14:40

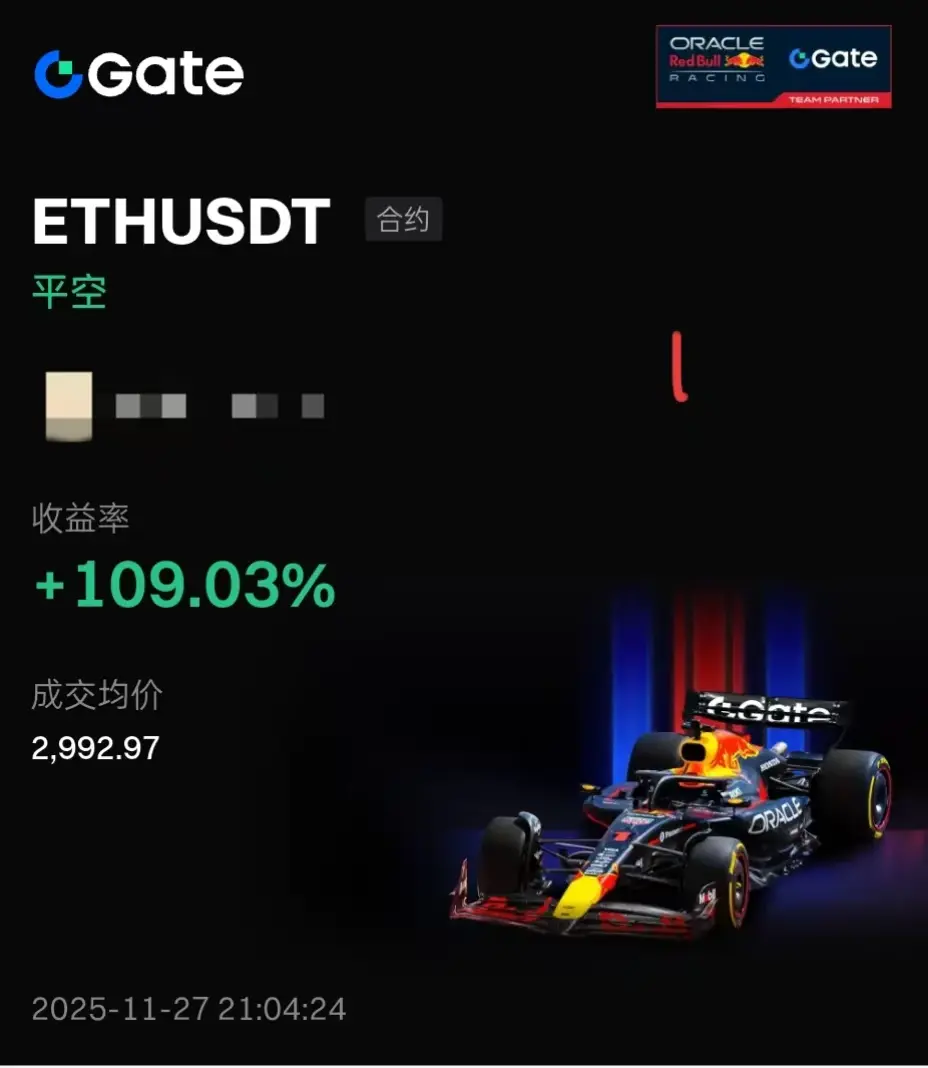

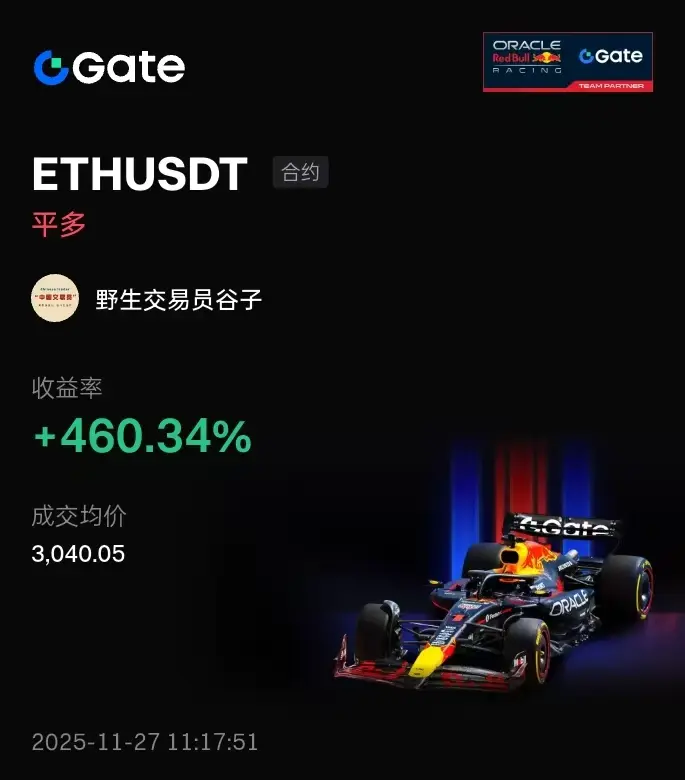

Last night's market performed as expected, but there was significant volatility after the US session. ETH made another attempt at 3220. Fortunately, the outcome was good, and the rebound happened as anticipated. Whether it will break through 3250 remains to be seen.

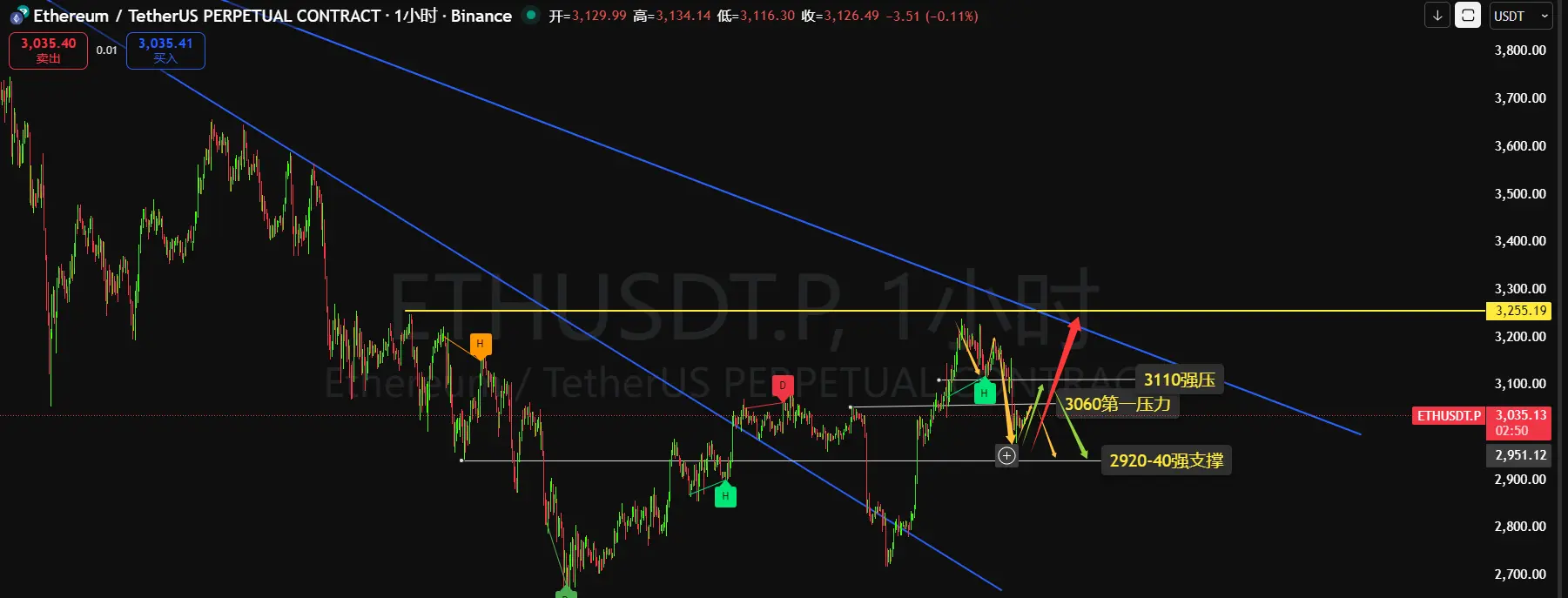

My personal view on the current market is shown in the chart below: After the rebound, there's resistance at 3200, with the highest point near 3192, followed by a drop and a one-hour pullback. The current minor support is at 3110, with the second support around 3050, similar to yesterday. The difference is that yesterday was a four-hour pullback, while now we might see a four-hour wide-range consolidation.

In terms of strategy, selling high today may work better. You can short at the current price of 3155-65, with a small stop loss at 85, a reasonable stop loss at 3200, and target 3105-3060. I personally suggest taking profit a few points above the support level. The main goal is to exit the position; aiming for perfection can sometimes cause you to miss out and affect your mindset.

