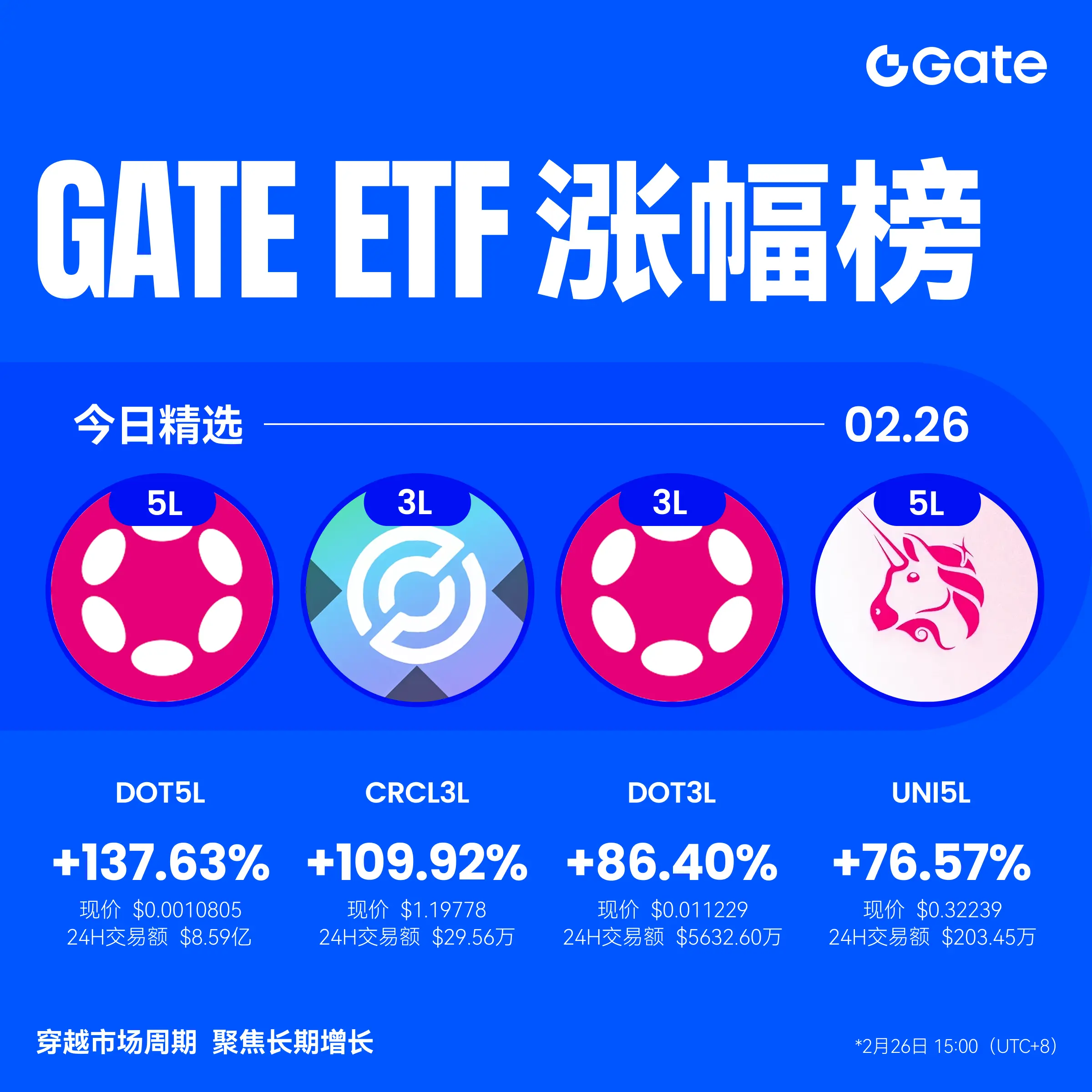

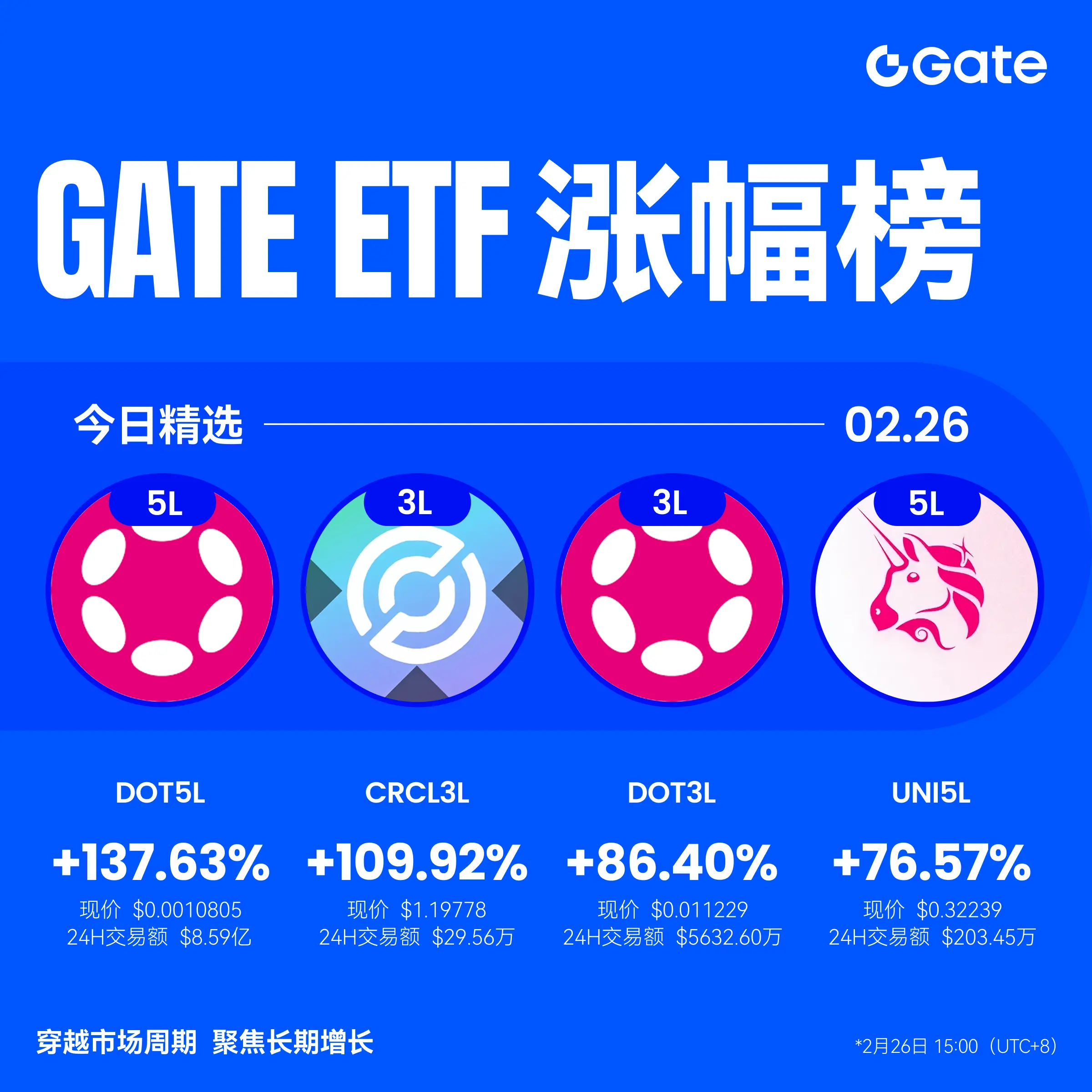

# etf

604.89万

🚀 加密货币今日上涨 🔥

SOL +7% 领涨山寨币,AI 题材强劲,FET/RENDER 热度升温,梗币如 SIREN 和 PIPPIN 也疯狂上涨!

比特币持稳 $68k ——牛市即将到来?

别忽视这些动向 👀💰

你在押注哪一个?在下方留言!

