spectrum💎🙌

- Reward

- like

- Comment

- Repost

- Share

These three lessons will give you a basic understanding of one of the key pillars of on-chain analysis - unrealized profit/loss and the psychology of market cycles.

Save them to your bookmarks and set aside 2-3 hours over the weekend to calmly go through them and understand how it works.

Save them to your bookmarks and set aside 2-3 hours over the weekend to calmly go through them and understand how it works.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More254.21K Popularity

875.59K Popularity

10.64M Popularity

101.56K Popularity

524.09K Popularity

Pin