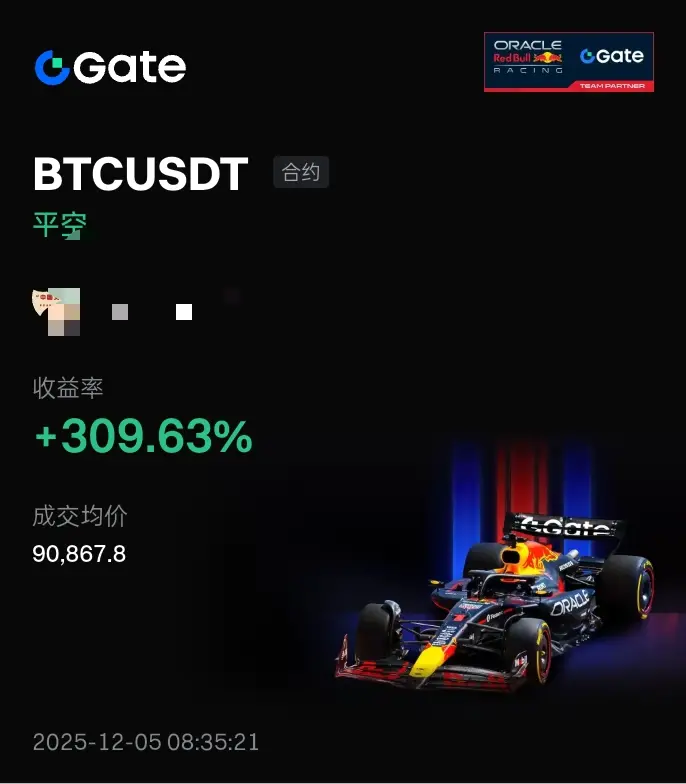

BTC is also in a wide-range consolidation between 93200-90800. A reasonable short position should have a stop loss above 93200, and take profit above 90800.

These are just my personal opinions for reference only.