📊 加密货币 #ETF 流入 — 3月5日

所有主要现货ETF今日均出现净流出:

$XRP : -$6.15M

$BTC : -$227.83M

$ETH : -$90.9M

$SOL: -$5.23M

市场在近期资金流入后开始降温。#FebNonfarmPayrollsUnexpectedlyFall

查看原文SOL +7% 领涨山寨币,AI 题材强劲,FET/RENDER 热度升温,梗币如 SIREN 和 PIPPIN 也疯狂上涨!

比特币持稳 $68k ——牛市即将到来?

别忽视这些动向 👀💰

你在押注哪一个?在下方留言!

📊 加密货币 #ETF 流入 — 3月5日

所有主要现货ETF今日均出现净流出:

$XRP : -$6.15M

$BTC : -$227.83M

$ETH : -$90.9M

$SOL: -$5.23M

市场在近期资金流入后开始降温。#FebNonfarmPayrollsUnexpectedlyFall

- 赞赏

- 1

- 评论

- 转发

- 分享

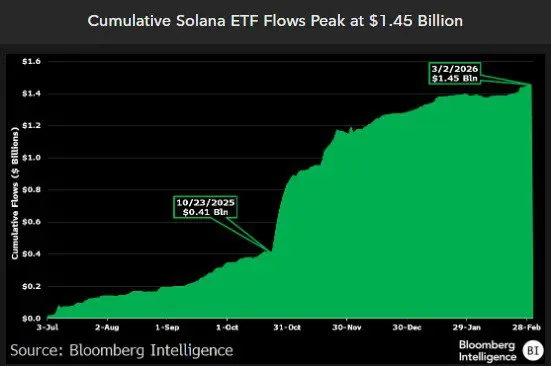

加密ETF出现大规模资金流入

机构需求回归:2月25日加密ETF合计吸引超过$630M 的资金流入

数字资产市场在2026年2月25日迎来机构需求的显著增长,现货比特币和以太坊ETF合计吸引了超过$630 的净资金流入。这一大规模的资金注入可能标志着市场的转折点,此前市场在二月的大部分时间里一直处于持续的资金流出状态。

根据SoSoValue的数据,这一反弹表明机构投资者正从“观望”防御姿态转向积极的积累。

比特币ETF:贝莱德的IBIT领跑

美国现货比特币ETF当天总净流入高达5.0651亿美元。这一表现主要由一只重量级基金推动:

• 贝莱德(IBIT):领头羊,IBIT吸引了2.9737亿美元,巩固了其作为机构比特币敞口首选工具的地位。

• 全局视角:这些资金流入伴随着比特币重新站上68,000美元关口,显示专业资产管理者在经历五周赎回荒后,采取“逢低买入”的心态。

以太坊ETF:富达领跑

不甘示弱,以太坊现货ETF也表现强劲,全天总资金流入达1.2587亿美元。

• 富达(FETH):占据当天ETH资金流入的近一半,获得6194万美元。

• 市场情绪:分析师指出,BTC和ETH的同步关注表明更广泛的“风险偏好”情绪正在回归加密行业,受到宏观经济因素稳定和技术面复苏的支持。

关键数据总结:2026年2月25日

资产类别 | 当日总净流入 | 领先基金 | 领先基金流入

比特币(

查看原文机构需求回归:2月25日加密ETF合计吸引超过$630M 的资金流入

数字资产市场在2026年2月25日迎来机构需求的显著增长,现货比特币和以太坊ETF合计吸引了超过$630 的净资金流入。这一大规模的资金注入可能标志着市场的转折点,此前市场在二月的大部分时间里一直处于持续的资金流出状态。

根据SoSoValue的数据,这一反弹表明机构投资者正从“观望”防御姿态转向积极的积累。

比特币ETF:贝莱德的IBIT领跑

美国现货比特币ETF当天总净流入高达5.0651亿美元。这一表现主要由一只重量级基金推动:

• 贝莱德(IBIT):领头羊,IBIT吸引了2.9737亿美元,巩固了其作为机构比特币敞口首选工具的地位。

• 全局视角:这些资金流入伴随着比特币重新站上68,000美元关口,显示专业资产管理者在经历五周赎回荒后,采取“逢低买入”的心态。

以太坊ETF:富达领跑

不甘示弱,以太坊现货ETF也表现强劲,全天总资金流入达1.2587亿美元。

• 富达(FETH):占据当天ETH资金流入的近一半,获得6194万美元。

• 市场情绪:分析师指出,BTC和ETH的同步关注表明更广泛的“风险偏好”情绪正在回归加密行业,受到宏观经济因素稳定和技术面复苏的支持。

关键数据总结:2026年2月25日

资产类别 | 当日总净流入 | 领先基金 | 领先基金流入

比特币(

- 赞赏

- 3

- 评论

- 转发

- 分享

- 赞赏

- 3

- 3

- 转发

- 分享

楚老魔 :

:

马年发大财 🐴查看更多

#LINK #ETF

📈 Chainlink的ETF显示出资金流入,伴随着其他加密ETF的资金流出

3月,唯一实现资金净流入的加密ETF是Chainlink ETF。

根据市场数据,3月,现货@Chainlink ETF的净流入约为$2 百万,而同期最大加密资产ETF出现资金流出:

— $BTC

— $ETH

— $XRP

— $SOL

📊 这意味着什么

— 资本在加密ETF内部的选择性轮换

— 机构投资者对基础设施项目兴趣的增长

— 对预言机和RWA基础设施板块的需求持续存在

观点:

对LINK在机构产品中的兴趣并非偶然。Chainlink正逐步成为资产代币化的关键基础设施,正是这些项目在加密市场走向机构化阶段能够获得优先的资金流入。

查看原文📈 Chainlink的ETF显示出资金流入,伴随着其他加密ETF的资金流出

3月,唯一实现资金净流入的加密ETF是Chainlink ETF。

根据市场数据,3月,现货@Chainlink ETF的净流入约为$2 百万,而同期最大加密资产ETF出现资金流出:

— $BTC

— $ETH

— $XRP

— $SOL

📊 这意味着什么

— 资本在加密ETF内部的选择性轮换

— 机构投资者对基础设施项目兴趣的增长

— 对预言机和RWA基础设施板块的需求持续存在

观点:

对LINK在机构产品中的兴趣并非偶然。Chainlink正逐步成为资产代币化的关键基础设施,正是这些项目在加密市场走向机构化阶段能够获得优先的资金流入。

- 赞赏

- 2

- 评论

- 转发

- 分享

- 赞赏

- 1

- 评论

- 转发

- 分享

加载更多

加入 4000万 人汇聚的头部社区

⚡️ 与 4000万 人一起参与加密货币热潮讨论

💬 与喜爱的头部博主互动

👍 查看感兴趣的内容

热门话题

90.56万 热度

470.4万 热度

49.84万 热度

24.44万 热度

18.35万 热度

1356 热度

9.89万 热度

2.94万 热度

2701.11万 热度

65.61万 热度

160.74万 热度

28.82万 热度

- 13

#Gate蓝龙虾

1.18万 热度

318.74万 热度

8.36万 热度

快讯

查看更多置顶

Gate 广场|3/5 今日话题: #比特币创下近一月新高

🎁 解读行情走势,抽 5 位锦鲤送出 $2,500 仓位体验券!

随着白宫表示已向参议院提交凯文·沃什担任美联储主席的提名,美国参议院未通过叫停特朗普打击伊朗的投票,比特币于今日凌晨创下 2 月 5 日以来新高,最高触及 74,050 美元,加密货币总市值回升突破 2.538 万亿美元。

💬 本期热议:

1️⃣ 凯文·沃什的提名是否意味着降息预期升温?

2️⃣ 当前关口,你是持币待涨、顺势追多,还是反手布局回调?

分享观点,瓜分好礼 👉️ https://www.gate.com/post

📅 3/6 15:00 - 3/8 12:00 (UTC+8)Gate 广场内容挖矿奖励继续升级!无论您是创作者还是用户,挖矿新人还是头部作者都能赢取好礼获得大奖。现在就进入广场探索吧!

创作者享受最高60%创作返佣

创作者奖励加码1500USDT:更多新人作者能瓜分奖池!

观众点击交易组件交易赢大礼!最高50GT等新春壕礼等你拿!

详情:https://www.gate.com/announcements/article/49802