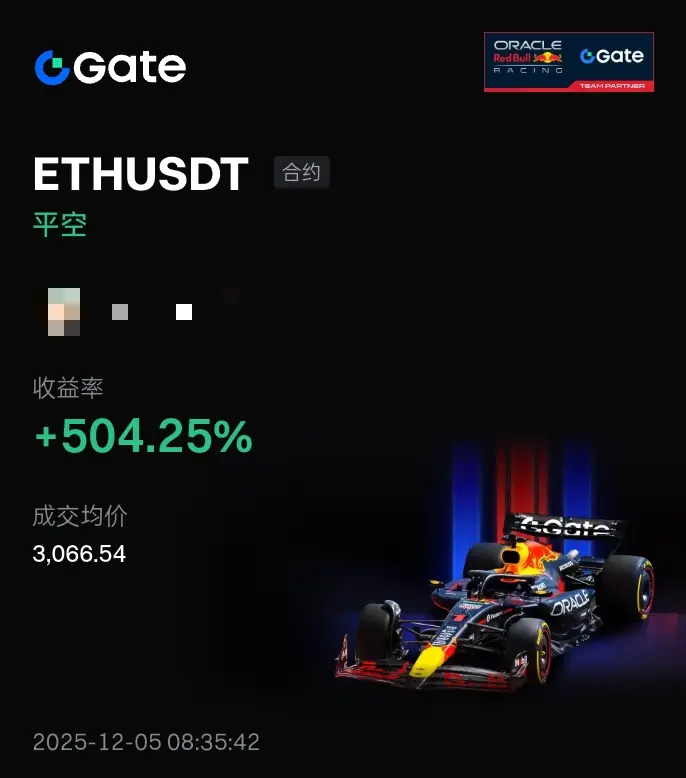

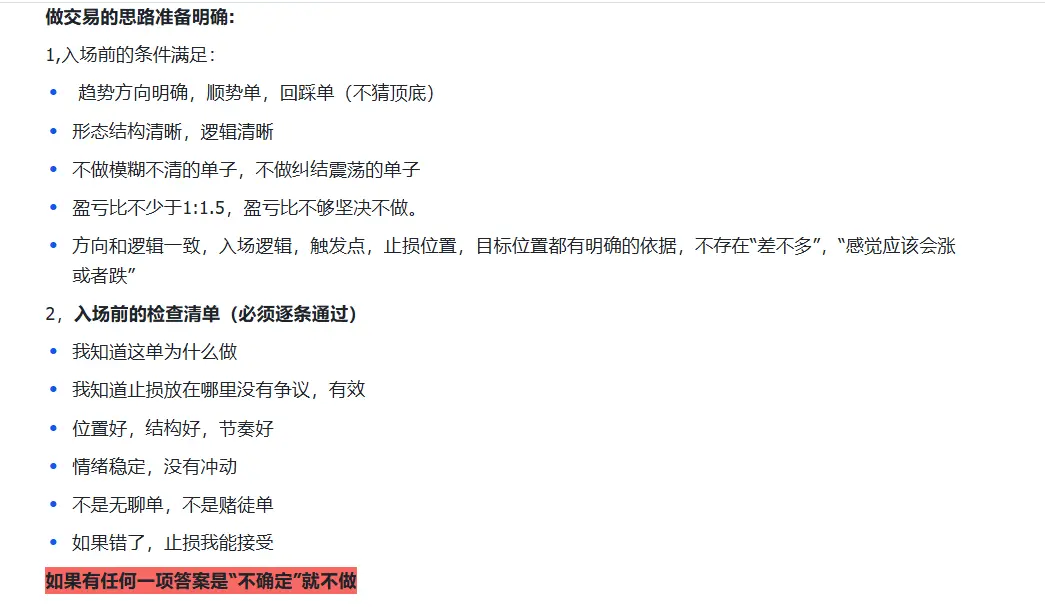

I don’t trade frequently. If you’re making money by following my strategies, please like and follow for more consistent profits! If you trade frequently, whether you’re making money or not, you need to be mindful of your mindset. Normal stop losses are fine, but you need to have a basis for them and a good risk-reward ratio. Only with a good mindset can you survive in this market.

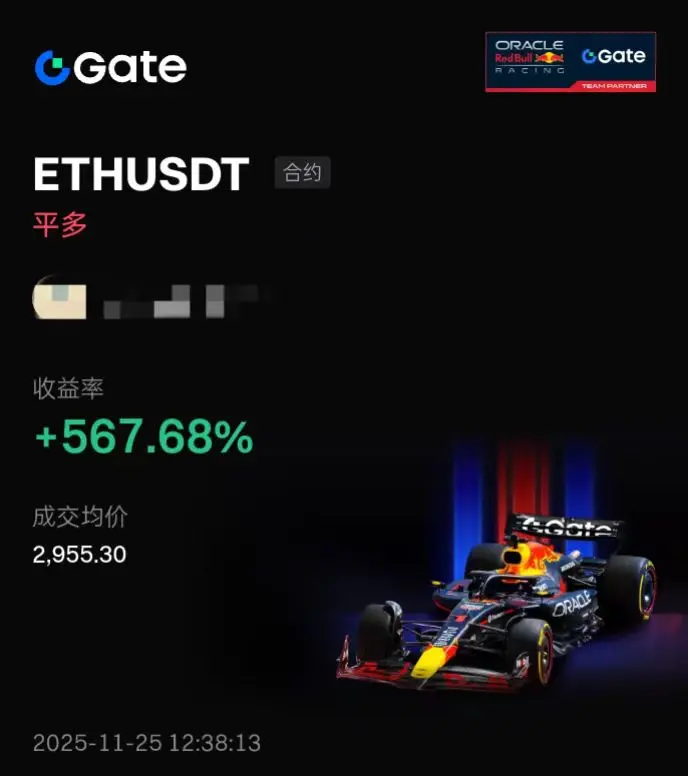

Last night's market performed as expected, but there was significant volatility after the US session. ETH made another attempt at 3220. Fortunately, the outcome was good, and the rebound happened as anticipated. Whether it will break through 3250 remains to be seen.

My personal view on the current market is shown in the chart below: After the rebound, there's resistance at 3200, with the highest point near 3192, followed by a drop and a one-hour pullback. The current minor support is at 3110, with the second support around 3050, similar to yesterday. The difference is that yesterday was a four-hour pullback, while now we might see a four-hour wide-range consolidation.

In terms of strategy, selling high today may work better. You can short at the current price of 3155-65, with a small stop loss at 85, a reasonable stop loss at 3200, and target 3105-3060. I personally suggest taking profit a few points above the support level. The main goal is to exit the position; aiming for perfection can sometimes cause you to miss out and affect your mindset.

BTC is also in a wide-range consolidation between 93200-90800. A reasonable short position should have a stop loss above 93200, and take profit above 90800.

These are just my personal opinions for reference only.

I don’t trade frequently. If you’re making money by following my strategies, please like and follow for more consistent profits! If you trade frequently, whether you’re making money or not, you need to be mindful of your mindset. Normal stop losses are fine, but you need to have a basis for them and a good risk-reward ratio. Only with a good mindset can you survive in this market.